In this article, we'll explore the essential elements of crafting a compelling letter template for responding to insurance inquiries. Whether you're a customer service representative or a policyholder looking to address queries, having a well-structured template can streamline communications and ensure clarity. By incorporating key details, personalized touches, and a professional tone, your correspondence will resonate more effectively with recipients. Ready to enhance your insurance communication skills? Keep reading to discover our expert tips and templates!

Personalization and Salutation

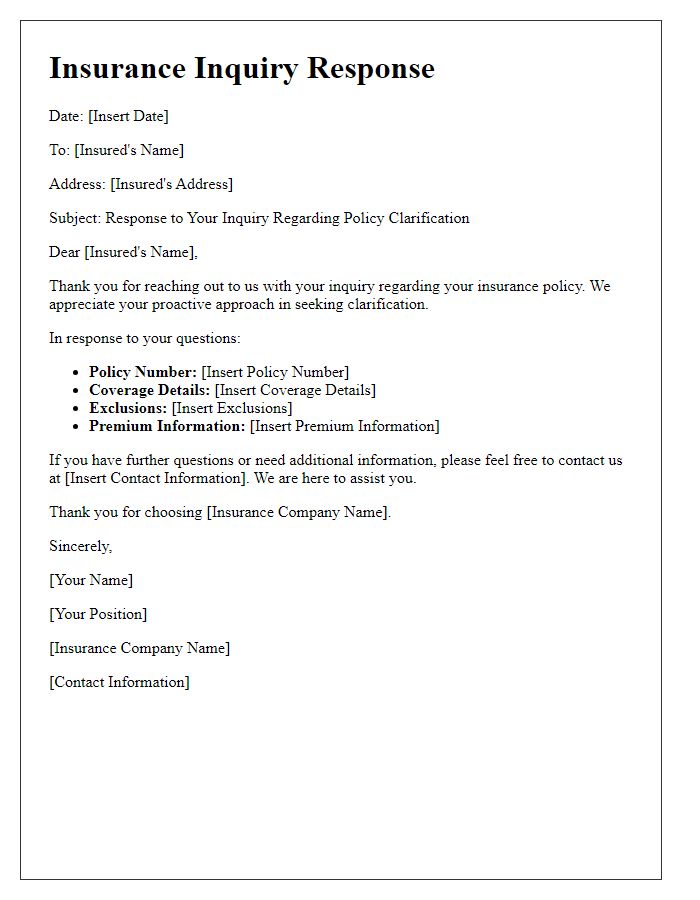

Insurance companies often engage clients through personalized communication methods. Addressing clients by name (e.g., Ms. Smith or Mr. Johnson) fosters a sense of respect and recognition, crucial in building customer trust. Including specific details such as policy numbers allows for direct context, enhancing the clarity of the inquiry response. Furthermore, the use of a warm salutation, such as "Dear Valued Policyholder" or "Hello [Client's Name]," immediately establishes a friendly tone, making the communication feel tailored and sincere. Personal touches, like acknowledging previous interactions or concerns, ensure that clients feel heard and valued, impacting overall satisfaction positively.

Policy and Claim Details

Insurance inquiries often involve critical elements such as policy numbers, claim numbers, and covered events. Policy numbers serve as unique identifiers for individual insurance agreements, while claim numbers relate to specific incidents, facilitating efficient processing. When addressing claims, factors such as loss amounts, dates of the occurrence, and applicable coverage limits become essential for thorough evaluation. Understanding policy terms, including exclusions and deductibles, is crucial for determining eligibility for coverage. The claims processing timeline varies among insurance providers, commonly taking anywhere from a few days to several weeks, depending on the complexity of the case and required documentation. Additionally, communication channels such as phone numbers or email addresses are vital for regular updates and inquiries.

Status Update and Explanation

The insurance claim status update provides essential insights into the process of reviewing claims within insurance companies, specifically regarding policyholders' requests for financial compensation. Each insurance claim, such as health insurance or auto insurance, undergoes a thorough evaluation, often taking several weeks to several months depending on the complexity. Factors influencing the timeline include required documentation, claim type, and internal review protocols. In the case of auto insurance claims, for example, an assessment of damages may involve inspections, photographs, and police reports from incidents, which contribute to the overall processing time. Policyholders often receive periodic updates through emails or customer service channels, ensuring clarity and transparency throughout the claim's investigation.

Next Steps and Requirements

After submitting an insurance inquiry, it is crucial to understand the next steps and requirements for seamless processing. Typically, policyholders will receive a confirmation email, indicating that the inquiry has been logged in the system. Required documentation may include a completed claims form (reflecting details of the incident), proof of loss (such as photos or receipts), and relevant identification (like a government-issued ID). Communication from the claims adjuster will outline specific deadlines for submission, which generally range from 14 to 30 days, depending on the insurance provider. Following the instructions carefully ensures efficient handling of the inquiry, leading towards potential resolution or payment. For further assistance, contact customer service or your insurance broker during business hours (typically 9 AM to 5 PM, Monday through Friday).

Contact Information and Support

Prompt and effective communication is essential in addressing insurance inquiries. Utilizing official contact information ensures that policyholders can easily reach customer support services, such as phone lines or dedicated email addresses, to seek clarification on their coverage details or claims process. Insurance companies often provide support through various channels, including online chat, claim tracking portals, or in-person consultations at local offices across major cities like New York or Los Angeles. Timely responses from trained representatives can significantly enhance customer satisfaction, providing clear guidance on policy terms, premium payments, or coverage limitations, ultimately fostering a loyal client relationship.

Letter Template For Insurance Inquiry Response Samples

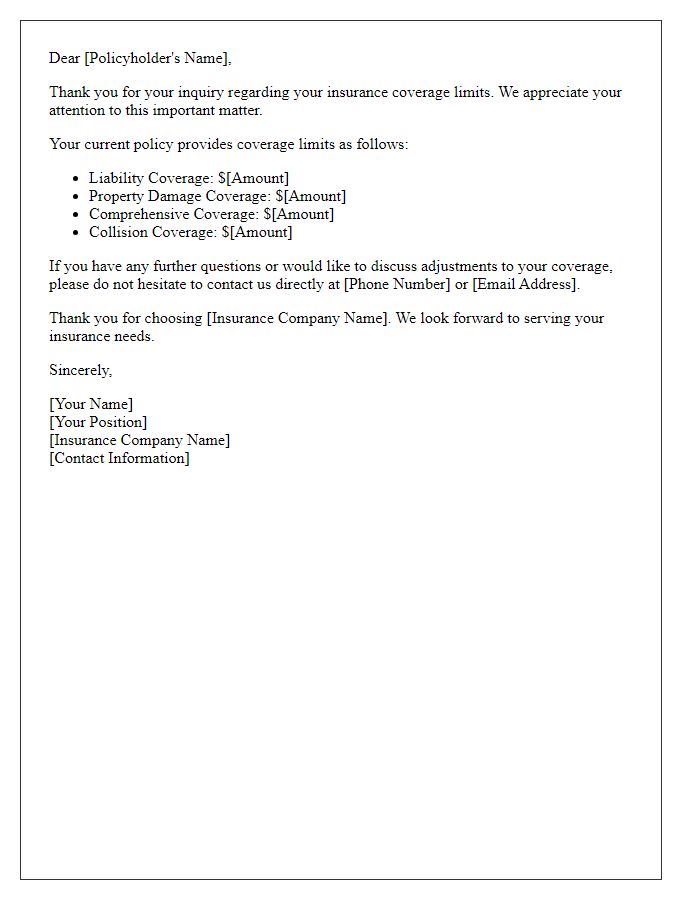

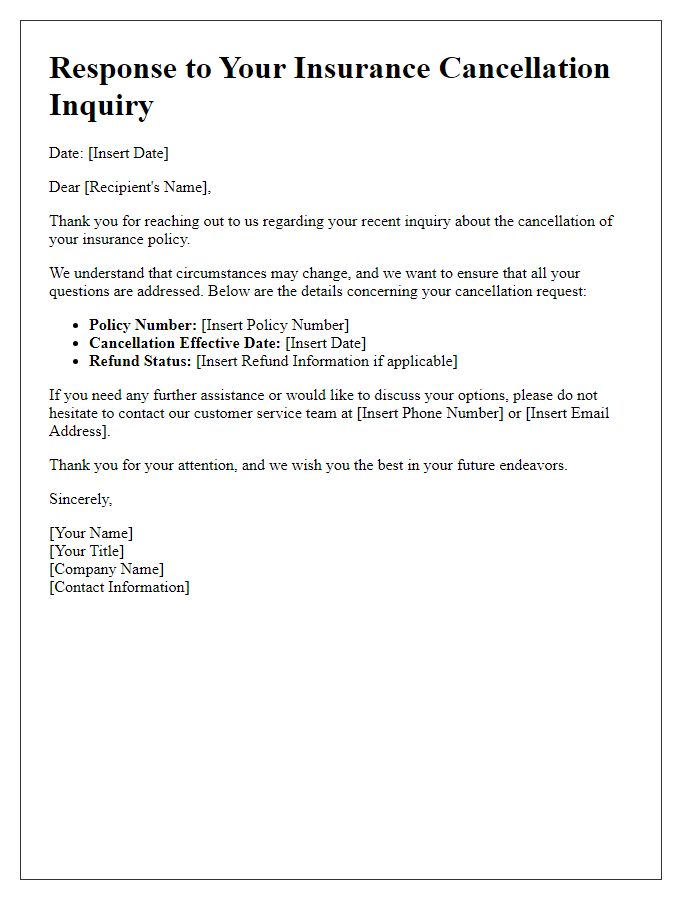

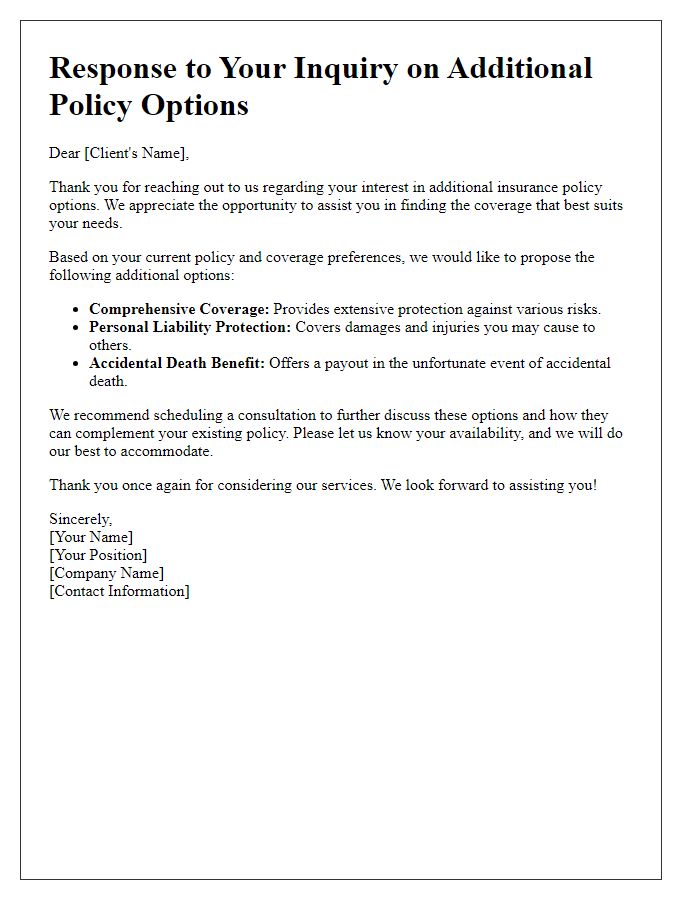

Letter template of insurance inquiry response addressing coverage limits.

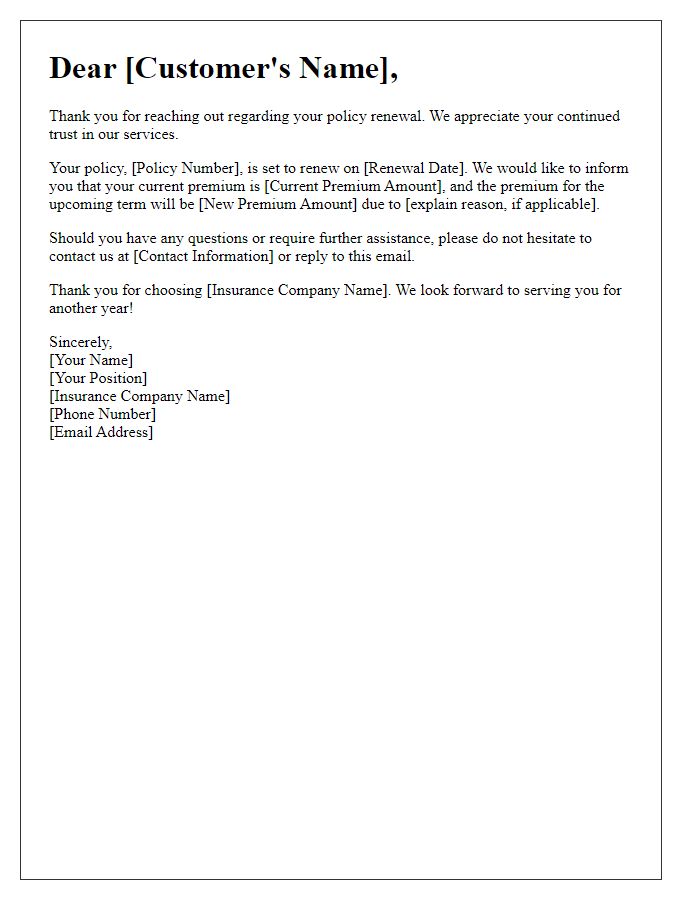

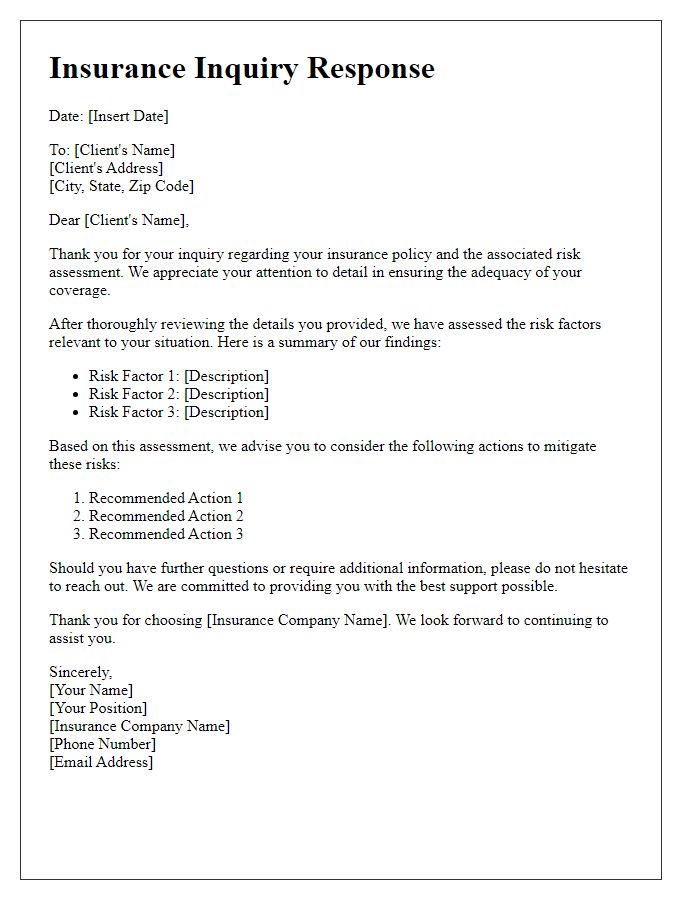

Letter template of insurance inquiry response concerning policy renewal.

Comments