Are you looking to inform your insured parties about important indemnity notifications? Crafting a clear and concise letter is essential for ensuring that your message is understood. In this article, we'll walk you through a customizable letter template that effectively communicates the necessary details while maintaining a professional tone. So, grab your notepad and let's dive into the world of insurance indemnity notifications!

Claimant Information

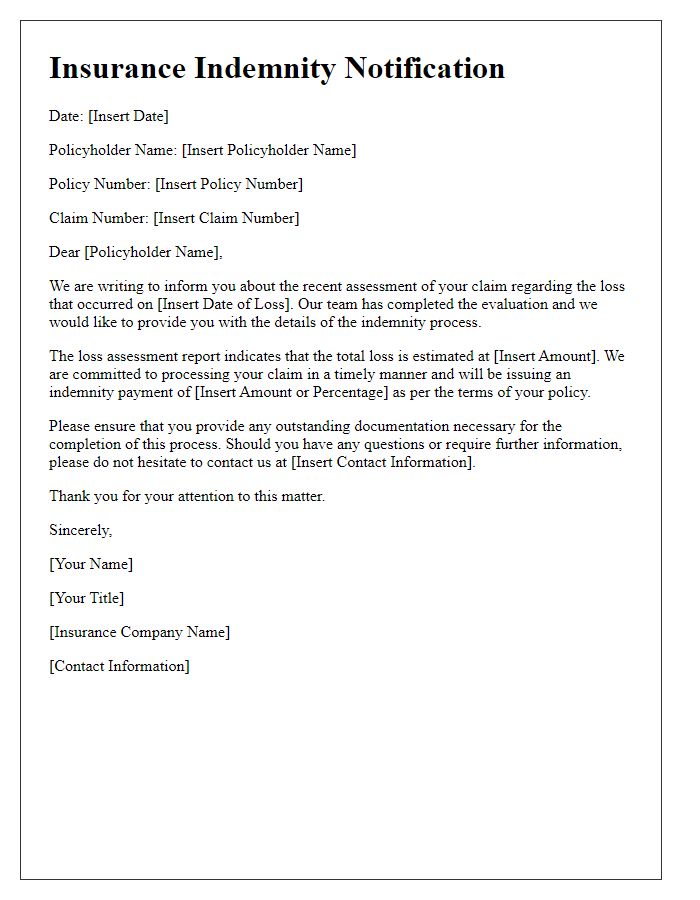

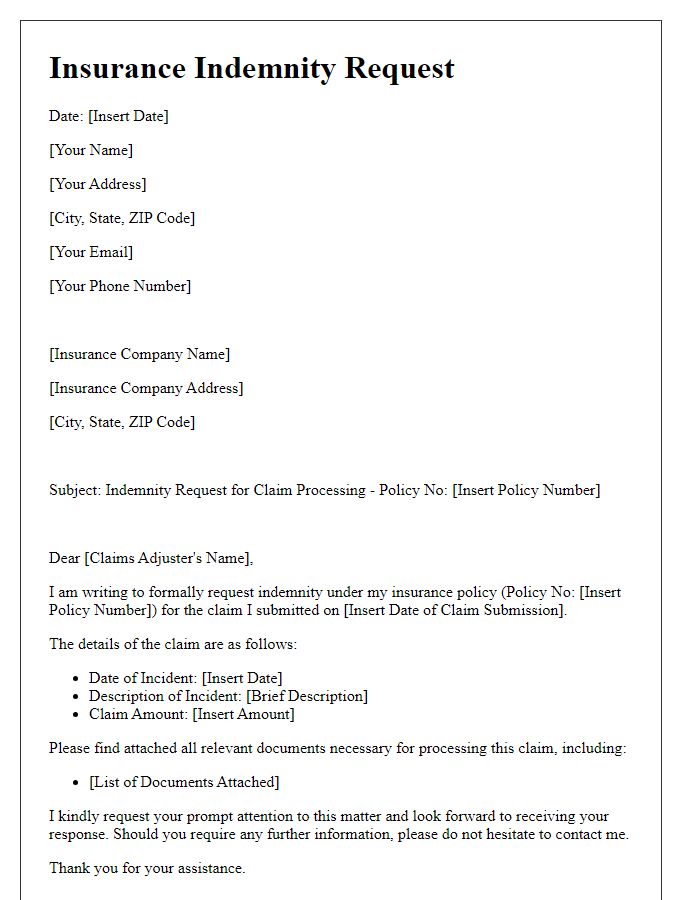

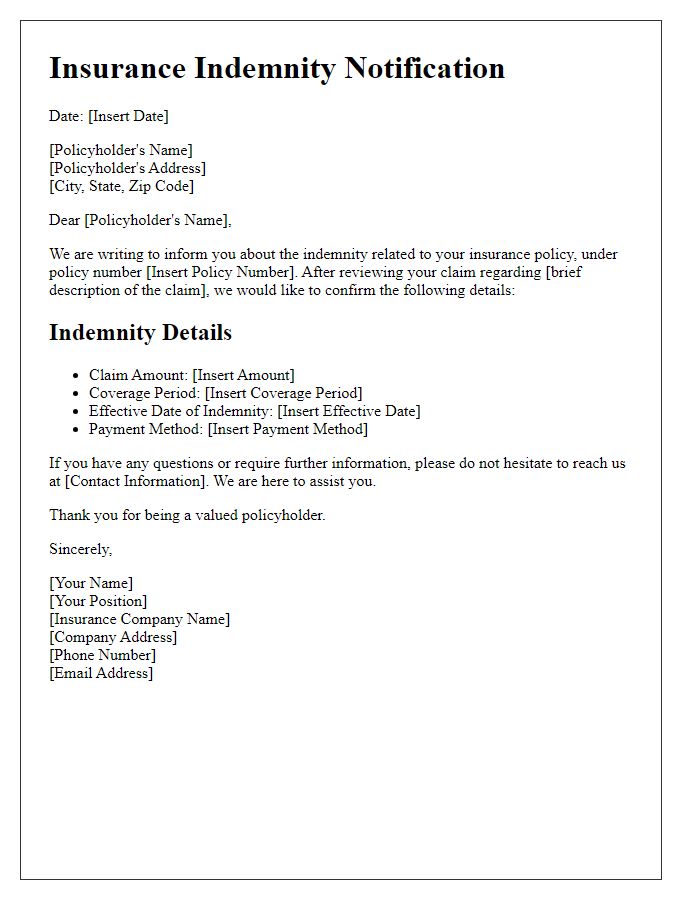

The process of submitting an insurance indemnity notification requires detailed claimant information to ensure proper handling and prompt resolution. Essential details include the claimant's full name, typically a legal name used for identification, and the contact information comprising an address, email, and phone number. A unique claim number should be included, assigned by the insurance company for tracking purposes. Furthermore, the policy number, linking the claimant to the specific insurance contract, is vital. The date of the incident triggering the claim is crucial, as it often determines the validity period for claims. A brief description of the incident provides context, while any supporting documentation, such as photographs or police reports, enhances the submission by corroborating the claim. Lastly, the claimant's signature may be required to validate the authenticity of the notification.

Policy Details

Insurance indemnity notifications convey critical information regarding the coverage and responsibilities under specific policies. Standard policy details encompass elements such as the unique policy number assigned at the inception of coverage, the effective date which marks the commencement of insurance protection often set for one year, the name of the insured individual or entity that outlines who is protected under the policy, and the insurer's information detailing the insurance company's name and contact information for claims submission. Additionally, the type of coverage--such as general liability, property insurance, or professional indemnity--should be specified, alongside any limits on coverage amounts, deductibles, and relevant endorsements or riders that customize the policy for particular circumstances or risks. Timely notification to the insurance provider about claims or incidents is essential to uphold indemnity rights, ensuring that all required documentation adheres to policy stipulations for effective processing.

Incident Description

On June 15, 2023, a significant incident occurred at the commercial property located at 123 Main Street, Springfield, resulting in substantial damage due to a catastrophic fire. The blaze, reportedly ignited by faulty electrical wiring, rapidly spread through the first and second floors, engulfing approximately 3,000 square feet of the building. Firefighters from the Springfield Fire Department responded promptly, deploying over 20 personnel and four fire engines; despite their swift action, the fire caused an estimated $500,000 in damages, affecting both structural integrity and valuable inventory. Subsequently, the property owner submitted a claim for insurance indemnity under the commercial property policy with XYZ Insurance Company. Comprehensive reports from local authorities and independent assessors indicate the urgent need for restoration and rebuilding efforts to mitigate further losses.

Indemnity Amount Requested

Indemnity notification involves a formal communication where an individual or entity requests compensation for losses or damages covered under an insurance policy. Important details include the specific indemnity amount sought, such as $50,000 for property damage, the incident date (e.g., September 15, 2023), and the policy number associated with the claim (e.g., Policy #123456789). The notification should reference the nature of the loss, mentioning, for instance, a fire incident at 250 Elm Street in Springfield, resulting in extensive damage to a residence. Supporting documents, like repair estimates or photographs, can be included, ensuring all pertinent information is conveyed to facilitate a timely review by the insurance company.

Documentation and Evidence

Insurance indemnity notifications require detailed documentation and evidence to support claims. Essential documents include the original policy number (for identification) and the claim form (detailing the incident). Photographic evidence (high-resolution images capturing damage) and incident reports (from authorities or witnesses) provide clarity. Medical records (if applicable) and repair estimates (from certified professionals) substantiate costs. Additionally, correspondence (emails, letters) between the insured and insurer can demonstrate communication history. All evidence must maintain proper timestamps and signatures to verify authenticity and support the validity of the claim during the review process.

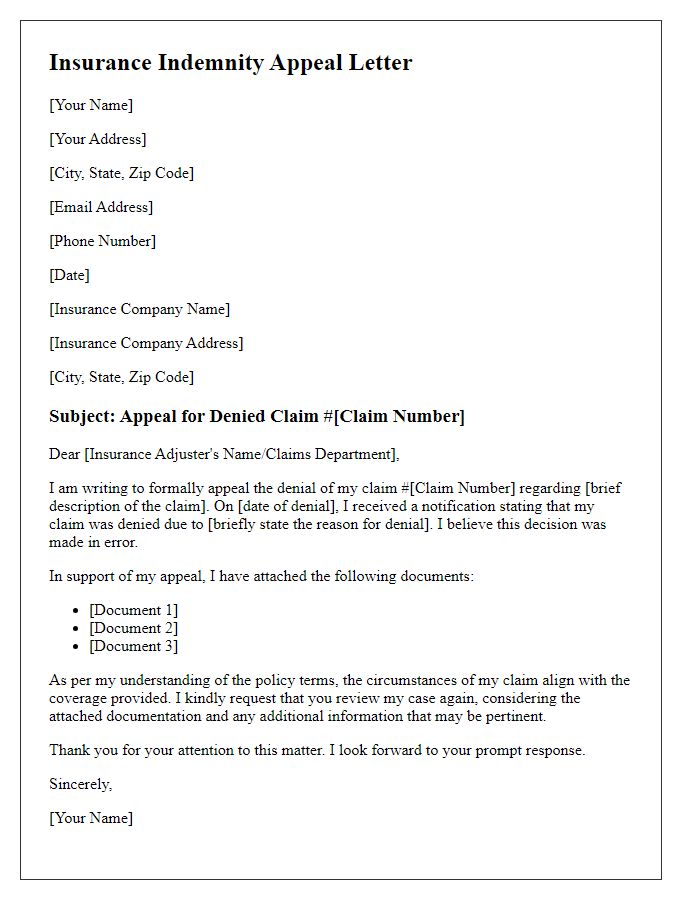

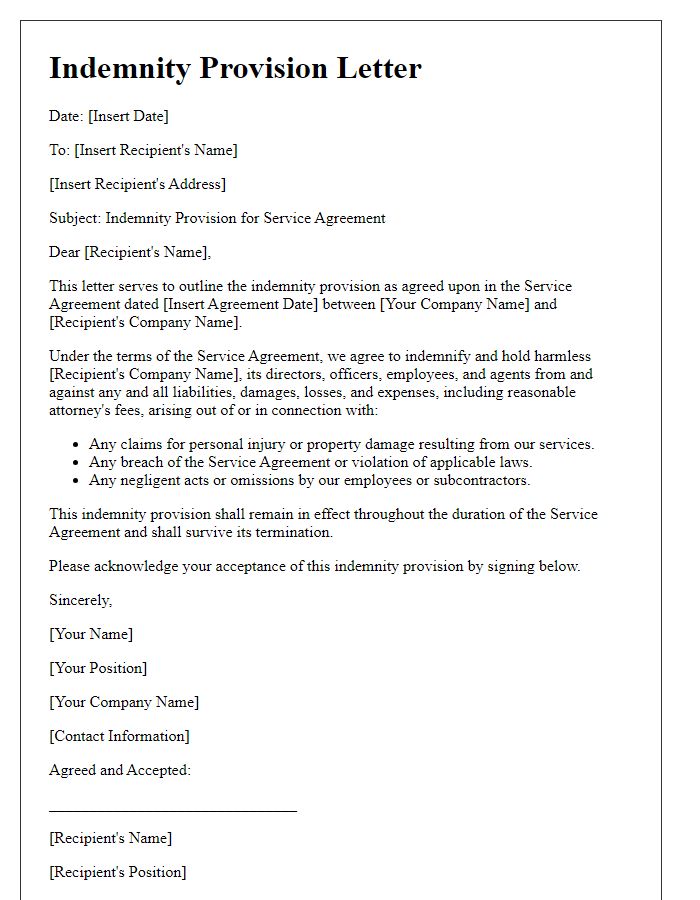

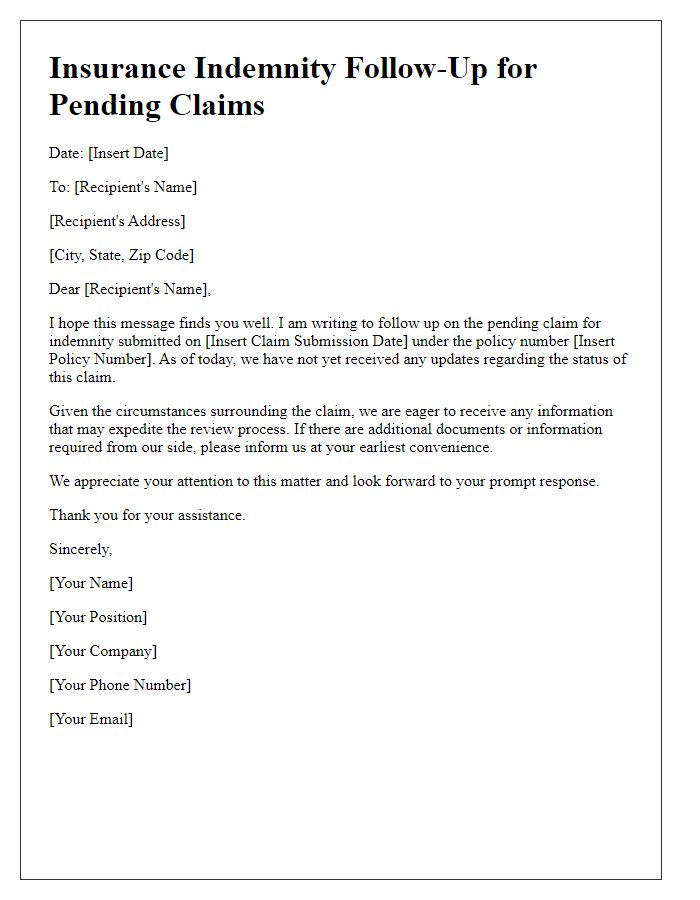

Letter Template For Insurance Indemnity Notification Samples

Letter template of insurance indemnity communication for loss assessment

Comments