Hey there! If you're considering terminating your insurance agreement, you're not aloneâmany people find themselves in similar situations. Whether it's due to financial changes, finding a better policy, or simply wanting a new direction, understanding the termination process can be crucial. In this article, we'll guide you through the steps to effectively communicate your decision and ensure a smooth transition. So, let's dive in and explore how to make this process as seamless as possible!

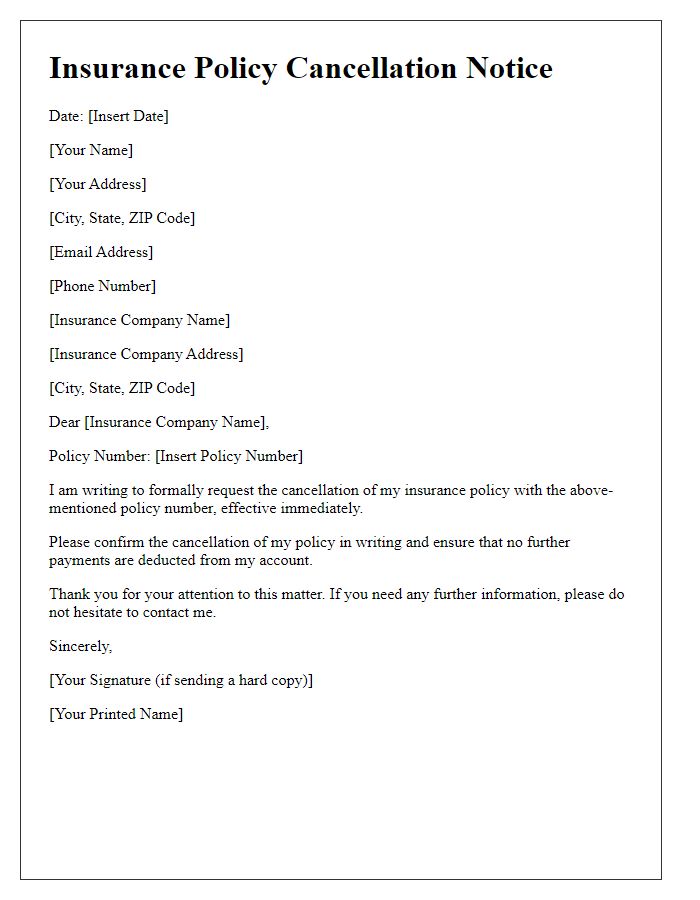

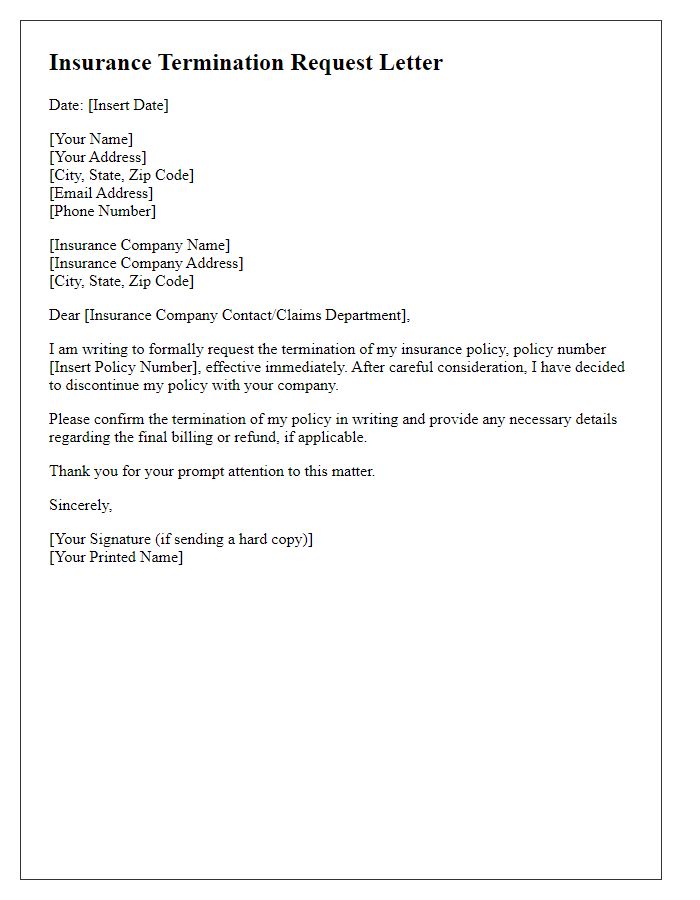

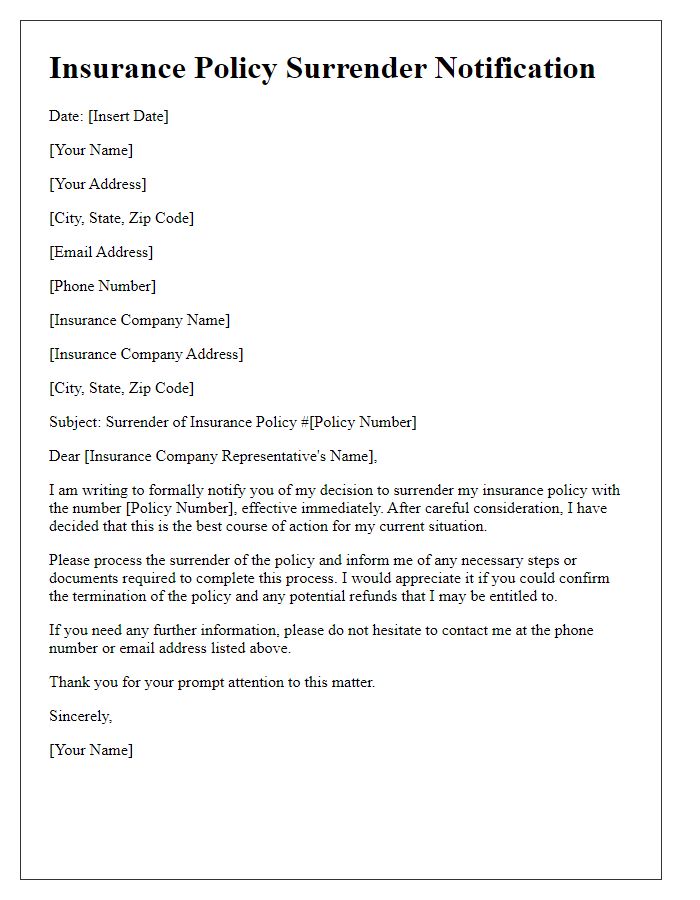

Policyholder Information

Policyholder information, crucial for the insurance agreement termination process, includes key details such as full name, address, and contact information of the policyholder. These details must align with the documents filed with the insurance company to ensure proper identification. The policy number, an essential numeric identifier, assists the insurer in locating specific accounts efficiently. Additionally, the policy start date and termination effective date are necessary to clarify the time frame of coverage and the cessation of obligations. Also, it may be beneficial to include the reason for termination, which could range from personal circumstances to financial considerations, contributing to a complete understanding of the policyholder's situation.

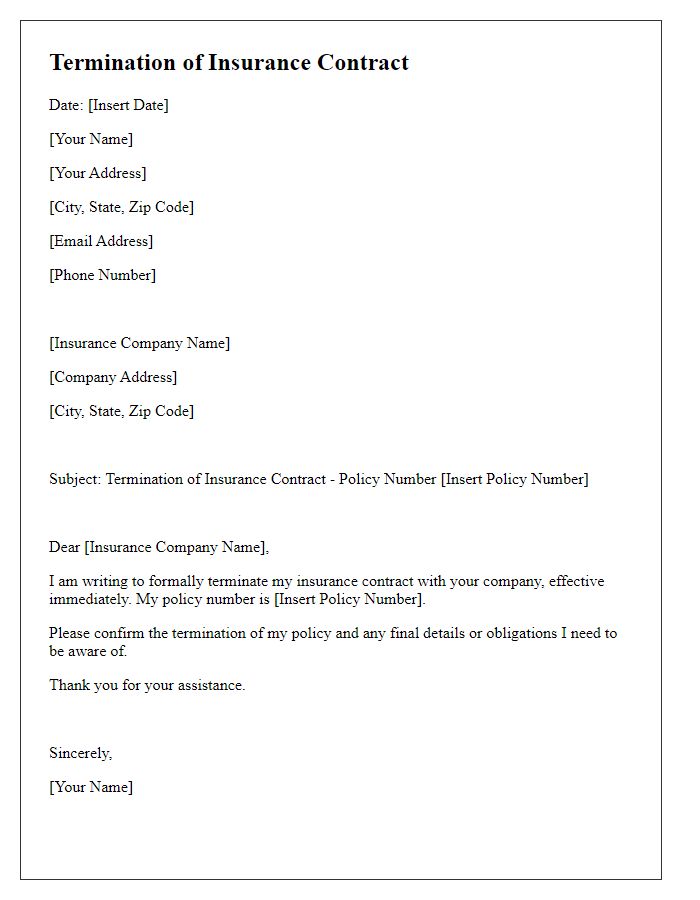

Policy Details

Terminating an insurance agreement, especially a policy with significant coverage parameters, requires careful consideration of the specific policy details. Policy number 123456789 pertains to comprehensive auto coverage, effective from January 1, 2023, with an annual premium of $1,200. The insured vehicle, a 2022 Honda Accord, has a market value of approximately $25,000. Noteworthy clauses include a 30-day notice period for termination and potential penalties for early cancellation defined in section 4 of the policy document. The insurance provider, ABC Insurance Company, headquartered in Chicago, Illinois, with contact number (123) 456-7890, has outlined procedures for submitting termination requests via certified mail to ensure acknowledgment and compliance. Ensuring all procedures align with the policy terms is crucial to avoid disruptions in coverage or financial penalties.

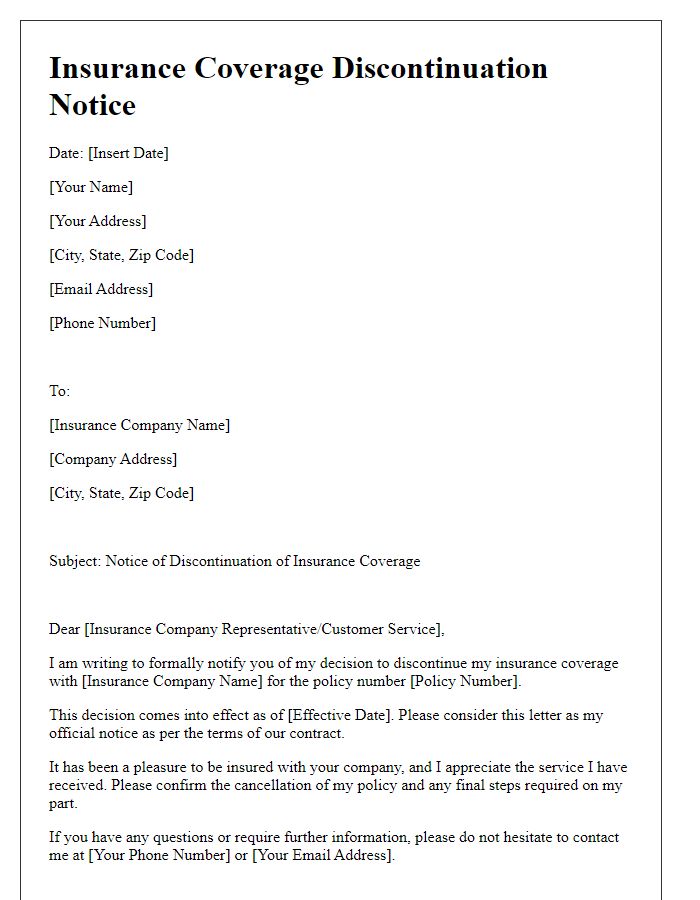

Termination Effective Date

The termination of an insurance agreement may occur due to various reasons, including non-payment of premiums, changes in risk factors, or mutual consent between the parties involved. Upon reaching the termination effective date, typically designated in the policy renewal documents, the coverage will cease, obligating both the insured and the insurer to adhere to any post-termination responsibilities. For instance, claims submitted after this date may not be honored, and any unearned premiums could be subject to refund per state regulations. It is crucial for both parties, particularly the insured, to understand the implications of this date, ensuring that new coverage or alternatives are secured to avoid potential gaps in protection against losses or liabilities.

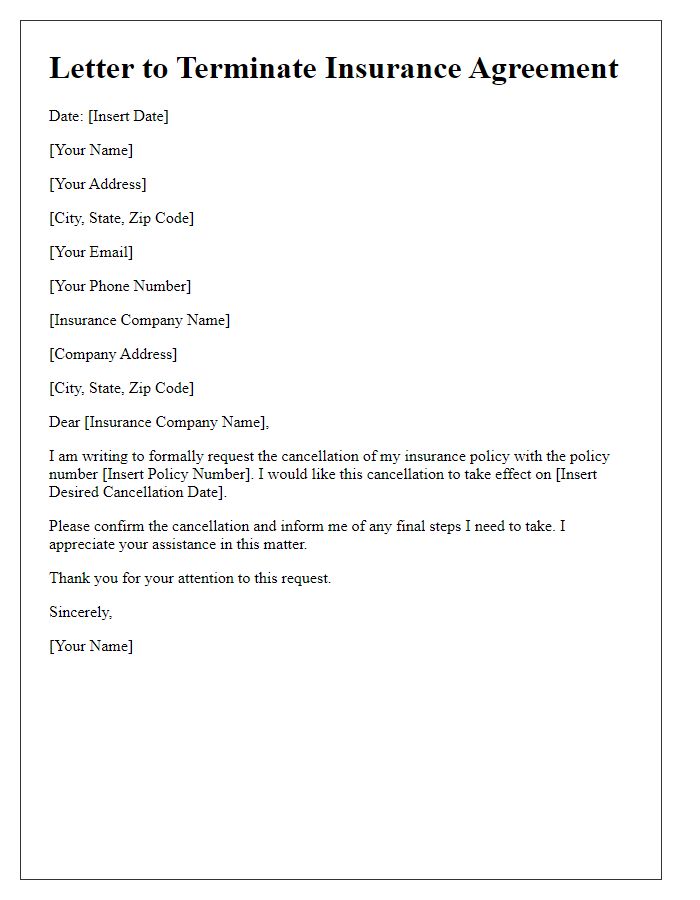

Reason for Termination

Insurance agreements often conclude due to various circumstances, such as policyholder decision, insurer concerns, or regulatory changes. Common reasons for termination include non-payment of premiums, where policyholders fail to meet payment deadlines, leading to cancellation after a grace period of typically 30 days. Policyholders may also terminate agreements voluntarily due to changes in coverage needs, often arising from significant life events like marriage or home purchase. Insurers might terminate policies based on risk assessment, identifying changes in the insured's risk profile. Regulatory requirements can also necessitate termination, especially if a policy does not comply with specific state laws. Clear communication regarding the termination process is essential for both parties to manage expectations and ensure a smooth conclusion of the policy agreement.

Contact Information for Queries

Insurance policy termination can often involve various complexities and important contact points. Customers may need clarification on specific details such as policy numbers, effective dates, and cancellation procedures. Understanding the termination process for insurance agreements with providers, such as Allstate or State Farm, is crucial. Furthermore, individuals must be aware of the implications, including potential refunds or outstanding premiums. Inquiries can generally be directed to customer service departments, which may be reached via phone or email, usually listed on the insurance provider's official website. Ensuring proper communication with the right department can facilitate a smoother termination process.

Comments