Are you considering surrendering your insurance policy, but unsure where to start? Understanding the process can feel daunting, but it doesn't have to be. In this article, we'll walk you through a clear and concise letter template that makes your insurance policy surrender straightforward and hassle-free. So, let's dive in and simplify this for youâread on to learn more!

Policyholder Details

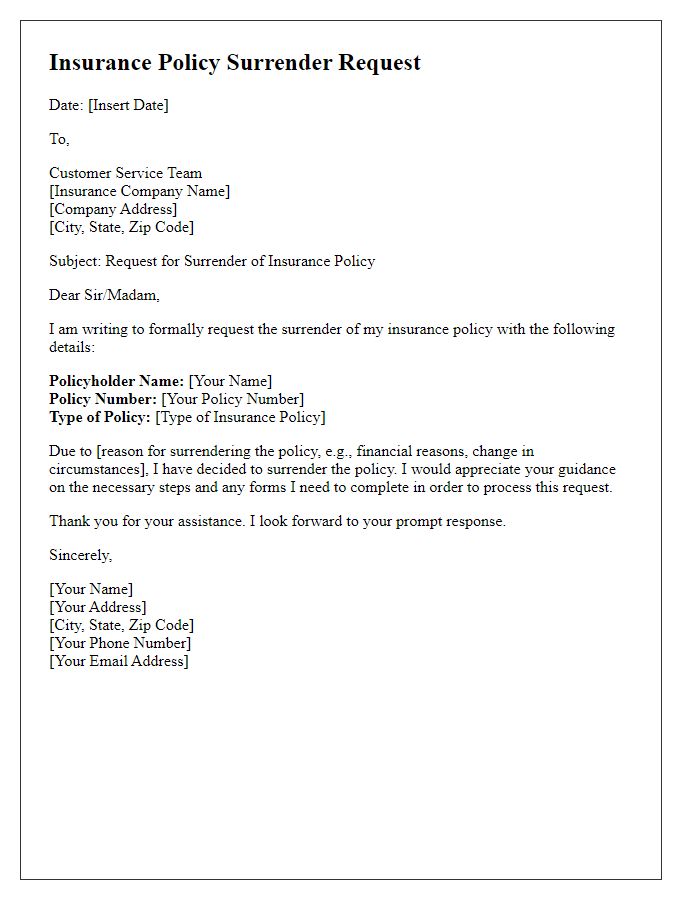

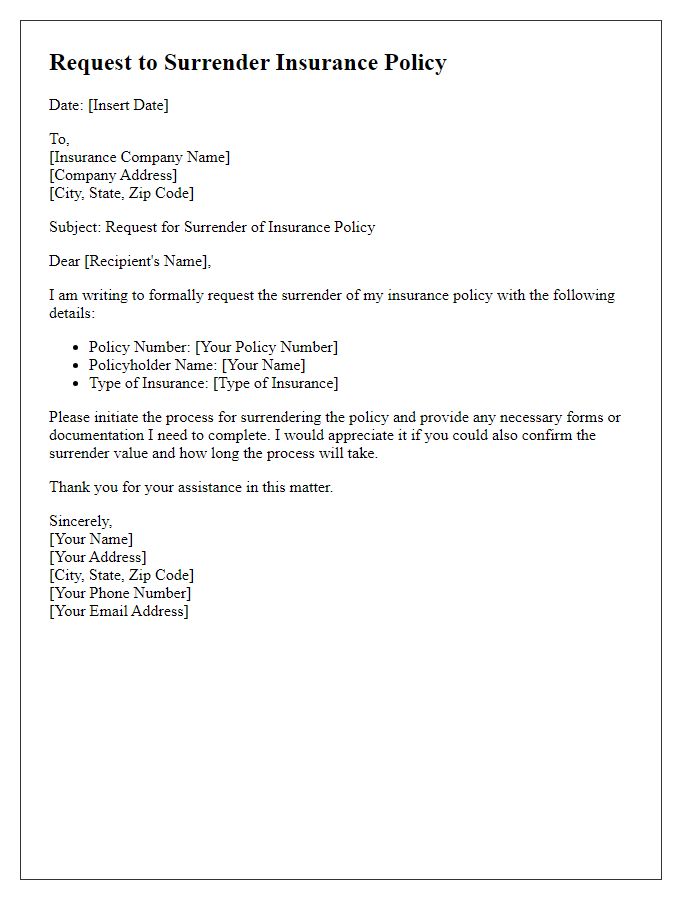

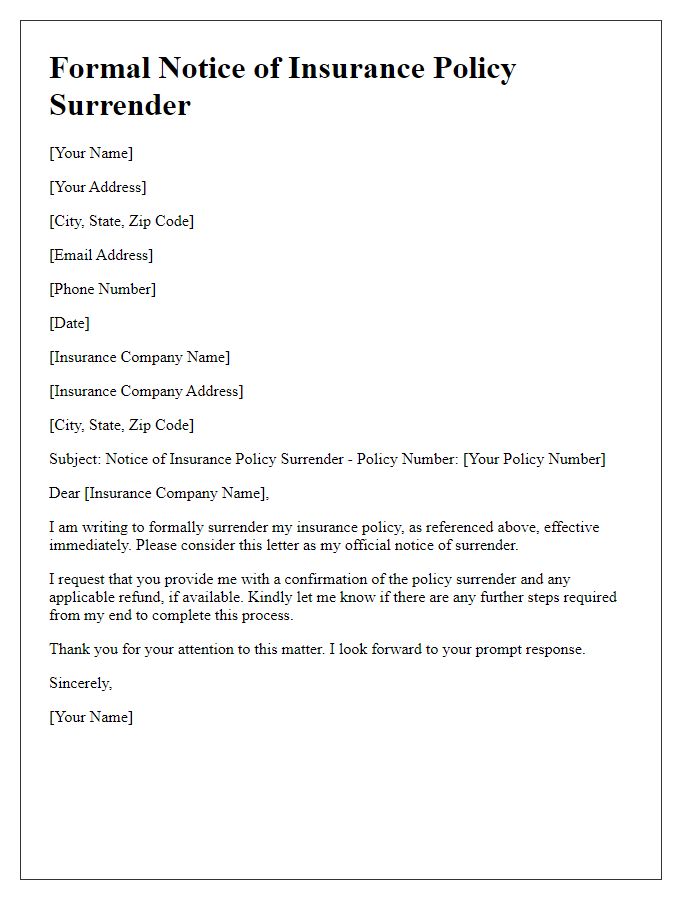

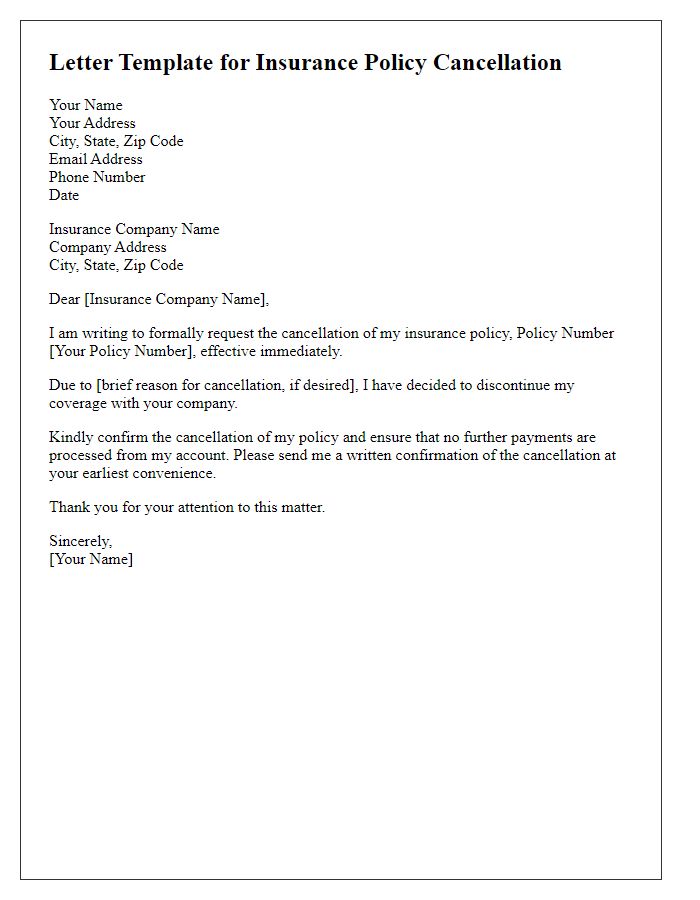

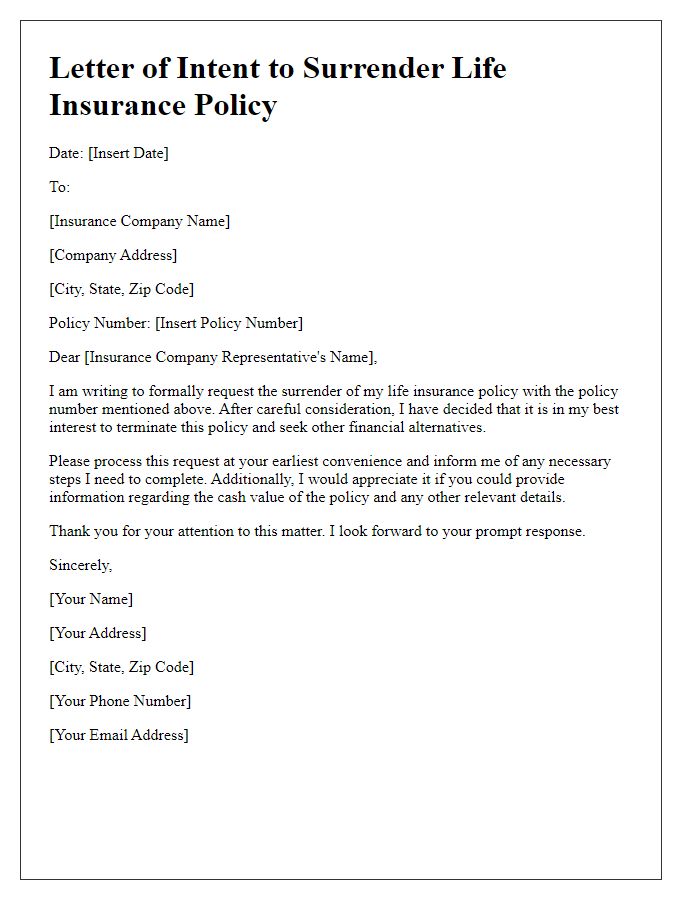

The insurance policy surrender process requires careful submission of relevant details such as the policyholder's full name, address, and contact information. The policy number, which uniquely identifies the insurance contract, is critical for proper processing of the surrender request. Inclusion of the date of birth may also be necessary for verification purposes. It is essential to specify the type of policy being surrendered, for example, whole life or term insurance, and the reasons for surrendering, which could include financial needs or changes in personal circumstances. Accurate and complete information ensures a smooth surrender experience and expedites the return of any cash value associated with the policy.

Policy Information

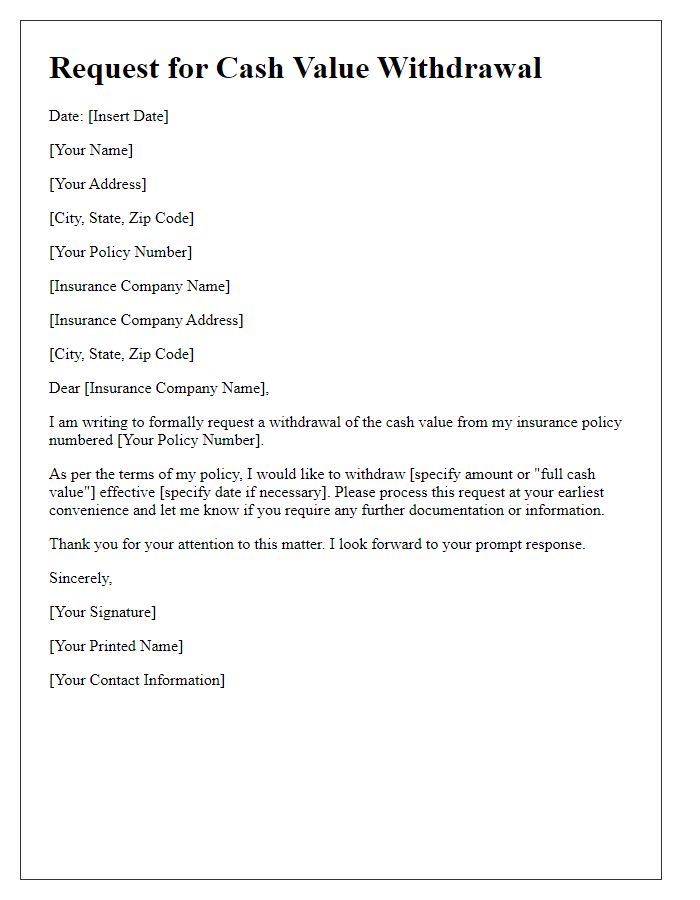

Surrendering an insurance policy requires specific information detailing policyholder identification and contract numbers. Policyholders should clearly state their name, address, and contact details. The policy number, typically a unique identifier such as 123456789, and the type of policy (e.g., whole life, term insurance) are essential for processing the surrender request. Dates of issue and expiry can provide additional context. Accurate records such as outstanding loans against the policy or premium payment history may be included to ensure seamless processing. These details facilitate the insurer's ability to verify the policy and initiate the surrender process, adhering to the guidelines set forth in the insurance agreement.

Surrender Request Statement

Surrendering an insurance policy, such as a whole life or endowment policy, involves submitting a Surrender Request Statement to the insurance company. This document typically includes the policyholder's details, such as name and policy number, along with a formal request for the cash surrender value. The cash surrender value represents the amount payable to the policyholder upon cancellation of the policy before maturity. It is crucial for policyholders to confirm their understanding of any potential tax implications associated with the surrender, as well as to ensure any outstanding loans against the policy are settled. Additionally, referencing specific policy terms and conditions helps streamline the surrender process and avoid delays. Be mindful that surrendering a policy may also affect future insurability options and beneficiaries' benefits.

Reason for Surrender

Insurance policy surrender represents a significant decision, often driven by various factors. Financial hardships, such as a job loss or emergency expenses, may prompt individuals to withdraw their investment. Changing life circumstances, including marriage or relocation, can lead to the reevaluation of existing policies. Insurance policyholders might also surrender their policy if they find better options for coverage, offering lower premiums or enhanced benefits. Additionally, the desire to free up cash for immediate needs or investment opportunities can influence this decision, reflecting personal financial priorities and goals. Each reason highlights the evolving nature of individual financial planning and needs over time.

Payment Instructions

Insurance policy surrender involves the process of terminating an insurance agreement to receive a cash value. Insurers often provide detailed payment instructions to facilitate this transaction smoothly. Policies, such as whole life or universal life insurance, can accumulate cash value over time. When surrendering a policy, important details, including the policy number and policyholder's identification, may be required for verification. Payment methods can vary, including direct bank transfers, checks, or wire transfers. Specific timeframes for processing the surrender request, which can take several weeks, are also crucial. Some insurers may levy surrender charges, which can reduce the cash payout significantly. Additionally, understanding tax implications on any gains received from a surrendered policy is vital for financial planning.

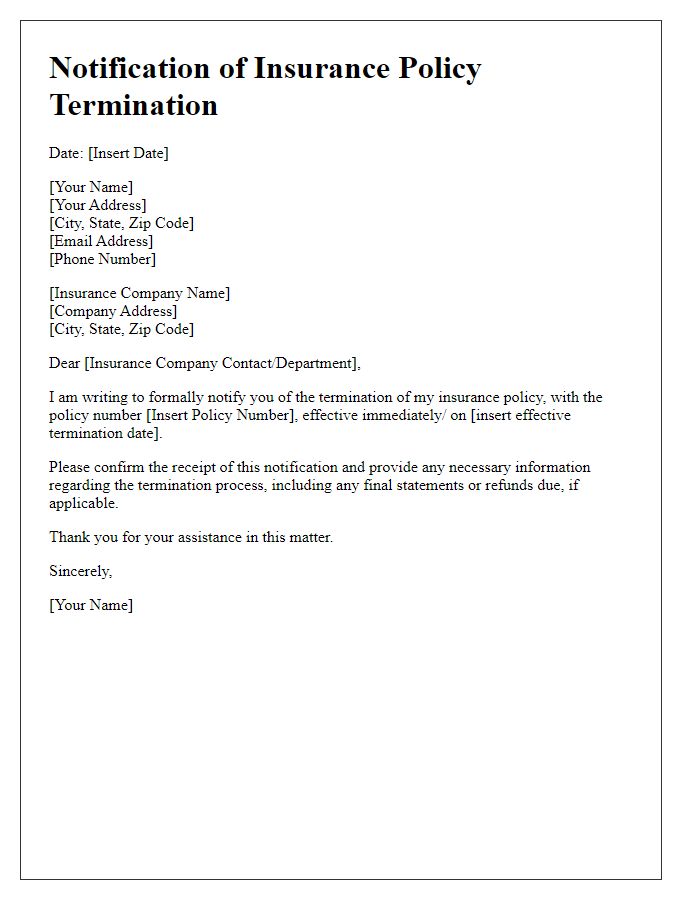

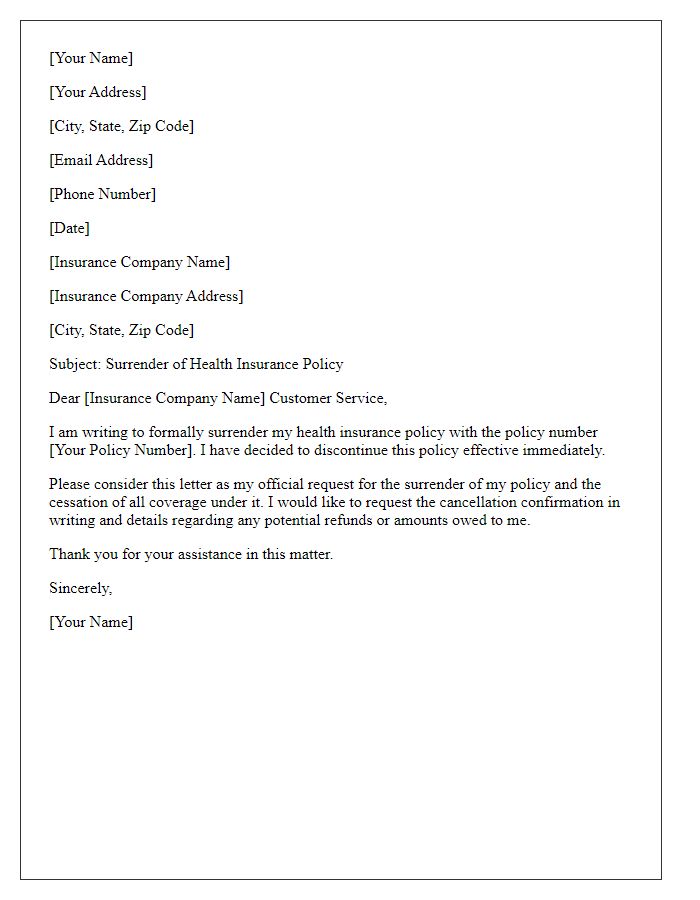

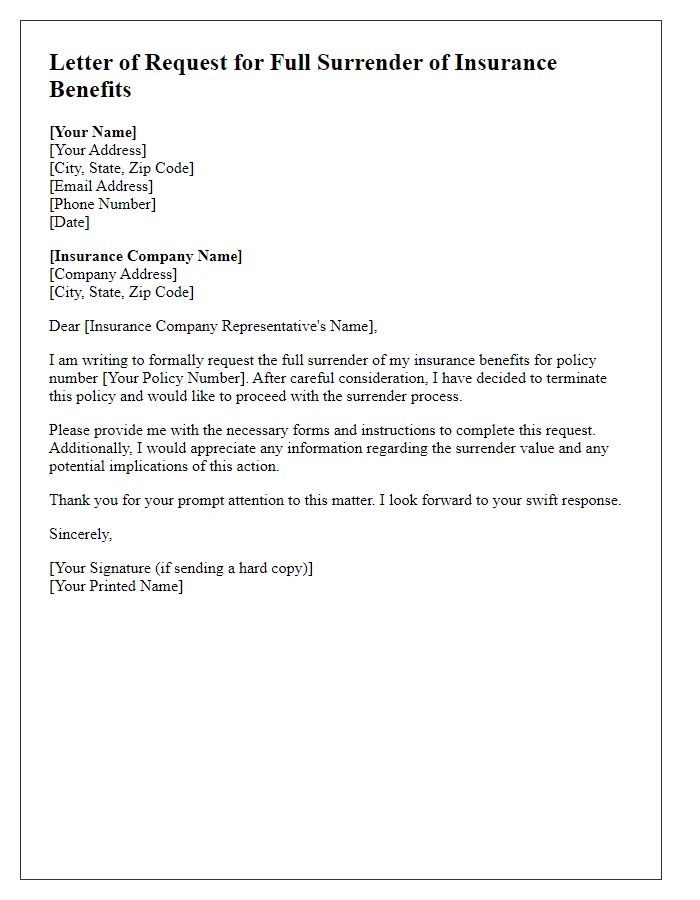

Letter Template For Insurance Policy Surrender Samples

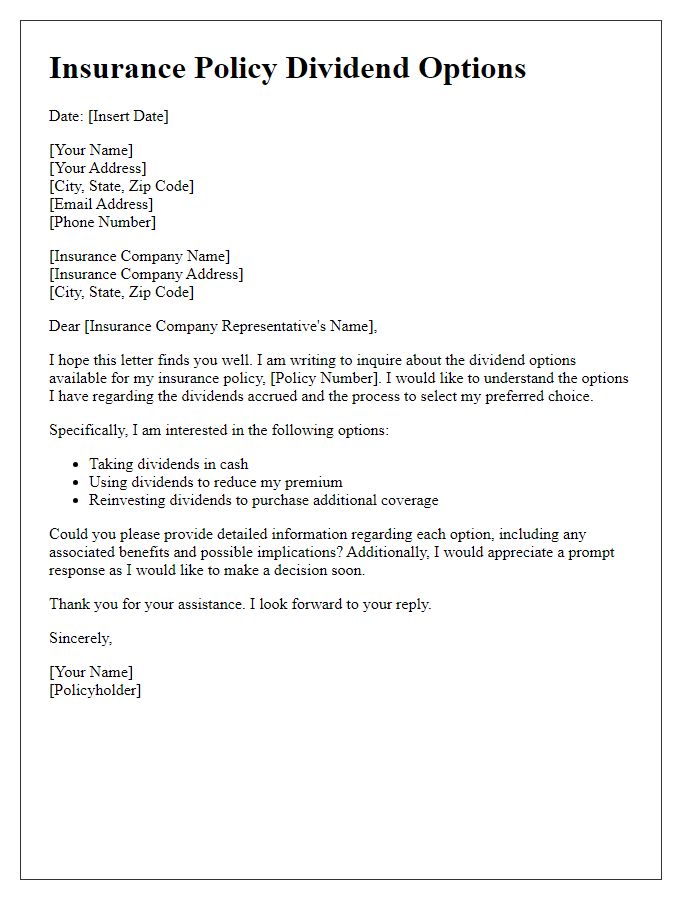

Letter template of correspondence for insurance policy dividend options.

Comments