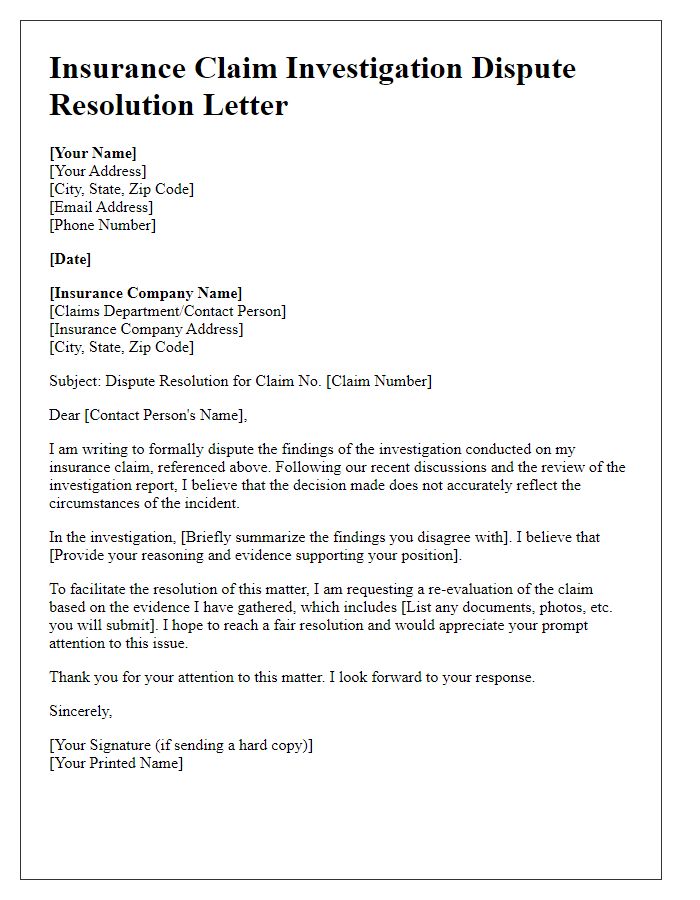

Are you navigating the sometimes overwhelming process of filing an insurance claim? It can be confusing, but understanding how to effectively communicate with your insurance company is crucial. In this article, we'll provide you with a comprehensive letter template specifically designed for insurance claim investigations, ensuring you have all the necessary details covered. So, grab a cup of coffee and let's dive into the essential steps you need to take!

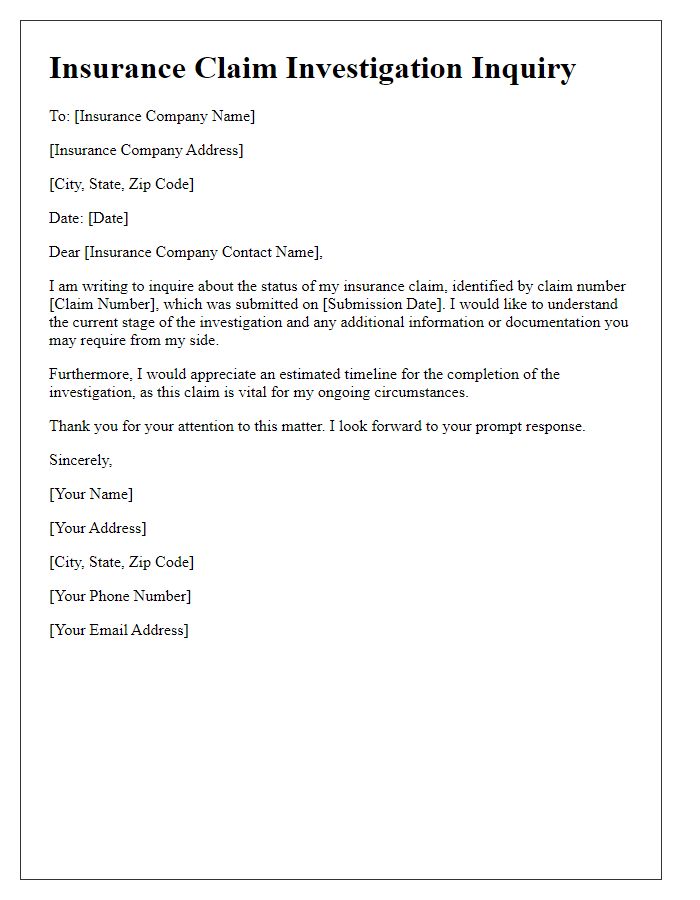

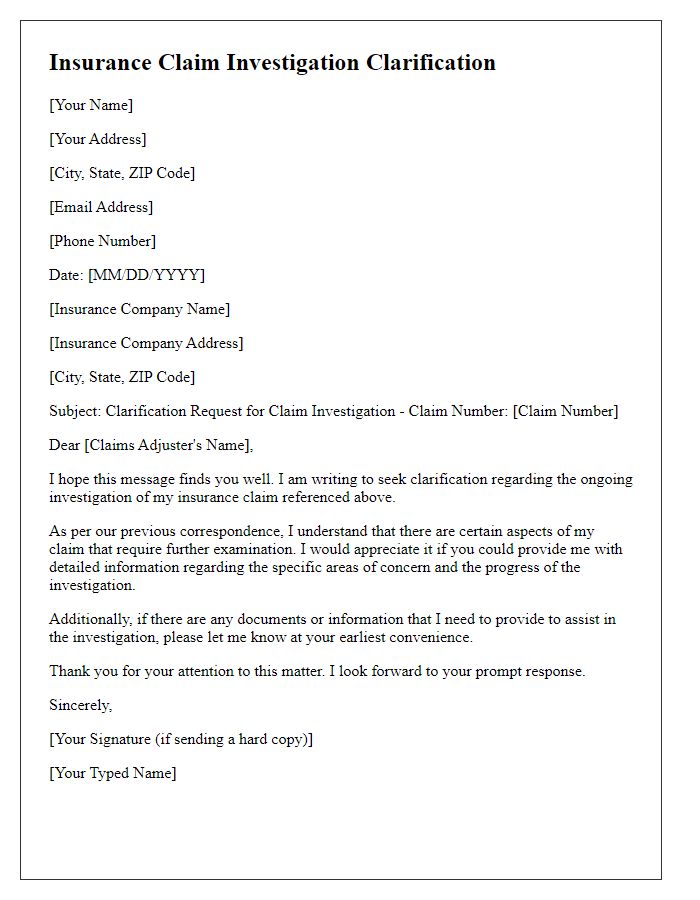

Claimant Information

Claimant information plays a crucial role in the insurance claim investigation process, ensuring accurate identification and evaluation. Essential data includes full name, contact details, and policy number to link claims to specific policies. Date of birth provides context for risk assessment, while mailing address aids in correspondence and verification. Incident details must be documented, highlighting the nature of the claim, date of occurrence, and location (for example, a car accident at 123 Main St, Springfield). Witness information, if applicable, can significantly impact the investigation's outcome by providing additional perspectives on the event. Lastly, any prior claim history relevant to the current claim can indicate patterns or areas of concern, influencing the insurer's assessment and resolution process.

Description of Loss or Incident

In September 2023, a severe storm categorized as a Category 2 hurricane (winds exceeding 96 mph) struck the coastal town of Clearwater, Florida, causing significant damage to residential properties. During this event, my home at 123 Ocean Drive experienced extensive water intrusion, resulting in damage to the interior walls and foundation. Roof shingles were displaced, allowing rainwater to infiltrate living areas. The damage estimate was projected at $30,000, encompassing repairs for both water-damaged drywall and structural reinforcements. As documented, I attempted to restore the property immediately after the storm's passage and contacted professional contractors for remediation. Moreover, local authorities issued emergency declarations due to widespread damage, further supporting the severity of this incident.

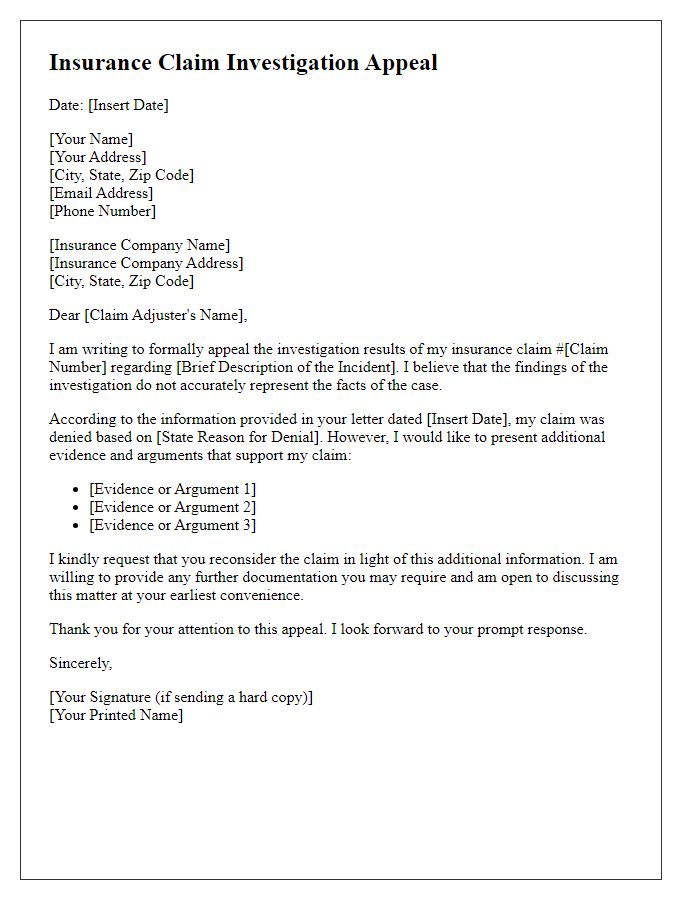

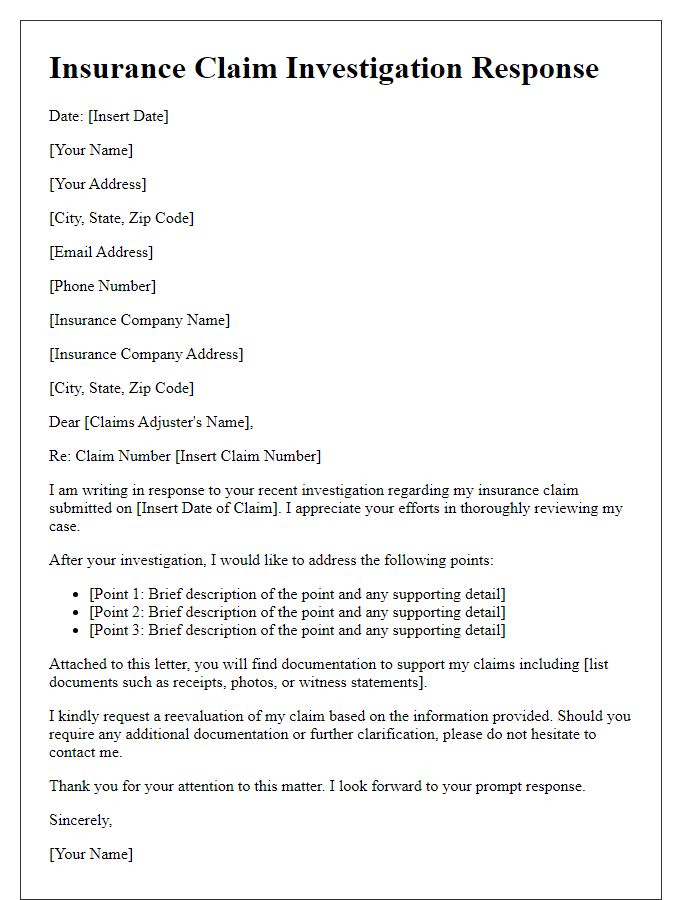

Policy Details and Coverage

Insurance policies provide vital coverage for various risks and events, such as property damage, theft, or health-related issues. For instance, a homeowner's insurance policy typically covers losses from incidents like fire, natural disasters, and vandalism, offering financial protection for properties valued at significant amounts (averaging around $300,000 in the United States). In the case of car insurance, coverage can include collision, liability, and comprehensive options, safeguarding vehicles worth thousands of dollars against accidents and unforeseen events. Additionally, health insurance plans can cover medical expenses, often ranging from routine check-ups to major surgeries, ensuring policyholders receive necessary care without incurring crippling out-of-pocket costs. Understanding individual policy details, including deductibles, limits, and exclusions, is essential for effective claim filing and investigation processes.

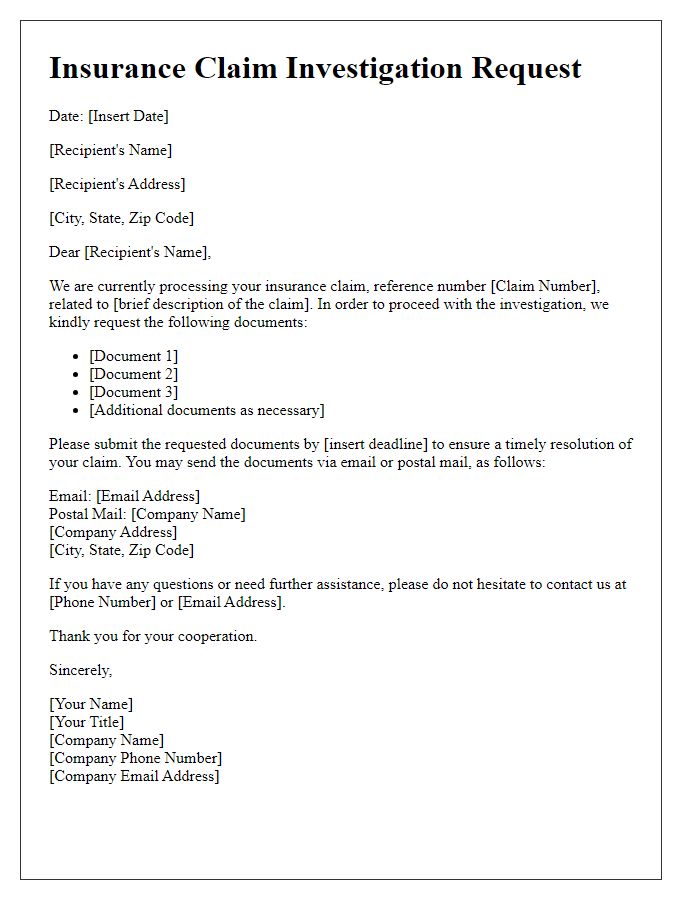

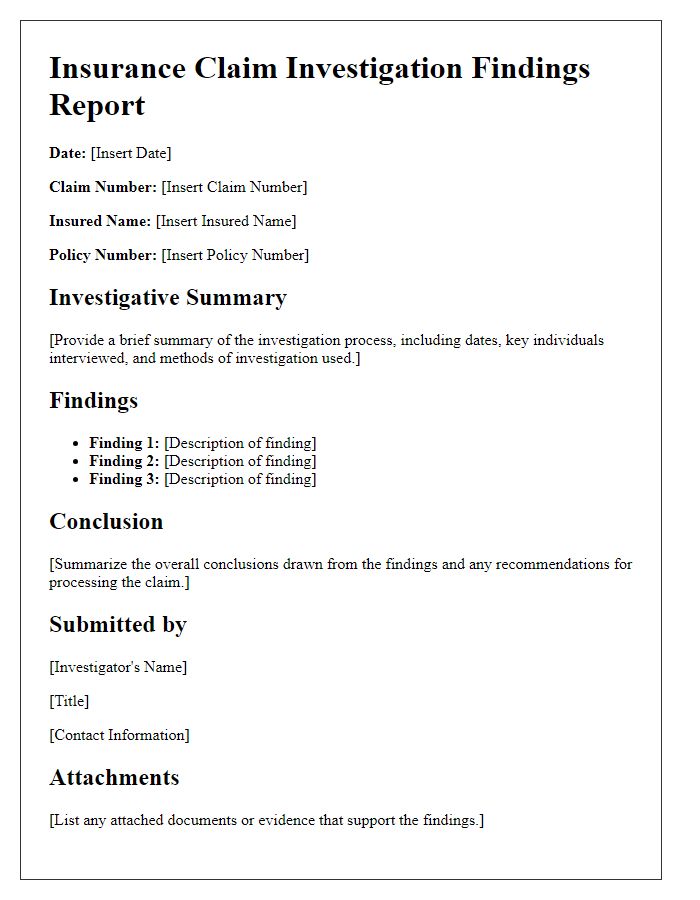

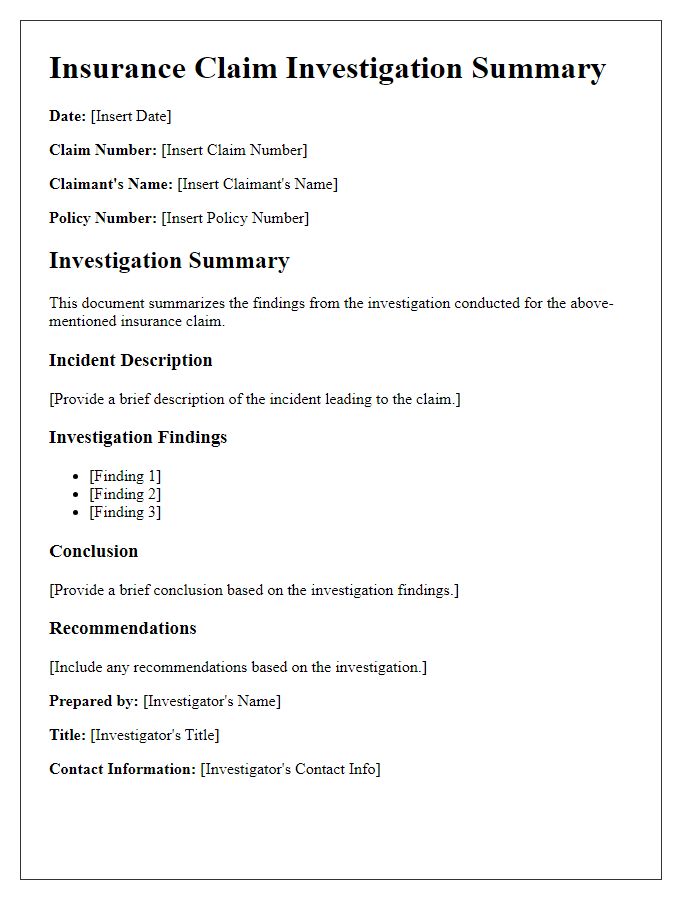

Documentation and Evidence Required

Insurance claim investigations rely heavily on documentation and evidence to validate claims made by policyholders. Essential documents include the initial claim form detailing the incident, photographs capturing the damage or event, and police reports in cases of theft or accidents. Additionally, medical records are crucial for claims involving injuries, providing evidence of treatment and associated costs. Witness statements can further support claims, offering third-party perspectives on the incident. Financial documentation, such as repair estimates and receipts, is necessary to substantiate the value of loss or damage claimed. Accurate and comprehensive evidence ensures a smoother investigation and quicker resolution by claims adjusters.

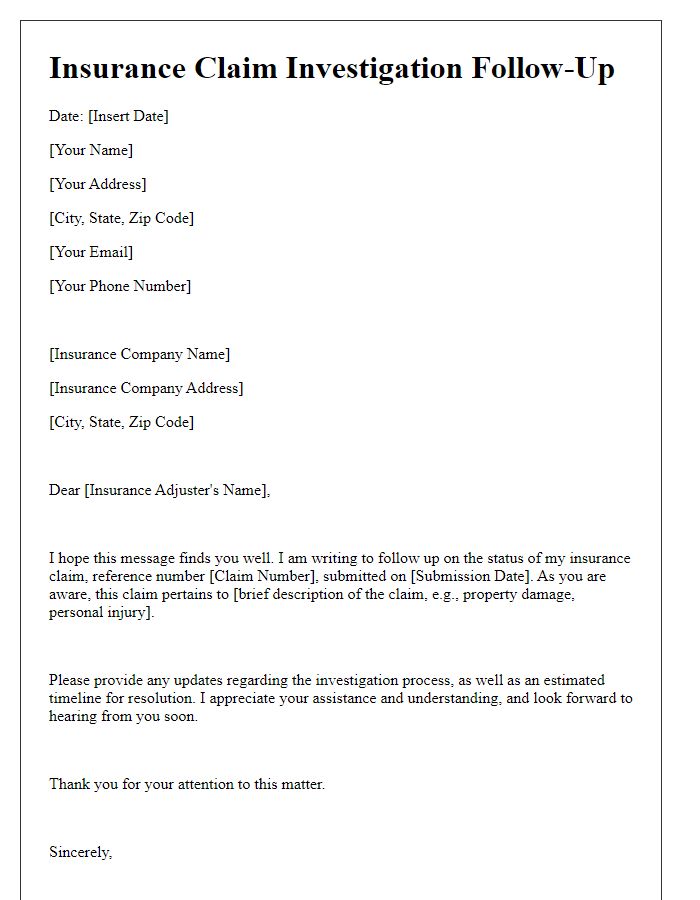

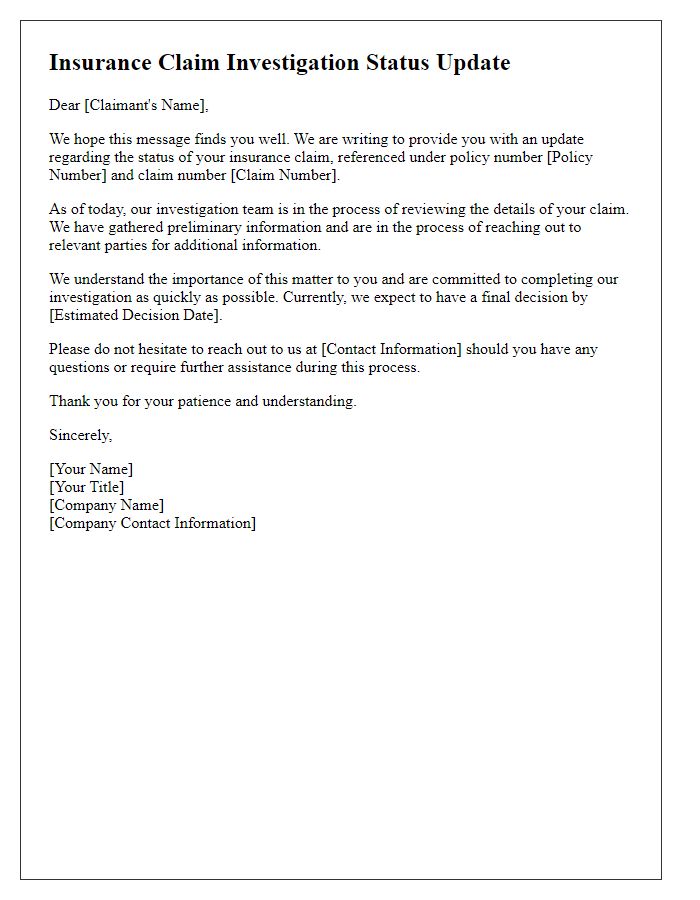

Contact Information for Further Assistance

In insurance claim investigations, clear contact information is crucial for facilitating communication and resolving inquiries efficiently. Policyholders should include their full name, claim number, and specific policy details to ensure accurate tracking. Insurers typically provide a dedicated customer service phone line, often operational during business hours (8 AM - 6 PM local time), alongside an email address for direct correspondence. Some companies may also offer online chat services for immediate assistance. Providing an accessible mailing address (usually for documentation purposes) enhances customer support, ensuring swift responses to any additional requirements or clarifications regarding the claim process.

Comments