Are you feeling overwhelmed by your current insurance coverage? Adjusting your policy can seem like a daunting task, but it doesn't have to be! By taking a few simple steps, you can ensure that your coverage reflects your current needs and circumstances. Join us as we explore how to navigate the process of adjusting your insurance coverage with ease.

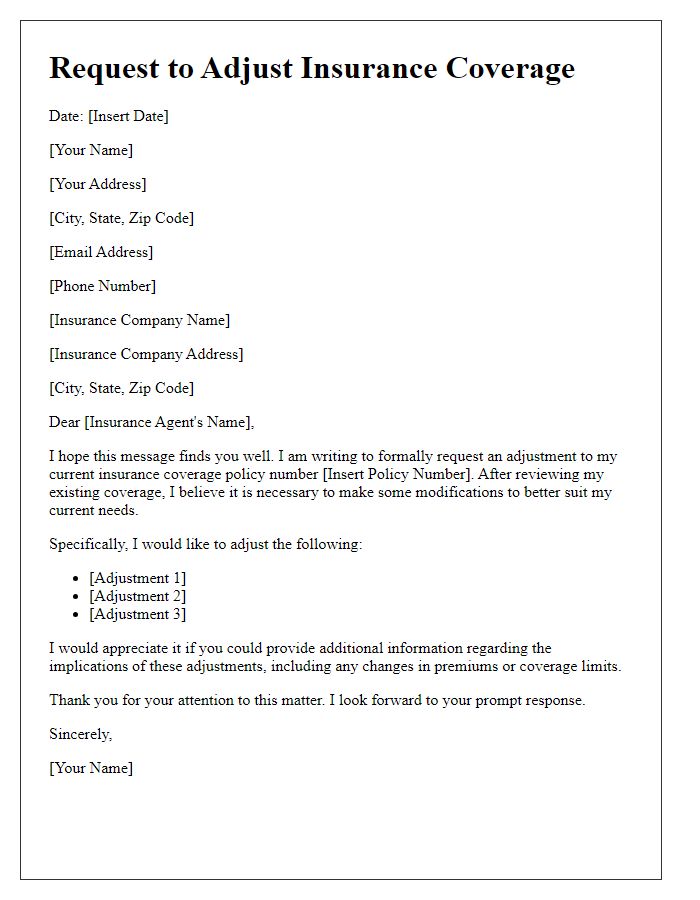

Policyholder Information

Insurance coverage adjustments require careful attention to the policyholder's details to ensure accuracy and clarity. Essential elements include the policyholder's full name, address, contact number, and policy number. These details provide the insurance company with vital information to identify the correct account (such as a unique identifier for review). Additionally, the date of the request and a comprehensive description of the desired adjustments or changes in coverage, such as increased liability limits or added endorsements, are critical for the underwriting process. Any recent life events affecting coverage, such as marriage, home purchase, or changes in income, should also be mentioned to provide context for the adjustment request.

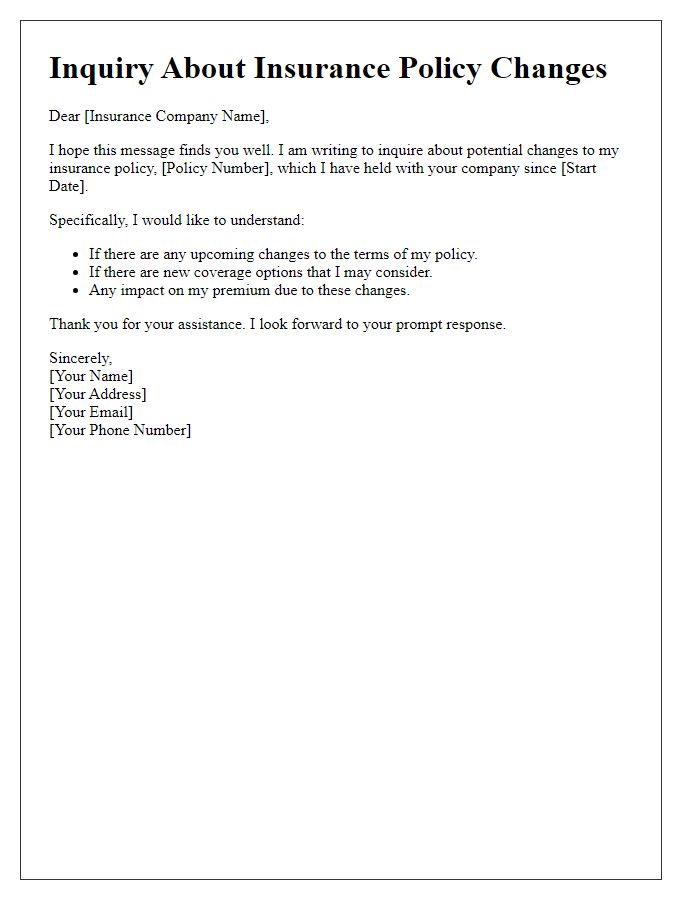

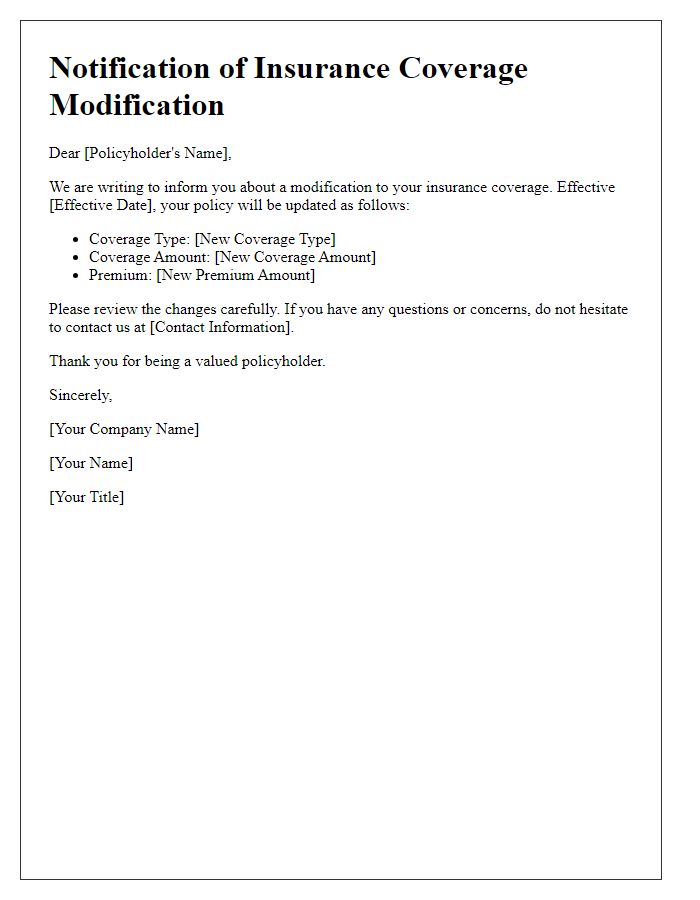

Current Coverage Details

Insurance policies often require periodic adjustments to ensure adequate protection for policyholders. Current coverage details typically include specific information such as policyholder's name, policy number, effective date, and coverage limits. Standard coverage categories encompass property insurance, liability coverage, and personal injury protection, each with designated limits (for instance, liability coverage may be limited to $100,000). Additionally, endorsements may be attached to customize policies, such as adding coverage for valuable items or natural disaster events like floods or earthquakes. Regularly reviewing these details is essential to align with changes in risk exposure or asset value, ensuring optimal coverage. Policyholders should maintain updated records and communicate with insurance agents to tailor their policies accordingly.

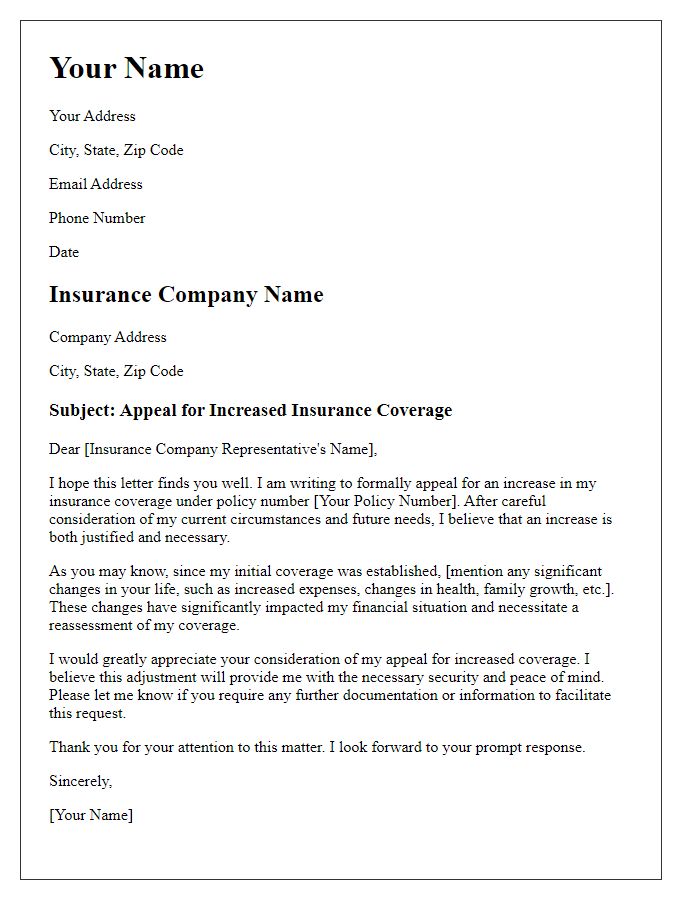

Requested Adjustment Changes

Insurance coverage adjustments can reflect significant changes in policy needs and circumstances. For example, a homeowner may require increased dwelling coverage (up to 20% over the original limit) due to recent home renovations in upscale neighborhoods like Beverly Hills. Changes in auto insurance could involve adjusting liability coverage limits (such as increasing from $100,000 to $300,000) following the purchase of a new luxury vehicle, such as a Tesla Model S. Additionally, the inclusion of new personal property, like fine art collections insured at estimated values of over $50,000 per item, necessitates a reevaluation of current coverage limits. Regular reviews ensure clients maintain adequate protection against emerging risks and market fluctuations.

Justification for Adjustment

Insurance coverage adjustments often arise from changes in policyholder circumstances or market conditions. A thorough justification for coverage adjustments requires analyzing factors such as the insured property's current market value, trends in regional real estate markets, and personal circumstances like changes in income or employment. For example, a home located in San Francisco, California, experiencing a 20% increase in average home values over the past year may necessitate an adjustment to the homeowner's policy to ensure adequate coverage. Additionally, documentation supporting the need for higher limits or different coverage types, such as replacement cost versus actual cash value for items insuring personal property, can strengthen the request. Updating coverage in response to these evolving conditions protects policyholders from financial strain during unexpected events, guaranteeing their assets are sufficiently safeguarded.

Contact Information for Follow-up

Insurance coverage adjustment inquiries often require clear and concise communication. For these purposes, including precise contact information is vital. Providing a full name, such as John Smith, alongside a phone number (e.g., +1-234-567-8901) allows the insurance representative to reach out easily. An email address, like john.smith@email.com, ensures that documentation can be exchanged efficiently. Additionally, including a physical address, such as 1234 Maple Street, Springfield, serves as a reference for any formal communications. Clear timestamps, like a request made on October 20, 2023, may also assist in tracking the adjustment process.

Comments