Are you curious about how insurance premium structures work? Understanding the components that influence your premium can make a significant difference in your financial planning. From risk assessment to coverage limits, each element plays a vital role in determining what you pay. Dive deeper into the intricacies of insurance premiums and learn how to make informed decisionsâread on!

Policy Details Overview

Insurance premium structures consist of various components that determine the overall cost of coverage. Factors influencing premiums include age, risk assessment, and policy type, such as comprehensive or liability coverage. In a comprehensive plan for vehicle insurance, drivers may encounter a monthly premium ranging from $75 to $300, depending on the vehicle's make, model, and safety features. Annual underwriting reviews help adjust premiums based on claims history and overall market trends. Discounts may apply for bundling policies or maintaining a claims-free record over a specified period, often resulting in savings of up to 25%. Understanding these elements assists policyholders in making informed decisions regarding their insurance options.

Premium Calculation Breakdown

Insurance premium structures involve several key factors that determine the cost of coverage. Policyholder demographics, such as age and health status, play a significant role in premium calculation. Geographic location influences risk assessment; for example, urban areas may have higher premiums due to increased theft and accident rates. Coverage limits and deductibles are essential variables; higher coverage limits typically result in elevated premiums, while higher deductibles can lead to lower costs. Claims history also impacts premiums; individuals with frequent claims may face elevated rates compared to those with a clean record. Additionally, type of insurance, such as auto, home, or health, has distinct pricing models, reflecting differing risk profiles associated with each category.

Risk Assessment Criteria

Insurance premium structures depend significantly on risk assessment criteria utilized by companies to evaluate potential hazards associated with insured entities. Key factors influencing premiums include the policyholder's claims history, where frequent claims can indicate higher future risk, and demographic details such as age and occupation which may correlate with risk levels. Geographic location plays a crucial role, with policies in high-crime areas or regions prone to natural disasters, like hurricanes in Florida or wildfires in California, often incurring higher premiums. Additionally, property features, such as the presence of security systems or the age of electrical wiring, can affect damage risk. Underwriting practices often incorporate advanced analytics, statistical models, and industry benchmarks to determine an appropriate premium that accurately reflects the risk profile while ensuring the insurer's financial stability.

Discounts and Incentives

Insurance premium structures often include various discounts and incentives designed to make coverage more affordable. Common discounts can include multi-policy discounts, where customers receive a percentage off their total premium if they bundle multiple policies, such as home and auto insurance. Safe driving bonuses incentivize responsible behavior; drivers with no accidents or claims over a specified duration can qualify for significant reductions. Additionally, certain insurers provide discounts for installing safety devices, like alarm systems or anti-theft features in vehicles, enhancing protection against loss. Loyalty programs reward long-term customers with tiered discounts that increase with the duration of their policy, fostering customer retention. These incentives serve not only to lower individual premiums but also to encourage risk-reducing behaviors among policyholders, ultimately benefiting the insurer's overall risk management strategy.

Contact Information for Queries

Insurance premium structures can vary significantly based on multiple factors such as individual risk profiles, coverage levels, and policy terms. For instance, auto insurance premiums may be influenced by vehicle make, model, and age, along with the driver's history of claims and accidents. Homeowners insurance often considers property location, value, and the presence of security systems. Premiums are typically calculated using actuarial data, reflecting statistical likelihoods of claims based on demographic trends. For further clarification or detail on specific premiums, customers are encouraged to reach out to dedicated contact centers, which can provide tailored explanations and address individual concerns regarding coverage options and pricing.

Letter Template For Insurance Premium Structure Explanation Samples

Letter template of insurance premium renewal notice for existing customers.

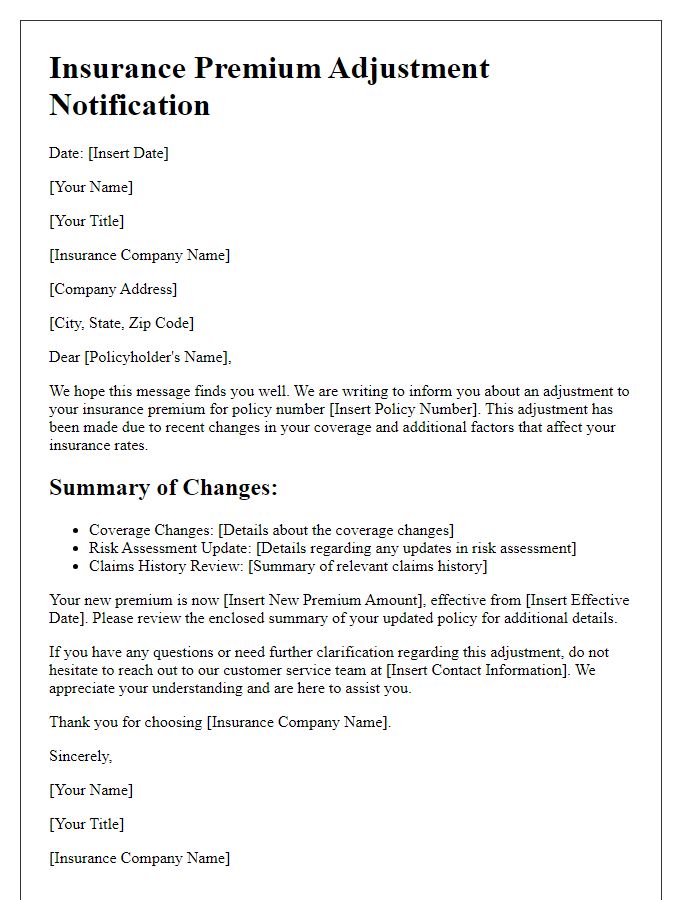

Letter template of insurance premium adjustment explanation for policy changes.

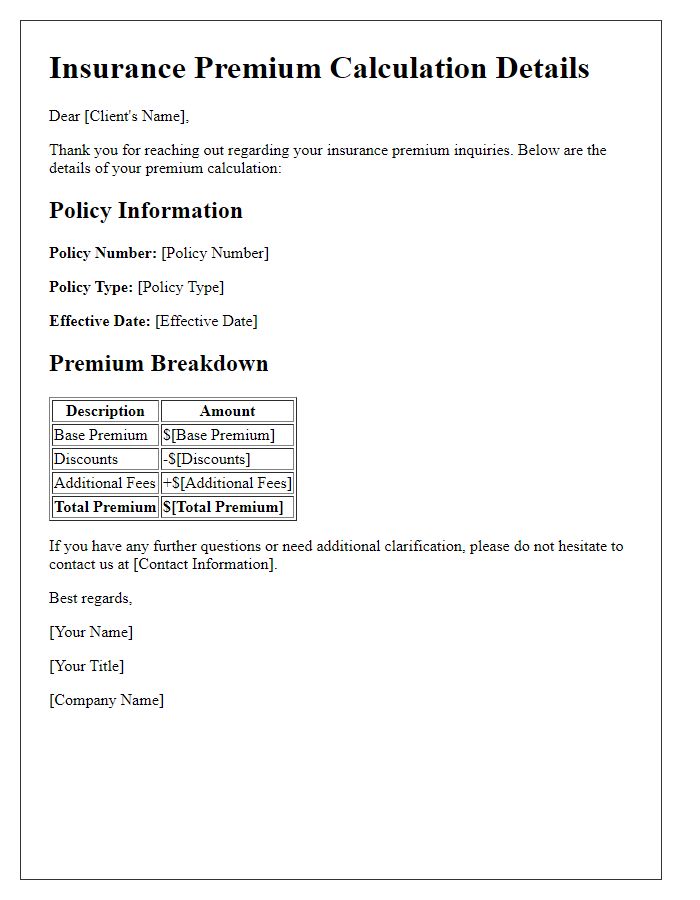

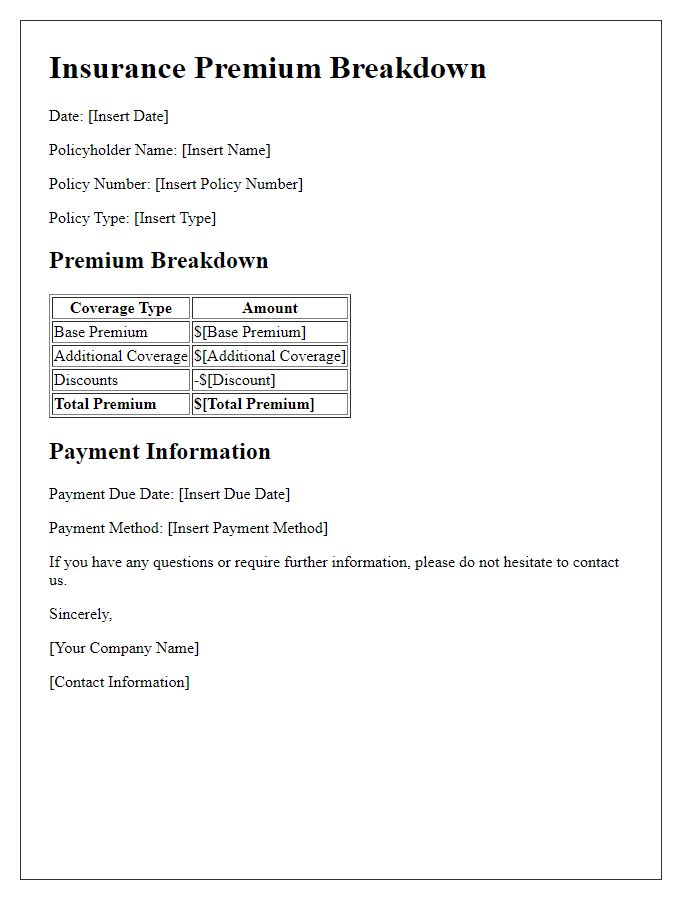

Letter template of insurance premium calculation details for client inquiries.

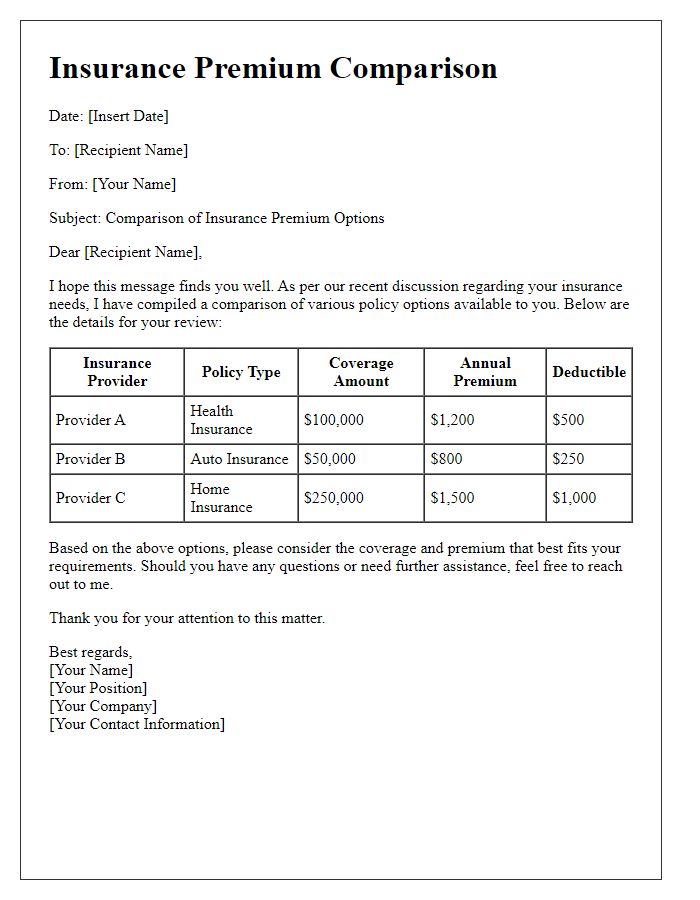

Letter template of insurance premium comparison for multiple policy options.

Letter template of insurance premium rate increase notification for clients.

Letter template of insurance premium benefits summary for policyholders.

Comments