Are you ready to take control of your future with a comprehensive insurance consultation? In this article, we'll explore everything you need to know about what to expect during your insurance meeting and how it can help safeguard your assets. We'll also share tips on how to prepare for your consultation, ensuring you get the most out of your experience. So, sit back, relax, and read on to embark on your journey to better insurance understanding!

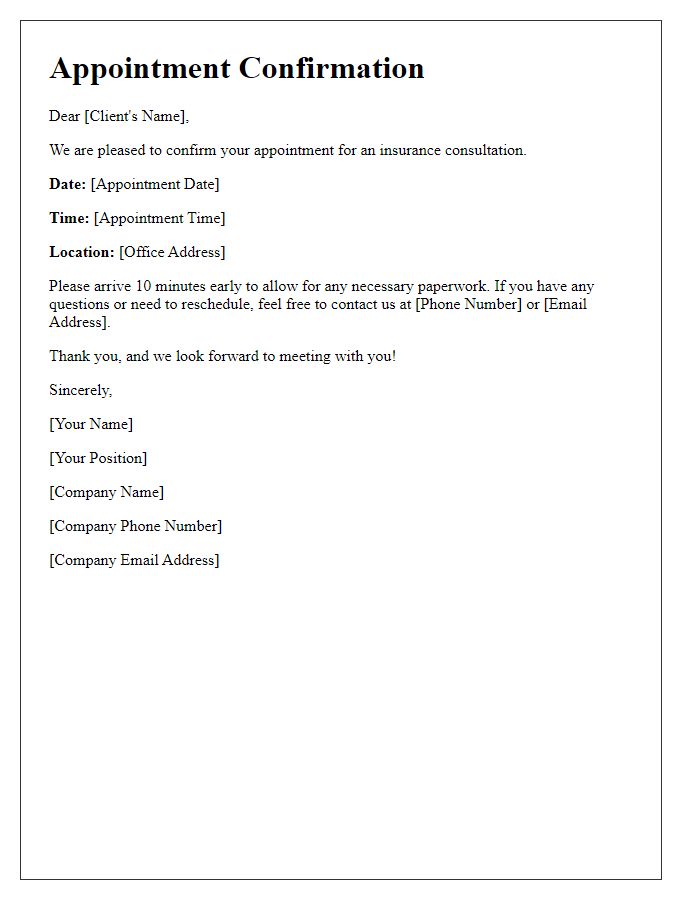

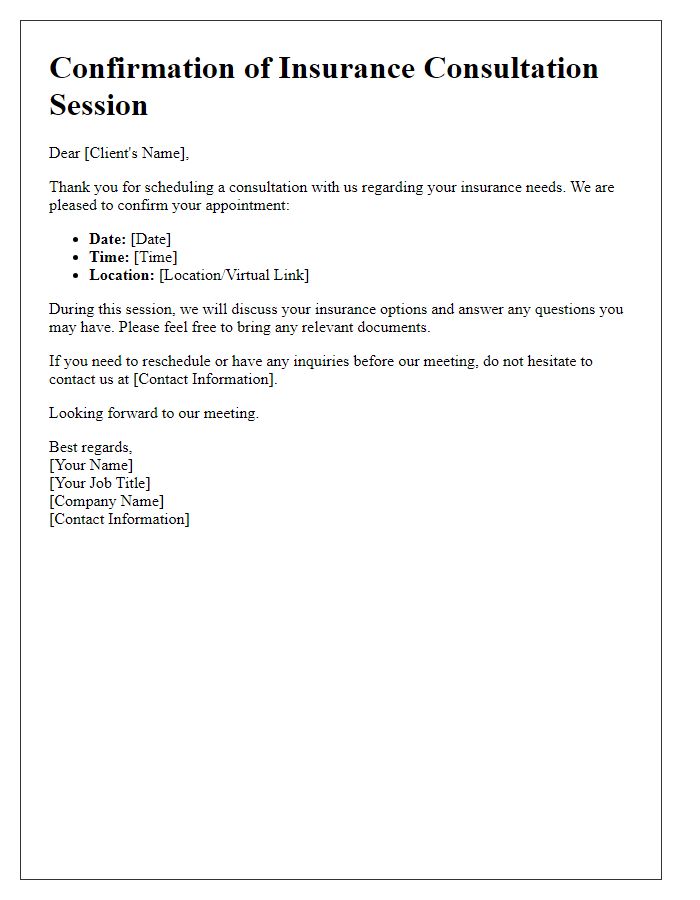

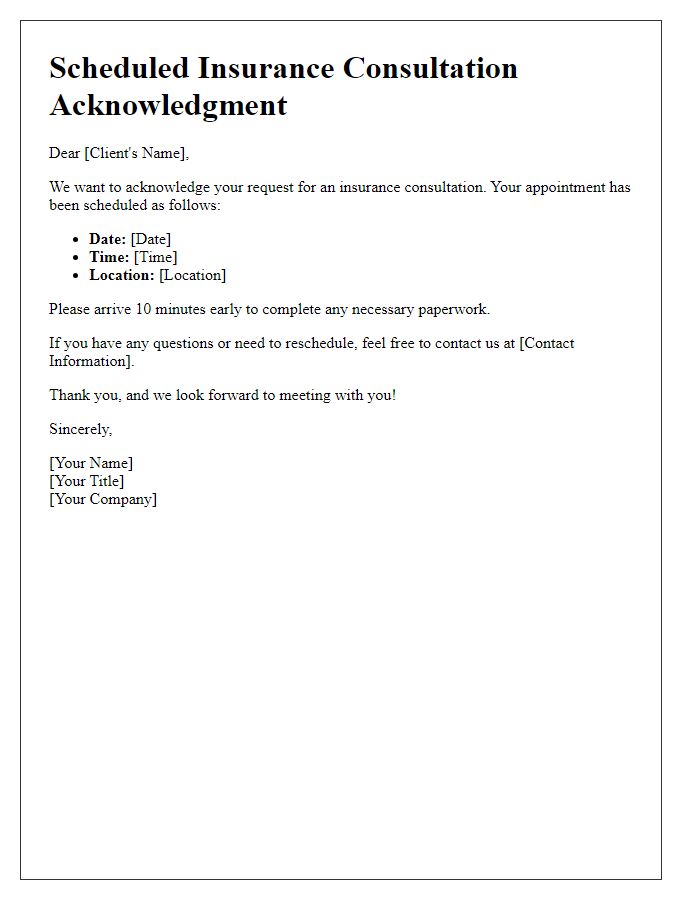

Salutation and Recipient Name

Insurance consultation confirmation marks an essential step in engaging clients effectively. Personalized salutations enhance the professional tone; for instance, addressing the client by name fosters a sense of trust. Utilizing clear identifiers, such as "Dear Mr. John Smith" or "Dear Mrs. Jane Doe," establishes a direct connection. It's important to ensure accuracy in spelling, as incorrect names may diminish credibility. This concise communication sets the stage for further discussions about coverage options, claims processes, and customer service pathways.

Appointment Date and Time

Insurance consultations often focus on policy details (specific coverage types like health, auto, and home insurance). The appointment may be set for a specific date, such as March 15, 2024, at 10:00 AM, in a designated office location like Downtown Insurance Agency, 123 Main St, Suite 456, Anytown. During the session, clients typically review essential documents (such as current insurance policies and identification) and discuss claims processes (including necessary steps for filing and potential payouts). This ensures that clients fully understand their coverage and can make informed decisions regarding their insurance needs.

Consultation Location or Mode (e.g., in-person, virtual)

Insurance consultations often occur either in-person at designated offices or virtually through secure online platforms. Each mode has its specific advantages, providing convenience for clients. In-person meetings allow for face-to-face interaction, fostering a more personal connection at the insurance office, which might be located in a high-rise building in downtown (city name), while virtual consultations offer flexibility, enabling clients to connect from their homes using video conferencing tools. The choice of consultation mode can impact the overall experience, with in-person meetings providing immediate document exchange capabilities, while virtual options reduce travel time and enhance accessibility.

Contact Information for Queries

Insurance consultations often require confirmation of details such as time, date, and location. Providing contact information for queries is crucial for seamless communication. Typically, a primary contact number, such as a toll-free hotline (1-800-555-0199), ensures clients can reach representatives directly. Email addresses (support@exampleinsurance.com) serve as an alternative for detailed inquiries. If applicable, include office hours, typically between 9 AM and 5 PM, Monday to Friday, allowing clients to gauge when they can expect a response. Additionally, incorporating geographical details, like the main office location at 123 Main Street, Suite 200, Anytown, USA, enables clients to visit in person if needed.

Closing and Signature

Consultation confirmations for insurance consultations often include specific details. Policies, such as auto insurance, health insurance, or home insurance, may require consultation about coverage options and claims processes. Details such as appointment date (October 10, 2023), time (3:00 PM), and location (123 Insurance Lane, Suite 300, Springfield) are crucial for clients. Signature lines may include names and titles, such as "John Smith, Insurance Advisor," followed by company information, like "ABC Insurance Company, licensed since 1995." Resources like brochures or links to online FAQs about coverage limits and deductible amounts can be attached for better understanding.

Comments