Have you ever found yourself in a situation where your insurance premium is due, but life gets in the way? Insurance companies often offer a grace period to help you avoid lapsing coverage during those unexpected times. This letter template guides you through notifying individuals about their important grace period details, ensuring they remain informed and protected. Curious to see how you can effectively communicate this important information? Read on!

Clear Policy Information

Insurance policies often come with a grace period, a specified duration that allows policyholders some leeway in making premium payments without facing immediate penalties. For many insurance providers, this grace period is typically around 30 days. During this time, coverage remains active, protecting the policyholder from any potential loss. It's crucial to communicate clearly the terms of this grace period, including the specific dates, required payment amounts, and possible consequences of failing to pay by the end of the grace period. Additionally, reminding policyholders about the importance of timely premium payments ensures continued coverage and peace of mind for the insured.

Specific Grace Period Dates

Insurance policies typically include a grace period, which is a specified timeframe allowing policyholders to make premium payments without losing coverage. For example, the grace period could span 30 days for life insurance policies issued by companies like MetLife or Prudential. During this time, coverage remains intact despite non-payment. Failure to pay by the end of this window may result in a lapse in coverage, which could affect claims. The grace period often begins on the due date of the premium, providing essential leeway for policyholders experiencing financial hardship or unexpected events. Legal obligations, such as compliance with state insurance laws, require insurers to communicate these critical dates clearly to avoid misunderstandings. Always review the specific policy documents for accurate and relevant grace period dates and terms.

Payment Instructions

Insurance policies often include a grace period, typically ranging from 10 to 30 days, during which policyholders can submit their premium payments without losing coverage. During this time, insurers provide clear payment instructions, indicating the acceptable methods of payment such as online transactions, mailed checks, or automatic bank drafts. Failure to make a payment by the end of the grace period may result in policy cancellation or lapse, impacting the policyholder's financial protection. It is crucial for policyholders to review their insurance policy's specific terms and conditions, including grace period details, to ensure uninterrupted coverage and adherence to payment timelines.

Consequences of Non-payment

Failure to make timely premium payments can result in serious ramifications for policyholders, particularly in the realm of insurance. Many policies, such as life insurance or health insurance, typically feature a grace period of 30 days, allowing customers to rectify missed payments without immediate lapse of coverage. However, if payment is not received within this timeframe, the insurance contract may become void, exposing the insured party to significant financial risks and loss of benefits. For instance, under United States federal regulations, specific states might impose fines on insurers for policies lapsed due to non-payment, and in other cases, reinstatement might require passing medical underwriting or higher premiums. Being informed and proactive about payment schedules is essential for maintaining continuous coverage and avoiding potentially devastating consequences.

Contact Information

Insurance grace periods provide policyholders extra time to make premium payments after the due date. Most insurance companies, such as State Farm or Allstate, offer a grace period ranging from 10 to 30 days, depending on the policy type. During this time, coverage remains intact, ensuring that individuals and families, across various states like California or Texas, do not experience lapses in their health, auto, or home insurance. It is essential to review policy documents for specific grace period details and contact the insurance provider's customer service for personalized assistance, particularly if facing financial hardships or unforeseen circumstances. Keeping updated contact information, including phone numbers and email addresses, can facilitate prompt communication regarding grace periods and other insurance-related concerns.

Letter Template For Insurance Grace Period Notification Samples

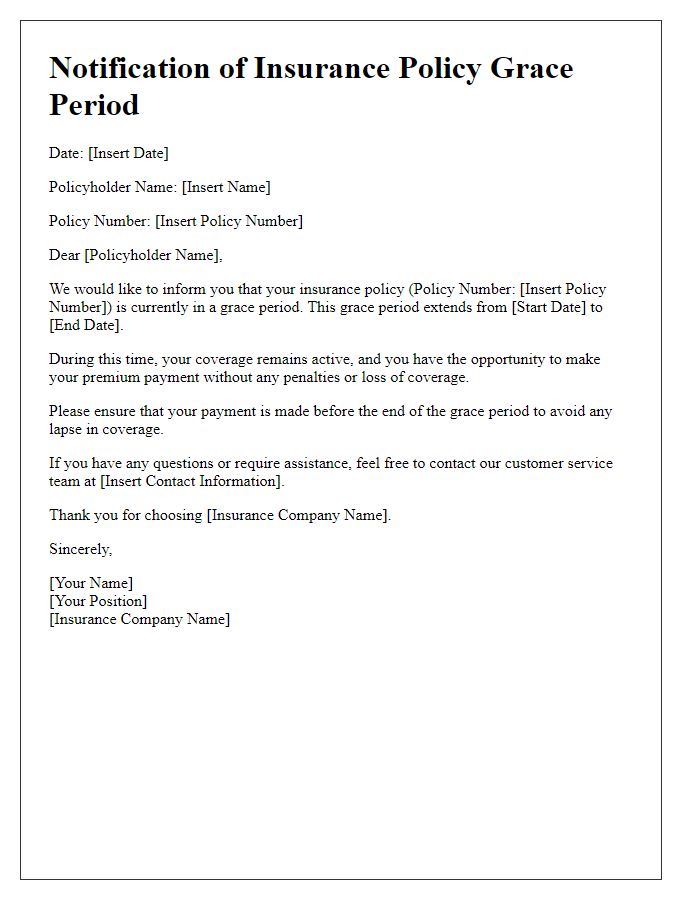

Letter template of notification regarding insurance policy grace period.

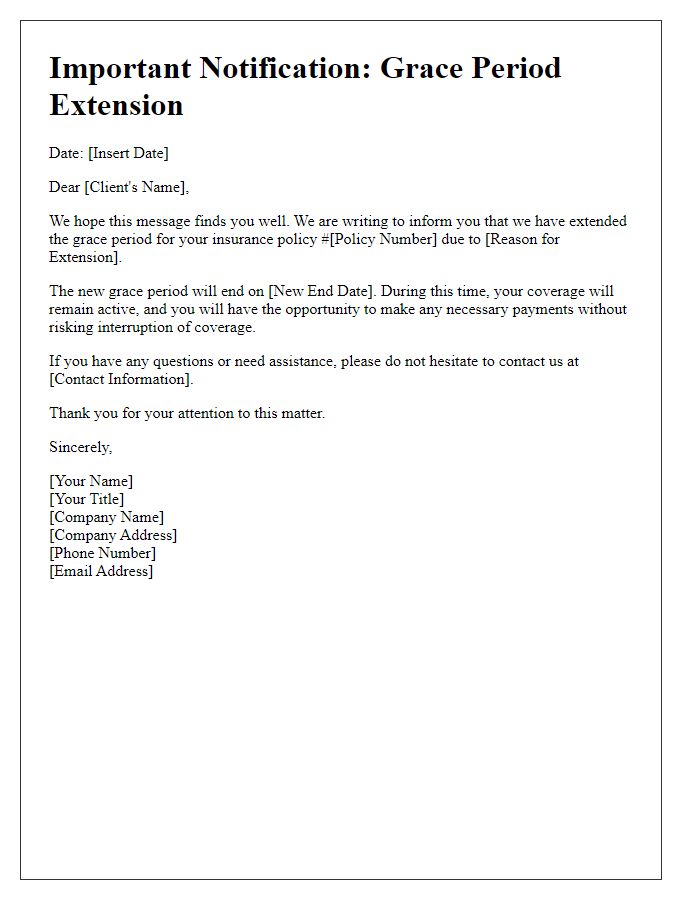

Letter template of client notification for insurance grace period extension.

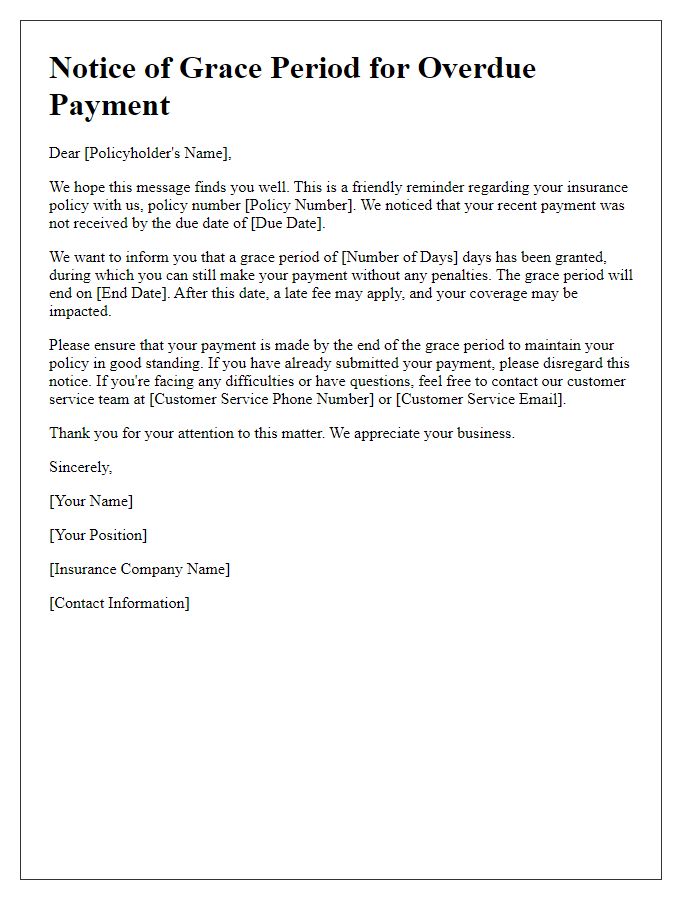

Letter template of insurance grace period communication for overdue payments.

Letter template of official notice regarding grace periods in insurance.

Comments