Are you feeling a bit lost in the maze of insurance claims? You're not alone; many people find navigating the claims process to be daunting and frustrating. In this article, we'll break down the essential steps you need to take when following up on your insurance claim and provide you with a handy letter template to streamline your communication. So, let's dive in and ensure you're equipped to tackle your insurance claim with confidence!

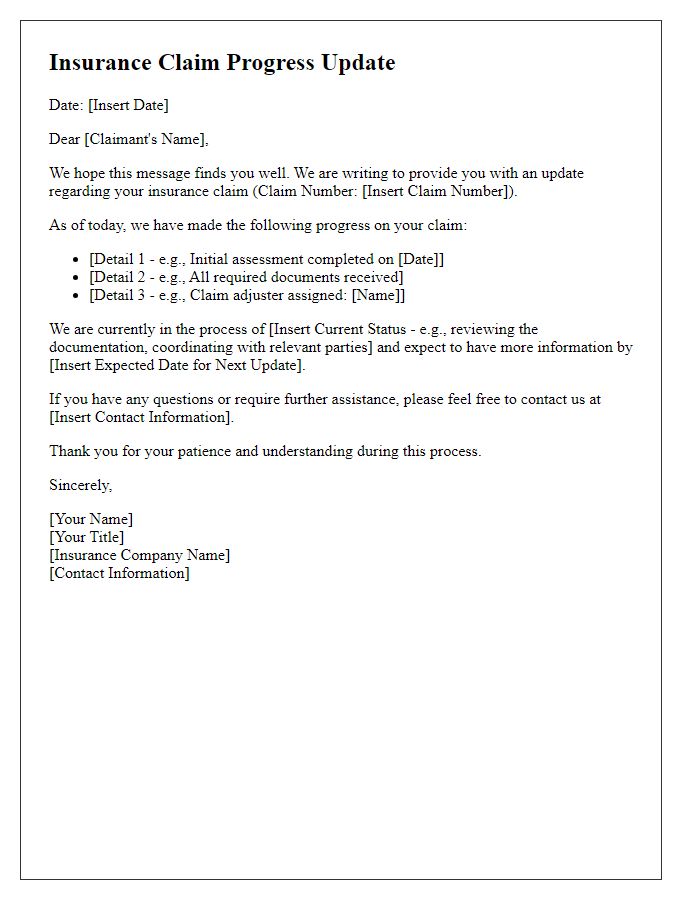

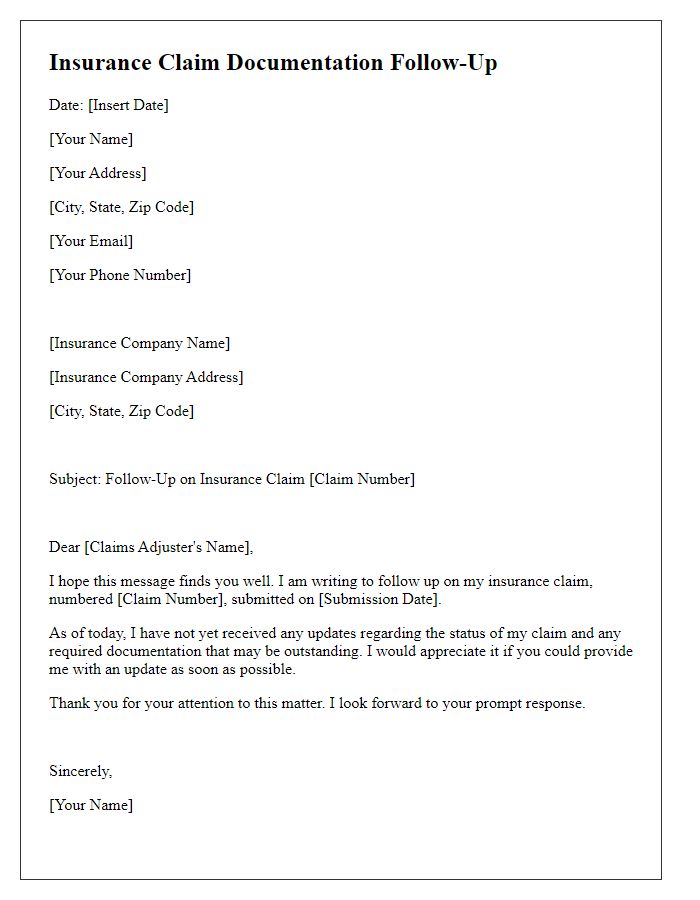

Claim Details and Reference Number

Following up on an insurance claim involves addressing the claim details and referencing the unique claim number assigned by the insurance company. The claim number, often a combination of letters and digits (typically 8-12 characters), serves as a key identifier for tracking the status of a specific incident. Claim details may include the date of the incident, the type of coverage involved (such as auto, home, or health insurance), and the amount being claimed. Timely follow-up is essential, as insurance companies often have specific timelines (usually 30 days) for processing claims and providing updates. Keeping detailed records of all communications, such as emails and phone calls, enhances the follow-up process and ensures clarity and efficiency in resolving any outstanding issues.

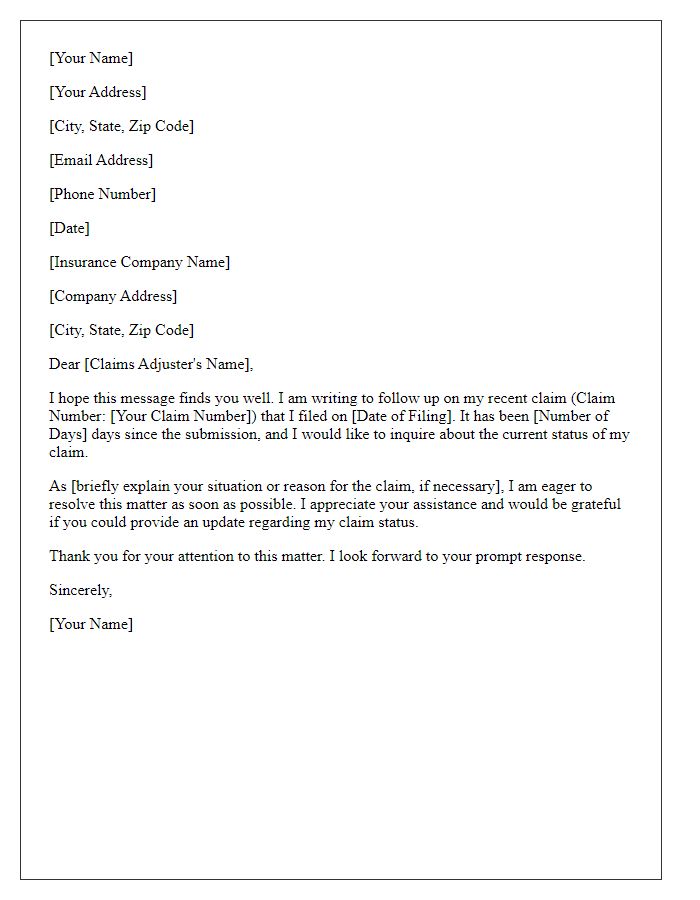

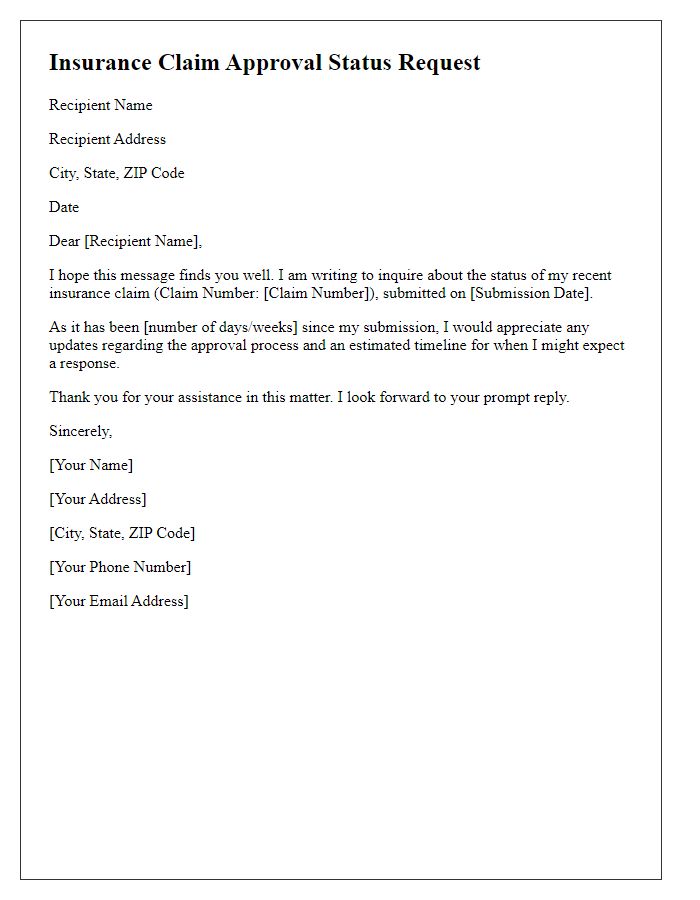

Policyholder Information

Persistent follow-ups on insurance claims can significantly impact the processing times of policyholder requests. A policyholder, defined as an individual or entity holding an insurance policy, often experiences delays in receiving claim settlements, especially in complex cases like property damage or health-related incidents. Insurance companies maintain rigorous protocols that involve evaluating claims based on submitted documentation, which may sometimes lead to prolonged processing durations. Effective communication with adjusters or claim representatives, often based in regional offices like those in Chicago or Los Angeles, is essential for speeding up these procedures and ensuring timely updates. Policyholders are encouraged to document every interaction and maintain a record of claim reference numbers to track progress efficiently.

Description of Incident and Loss

A vehicle collision occurred on September 15, 2023, at the intersection of Elm Street and Maple Avenue, during rush hour traffic. The involved parties included a blue 2019 Honda Civic (VIN: 1HGBH41JXMN109186) and a red 2021 Ford F-150 (VIN: 1FTEW1C54KFA12345). The accident resulted in significant front-end damage to the Honda Civic, estimated repair costs reaching $7,500, with the airbags deploying. Minor injuries were reported; however, the medical expenses associated with these injuries totaled approximately $1,200. The local police report (Incident Number: 2023-08845) documented the scene and confirmed liability lies primarily with the Ford driver. This incident has caused substantial financial strain due to repair costs, medical bills, and loss of vehicle usage, with an estimated loss of income during this period averaging $300 weekly.

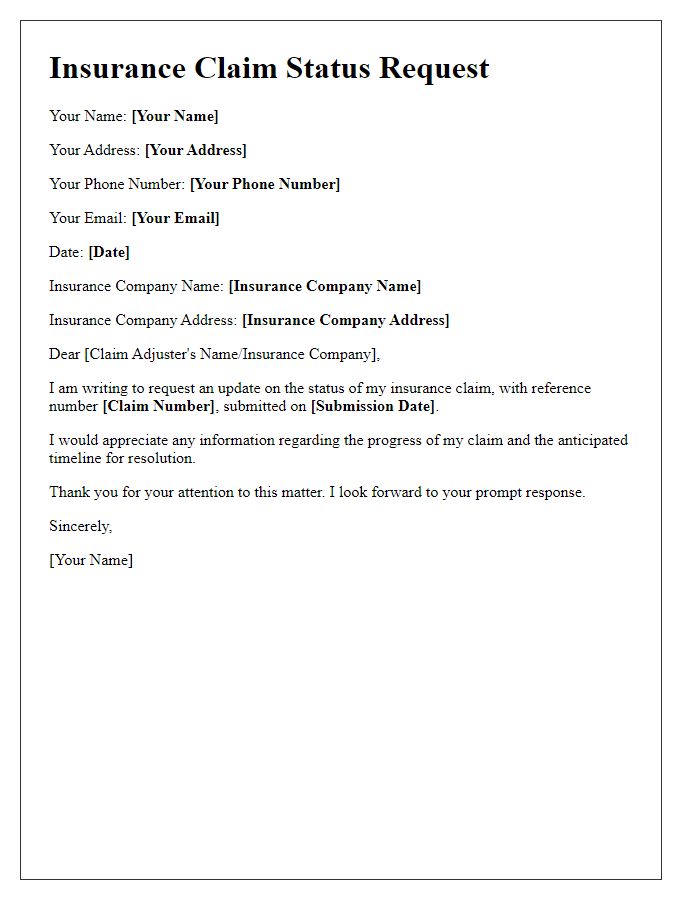

Request for Status Update

Insurance claims often require timely follow-ups to ensure proper processing and reimbursement. A status update on the claim submitted under policy number XYZ1234, dated July 15, 2023, is crucial for understanding its progress. The insurance provider, ABC Insurance Company, based in New York City, typically processes claims within 30 days, but delays can occur due to various reasons such as documentation issues or increased claim volume following events like natural disasters. A prompt response regarding the claim's current status, any required documents, and estimated timelines for resolution will greatly assist policyholders in managing their financial expectations and planning accordingly.

Contact Information and Preferred Response Method

Insurance claim follow-up can be enhanced by clearly communicating contact information and preferred response method. A user might include their phone number (for instance, +1-234-567-8901) and email address (example@mail.com) to ensure the insurance company can easily reach them. Preferred response methods could include telephone calls during specific hours, such as 9 AM to 5 PM, or email replies whenever convenient. Providing this information facilitates efficient communication, allowing for prompt updates regarding the claim's status and preventing unnecessary delays. Clear contact details can significantly improve the resolution process, ultimately benefiting the policyholder.

Comments