Are you looking for a straightforward way to request redaction of your insurance information? Crafting the perfect letter can make all the difference in ensuring your privacy is protected. In this article, we'll guide you through key elements to include in your insurance redaction request letter, making the process hassle-free. So grab a cup of coffee, sit back, and let's dive into the details!

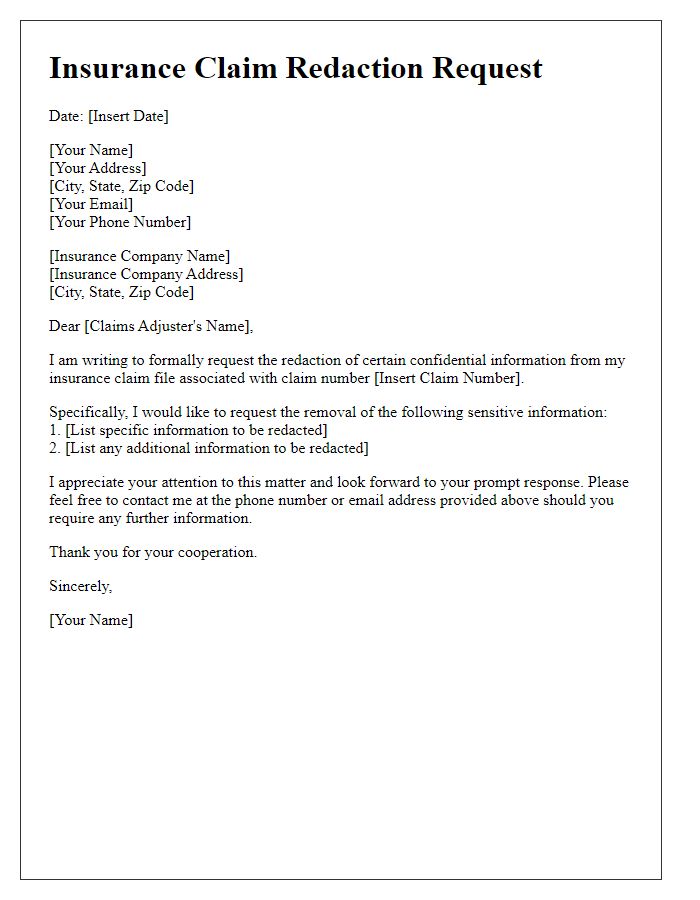

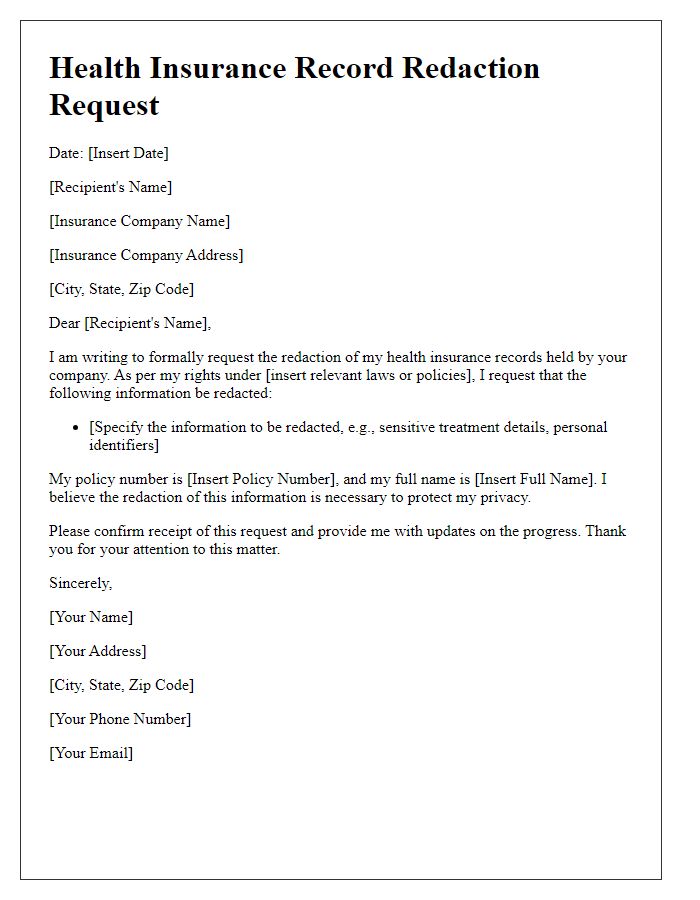

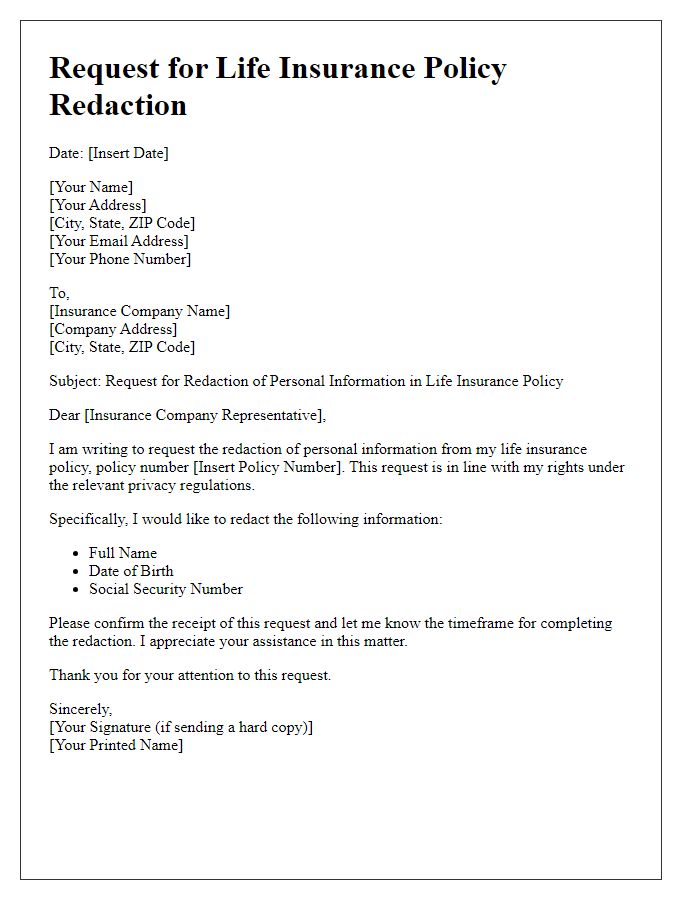

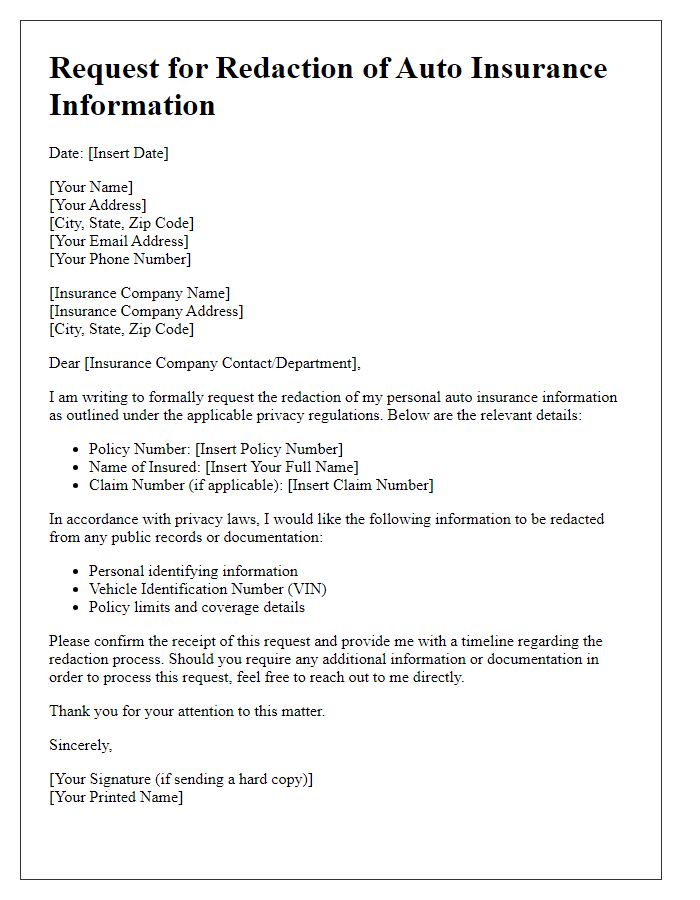

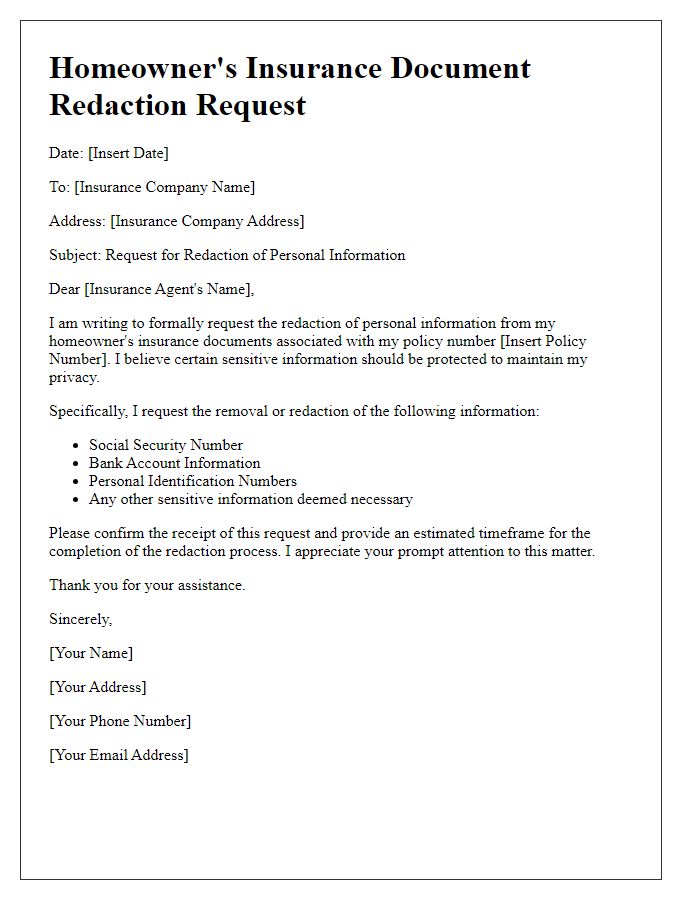

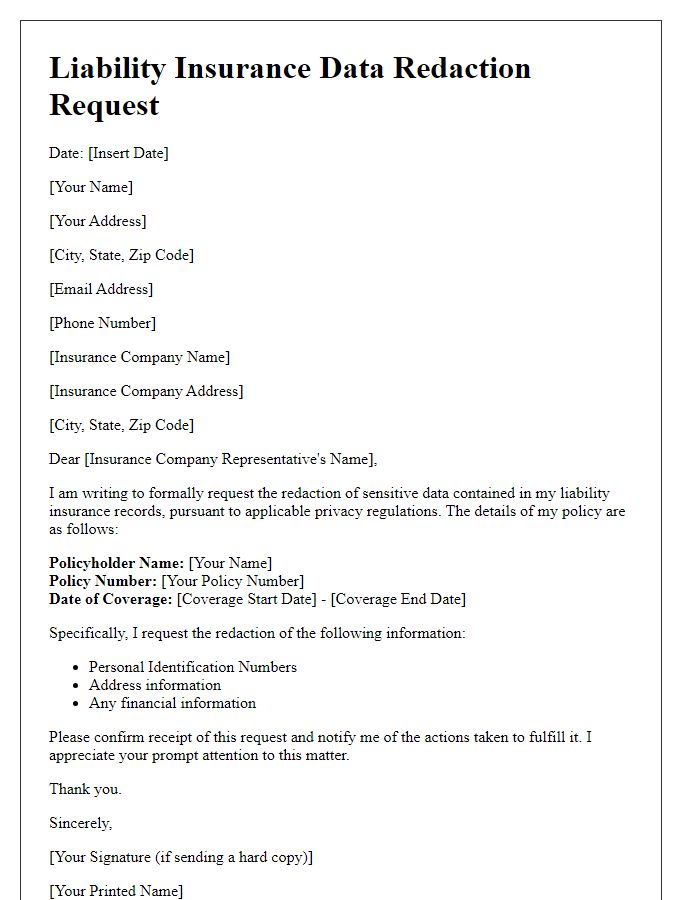

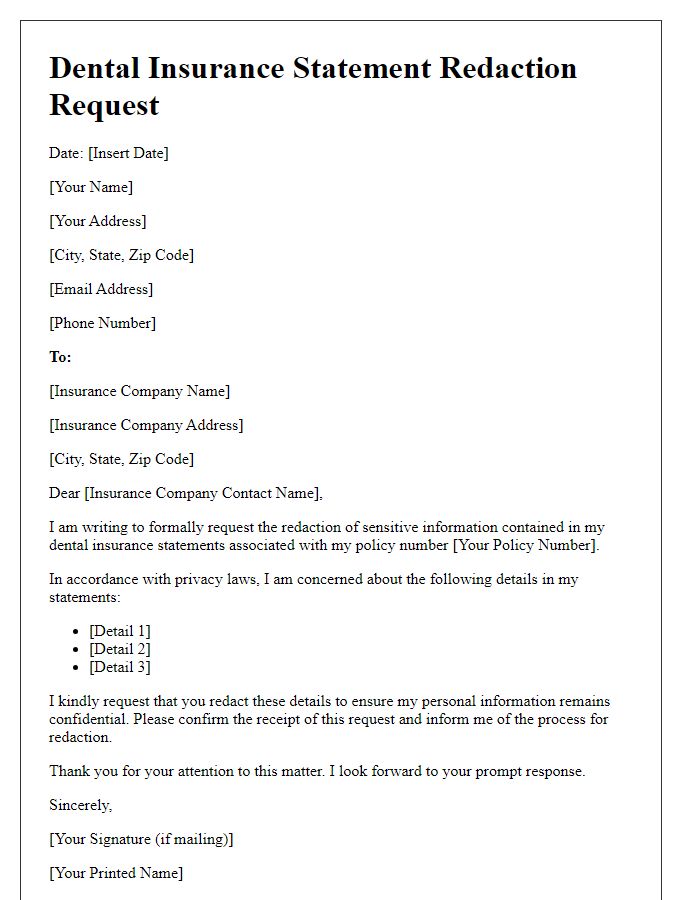

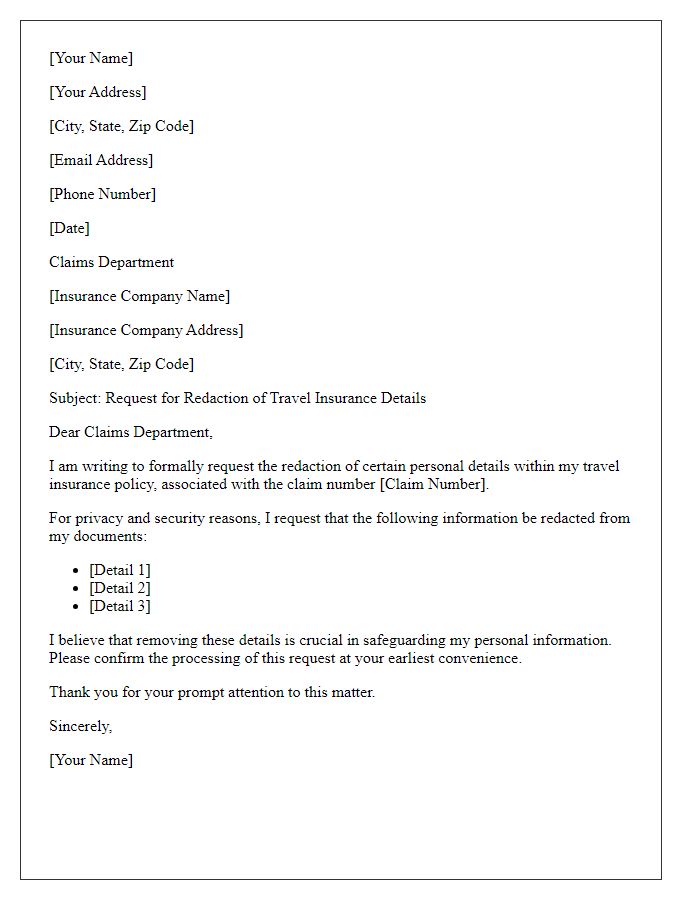

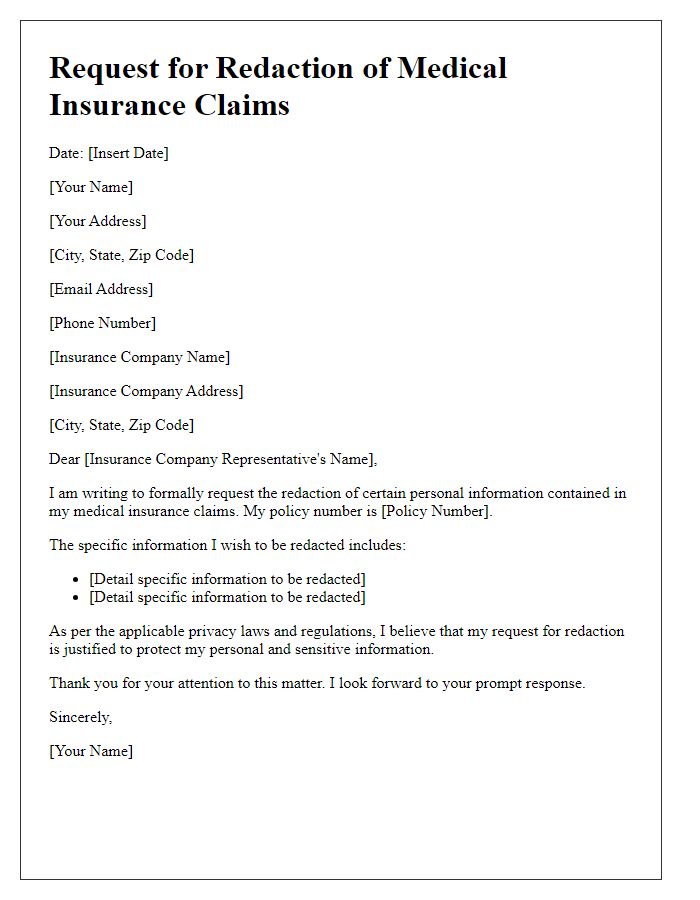

Personal Information (Full Name, Address, Contact Details)

Personal information, such as Full Name and Address, plays a crucial role in identifying individuals during an insurance redaction request. These details ensure the protection of privacy while processing sensitive information. Contact Details, including phone number and email address, facilitate communication with insurance representatives to expedite the redaction process. Adhering to privacy regulations, organizations must handle this information with care, particularly in regards to potential data breaches or unauthorized access. Proper redaction ensures that personal identifiers are removed from documents prior to sharing, thus safeguarding individual privacy rights.

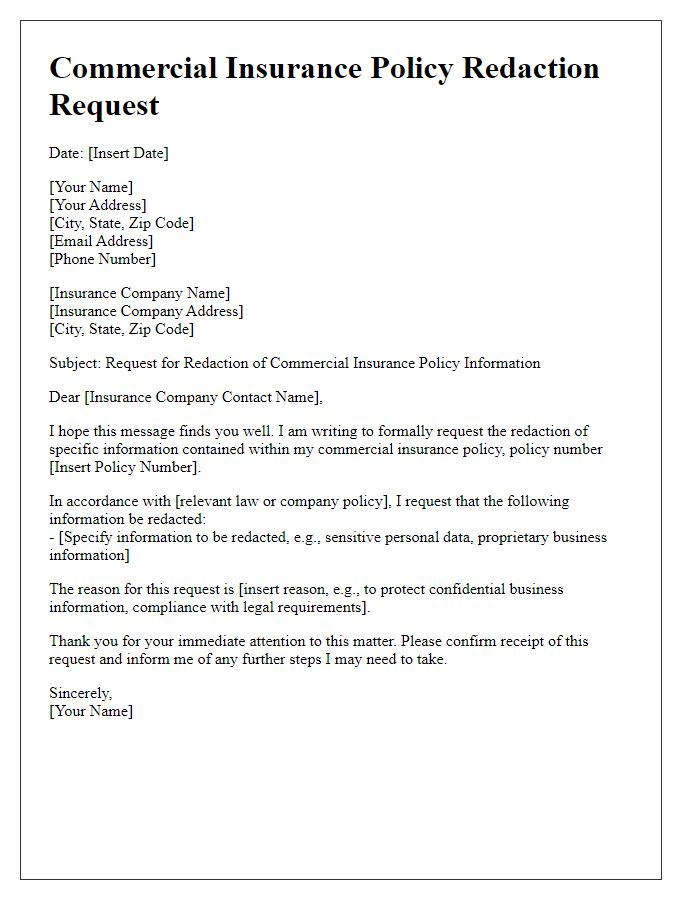

Insurance Policy Details (Policy Number, Provider Name)

An insurance redaction request must include specific details to ensure accurate processing. The policy number, identified by unique alphanumeric characters, serves as a reference for the document associated with an individual's coverage. The provider name, representing the insurance company such as Allstate or State Farm, is crucial for addressing the request correctly. Inclusion of information such as effective dates of coverage (date range indicating when the policy is active) and personal details (such as the policyholder's name and address) can aid in expediting the redaction process. Such requests are often guided by privacy laws, including the Health Insurance Portability and Accountability Act (HIPAA) for medical insurers, ensuring personal information is protected during disclosure.

Specific Request (Clarify Redaction Purpose)

A request for insurance document redaction typically involves the desire to protect sensitive personal information within documents such as claims, policy agreements, or communications. This redaction process aims to conceal identifiable details, including names, addresses, Social Security numbers, and financial information, ensuring compliance with privacy regulations like the Health Insurance Portability and Accountability Act (HIPAA) or the General Data Protection Regulation (GDPR). Understanding the specific purpose for redaction enhances the effectiveness of the request, enabling insurance representatives to focus on relevant sections of the documentation that require confidentiality. Properly executed, this safeguards individuals' private data while allowing necessary information to be shared with authorized entities for processing claims or resolving disputes.

Justification (Reasons for Redaction)

When requesting a redaction of specific information within an insurance document, various types of justifications may be appropriate. One common reason for redaction is to protect sensitive personal information such as Social Security numbers, which can lead to identity theft if disclosed. Another justification might be the need to keep protected health information (PHI) confidential as mandated by HIPAA regulations, ensuring patient privacy. Furthermore, proprietary business information related to claim details, internal processes, or loss history may require redaction to safeguard trade secrets from competitors. Additionally, certain legal obligations may necessitate the withholding of specific data to comply with state or federal privacy laws. Each of these reasons highlights the importance of ensuring that sensitive information remains secure and is not accessible to unauthorized individuals.

Supporting Documentation (Proof of Identity, Relevant Documents)

To initiate an insurance redaction request, individuals must submit supporting documentation, including proof of identity such as a government-issued ID (passport, driver's license), which contains personal information like full name and date of birth. Relevant documents may include the specific insurance policy number, claim details or incident reports, ensuring that all sensitive data is properly redacted. These documents should be submitted through the insurer's official channels, such as customer service portals, ensuring compliance with privacy protection laws like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), which mandate careful handling of personal information.

Comments