Navigating an insurance claim dispute can often feel overwhelming, but you're not alone in this journey. Many individuals face challenges when seeking fair resolution after an unfortunate event, and it's crucial to know your rights and the best way to articulate your concerns. This article will guide you through a comprehensive letter template designed to address your insurance dispute effectively, ensuring your voice is heard. Ready to take the first step toward resolving your claim? Let's dive in!

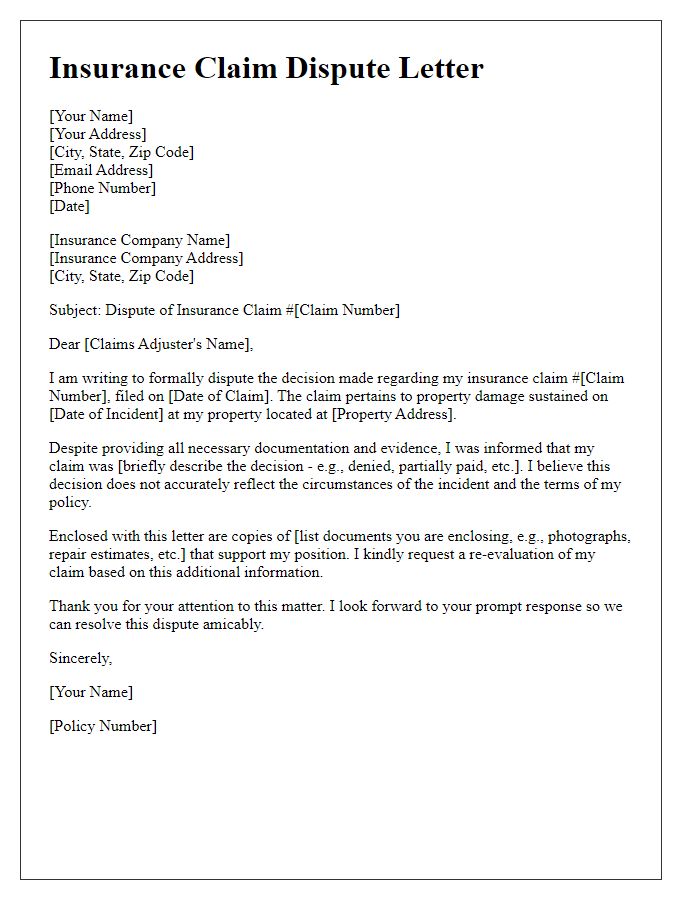

Policy Details and Claim Reference Numbers

In an insurance claim dispute, accurately referencing the relevant policy details is crucial. Documents typically include the unique policy number, such as 123456789, which verifies contract terms and conditions. Additionally, the claim reference number, for instance, CLM987654321, serves as a specific identifier for tracking the claim's progress and associated correspondence. Details regarding the incident, including dates and locations, are essential. For example, if the claim involves property damage from an event like a fire in Los Angeles, California on January 10, 2023, this context aids in resolution. Furthermore, including any previous correspondence attached to the claim will strengthen the argument in support of the dispute.

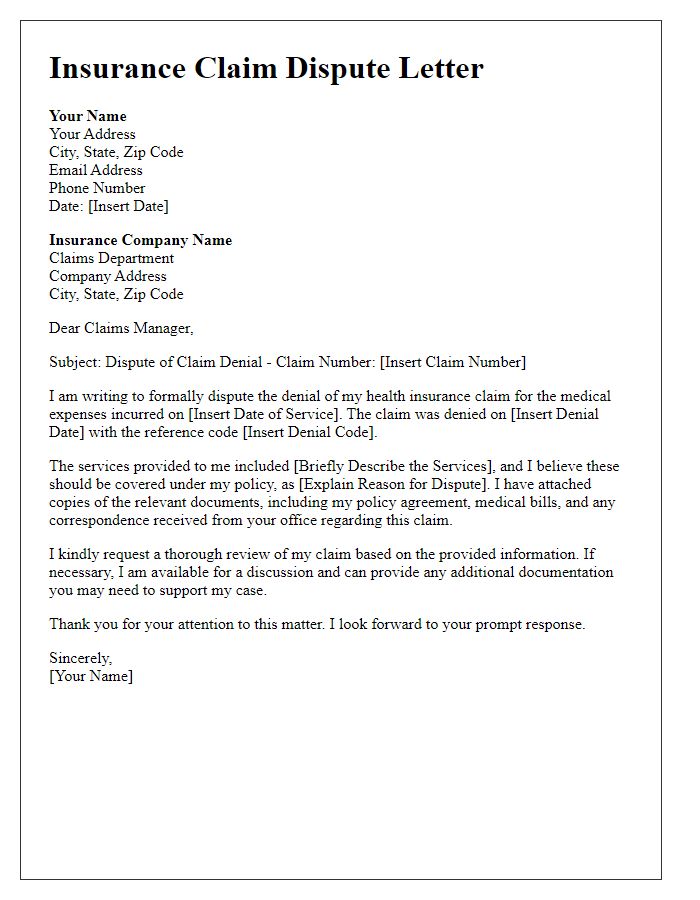

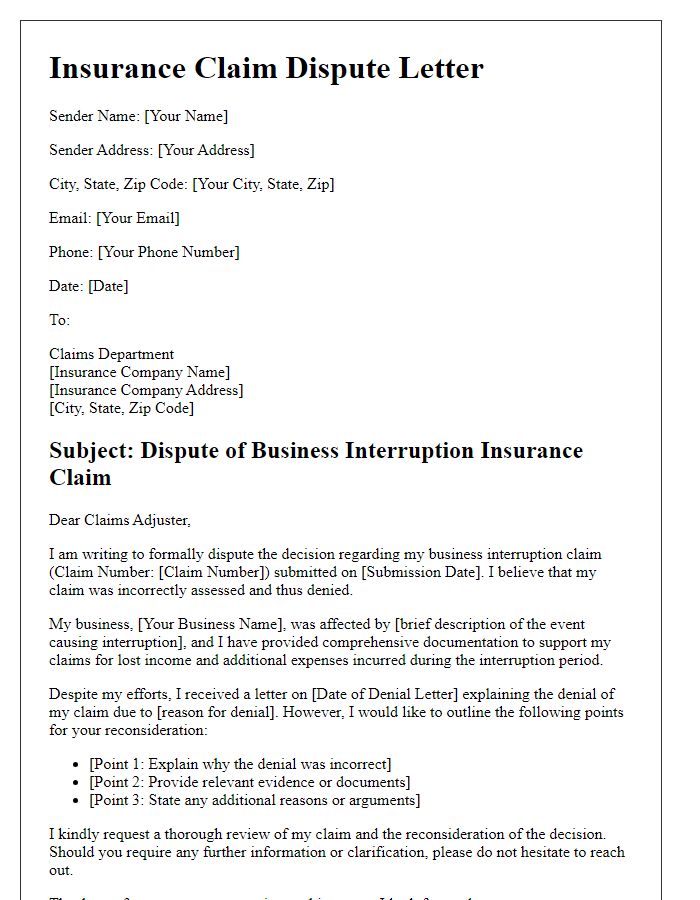

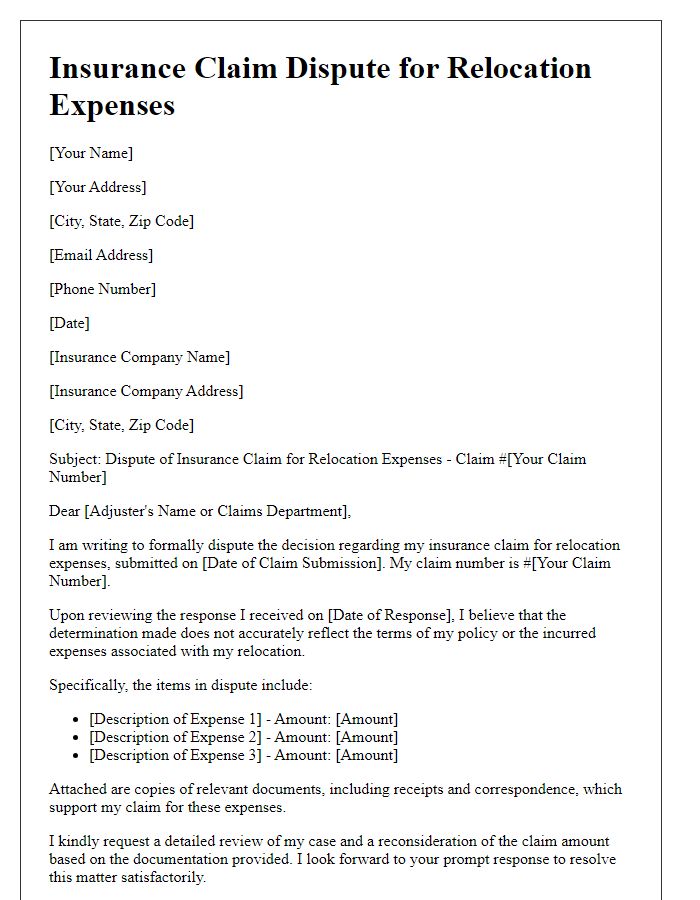

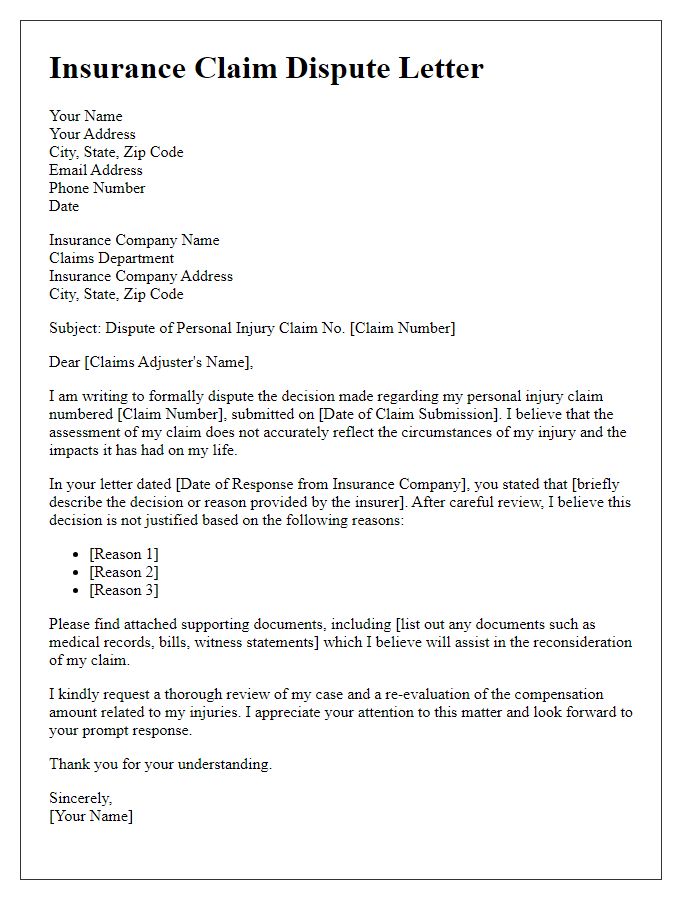

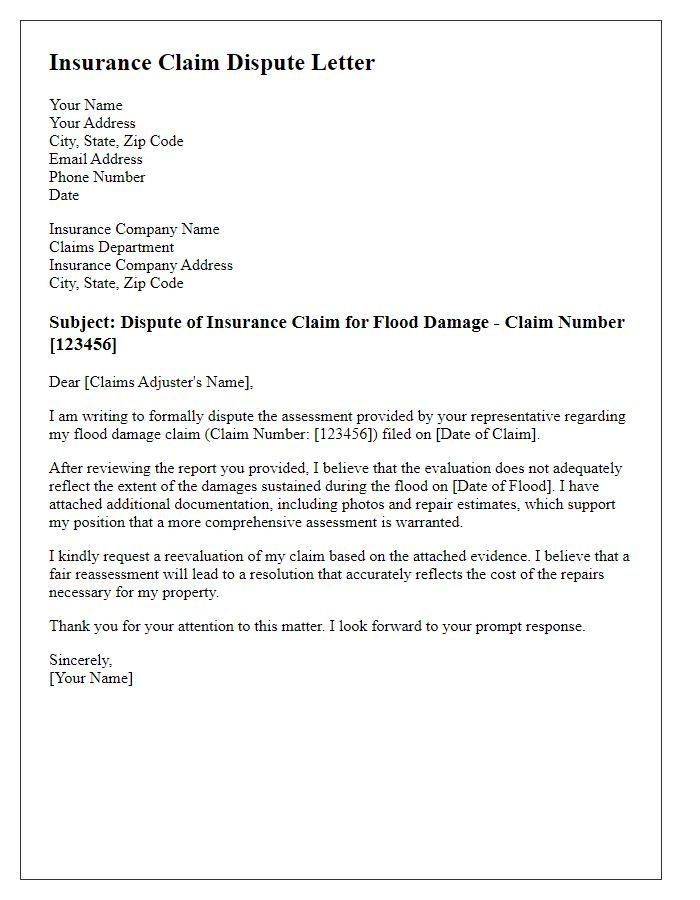

Detailed Explanation of the Dispute

A detailed explanation of an insurance claim dispute often involves specific events, policy numbers, and claim identifiers to shed light on the issue. The dispute may arise from a recent motor vehicle accident (for instance, a collision on January 15, 2023, in Los Angeles, California) covered under the policy number 123456-789, which was issued by a prominent insurance provider. The claimant, whose vehicle suffered significant damage estimated at $8,000, submitted a claim (reference number CLM-12345) promptly. The insurance company denied the claim citing an alleged policy exclusion related to the vehicle's previous history of minor accidents--events recorded as "no fault" from July 2021 and October 2022. The claimant argues that the policy does not explicitly mention these exclusions impacting current coverage, creating a basis for the dispute. Essential documents, such as repair estimates and accident reports, have been included, highlighting discrepancies and pushing for a fair reassessment of the claim based on the coverage terms.

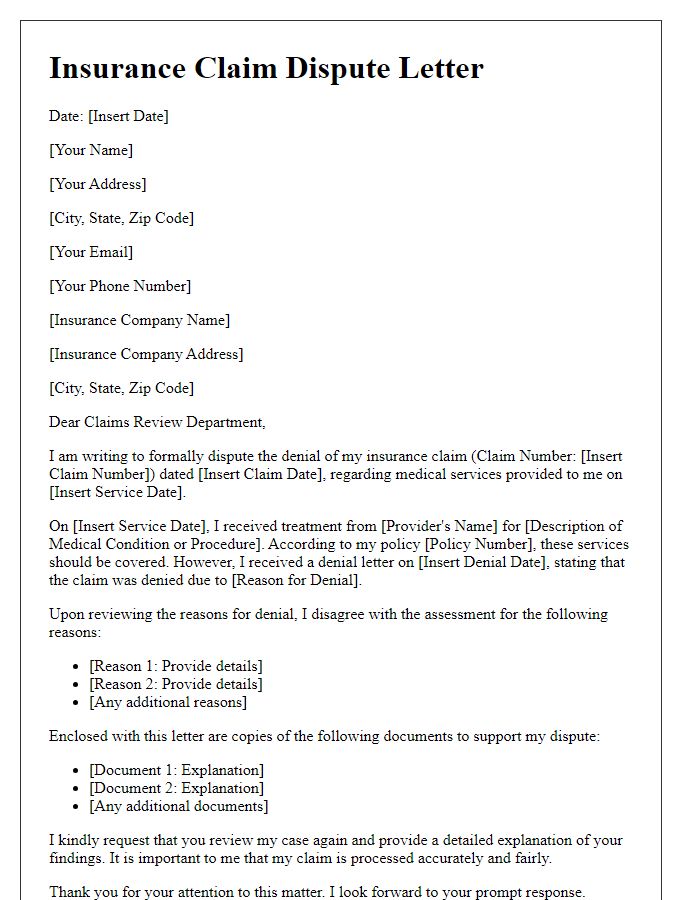

Relevant Supporting Documentation

A well-documented insurance claim dispute involves submitting relevant supporting documentation to strengthen your case. Key documents include the original policy agreement, detailing coverage limits and exclusions specific to the incident, such as the Comprehensive Auto Insurance Policy. Additionally, medical records, including bills and treatment plans, play a crucial role in claims related to personal injury, often sourced from healthcare facilities like hospitals or clinics. Photographic evidence of property damage or injuries captured at the scene can provide visual context and validation of the claim. Incident reports, whether from law enforcement or workplace safety investigations, offer an official account of the events leading up to the claim. Lastly, any correspondence with the insurance company, such as denial letters or adjustment explanations, should be included to showcase the timeline and nature of communications regarding the dispute.

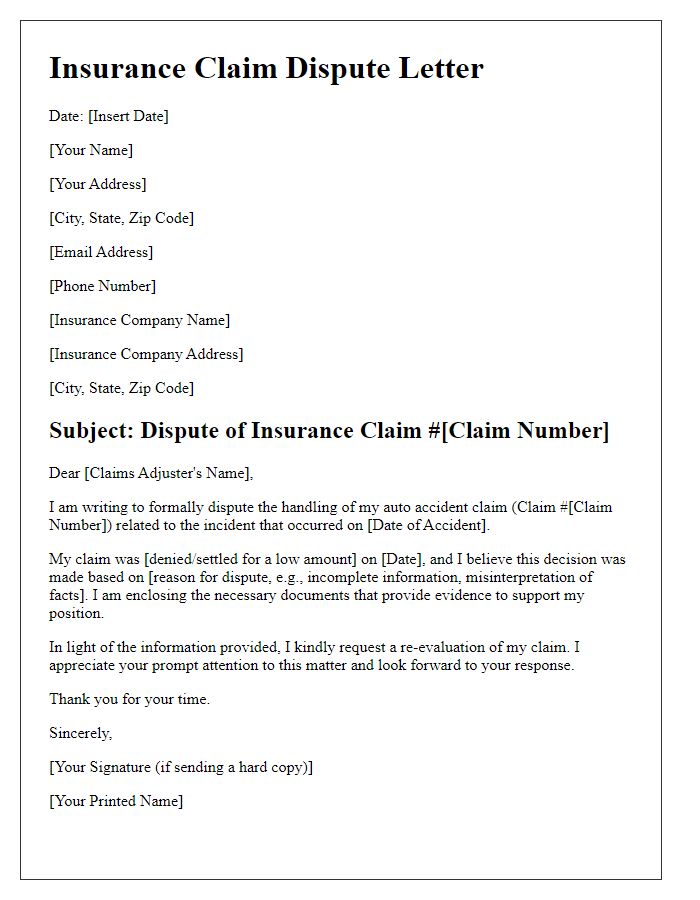

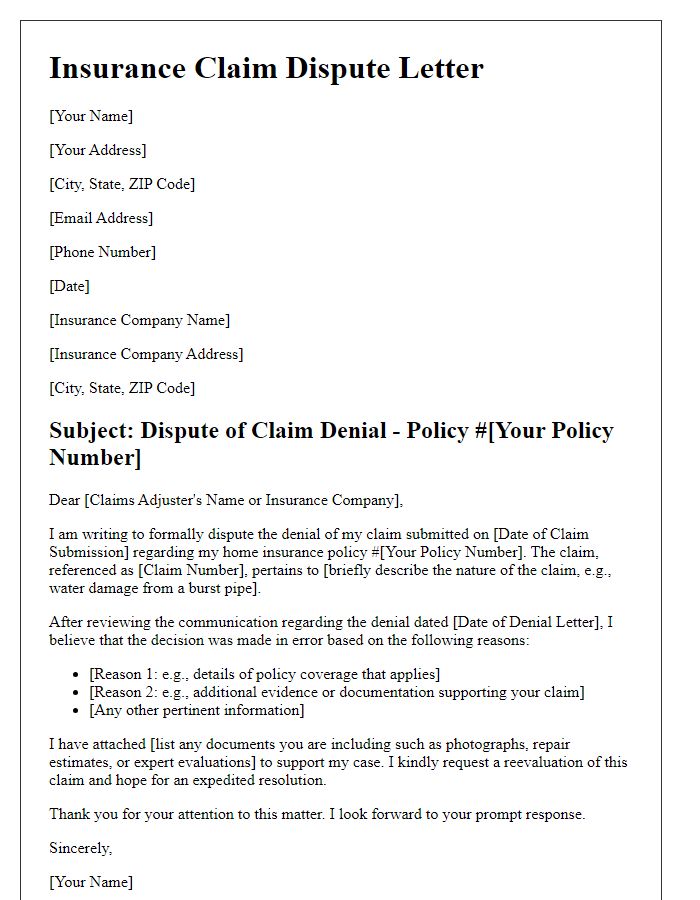

Request for Review and Resolution

An insurance claim dispute can arise when policyholders, like homeowners or vehicle owners, experience disagreements with insurance companies over claim settlements. Often, these disputes occur after unfortunate events such as home fires, car accidents, or natural disasters, which lead to significant financial strain for affected individuals. Disputes may involve claims for damages exceeding thousands of dollars, with policyholders expecting timely resolutions. Homes may be located in regions like California or Florida, where weather-related events lead to increased claim activity. Timeliness in response is crucial, as delays can exacerbate financial hardships. Proper documentation, including photographs and repair estimates, becomes essential in substantiating claims for insurance evaluators. Engaging with a claims adjuster through communication channels can facilitate resolution or further escalate the dispute if necessary.

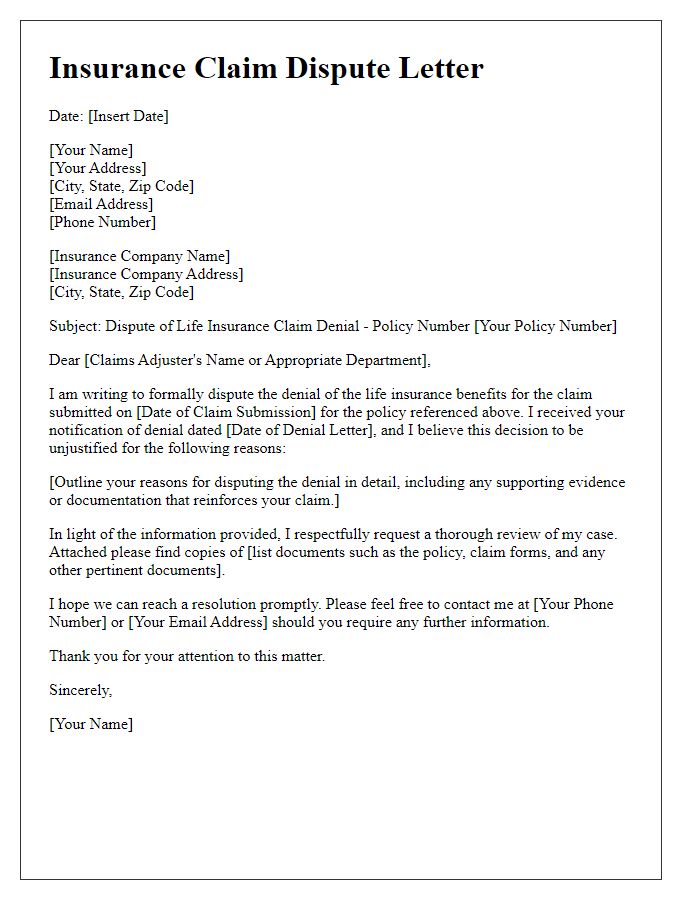

Contact Information for Further Communication

An insurance claim dispute requires timely and clear communication. Provide detailed contact information, including your full name, policy number, and specific claim number associated with the dispute. Ensure that all phone numbers include the area code, preferably a direct line to facilitate swift responses (e.g., +1-555-123-4567). Include an email address, preferably linked to a professional domain (e.g., yourname@example.com), to enable seamless written correspondence. Also, specify your physical address, including city, state, and zip code, to ensure all relevant correspondence is accurately directed. Lastly, indicate preferred hours of availability for contact to enhance communication efficiency.

Comments