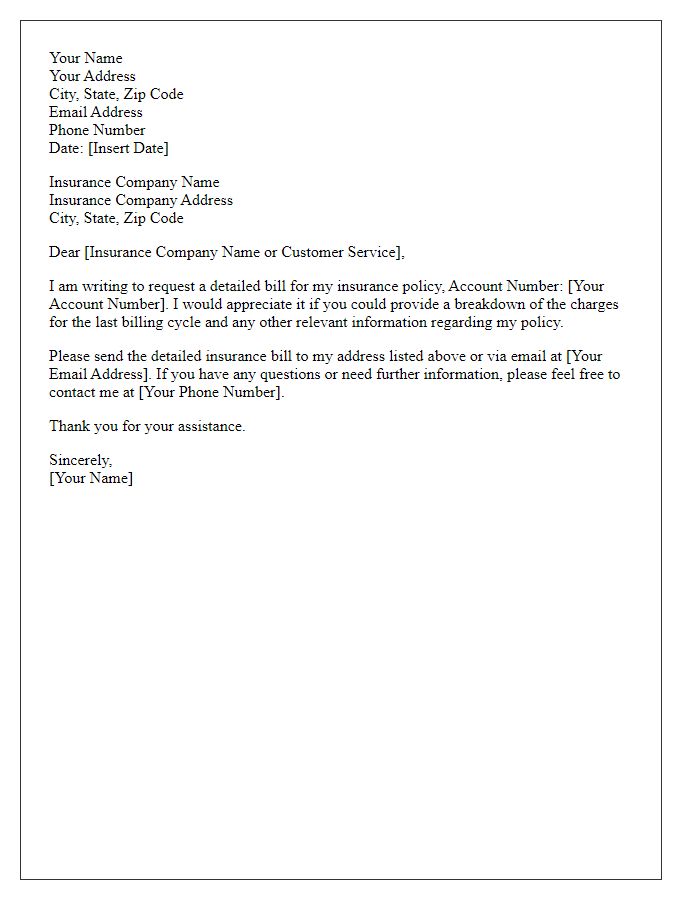

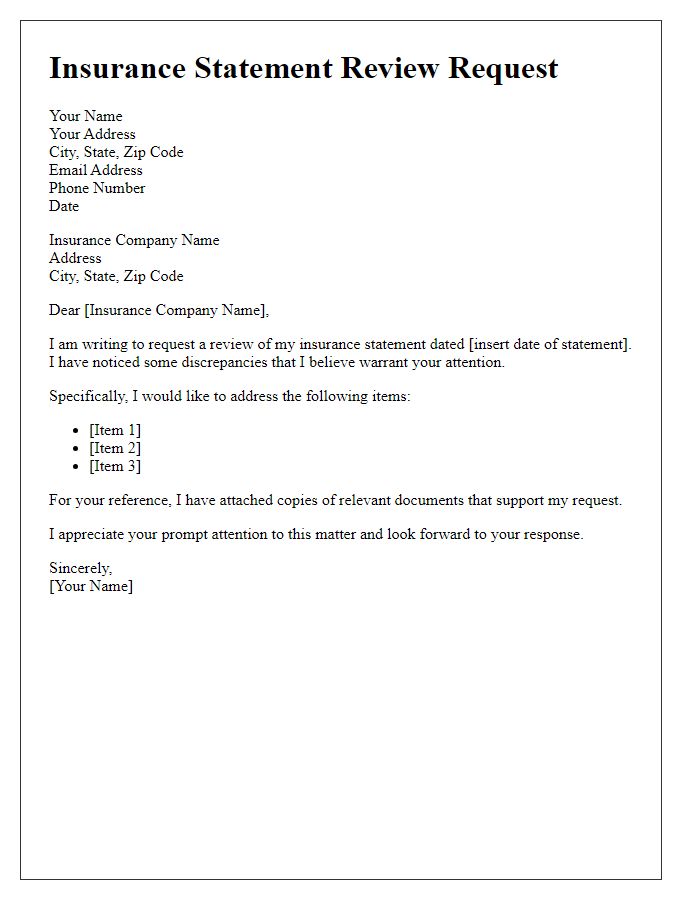

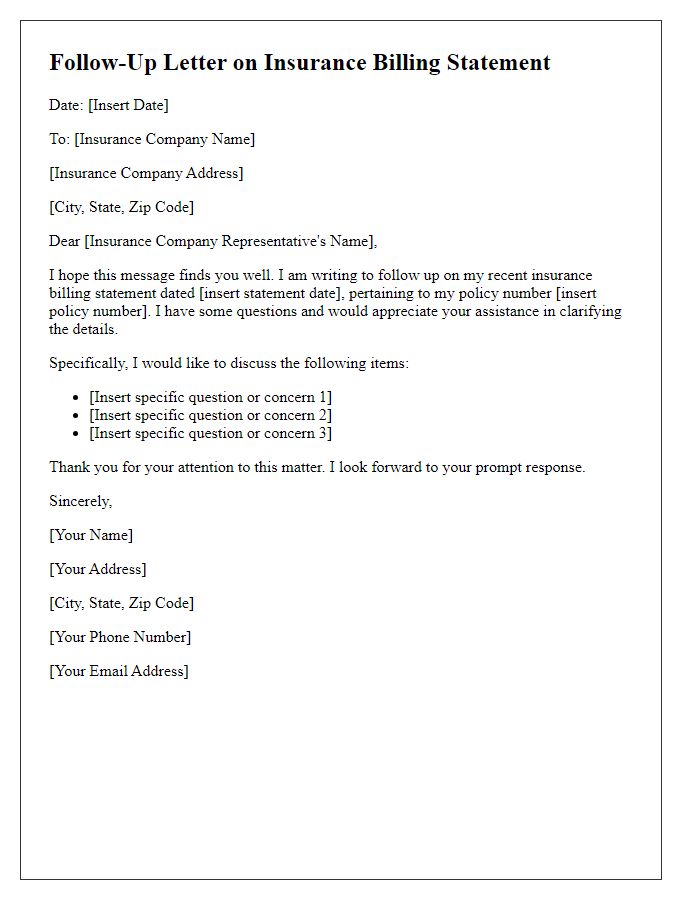

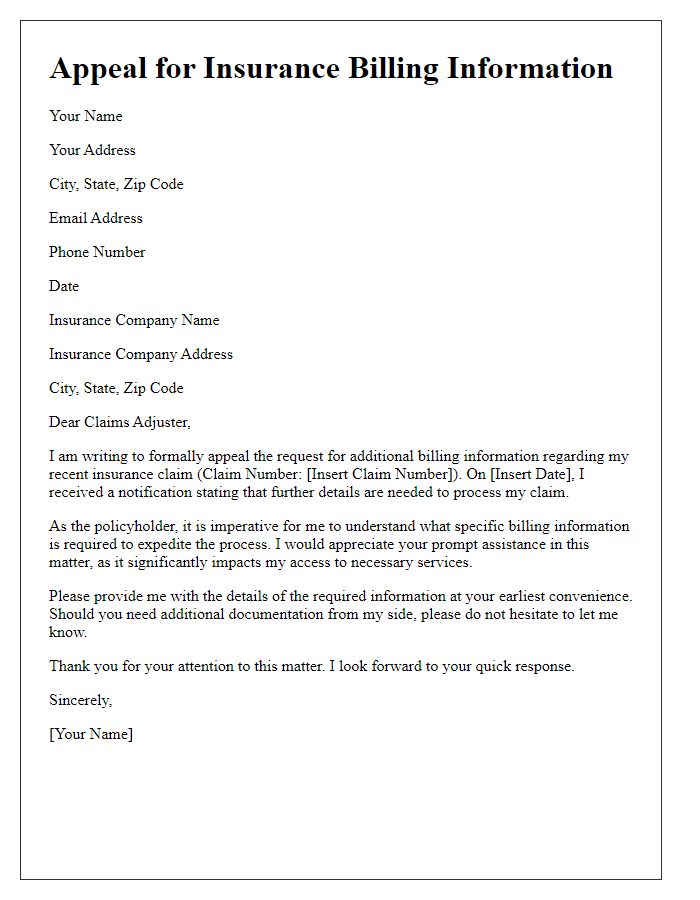

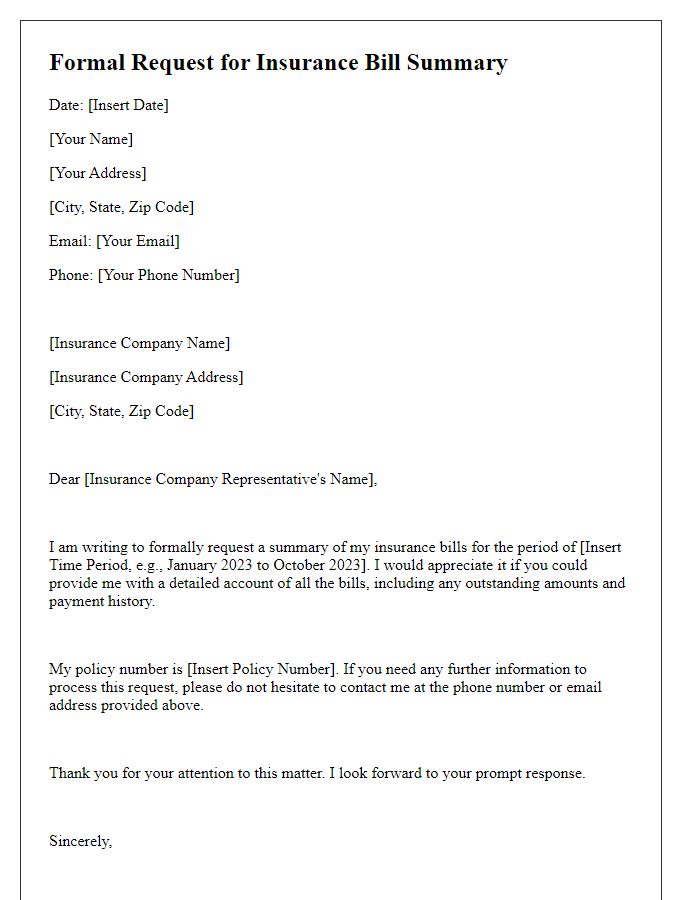

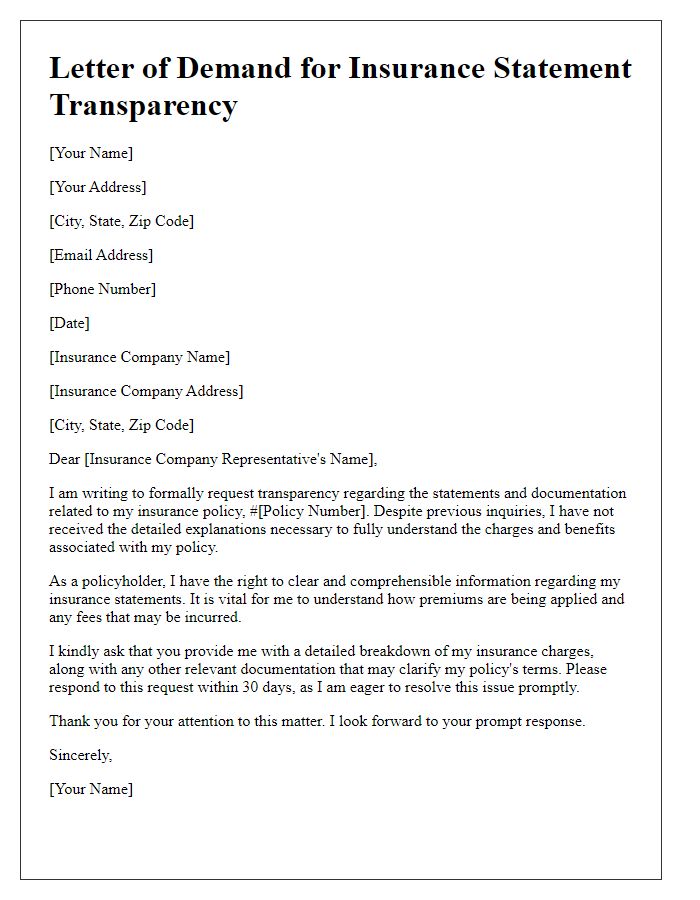

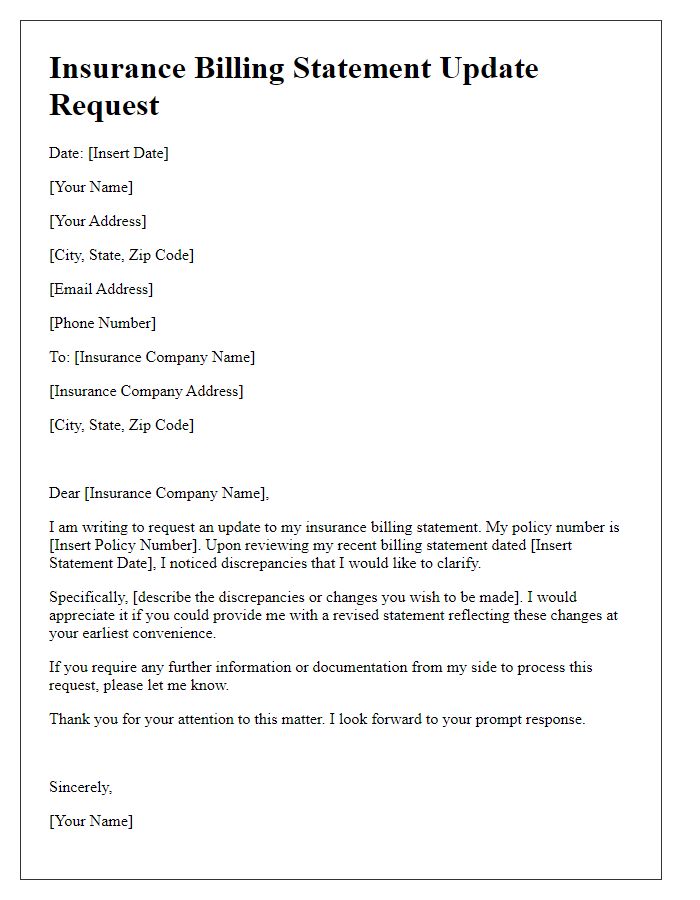

Are you tired of sifting through your insurance documents and feeling confused about your billing statements? Crafting a well-structured letter can make all the difference when requesting clarity from your insurance provider. In this article, we'll provide a helpful template that simplifies the process, ensuring you get the information you need without the added stress. Ready to take control of your insurance inquiries? Let's dive in!

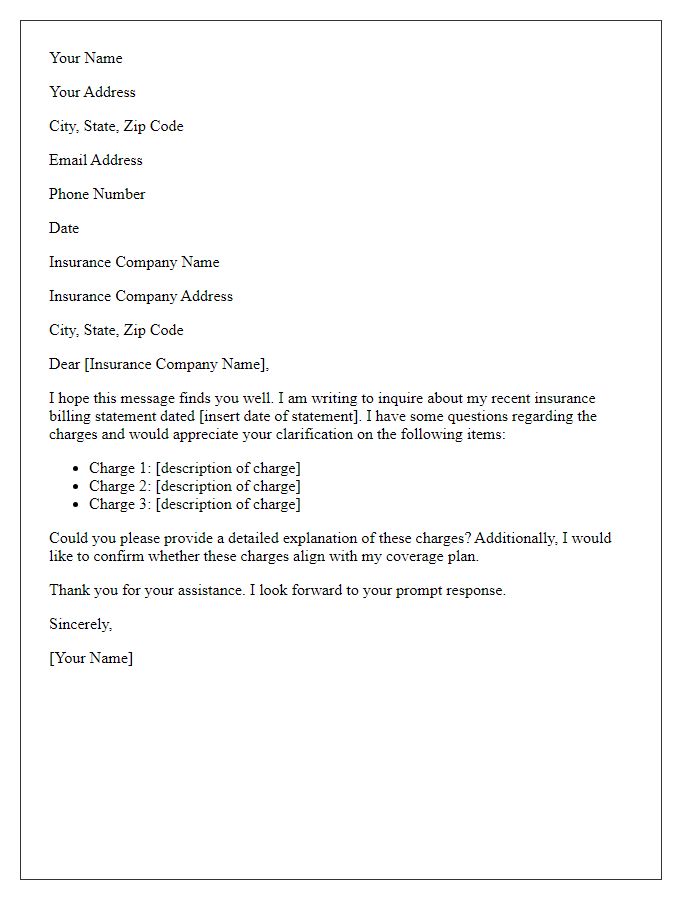

Policyholder Information

Policyholder information encompasses essential details such as the policyholder's name, contact number, and policy number. The name should include both first and last names (e.g., John Doe) to ensure clarity. Contact number refers to an active phone number (e.g., (555) 123-4567) for prompt communication regarding the request. The policy number serves as a unique identifier for the insurance policy (e.g., P123456789), which helps streamline the billing statement request process. Address information is also critical, typically including street address, city, state, and zip code (e.g., 123 Main St, Springfield, IL, 62701), ensuring proper identification and delivery of documents. Accurate policyholder information aids in resolving billing inquiries efficiently.

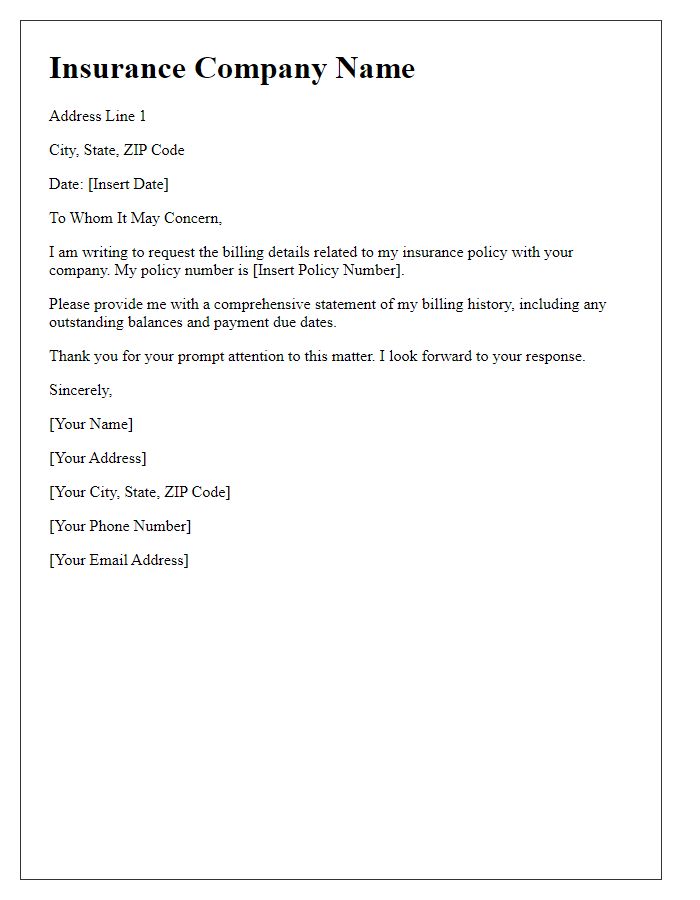

Account/Policy Number

Insurance billing statements provide critical financial information regarding an individual's health coverage. The account number, typically a unique identifier assigned by the insurance company, helps track claims and payments associated with specific policies. A policy number, also unique to each policyholder, reflects the specific coverage details, premium amounts, and individual benefits. Policyholders often need these documents for tax filings or to clarify coverage limits with healthcare providers. Timely access to accurate billing statements can ensure that individuals remain informed about their financial obligations and benefits under policies issued by various insurance companies.

Detailed Billing Period

Insurance billing statements play a crucial role in financial transparency for policyholders, particularly in understanding the detailed billing period which typically spans either monthly or annually. This billing period specifies the timeframe during which premium amounts are calculated, often from the first of the month to the last. For instance, a monthly billing period may run from January 1st to January 31st, with a due date for payment usually set around the 15th of the following month. It is important to note that any alterations in coverage or adjustments due to claims made during this period can also influence the final billed amount, thus requiring meticulous tracking by both the insurer and insured. Accurate billing, including the precise dates and any pertinent documentation, is essential for resolving discrepancies and ensuring policyholder satisfaction throughout the duration of the contract.

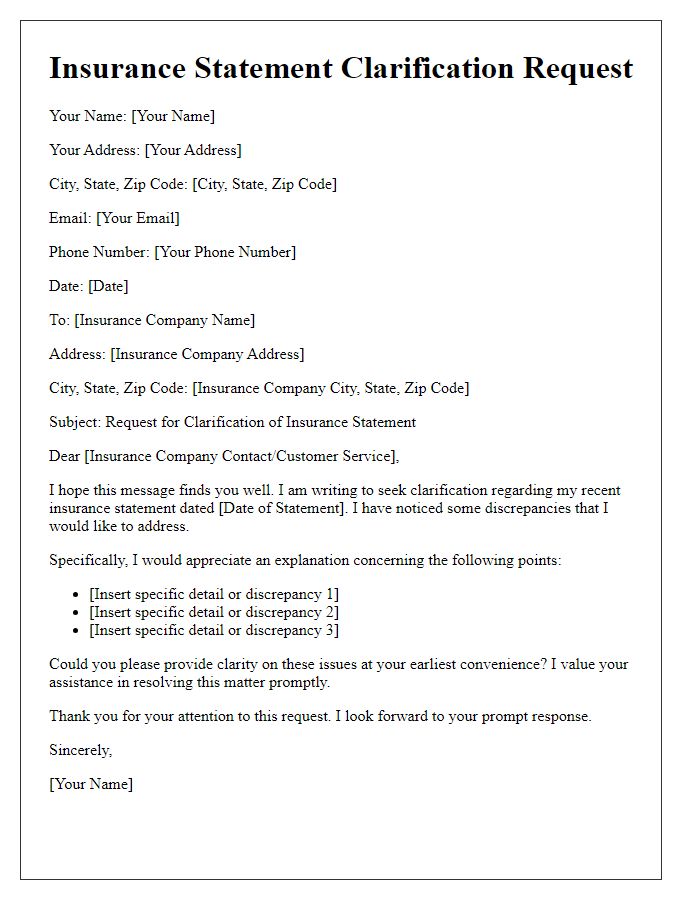

Itemized Charges and Services

An itemized billing statement is essential for clarity in understanding the expenses related to health care services received. Insurance companies often require a detailed breakdown of charges, including individual line items for every service rendered, such as diagnostic tests, consultations, and treatments. A comprehensive statement typically includes dates of service, specific codes for procedures (like CPT codes), descriptions of each service (such as MRI or blood tests), along with associated costs. Providing this information facilitates accurate claims processing and reimbursement from insurers, ensuring that all medical expenses, including those that patients may owe after deductibles and copayments, are clearly delineated and justified.

Contact Information for Queries

Contact information for queries regarding insurance billing statements typically includes essential elements such as company name, customer service phone number, email address, and physical mailing address. The company name, for instance, could be "XYZ Insurance Group," recognized for its comprehensive insurance services across various states. The customer service phone number, like "1-800-555-0123," is crucial for instant communication, allowing policyholders to resolve issues quickly. An email address, such as "customerservice@xyzinsurance.com," provides an alternative method for inquiries, where responses can be provided efficiently. The physical mailing address (e.g., "123 Insurance Lane, City, State, ZIP Code") is necessary for sending formal requests or paperwork related to billing discrepancies or clarifications. Maintaining accurate and accessible contact information ensures a smoother experience for policyholders seeking assistance with their insurance billing statements.

Comments