Are you looking to unlock the benefits of vision insurance but unsure where to start? Navigating the world of vision coverage can feel overwhelming, but we're here to make it easier for you! From understanding your options to finding the right provider, we've got you covered with all the essential information you need. Join us as we explore the ins and outs of vision insurance and discover how it can enhance your eye care experience!

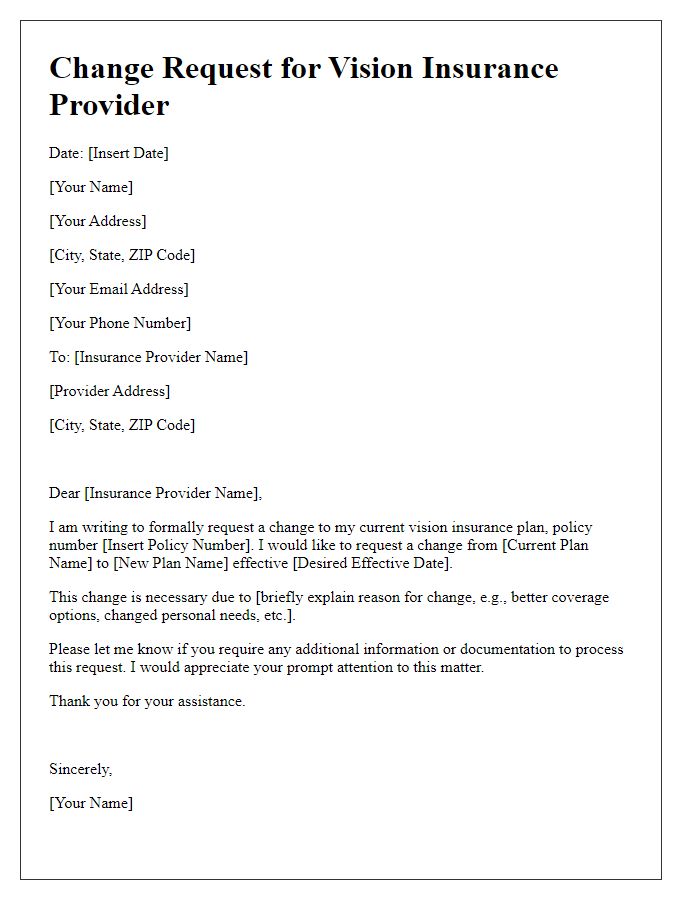

Subject line optimization

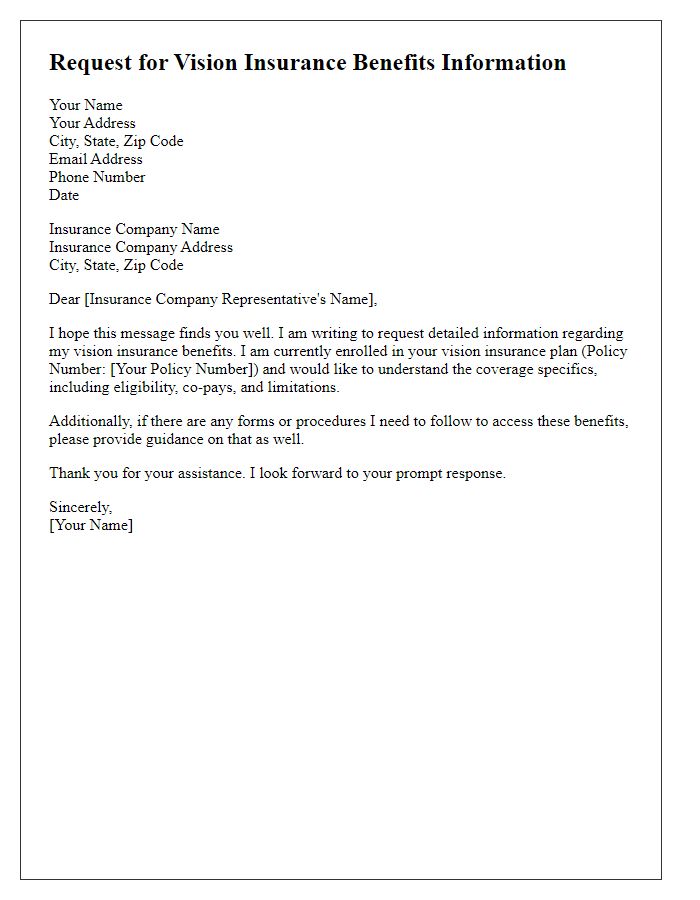

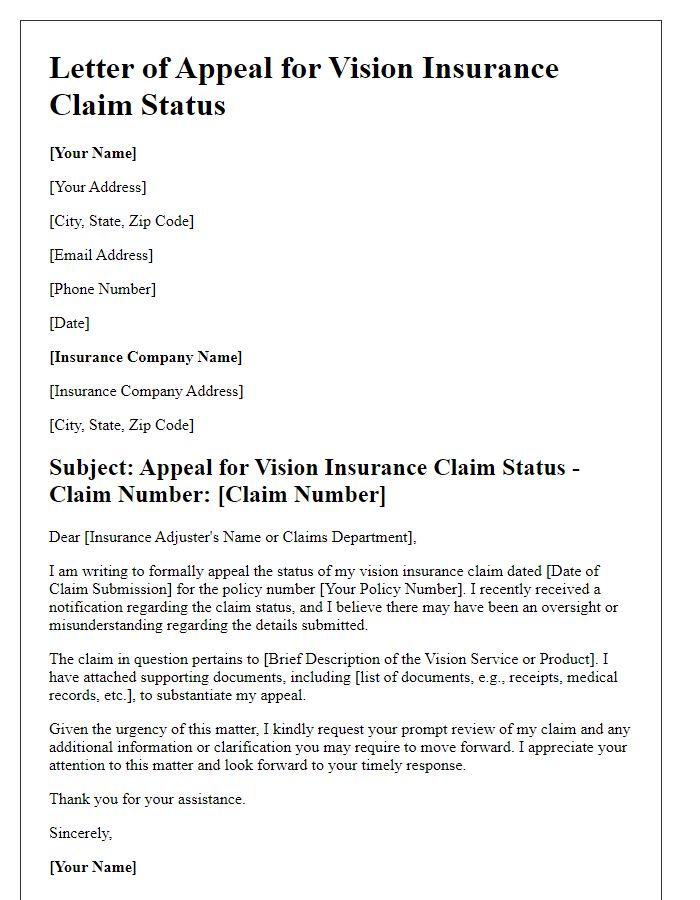

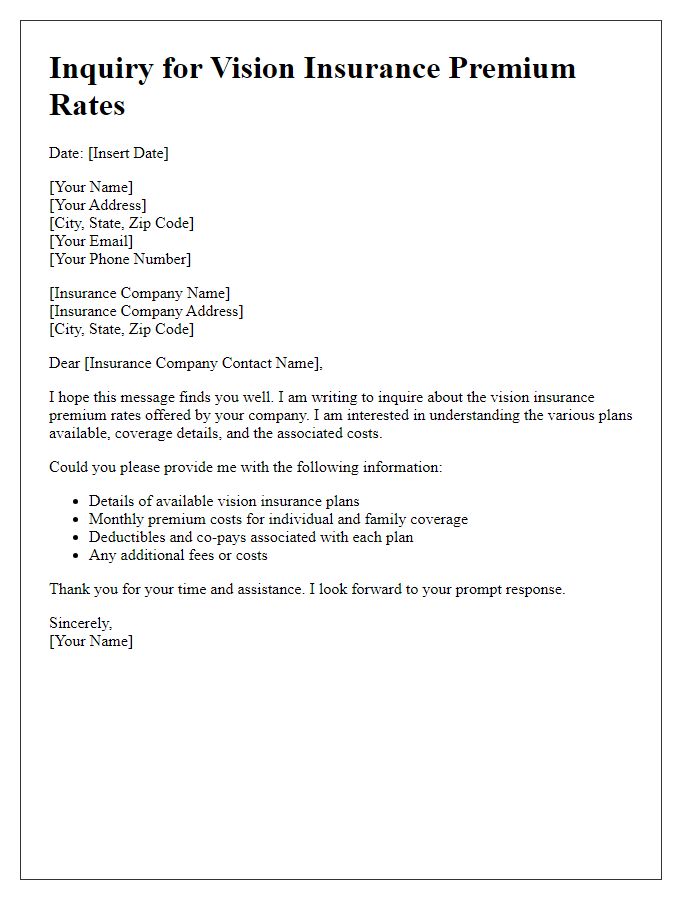

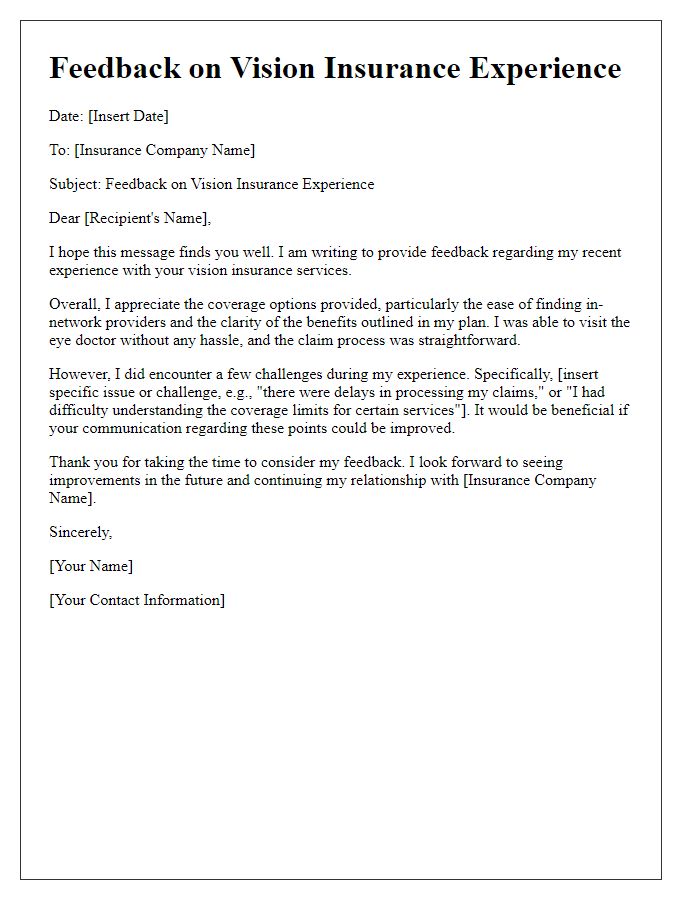

Vision insurance inquiries play a crucial role in understanding coverage options for eye care, including routine exams, contact lenses, and corrective eyewear. Individuals must seek clarity on benefits from providers like VSP or EyeMed, who typically offer various plans with distinct coverage limits. It is essential to know specific details such as annual allowances (often ranging from $150 to $300), copayment structures (frequently $10 to $25 for exams), and network providers' availability in local areas. Additionally, researching insights about out-of-pocket costs and eligibility requirements ensures informed decisions regarding eye health and associated expenses.

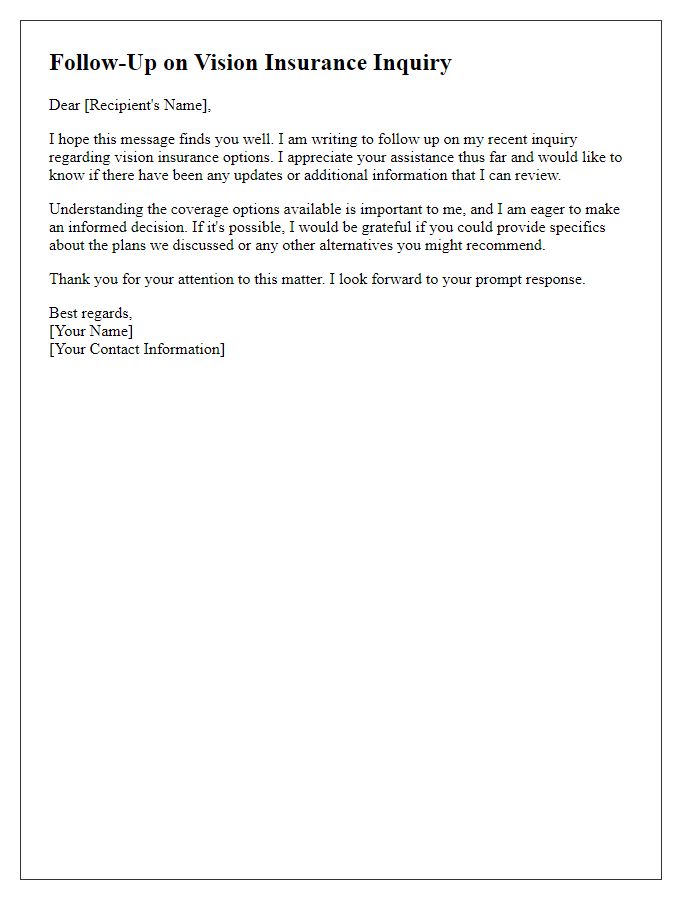

Clear and concise greeting

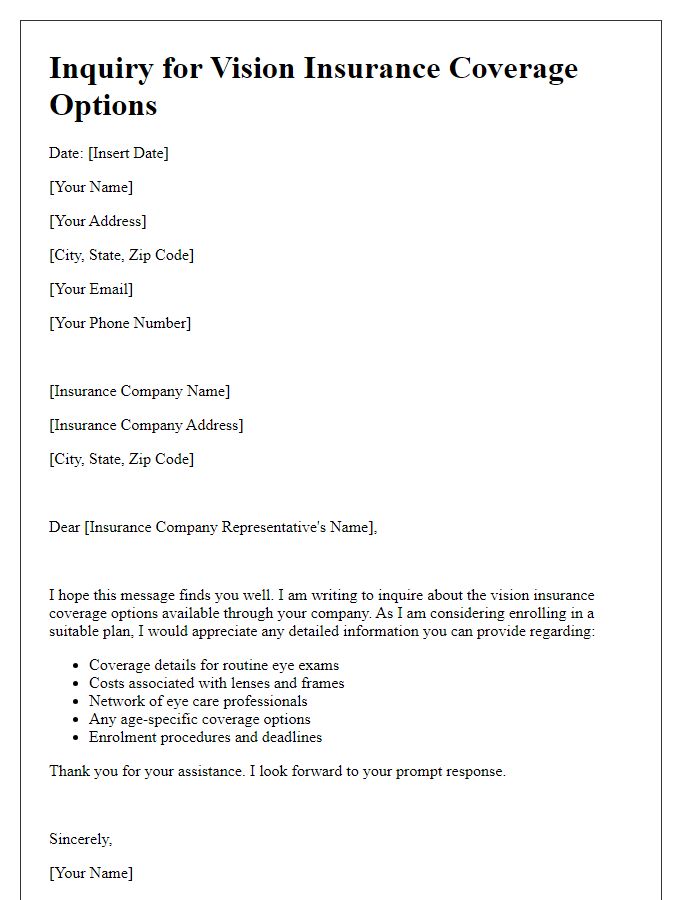

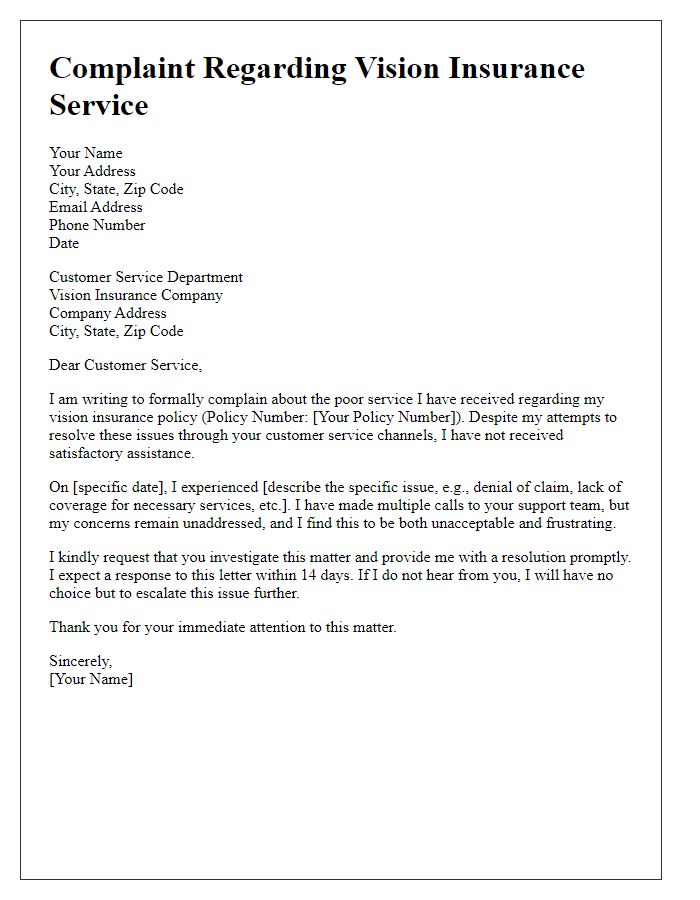

Inquiring about vision insurance requires clarity and conciseness, especially when addressing specific benefits and coverage details. Vision benefits can vary significantly by insurer, often covering eye exams, prescription glasses, or contact lenses. Ensure to specify the type of coverage desired, such as whether it includes routine eye exams (typically every one to two years) or if there are allowances for eyewear purchases. Additionally, identifying the insurance provider (for instance, VSP or EyeMed) can help streamline the inquiry process, leading to a more informative and relevant response.

Purpose of inquiry (specific details)

Vision insurance plays a crucial role in maintaining ocular health through routine check-ups and corrective lenses. Inquire about specific coverage aspects, such as the percentage of reimbursement for eye exams, typically ranging from 80% to 100%, and the annual benefit maximum, often around $300 to $500. Clarify the network of providers, including well-known optometrists and ophthalmologists, to ensure accessibility. Investigate the inclusion of lens options, such as contact lenses versus spectacles, as well as discounts that might be available for eyewear purchases. Understanding limitations on frequency of eye exams, commonly every 12 to 24 months, is also essential for effective planning. Additionally, ask about any pre-existing condition exclusions that may affect the coverage of specific vision issues.

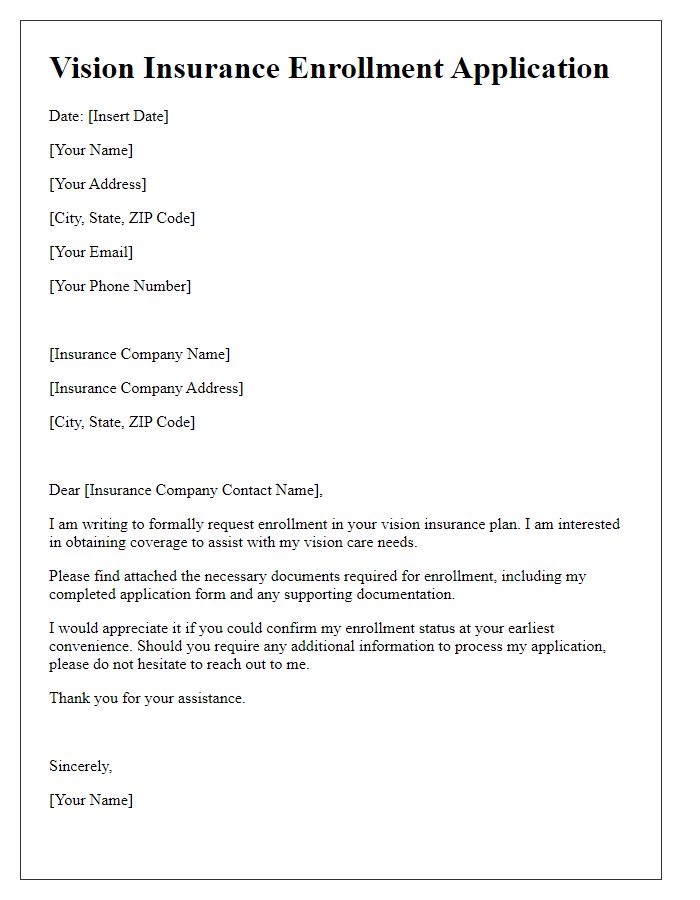

Personal information (policyholder's data)

The policyholder for vision insurance typically includes key data such as full name, policy number, date of birth, and contact information. Commonly required contact details are phone number and email address for efficient correspondence. In cases where premiums are paid via a specific method, the payment information might also be relevant. The inquiry may focus on understanding coverage details for eye examinations, contact lenses, or eyewear, as well as verifying any recent changes in policy terms. Providing this information ensures a clearer and more effective communication process with the insurance provider.

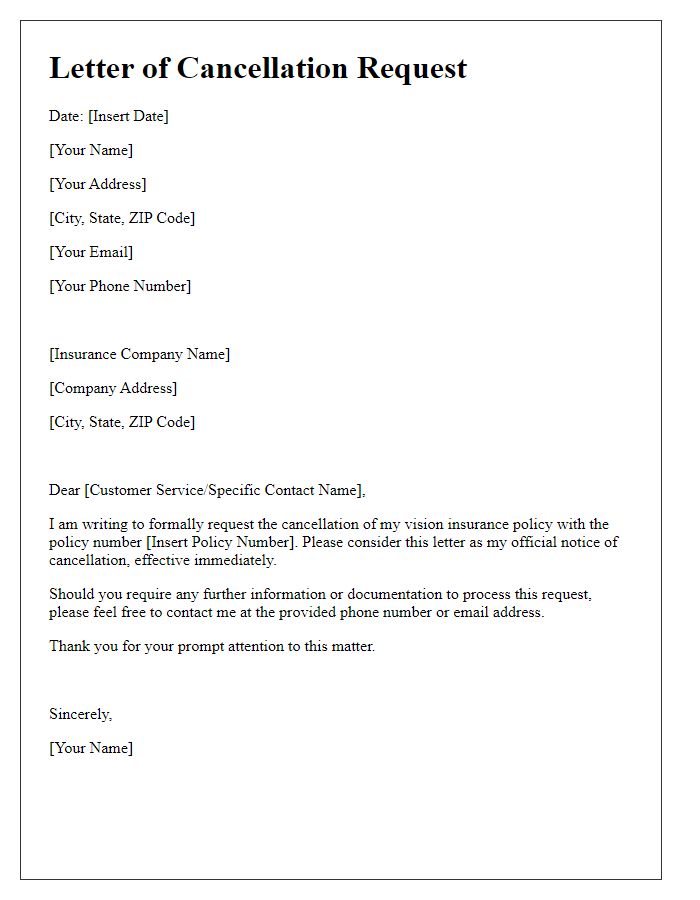

Call-to-action/request for response

Vision insurance plans offer a wide range of benefits, including coverage for eye exams, glasses, and contact lenses. These plans, provided by various insurers, can significantly reduce out-of-pocket expenses for necessary vision care. According to the American Optometric Association, regular eye examinations can detect conditions such as glaucoma and macular degeneration, protecting eye health. Inquire about specific coverage options, deductibles, and co-pays, as these can vary greatly between plans. Understanding limitations, such as network restrictions and waiting periods, is crucial for making informed insurance choices. Consider reviewing plan details to ensure adequate support for family vision needs.

Comments