Have you ever been in a fender-bender and worried about how it might affect your insurance premiums? Accident forgiveness insurance can be a game-changer, offering peace of mind in case of unfortunate mishaps. Understanding how this coverage works and whether it's right for you is crucial for making informed decisions. So, let's dive deeper into the intricacies of accident forgiveness insurance to see if it could benefit you!

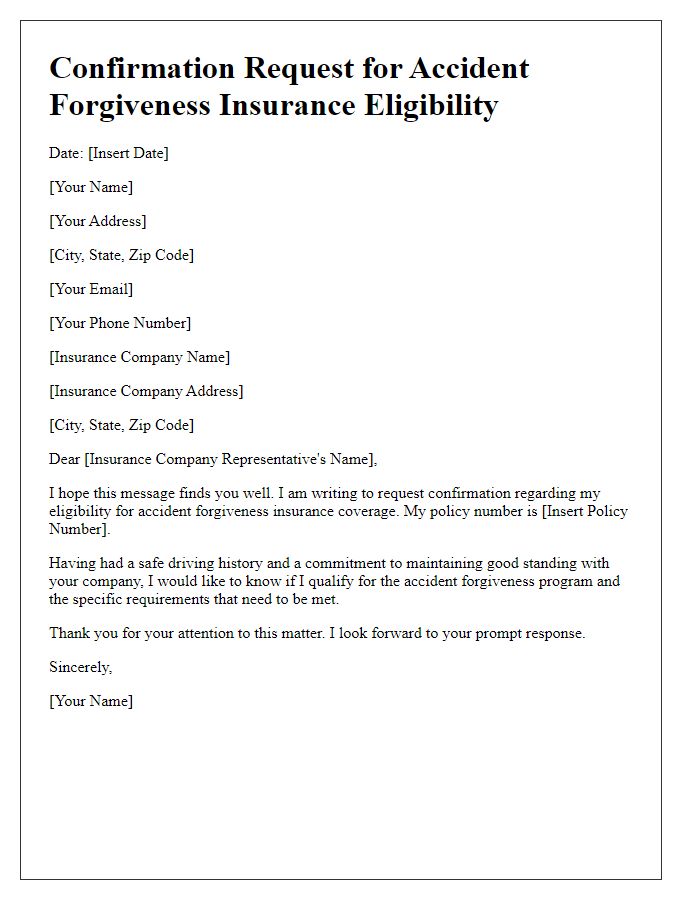

Personal Information: Full Name, Contact Details, Policy Number

Accident forgiveness insurance serves as a crucial safety net for drivers involved in minor incidents. It typically applies to auto insurance policies issued by various carriers, such as State Farm or Allstate, protecting a driver's premium from increasing due to their first at-fault accident. Policyholders can enjoy peace of mind knowing that their first accident (usually within the first three years of the policy) does not result in a higher premium. This benefit reinforces responsible driving habits and fosters trust between the insurer and the insured. Coverage conditions can vary greatly among insurers, making it essential for drivers to review their specific policy terms and eligibility requirements for accident forgiveness provisions.

Subject Line: Clear and specific, mentioning accident forgiveness inquiry

Accident forgiveness insurance provides a safety net for drivers facing the unfortunate events of car accidents. This type of coverage, often offered by major insurance companies such as Allstate and Progressive, allows policyholders to avoid premium increases after their first accident, typically occurring within a specified timeframe (often within a three-year period). Eligibility criteria may vary by state and insurer; for instance, certain states limit the availability of accident forgiveness plans. This coverage not only eases financial burdens post-accident but also incentivizes responsible driving behaviors. Understanding the terms, such as 'first accident' exclusions and additional premium costs, is crucial when considering this beneficial option for maintaining affordable insurance rates.

Policy History: Details about existing insurance coverage and past claims

Accident forgiveness insurance provides drivers with peace of mind regarding their driving history. A comprehensive policy history encompassing existing insurance coverage, such as liability, comprehensive, and collision, is crucial for assessing eligibility for accident forgiveness. Past claims, including frequency and severity, impact renewal rates and availability of forgiveness benefits. For instance, a driver with a clean record for five years may qualify for accident forgiveness, allowing them to avoid premium hikes after their first at-fault accident. It's also essential to consider the insurance provider's guidelines on accident forgiveness, as terms may vary significantly across companies and states, influencing overall coverage experience.

Accident Details: Description of the recent accident or incident

A recent incident occurred on September 15, 2023, when a minor collision took place on Maple Street in Springfield, involving a grey Honda Accord and a blue Toyota Camry. The Honda, traveling at a low speed, accidentally tapped the rear bumper of the Toyota while attempting to park. No injuries were reported, and both vehicles sustained minimal damage, estimated at $500. The Springfield Police Department (Incident Report #2345) documented the event, confirming it as a no-fault accident. Given this situation, inquiries regarding accident forgiveness insurance options are necessary to address potential impacts on future premiums while ensuring coverage retains its effectiveness.

Forgiveness Request: Explanation for needing accident forgiveness and its potential impact

Accident forgiveness insurance offers drivers the chance to maintain their premium rates despite infrequent mishaps. This coverage, often beneficial for those with a clean driving history, helps shield policyholders from increased costs following an accident. For instance, a single at-fault accident can raise premiums by an average of 20-50%, depending on factors such as insurance provider, state regulations, and individual driving records. Requesting accident forgiveness can be crucial for managing finances, especially for young drivers or families relying on a single vehicle. Ensuring that the coverage remains available could significantly impact long-term affordability and help maintain financial stability.

Letter Template For Accident Forgiveness Insurance Query Samples

Letter template of inquiry regarding accident forgiveness insurance options

Letter template of consultation request about accident forgiveness insurance features

Letter template of clarification needed on accident forgiveness insurance benefits

Letter template of feedback request for accident forgiveness insurance services

Letter template of proposal for accident forgiveness coverage discussion

Comments