Hey there! It's that time againâjust a friendly reminder that your insurance premium is coming due. Staying on top of your payments is key to ensuring uninterrupted coverage and peace of mind. If you have any questions about your policy or payment options, simply reach out! Read on to learn more about managing your insurance effectively.

Account details and billing information

Insurance premium reminders are crucial for maintaining coverage and financial stability. Typically, these communications include account details such as the policy number (usually a unique identifier for insurance contracts), billing information specifying the due date (common billing cycles are monthly, quarterly, or annually), and payment methods (credit cards, bank transfers, or online portals). Insurance providers often emphasize potential penalties for late payments, which can include lapses in coverage or late fees. Keeping these details clear and concise ensures that policyholders remain informed and can easily adhere to their financial obligations.

Due date and payment methods

Insurance premium payment reminders serve as crucial notifications for policyholders regarding upcoming due dates and available payment methods. For instance, an auto insurance policy, typically due on the 15th of each month, may accept various payment methods such as credit cards (Visa, MasterCard, American Express), bank drafts, or online payments via the insurance provider's secure portal. Additionally, some providers offer options for automatic payments to prevent lapses in coverage, ensuring continuous protection of assets like vehicles or homes. It's essential to verify payment methods and deadlines to avoid late fees or coverage interruptions, maintaining the policyholder's peace of mind.

Policyholder's contact information

The timely payment of insurance premiums ensures continuous coverage and protection against unexpected risks. Insurance policies, often renewed annually, require regular premium payments to remain active. Insurers typically send reminders, via email or postal mail, highlighting due dates and specific payment amounts. Policyholders should maintain updated contact information, including phone numbers and addresses, to receive notifications. Failing to pay premiums within the grace period, which can range from 10 to 30 days depending on the policy, may result in lapses in coverage or increased future premiums.

Consequences of non-payment

Failure to pay insurance premiums on time can lead to significant consequences for policyholders. Lapsed coverage may result in unprotected assets, exposing individuals to financial risk during unforeseen events such as accidents or natural disasters. For instance, auto insurance providers often declare policies inactive after 30 days of non-payment, meaning drivers could face liability for damages or injuries without coverage during that period. In certain cases, reinstating a policy after cancellation can incur higher premiums, particularly in health insurance, where risk is reassessed, often leading to increased costs. Additionally, credit scores may be negatively impacted due to unpaid premiums, affecting future borrowing opportunities. Overall, the repercussions of non-payment underscore the importance of timely premium remittance to ensure continuous protection and peace of mind.

Encouragement for prompt payment and support options

Insurance policyholders often receive reminders for premium payments, essential for maintaining coverage. Timely payments prevent policy lapses, ensuring continued protection from unforeseen events and accidents. Support options such as online payment portals or customer service hotlines may assist individuals who encounter financial difficulties. Premium payment deadlines typically fall on a monthly or annual basis, varying by policy type and insurer. Staying informed about renewal dates and available discounts encourages proactive management of insurance accounts, ultimately leading to peace of mind in times of uncertainty.

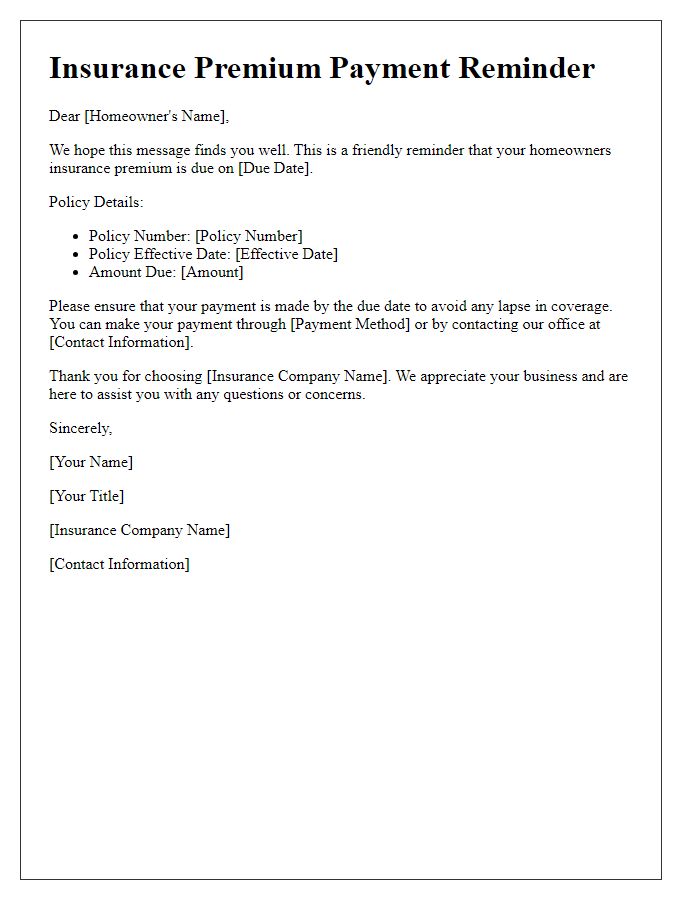

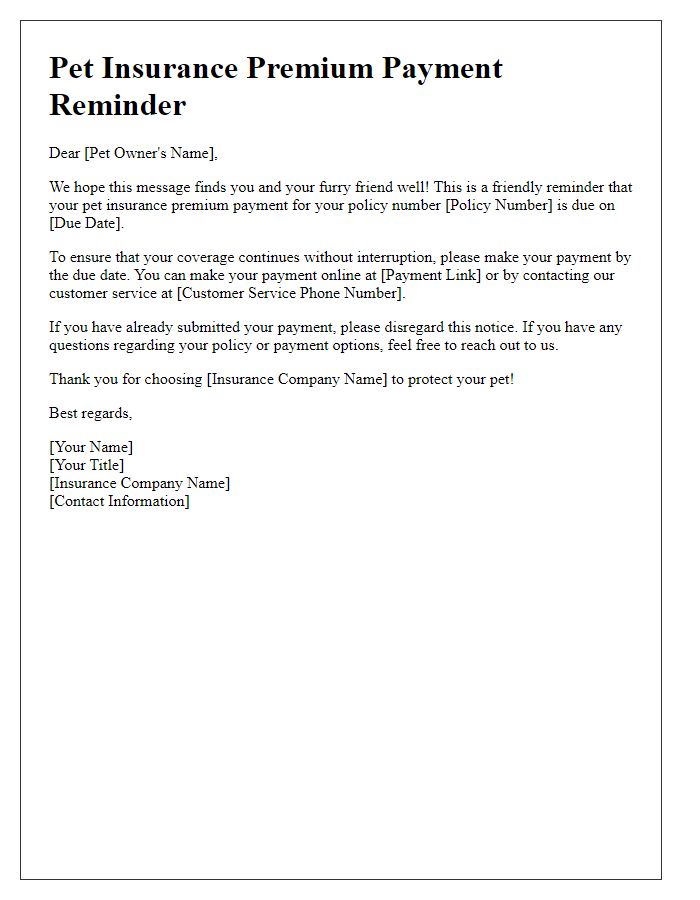

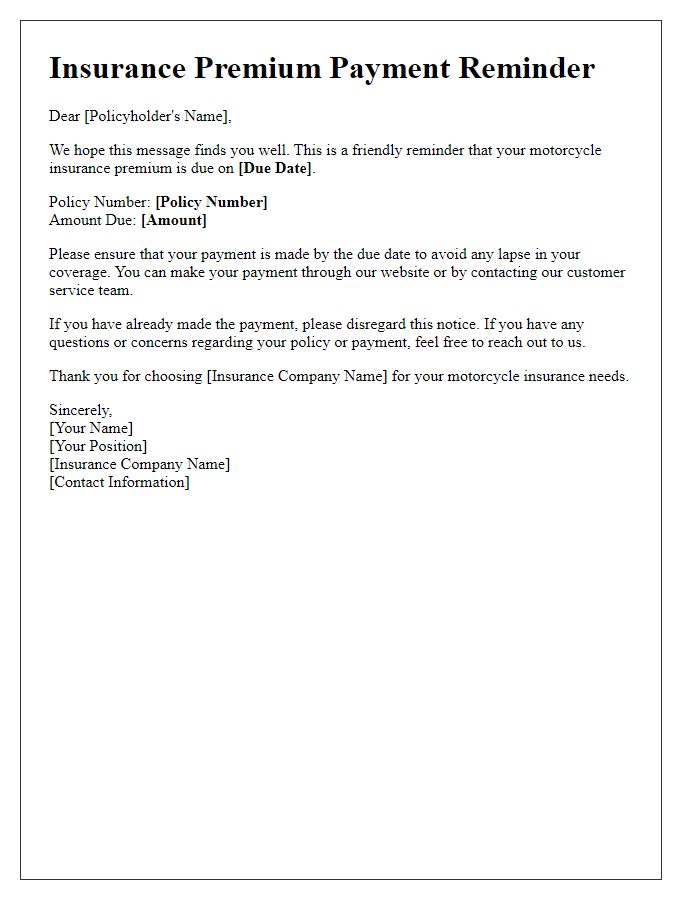

Letter Template For Insurance Premium Payment Reminder Samples

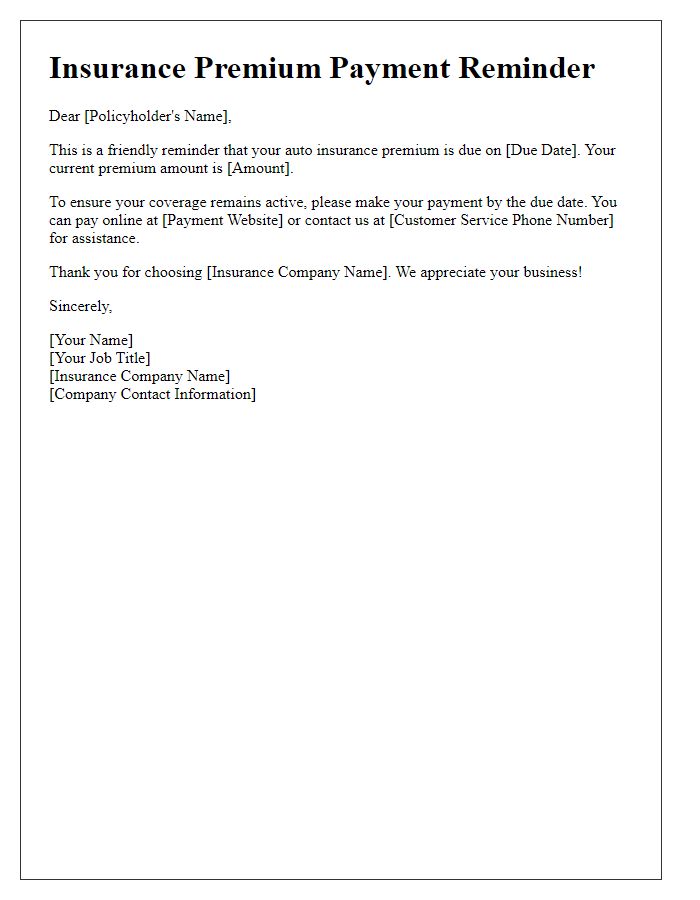

Letter template of Insurance Premium Payment Reminder for Auto Insurance

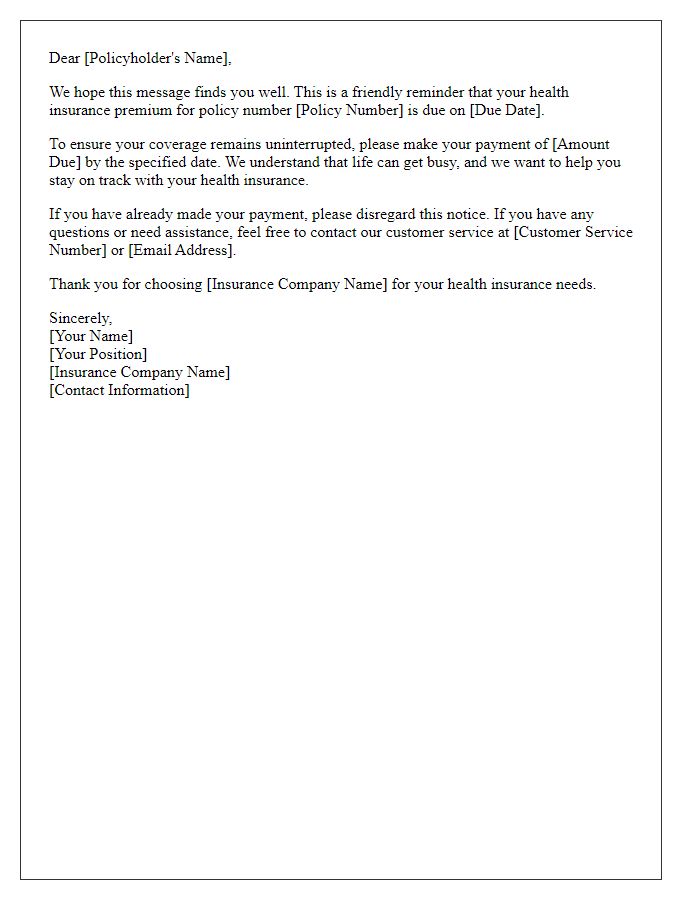

Letter template of Insurance Premium Payment Reminder for Health Insurance

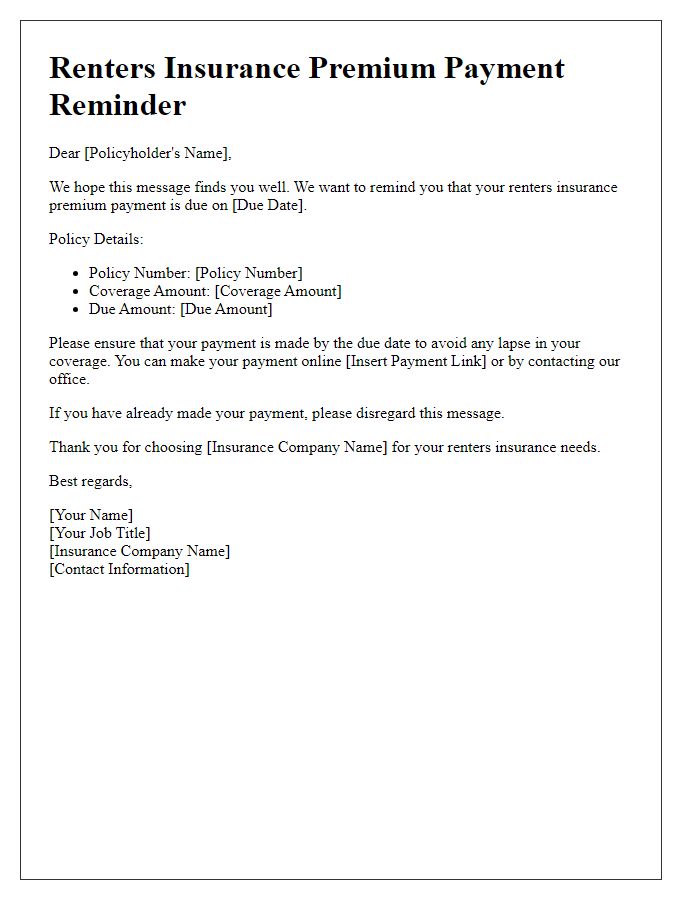

Letter template of Insurance Premium Payment Reminder for Renters Insurance

Letter template of Insurance Premium Payment Reminder for Life Insurance

Letter template of Insurance Premium Payment Reminder for Business Insurance

Letter template of Insurance Premium Payment Reminder for Travel Insurance

Letter template of Insurance Premium Payment Reminder for Professional Liability Insurance

Comments