Are you looking to make changes to your insurance policy? Crafting a well-structured letter is an essential step in communicating your needs effectively. In this article, we'll guide you through a simple yet powerful template for a valued policy insurance amendment letter that ensures clarity and professionalism. So, let's dive in and get you one step closer to safeguarding your interestsâread on to discover how!

Clear Policyholder Information

Valued policy amendments in insurance require clear and detailed policyholder information. Essential details include the policyholder's full name (for identification), policy number (unique reference for the insured item), and contact information (such as mailing address and phone number). Additionally, any pertinent changes to coverage, including increased limits, endorsements, or exclusions, should be explicitly outlined to ensure mutual understanding. Providing precise details of the amendment's effective date (when changes take place) and the reason for the amendment (such as a change in property value or risk assessment) is vital for maintaining trust and transparency between the insurer and policyholder.

Specific Policy Changes

Valued policy amendments can enhance customer satisfaction and coverage adequacy, ensuring client needs are met. Important documents include policy numbers and effective dates for clarity. Adding specific coverage details, such as increased limits on property damage or additional riders for personal items, ensures comprehensive protection. Adjusting premiums based on changes in risk assessment, alongside clear instructions for claims processes, addresses potential client concerns. Regular communication regarding these amendments fosters transparency and builds trust in the insurance provider's dedication to client welfare.

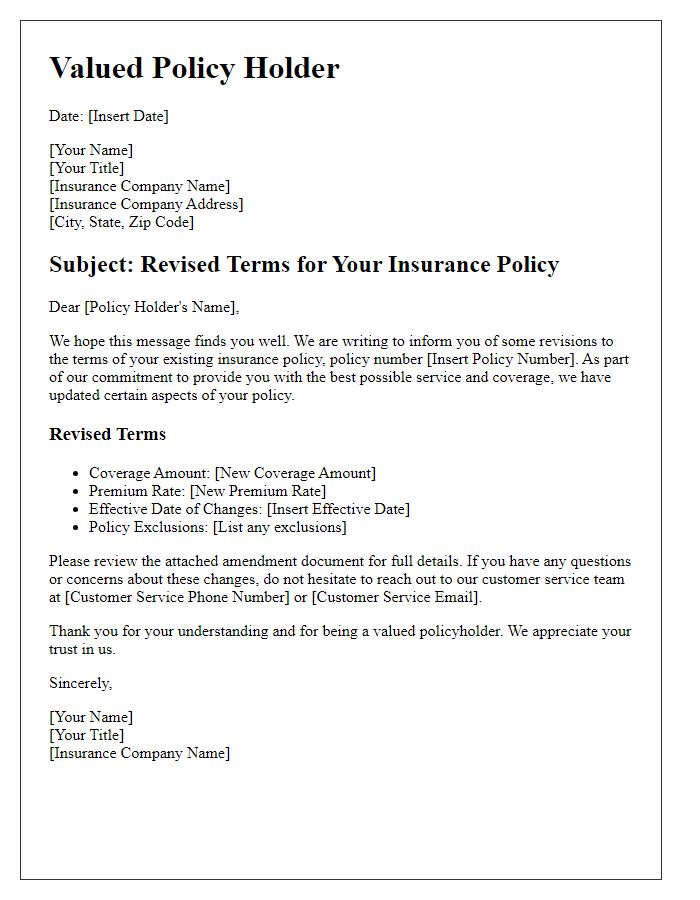

Effective Dates and Terms

Valued policy insurance amendments specify the effective dates and terms that govern the changes in insurance coverage. Detailed documentation ensures that policyholders understand the adjustments made to their insurance contracts. For example, a policy amendment effective from January 1, 2024, may increase coverage limits for property damage in natural disasters such as hurricanes or earthquakes. Additionally, terms might include modifications to deductibles or premium adjustments, reflecting updated risk assessments or market changes. Clear communication of these amendments is crucial for maintaining transparency and ensuring that policyholders are aware of their rights and responsibilities under the revised insurance agreement.

Detailed Coverage Descriptions

Valued policy insurance amendments can enhance coverage specifics, adjusting benefits for various property types. For instance, homeowners (property owners of residential structures) may seek additional protection against perils such as flooding (potentially devastating water damage) or fire (the destruction caused by flames or smoke). Businesses (commercial entities) might require specialized clauses for theft (the unauthorized taking of property) or liability (legal responsibility for harm) related to clients on premises. Each amendment must list exact terms, including coverage limits (maximum amounts payable) and deductibles (out-of-pocket expenses before insurance kicks in). Properly constructed amendments ensure comprehensive protection tailored to individual policyholder needs (the specific requirements of the insured).

Insurer's Contact Information

The insurer's contact information, typically included in an insurance policy amendment, provides essential details that facilitate effective communication. This section usually contains the official name of the insurance company, which may be a well-known entity like MetLife or State Farm. The mailing address, often a headquarters location, may include street number, city, state, and ZIP code, ensuring that all correspondence reaches the right department. Contact numbers, including a toll-free service line or a direct line to the claims department, enable quick access for policyholders seeking assistance. Email addresses, particularly those designated for customer service or policy amendments, enhance communication options. Additionally, a website URL may be provided, directing insured individuals to online resources for further information regarding their policies or contacting support.

Letter Template For Valued Policy Insurance Amendment Samples

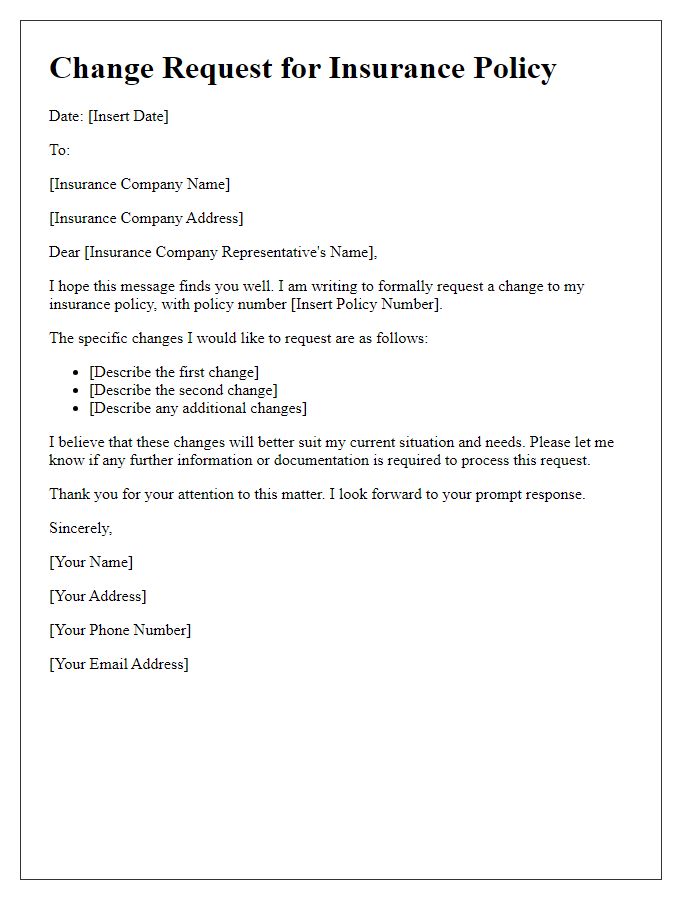

Letter template of policy amendment request for valued insurance coverage

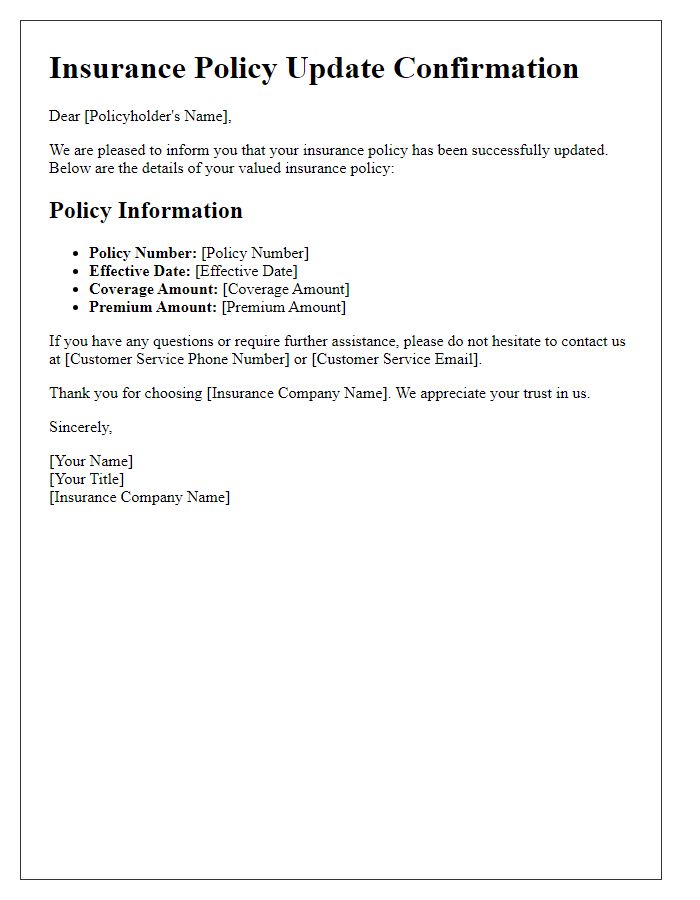

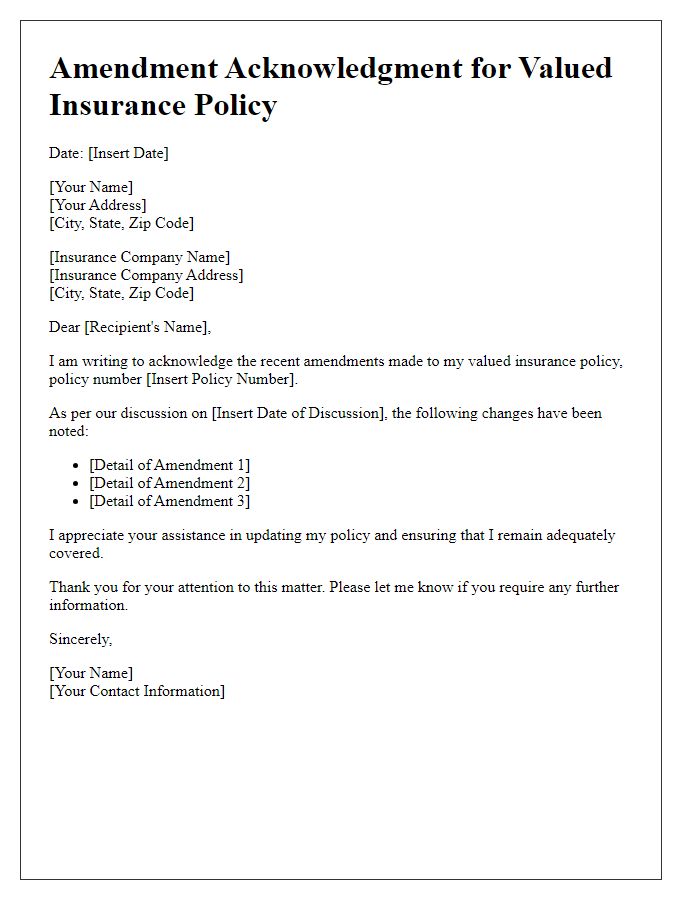

Letter template of notification for alteration of valued insurance policy

Comments