Hey there! Have you ever wondered what happens when your insurance coverage is about to expire? It's essential to stay ahead of the game and understand the implications it can have on your financial security. In this article, we'll break down the key reasons why you shouldn't let your coverage lapse and the steps you should take to ensure continuous protection. So, grab a cup of coffee and keep reading to find out how to safeguard your assets effectively!

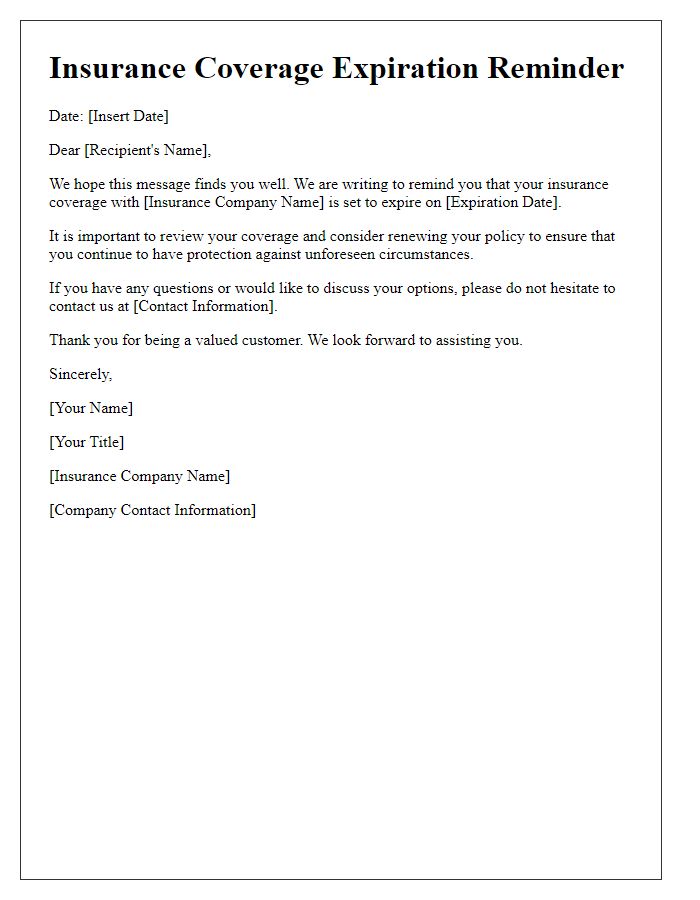

Recipient's Information

Insurance policies, such as auto or home insurance, typically include coverage expiration dates that require attention from policyholders. For example, a standard policy may expire after one year from the issue date, necessitating renewal to maintain comprehensive protection. Recipients should be aware that failure to renew can result in lapses in coverage leading to potential financial liabilities. Documentation such as premium payment records and policy endorsements must be reviewed to ensure continued eligibility, especially in states like California where specific regulations apply. Effective communication about upcoming expiration dates is crucial for both insurer and insured to avoid service interruptions.

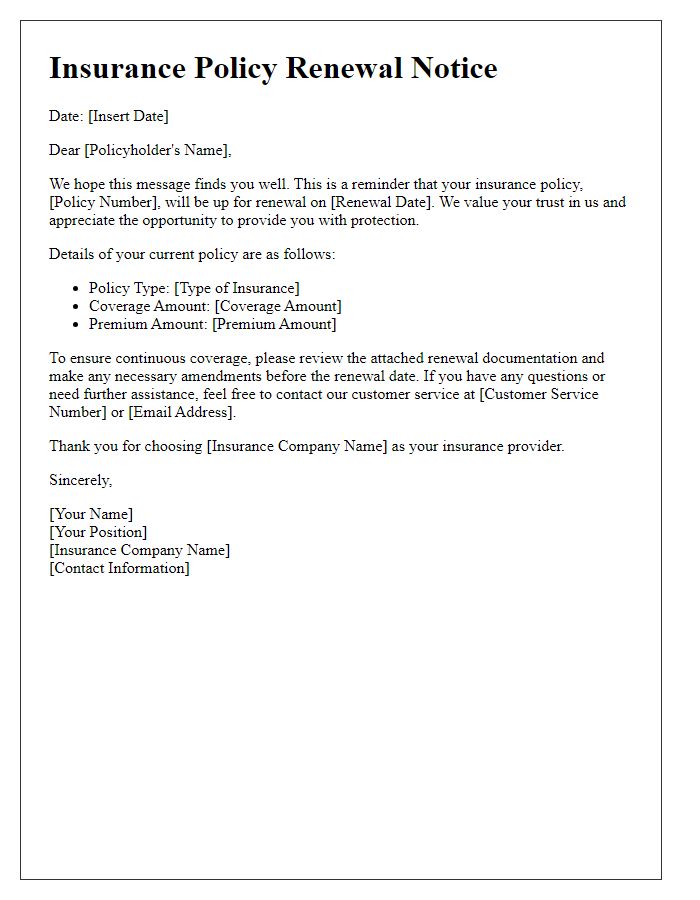

Policy Details

Insurance policies often include expiration dates that require attention from policyholders. Coverage details such as policy number, coverage limits, and expiration date must be clearly outlined. For example, a health insurance policy (policy number: H123456) may provide benefits up to $500,000 and is valid until December 31, 2023. It is crucial to review the terms before expiration, as lapses in coverage can lead to significant financial liabilities. Additionally, the insurer's customer service number (1-800-123-4567) can assist in renewal processes or questions regarding necessary documentation. Ensuring timely communication about expiration protects individuals from potential gaps in insurance coverage and associated risks.

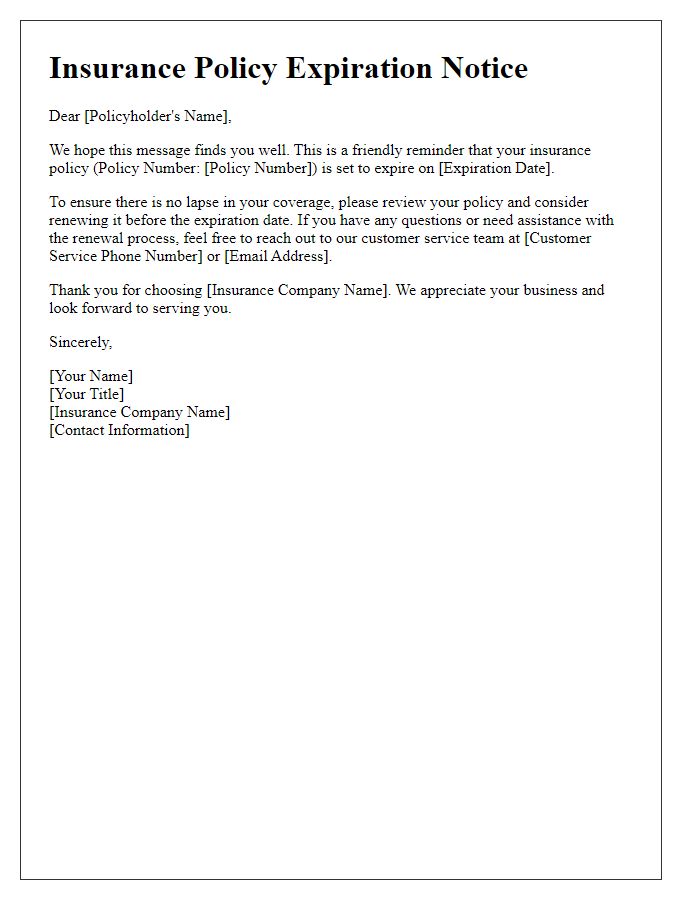

Expiration Date

Insurance coverage expiration notifications serve as essential reminders for policyholders to renew their plans. The expiration date, often displayed prominently in digital or physical communications, indicates the final day the existing coverage remains valid. Common types of insurance affected include health insurance, auto insurance, and home insurance, with renewal often encouraging timely updates to personal information. Failure to renew by the expiration date could result in lapses in coverage, leaving individuals vulnerable to unexpected medical expenses, vehicle damages, or property loss. Notifications typically highlight the importance of reviewing coverage options and contacting the insurance provider, such as a company like Allstate or State Farm, to discuss any necessary adjustments or changes to coverage.

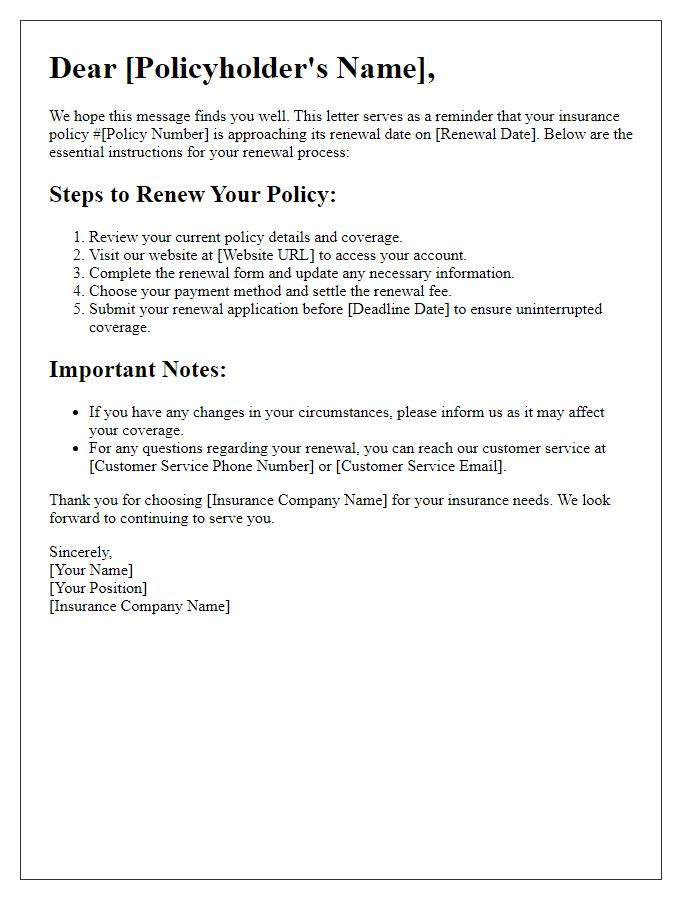

Renewal Instructions

Insurance coverage expiration can create significant concerns for policyholders. Effective notifications are crucial in communicating vital information. Insurance policies, such as auto, home, or health insurance, typically have a term lasting one year, leading to expiration dates. Policyholders receive reminders at least 30 days prior to expiration, detailing renewal instructions and premium amounts. Insurance companies may provide online platforms for easy renewal, often offering seamless transactions through credit card or bank transfer options. Failure to renew can result in lapses in coverage, leaving individuals vulnerable to financial risk. It's essential for policyholders to review their insurance needs periodically and ensure that coverage aligns with their current circumstances.

Contact Information

Insurance coverage expiration notifications are essential for informing policyholders about upcoming lapses in their coverage. Detailed information typically includes the policyholder's name, policy number, and type of insurance (such as auto, home, or health). A specific expiration date, often written as MM/DD/YYYY, serves as a critical timeframe for renewal actions. It may also include contact information for the insurance agent or company (including phone numbers and email addresses) for any inquiries regarding the renewal process. Additionally, the notification should emphasize the importance of continuous coverage to avoid risks associated with being uninsured, thus underscoring the need for timely communication.

Comments