Are you considering extending your insurance coverage but unsure how to start? Crafting a clear and concise request letter can make all the difference in ensuring you get the protection you need. In this article, we'll walk you through a step-by-step template that simplifies the process and highlights the key points to include. So, grab a pen and paper, and let's dive in to help you secure your peace of mind!

Policyholder Information

Insurance coverage extensions are often requested to enhance protection for individuals or entities facing specific circumstances. Policyholder information includes full name, policy number (a unique identification code representing the insurance agreement), contact details (such as phone number and email for communication purposes), and effective date of the current policy (the start date when coverage takes effect). Detailed information may also encompass the type of insurance (e.g., auto, home, life), the insured property or individual (defining what or who is covered), and any relevant endorsements or riders (additional coverage or modifications to the original policy). Providing accurate and comprehensive policyholder information is crucial for insurers to assess the risk and facilitate the coverage extension process efficiently.

Current Policy Details

Policyholders seeking an extension for their insurance coverage should provide specific details about their current policy. Policy ID (a unique identifier for tracking claims and renewals) must be included, along with the type of insurance (for example, health, auto, or home insurance) that describes the coverage type. The expiration date (the final date before the policy becomes inactive) is also crucial to denote urgency. Premium payment history (records of payments made) should outline the punctuality and reliability of payments, indicating the policyholder's commitment. Additionally, any claims made (requests for reimbursement or coverage under the policy) should be summarized to demonstrate the policyholder's history with the insurer. Providing this comprehensive information creates a clear context for the request to extend the insurance coverage.

Reason for Extension Request

Insurance coverage extensions may be necessary for various reasons. Recent changes in personal circumstances, such as an increase in travel frequency for work or leisure, can require broader protection levels. A recent home renovation, including installing high-value appliances or security systems, may necessitate adjusting the coverage limits to reflect the home's updated value. Additionally, upcoming life events such as marriage or childbirth often trigger the need for enhanced coverage options. Understanding the terms of the original policy, including the expiration date and limitations, plays a crucial role in determining the need for an extension. The extension ensures continued financial security against unforeseen events, ensuring that all assets and liabilities remain adequately protected.

Coverage Extension Period

A coverage extension request for an insurance policy, such as a homeowners insurance plan from a reputable provider like State Farm or Allstate, can significantly impact policyholders in critical situations. Insurance coverage might need to be extended beyond the original termination date, often specified as a standard six to twelve-month duration. This request can arise due to various reasons, including ongoing repairs following natural disasters like hurricanes (with winds exceeding 100 miles per hour) or delays related to regulatory approvals in industrial projects. Furthermore, home renovation timelines can extend due to material shortages, especially in economic downturns, impacting protection against potential liabilities and property damage. Addressing this need promptly can ensure continued peace of mind, safeguarding assets valued at hundreds of thousands, while adhering to current regulations and avoiding lapses in coverage during vulnerable periods.

Contact Information for Follow-up

Requesting an insurance coverage extension can benefit individuals needing more time to review terms or ensure comprehensive protection. The effective communication of such requests often includes crucial contact information for follow-up, ensuring prompt responses. Significant details typically encompass the policyholder's name, relevant policy number, and email address. Including a direct phone number fosters quicker communication. Providing additional details like preferred contact times optimizes the response process. A precise address may also prove advantageous, particularly for written correspondence. Clear documentation enhances the relationship between the insurer and policyholder, facilitating smoother negotiations for extended coverage.

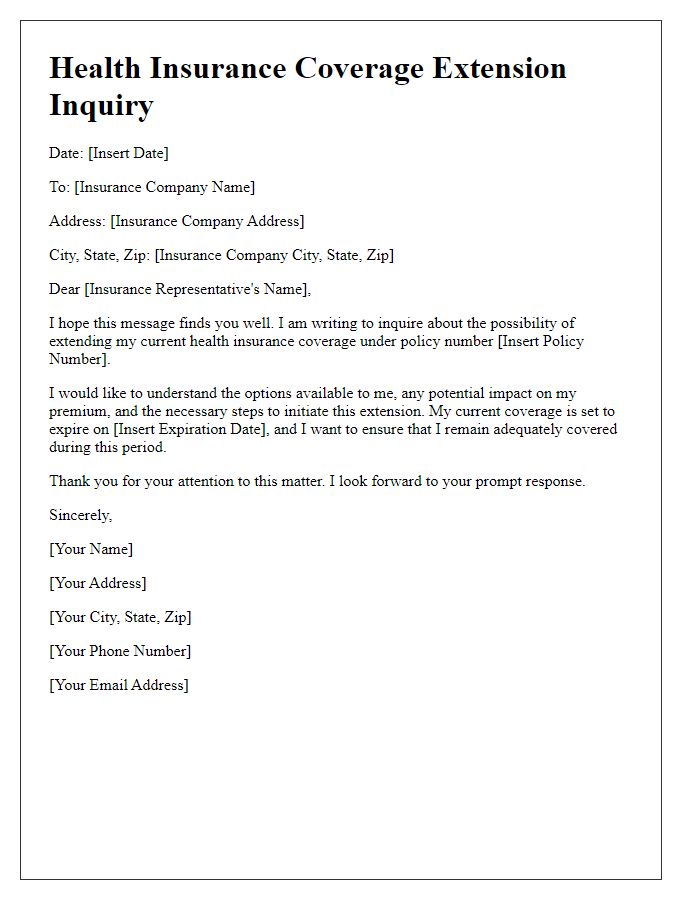

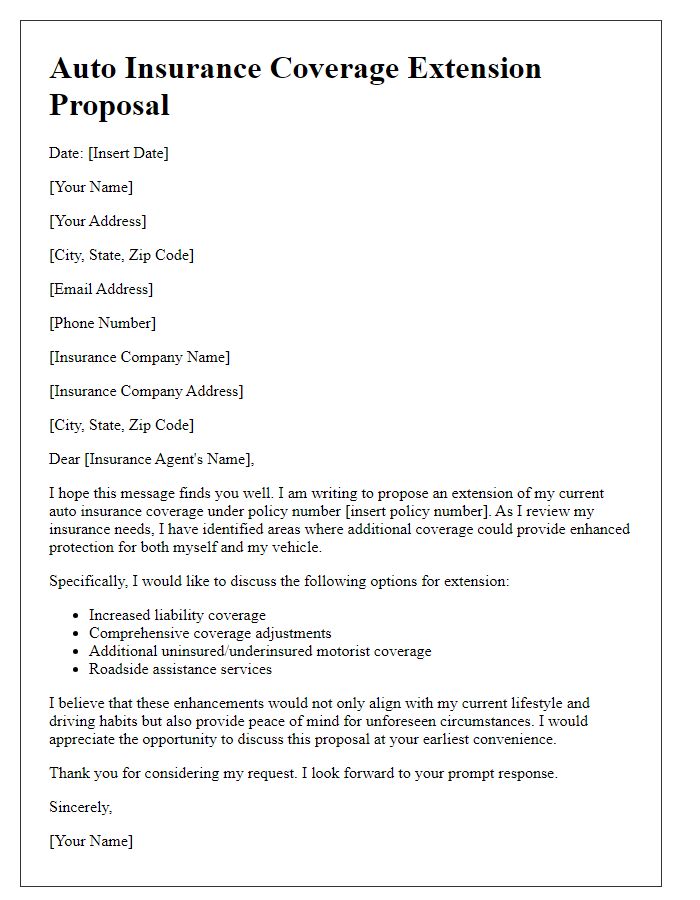

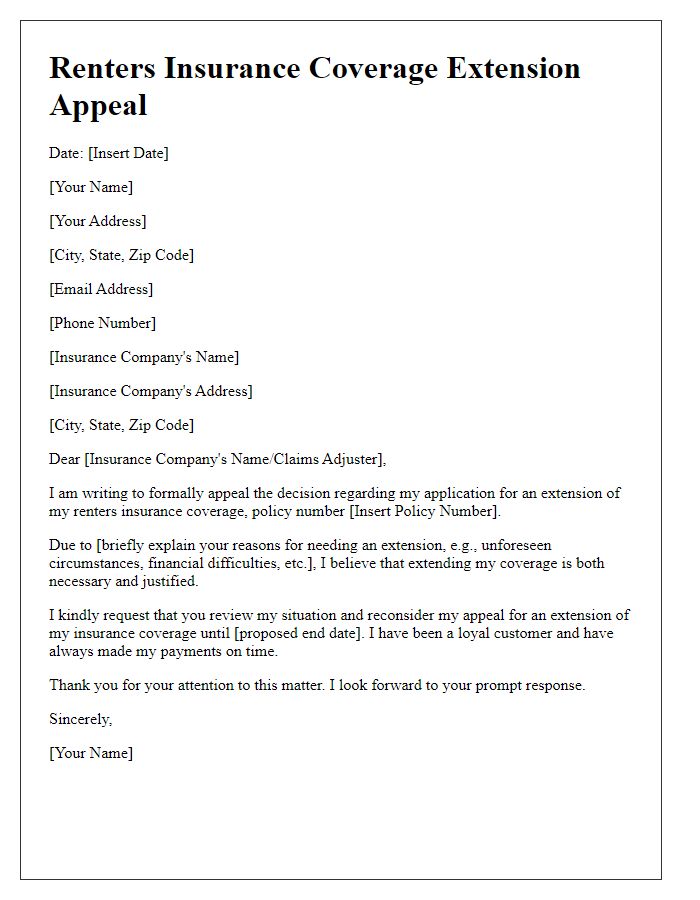

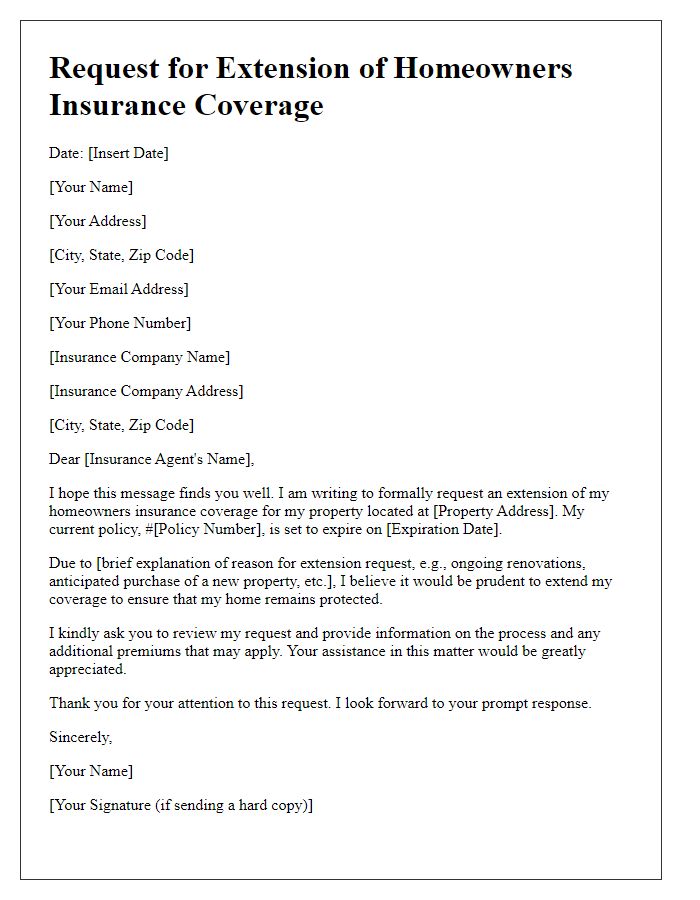

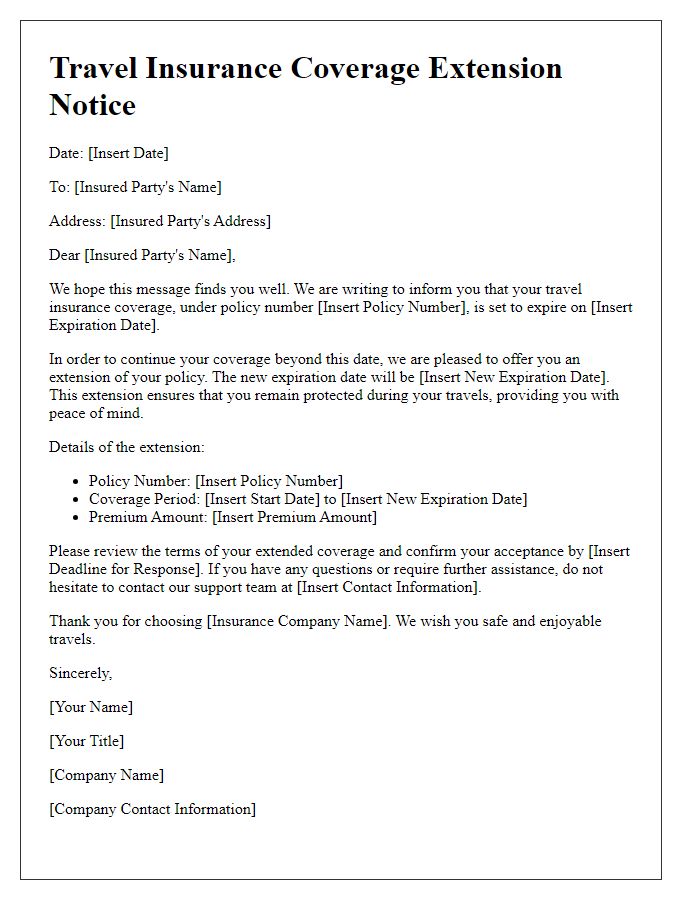

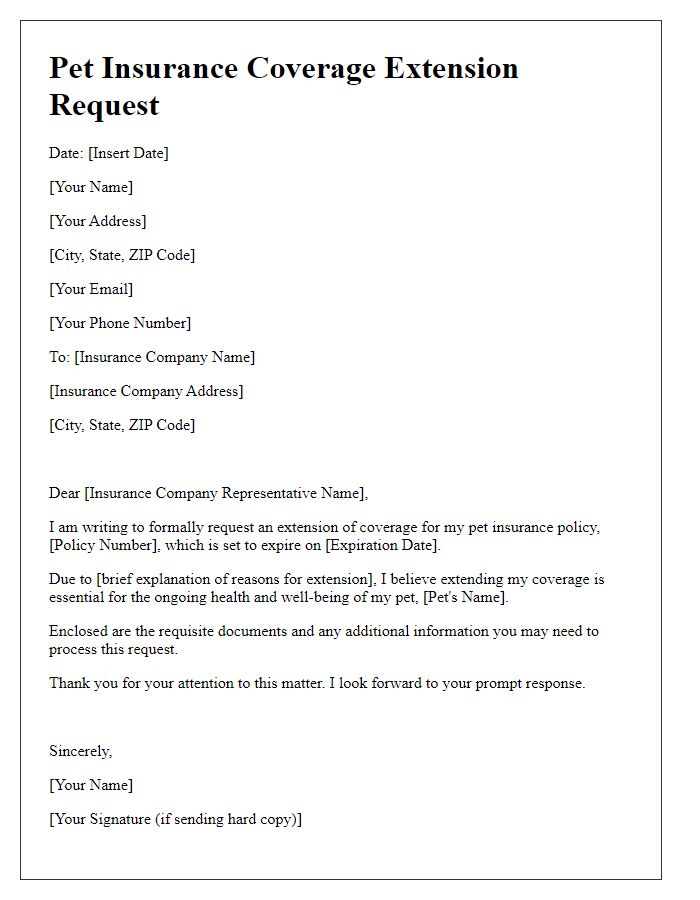

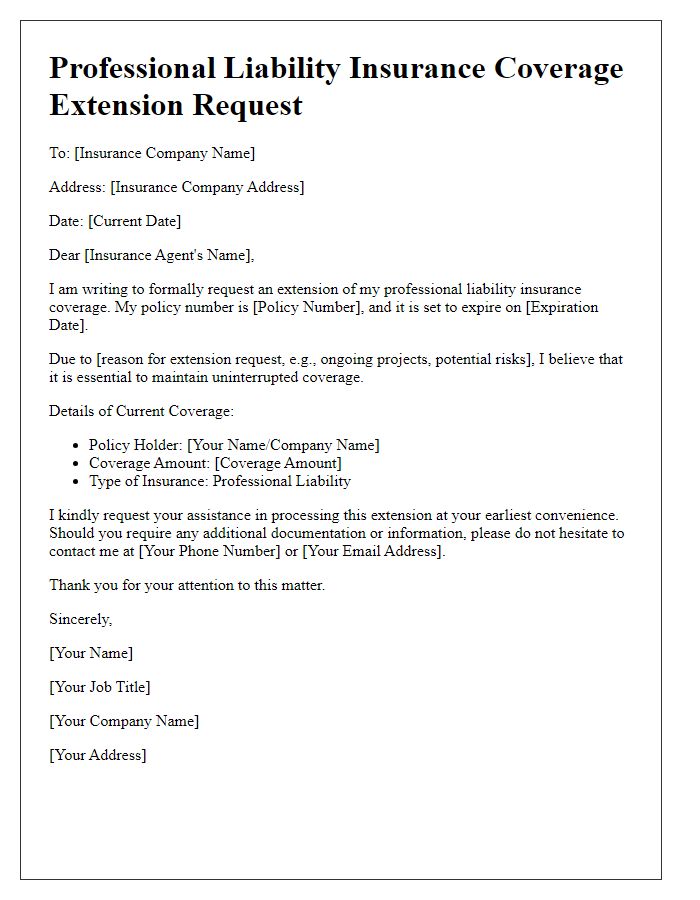

Letter Template For Insurance Coverage Extension Request Samples

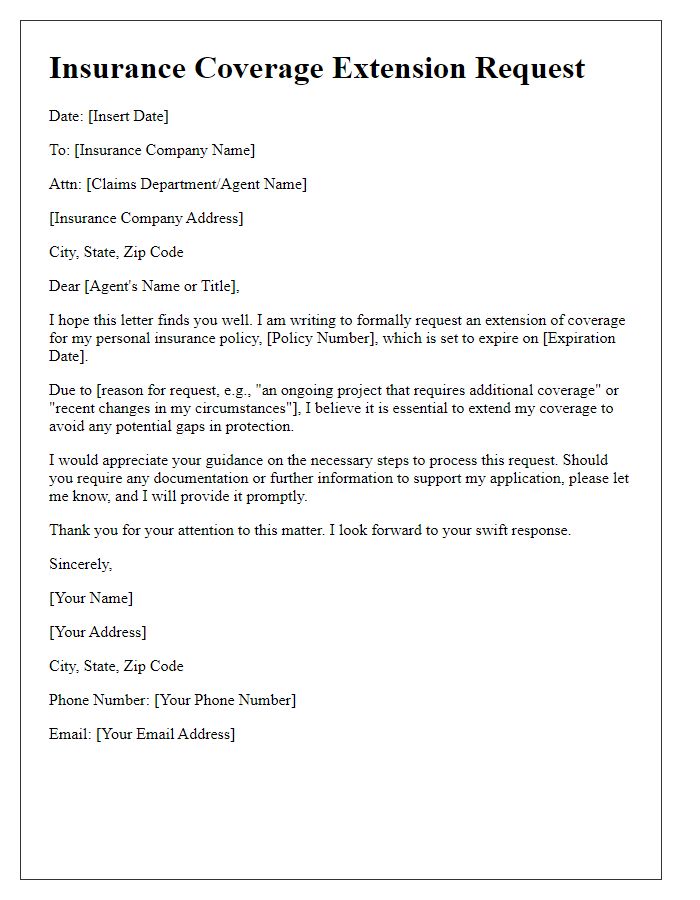

Letter template of insurance coverage extension for personal policy request

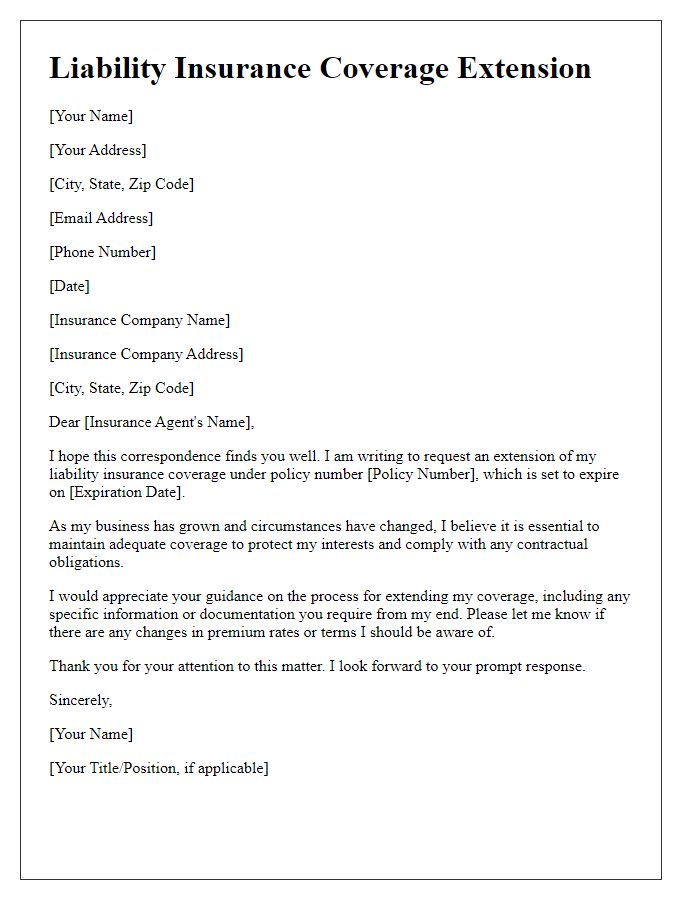

Letter template of liability insurance coverage extension correspondence

Comments