Are you feeling frustrated with your damaged mobile device? If so, you're not aloneâmany people face the hassle of replacing their phones due to unfortunate accidents. Thankfully, navigating the mobile insurance replacement process doesn't have to be a headache. In this article, we'll guide you through a straightforward letter template that will make your insurance claim a breeze, so keep reading to find out more!

Policyholder Information

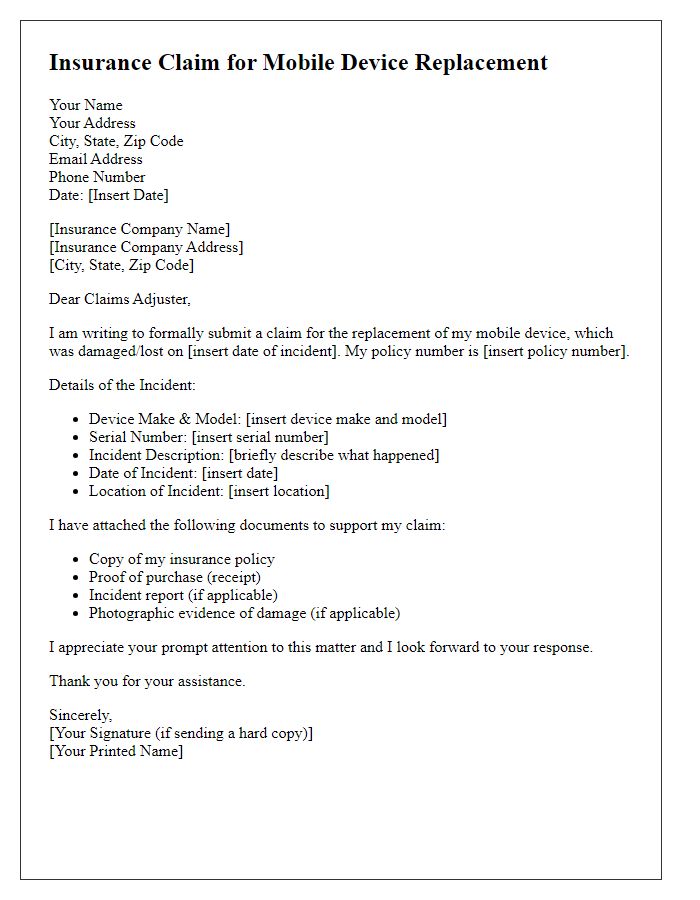

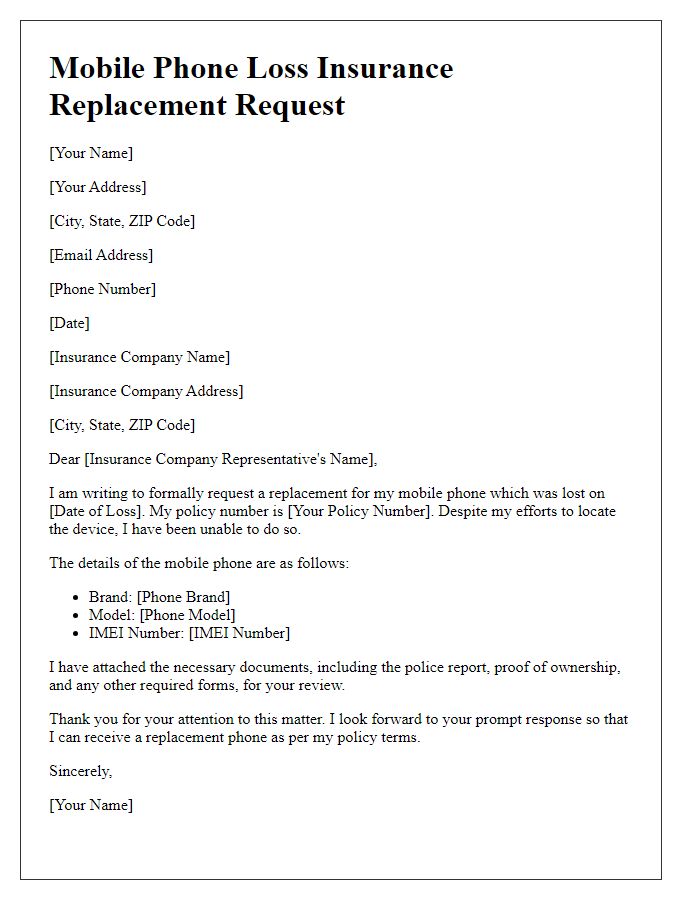

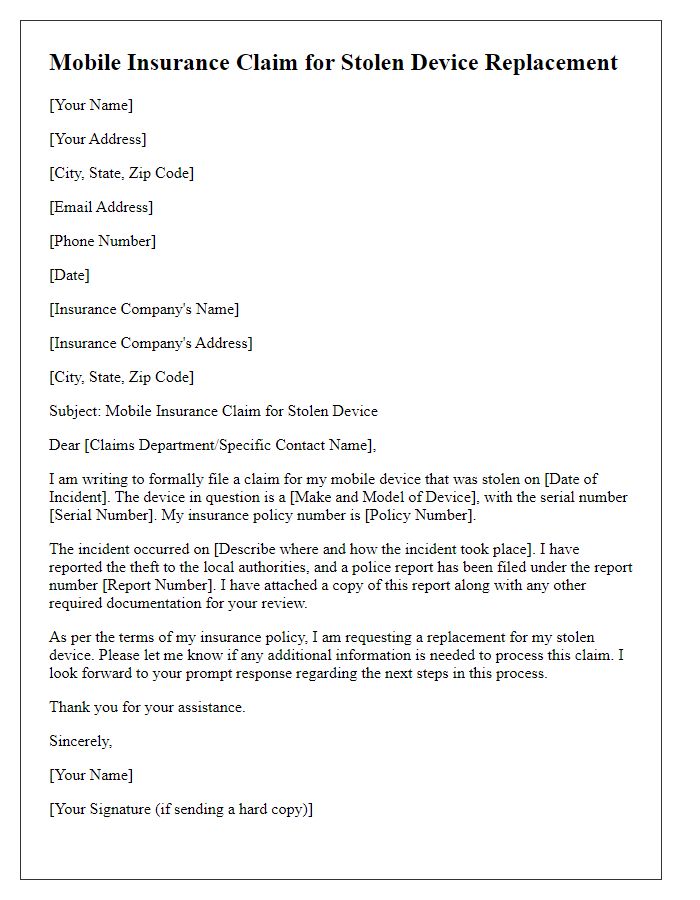

Policyholders, typically individuals or entities insured under a contract, must provide identifiable details for insurance claims. Essential information includes full name, often accompanied by a middle initial, phone number formatted in the standard international calling code, email address for correspondence, and the specific home or business address, including city and zip code for accurate processing. Additionally, the policy number, a unique string of digits or alphanumeric characters assigned by the insurance provider, serves as a reference point for accessing account details. Effective communication of this information facilitates timely responses to requests for mobile device replacements under insurance coverage.

Detailed Incident Description

A mobile phone insurance replacement request arises from an incident where a device, specifically an iPhone 12, suffered severe water damage after accidental immersion in a swimming pool in Orlando, Florida, during a summer family gathering. The phone, valued at approximately $800, was submerged for over ten minutes, leading to malfunctioning components such as the screen, battery, and charging port. Multiple diagnostic tests confirmed that the Liquid Damage Indicator (LDI) had tripped, indicating irreparable damage. Additionally, important data, including family photos taken during the event and essential contact information, were lost, highlighting the emotional and practical impact of the incident. The warranty did not cover water damage, necessitating the replacement request to the insurance provider.

Device Information

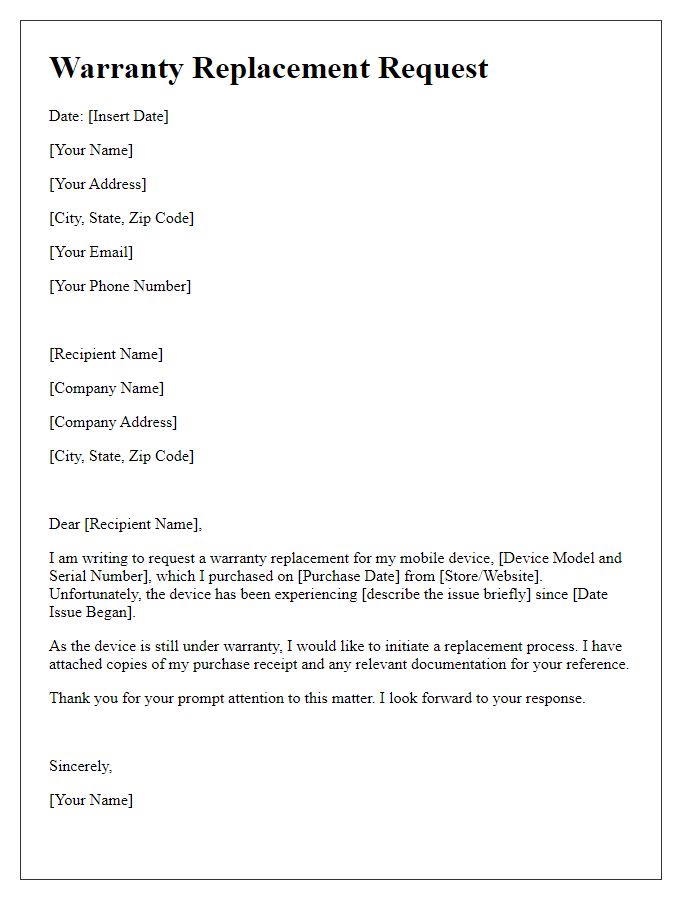

The mobile device information is crucial for processing insurance replacement requests efficiently. Include the device model, such as Apple iPhone 13 or Samsung Galaxy S21, along with the IMEI number, a unique identifier that aids in tracking and verifying the device's status. Document the purchase date, often found on the original receipt, which helps establish warranty eligibility and coverage timelines. Note the condition of the device, detailing any physical damage, such as screen cracks or water damage, which affects the eligibility for replacement under the policy terms. Additionally, register the account holder's name, contact information, and address for correspondence regarding the claim process.

Insurance Policy Number

The mobile insurance replacement request for your device under insurance policy number 123456789 involves specific criteria and processing steps. Typically, an insurance claim may be initiated when the smartphone, such as the latest iPhone or Samsung Galaxy model, has suffered damage (both accidental and liquid-related) that significantly affects its functionality. Coverage often includes comprehensive policies that provide financial support for repairs or outright replacement, contingent upon the terms set forth by the insurer. Additionally, essential documents such as proof of purchase, incident reports, and photographs of the damage may be required to expedite the claims process efficiently. Following proper submission guidelines increases the likelihood of a swift resolution to obtain a fully functional device once again.

Required Documentation

To successfully process a mobile insurance replacement request, individuals must gather specific documentation that includes an original purchase receipt detailing the device cost, a completed claim form provided by the insurance company, and a police report if the device was stolen, including the report number and officer's name. Additionally, photographic evidence of the damaged device must be submitted, capturing the extent of the damage clearly, along with a declaration of any prior repairs made, such as screen replacements or water damage restoration. Submission should be directed to the insurance provider's dedicated claims department, often found in their customer service portal or on the official website, ensuring all documentation adheres to their guidelines for effective processing.

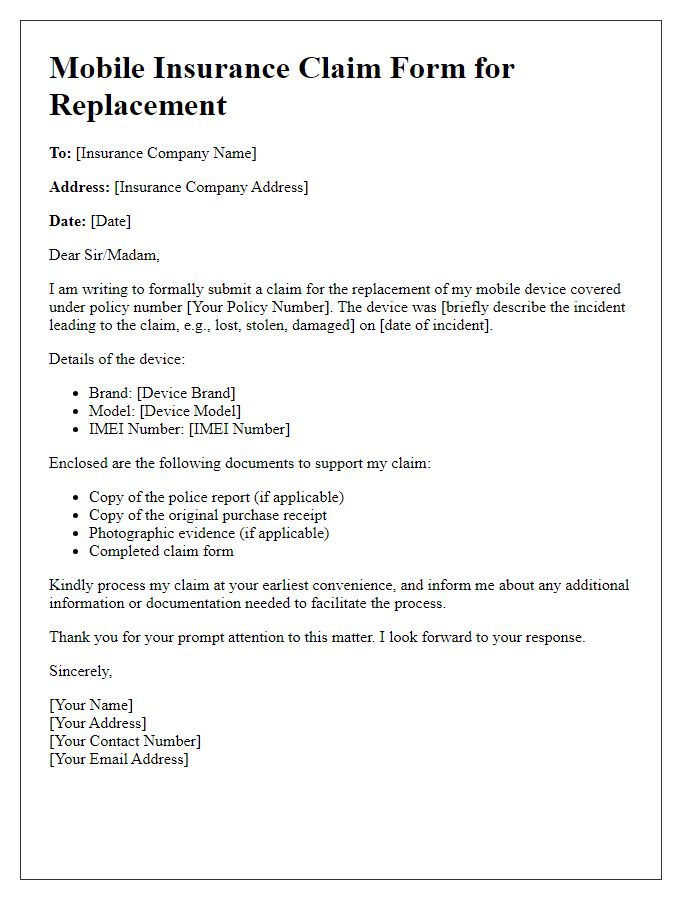

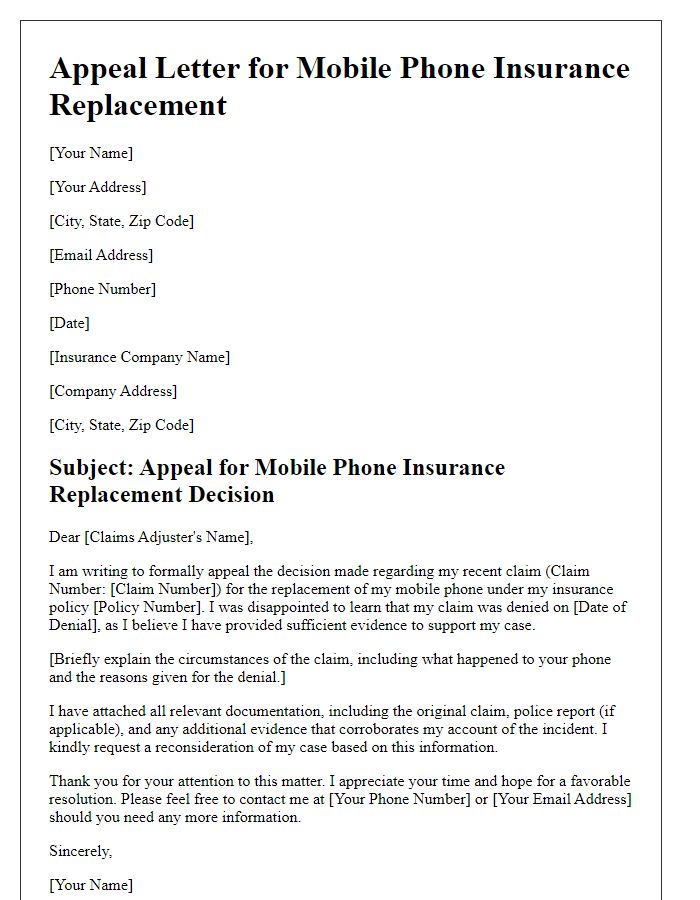

Letter Template For Mobile Insurance Replacement Request Samples

Letter template of mobile insurance request for faulty device replacement

Letter template of urgent request for mobile device insurance replacement

Comments