Losing a job can be one of the most stressful experiences in life, but understanding your insurance benefits can ease some of that burden. Many individuals overlook the potential support offered through job loss insurance, which can help bridge the gap during uncertain times. In this article, we'll break down everything you need to know about accessing these vital benefits and how they can assist you in your journey forward. So, let's dive in and explore what job loss insurance has to offer!

Personal Information

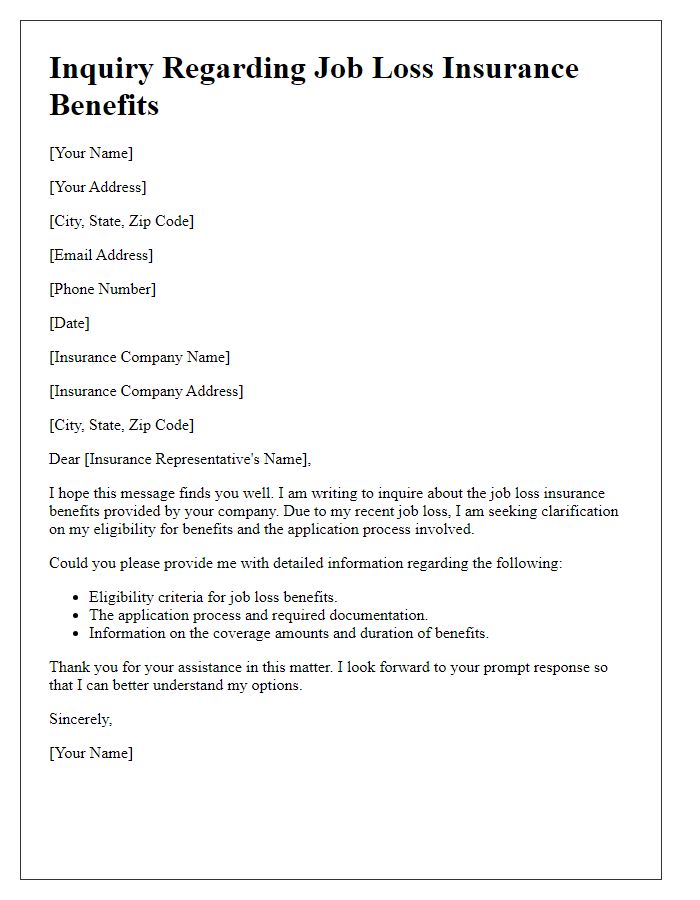

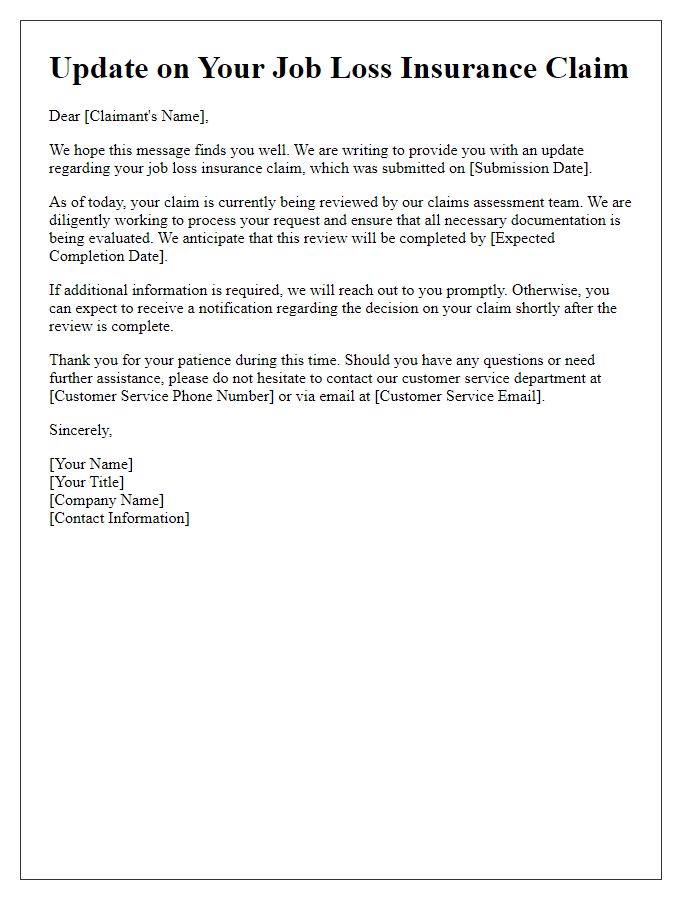

Job loss insurance benefits provide financial support during periods of unemployment. Individuals must submit a claim form, often requiring personal information such as full name, Social Security number (for identification and verification purposes), contact details (address, phone number, and email), and employment history. Furthermore, details about the last employer, including company name, job title, and dates of employment, must be included. Essential documents to attach may include the termination letter, proof of unemployment status, and any additional identification necessary to process the claim efficiently. Adhering to the specific requirements of the insurance provider ensures a smooth application process.

Policy Details

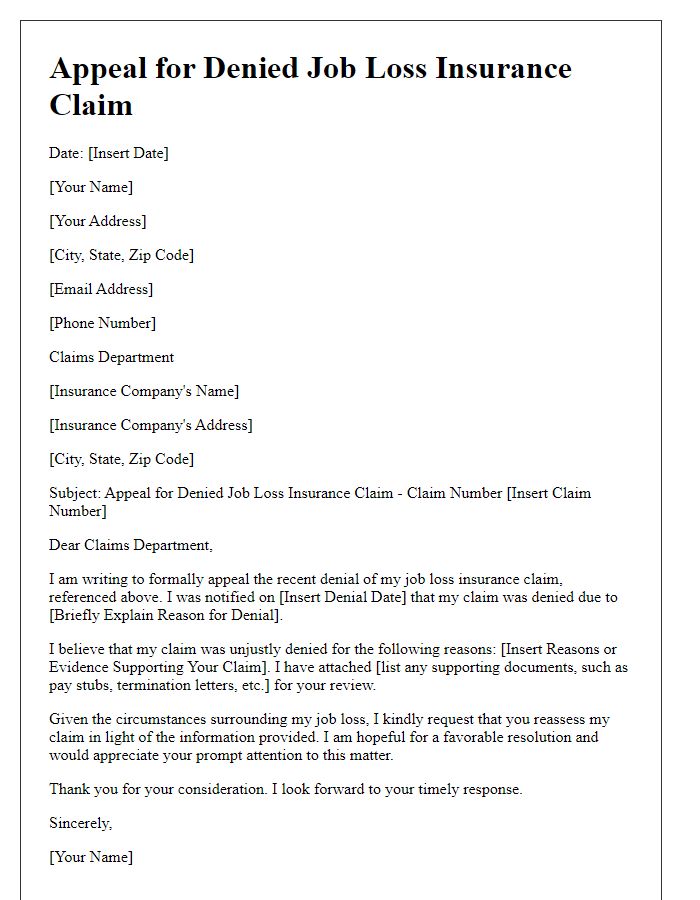

Job loss insurance benefits provide financial security during periods of unemployment. Typically, this insurance covers a percentage of your previous income, often ranging from 50% to 70%, for a specified duration, which can last up to six months to one year. Policies may include provisions for involuntary termination only, excluding voluntary resignation or retirement. Additional features may encompass job placement assistance programs and counseling services offered through specialized firms. It is crucial to review policy specifics such as waiting periods, coverage limits, and eligibility requirements, which may differ based on the insurer's regulations. Consideration of state laws impacting unemployment benefits can also influence the overall effectiveness of job loss insurance.

Employment History

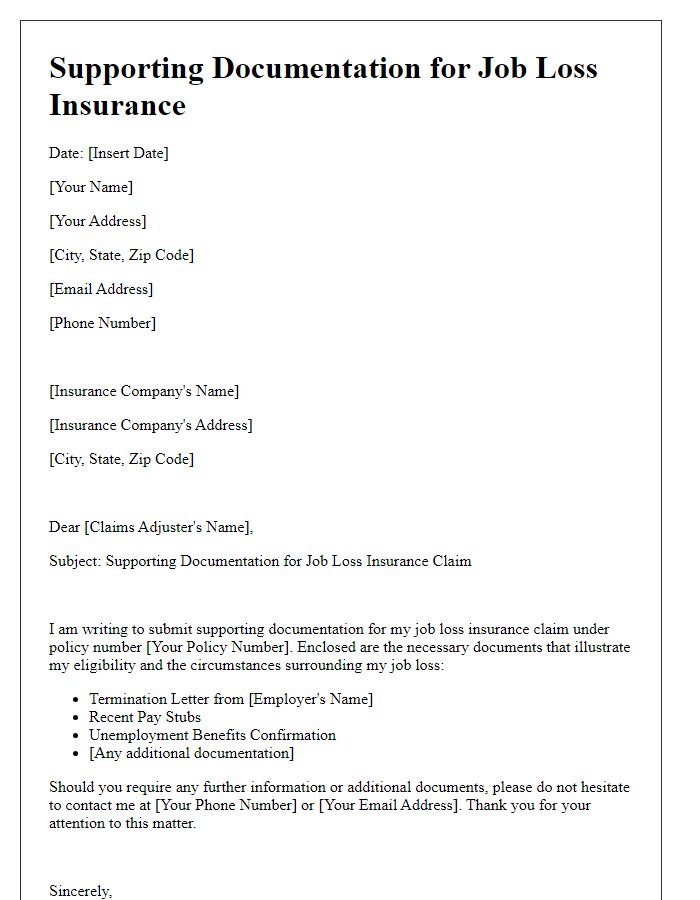

Job loss insurance benefits can provide crucial financial support during periods of unemployment, especially for individuals within sectors greatly affected by economic downturns, such as manufacturing or retail. This type of insurance typically requires a detailed employment history, including names of past employers, duration of employment (often measured in years or months), job titles, and specific reasons for termination, such as downsizing or company closure. Documentation may also include pay stubs or tax forms from the past year, emphasizing the importance of having accurate records for effective claims processing. Statistically, those who file with complete and correct information can see a smoother approval process, reducing the time spent waiting for benefits during stressful transitions.

Reason for Job Loss

Job loss insurance benefits provide financial support to individuals who have experienced unemployment due to various reasons. Common factors include company layoffs, which can occur when organizations downsize due to economic downturns or reduced market demand. Terminations without cause, often stemming from restructuring efforts within a company, also qualify for benefits. Involuntary resignations due to unsafe working conditions might lead to eligibility as well. Understanding the specific reason for job loss is crucial, as it influences the coverage offered by insurance policies and the application process for receiving benefits.

Contact Information

Job loss insurance benefits often provide crucial financial support during unexpected unemployment. Applicants typically need to submit documents outlining personal details including full name, social security number (e.g., XXX-XX-1234), and contact number (for example, (555) 123-4567). Additionally, providing an updated address including city, state, and ZIP code (e.g., Springfield, IL, 62704) is essential to facilitate communication. Employment details should include the name of the employer, position held, and termination date, ensuring accurate verification of the loss of income situation. Supporting documents, such as termination letters or pay stubs from the last few months, can further expedite the claims process.

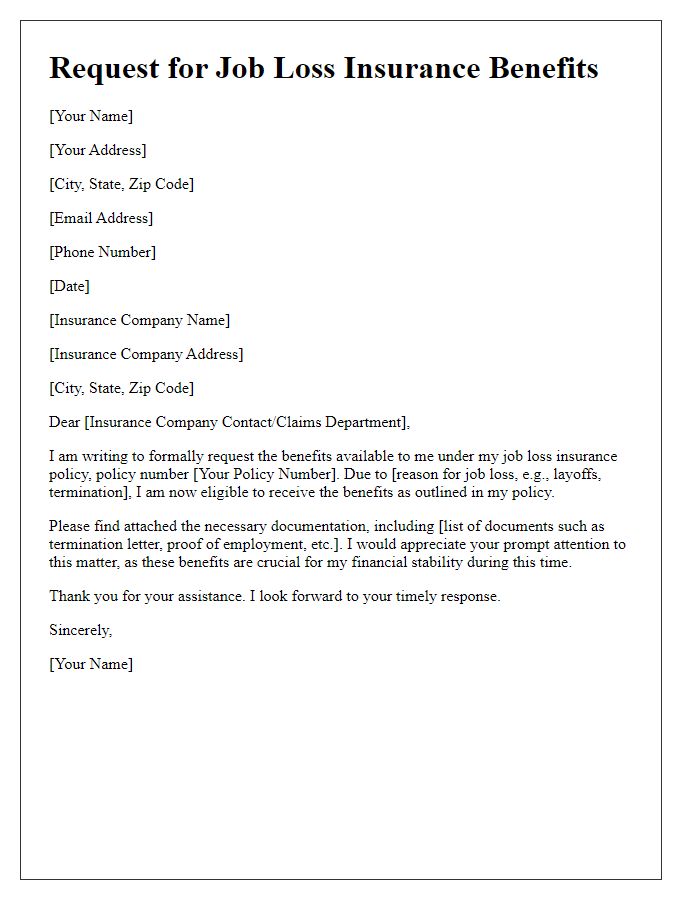

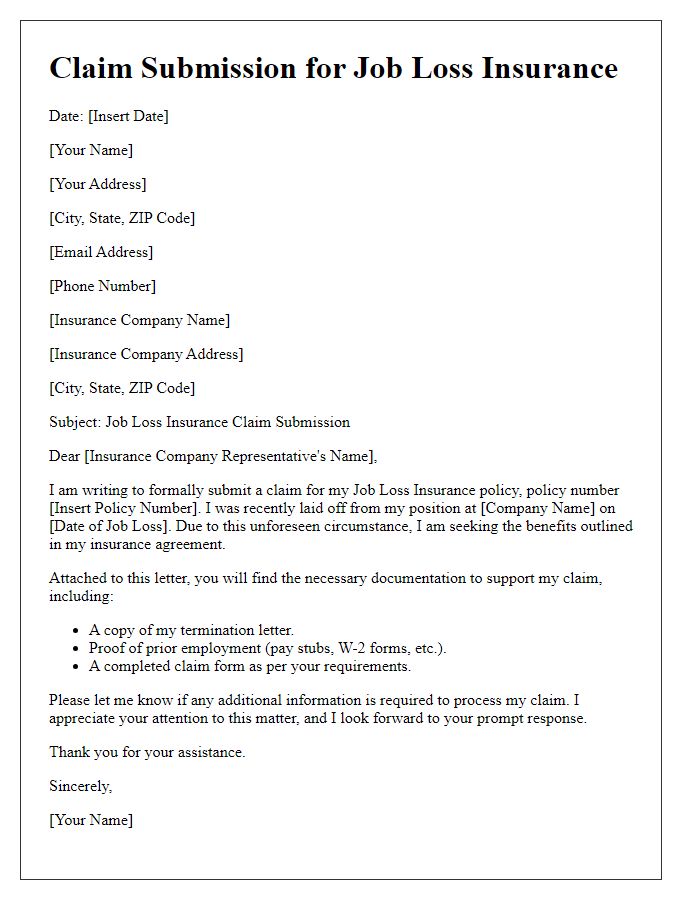

Letter Template For Job Loss Insurance Benefits Samples

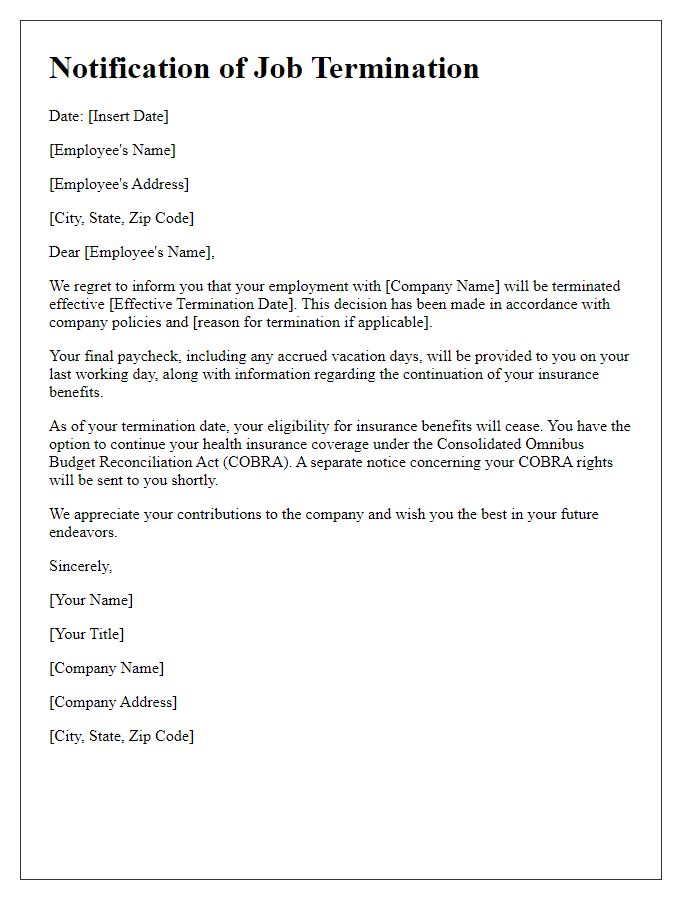

Letter template of Notification of Job Termination for Insurance Benefits

Comments