Writing a letter to request a mortgage insurance rate can feel daunting, but it doesn't have to be. By crafting a clear and concise message, you can effectively communicate your needs and potentially secure a more favorable rate. Whether you're looking to lower your monthly payments or simply want to explore your options, understanding the process is key. Ready to dive deeper into how to write an effective mortgage insurance rate request? Read on!

Clear Contact Information

Clear contact information is essential for successful communication regarding mortgage insurance rate inquiries. Include full name (e.g., John Smith), mailing address (e.g., 123 Maple Street, Springfield, IL 62701), telephone number (e.g., (555) 123-4567), and a valid email address (e.g., john.smith@email.com) to facilitate timely responses from mortgage providers. Additionally, referencing loan details (e.g., loan amount of $250,000) and property specifics (e.g., a 3-bedroom home in a designated ZIP code) can ensure accurate rate quotes. Providing this information upfront establishes credibility and helps expedite the review process for potential mortgage insurance changes.

Specific Loan Details

Specific loan details can significantly influence the mortgage insurance rate, impacting overall loan costs. Factors such as loan amount (for example, $300,000), down payment percentage (for instance, 20% or $60,000), and loan term (30-year fixed vs. 15-year fixed) are crucial in determining rates. Additionally, the type of mortgage (conventional vs. FHA) affects insurance requirements, with conventional loans traditionally having Private Mortgage Insurance (PMI) that may vary based on credit scores (e.g., a 740 FICO score versus a 620 FICO score). Property location also plays a role; homes in high-risk areas may face higher rates compared to those in lower-risk neighborhoods. Understanding these elements is vital for evaluating potential mortgage insurance savings.

Coverage Amount Requested

When considering mortgage insurance, the coverage amount requested plays a critical role in determining premium costs and protection levels. Standard coverage amounts often range from $50,000 to $500,000, depending on the mortgage size and lender requirements. As of October 2023, mortgage insurance premiums typically range between 0.3% to 2% of the loan amount annually, influenced by factors like credit score and loan-to-value ratio. Financial institutions such as Fannie Mae and Freddie Mac establish guidelines for coverage, ensuring borrowers can secure loans while minimizing risks. Understanding these parameters helps individuals negotiate better terms aligned with their financial objectives and risk tolerance.

Supporting Financial Documents

When applying for mortgage insurance premium rates, it is essential to gather and submit comprehensive financial documentation. Required documents include recent pay stubs (typically covering the last 30 days), bank statements (usually for the last two months), and proof of additional income sources, such as tax returns from the previous two years. A detailed credit report should highlight credit scores, as lenders assess risk based on these figures. Furthermore, a list of outstanding debts and accounts, including credit card balances and loans, provides insight into financial obligations. Providing a letter of employment verification from an employer can confirm job stability. All these documents play a critical role in determining eligibility for favorable mortgage insurance rates.

Deadline for Response

A mortgage insurance premium (MIP) rate request is essential for homebuyers, especially for Federal Housing Administration (FHA) loans. Typically, the MIP can range from 0.45% to 1.05% of the loan amount annually, depending on the loan's terms and the borrower's credit score. Submitting a request promptly is crucial; many lenders set a deadline of 30 days for responses to ensure an efficient approval process. The request should include details such as the property's address, loan amount of $250,000, and the proposed interest rate of 3.5% over 30 years, to help lenders assess risk accurately. Missing the deadline may delay the entire loan processing timeline, potentially impacting closing dates and contractual obligations.

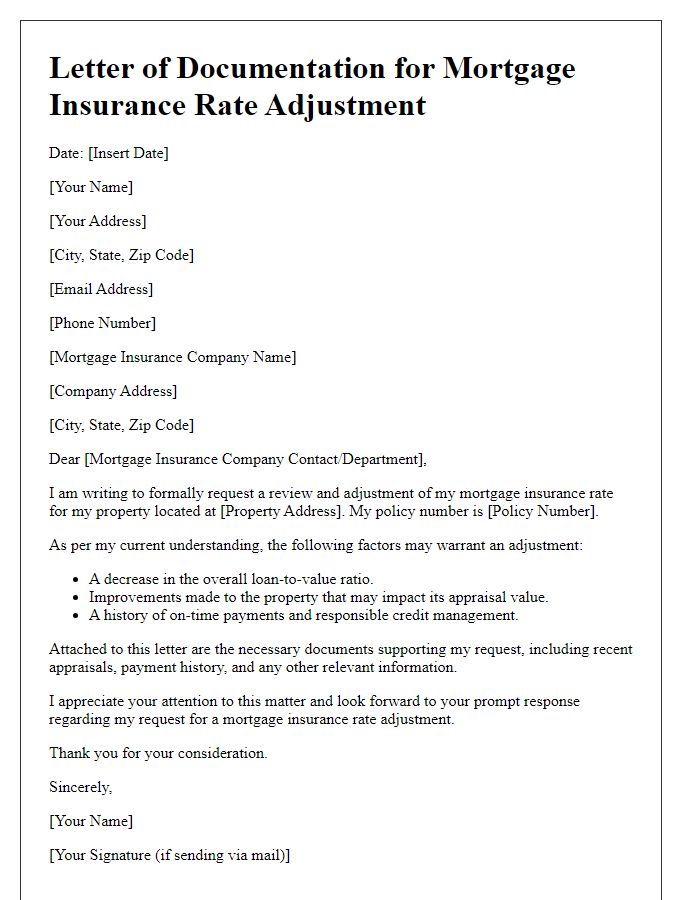

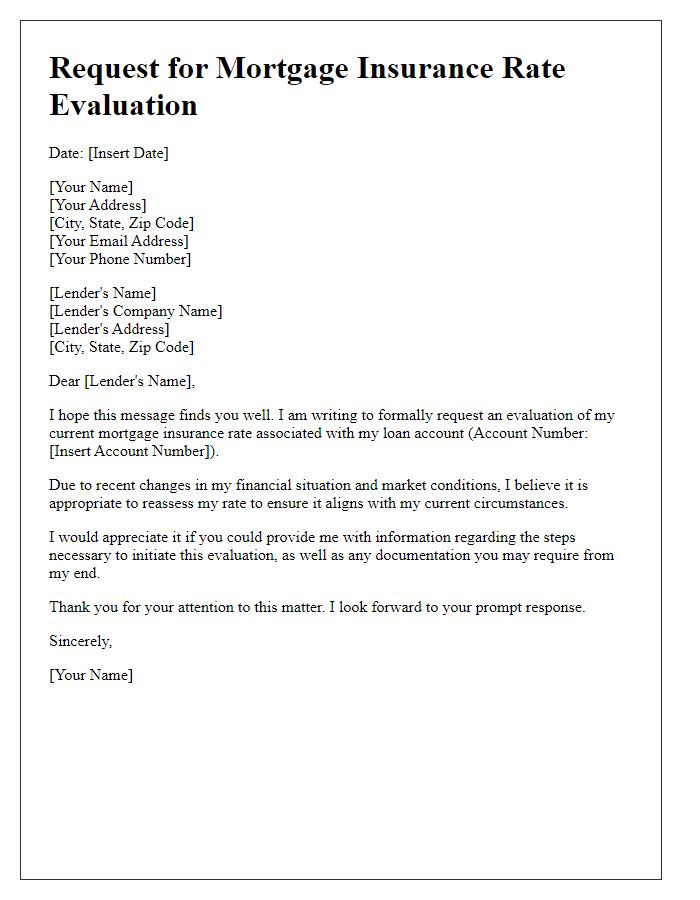

Letter Template For Mortgage Insurance Rate Request Samples

Letter template of appeal for mortgage insurance premium reconsideration

Comments