Hey there! If you're feeling a little overwhelmed by your insurance premium due dates, you're not alone. Life can get busy, and sometimes we need a little flexibility to catch up. That's why understanding the grace period for your insurance payments can be a game-changerâit gives you that extra time you need without losing coverage! Curious to learn how it all works? Read on!

Clear Identification of Policyholder and Policy Details

Insurance policies often have a grace period, typically 30 days, allowing policyholders to make payments without loss of coverage. For instance, John Doe, residing in Springfield, enrolled in a health insurance policy (Policy No. 123456) with coverage effective from January 1, 2023. If John misses his premium payment due on June 1, 2023, he can still maintain his coverage until June 30, 2023, provided he settles his dues by this date. This 30-day grace period safeguards against unintentional lapses in coverage, ensuring continuous protection against unforeseen medical expenses. Policyholders should always confirm specific terms and conditions outlined in their insurance agreement to avoid any discrepancies.

Specific Grace Period Duration and Dates

Insurance policies often include a grace period, allowing policyholders additional time to pay premiums without risking coverage lapses. For example, many insurance providers may offer a grace period of 30 days, starting from the due date of the premium payment, which in this case could be November 1, 2023. If the premium is not received by November 30, 2023, the policy may automatically lapse. It is essential for policyholders to remain aware of their specific policy terms regarding grace periods, as discrepancies can vary based on the insurance plan or provider which may also influence claims eligibility. Regular reminders and tracking of payment schedules help maintain continuous coverage during potential financial hardships.

Consequences of Non-Payment within Grace Period

Insurance policies typically include a grace period of 30 days during which policyholders can make premium payments without losing coverage. During this timeframe, which is crucial for maintaining active status, failure to pay can lead to significant consequences. Upon expiration of the grace period, coverage may lapse, leaving the policyholder unprotected against potential claims. For instance, a lapse means that in the event of an accident or health issue, the individual may incur substantial out-of-pocket expenses, as their insurance provider will not honor claims. Furthermore, a lapse can negatively impact the policyholder's credit score and lead to difficulties in obtaining future insurance. Reinstatement of a lapsed policy may also require payment of back premiums and possibly additional fees, complicating the policyholder's financial situation further.

Payment Methods and Options Available

Insurance premium grace periods provide policyholders with additional time to make payments without losing coverage. Various payment methods facilitate this process, including electronic transfers through bank accounts, mobile payments via applications like Venmo or PayPal, and traditional options such as checks or money orders. Insurance companies typically allow a grace period of 30 days, enabling customers to settle premiums while maintaining their coverage, usually dependent on the type of policy--auto, home, or life insurance. Additionally, setting up automatic payments through online banking can prevent lapses in coverage and streamline the payment process, ensuring timely premium submission within the designated grace timeframe.

Contact Information for Assistance and Queries

Insurance companies often provide a grace period for premium payments, allowing policyholders a limited time frame to submit overdue payments without losing coverage. For example, many insurers offer a grace period of 30 days, during which policyholders can communicate with customer service representatives for assistance. Policyholders can reach out via dedicated phone lines, typically available from 8 AM to 8 PM, or through online chat support. Insurance providers such as MetLife or State Farm may also have specific email support options to address concerns regarding payments or policy status. Having immediate access to contact information ensures timely resolution of queries, maintaining uninterrupted insurance coverage during the grace period.

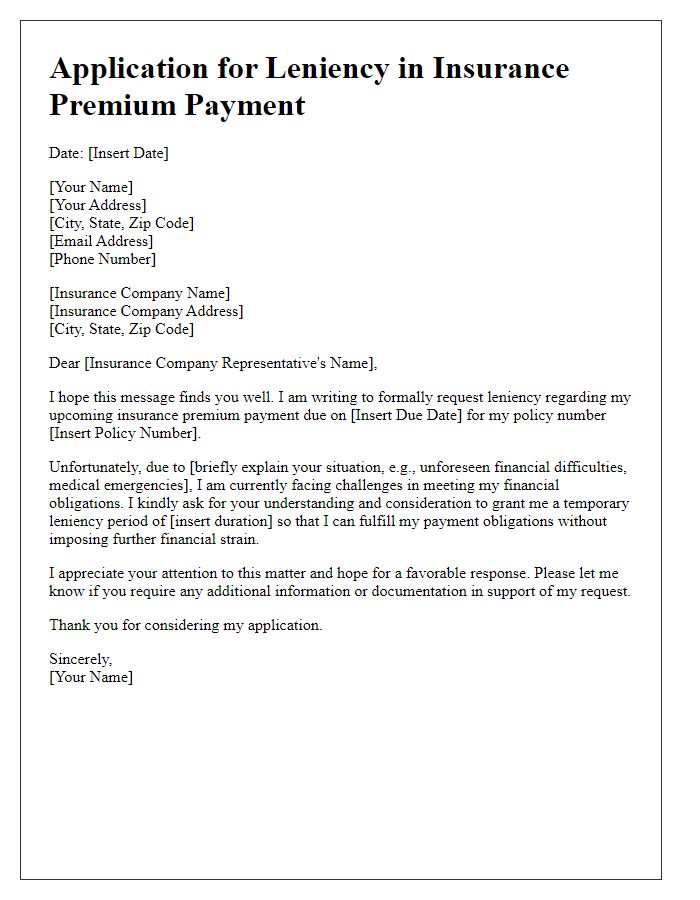

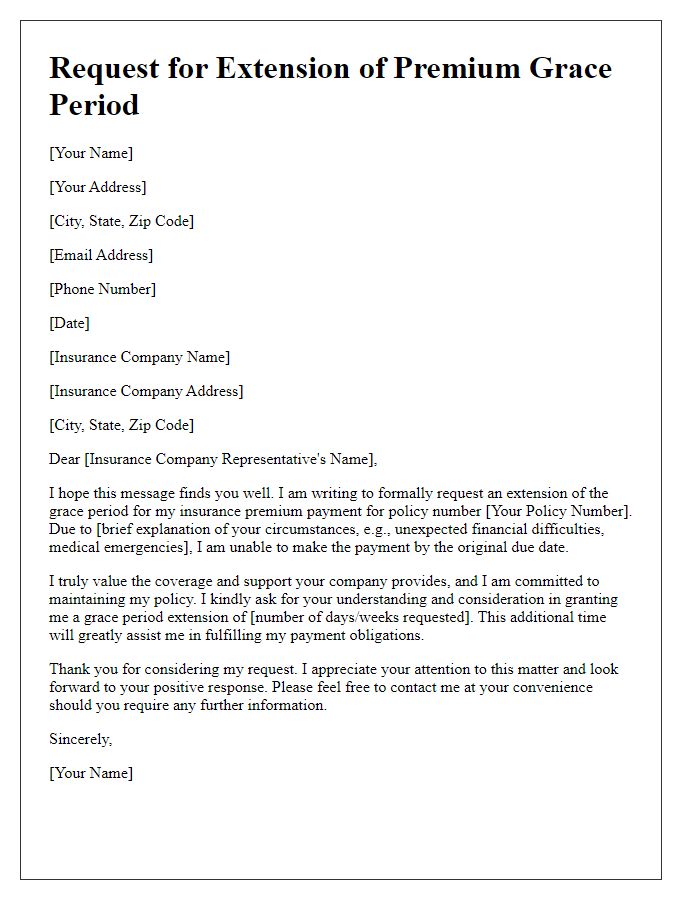

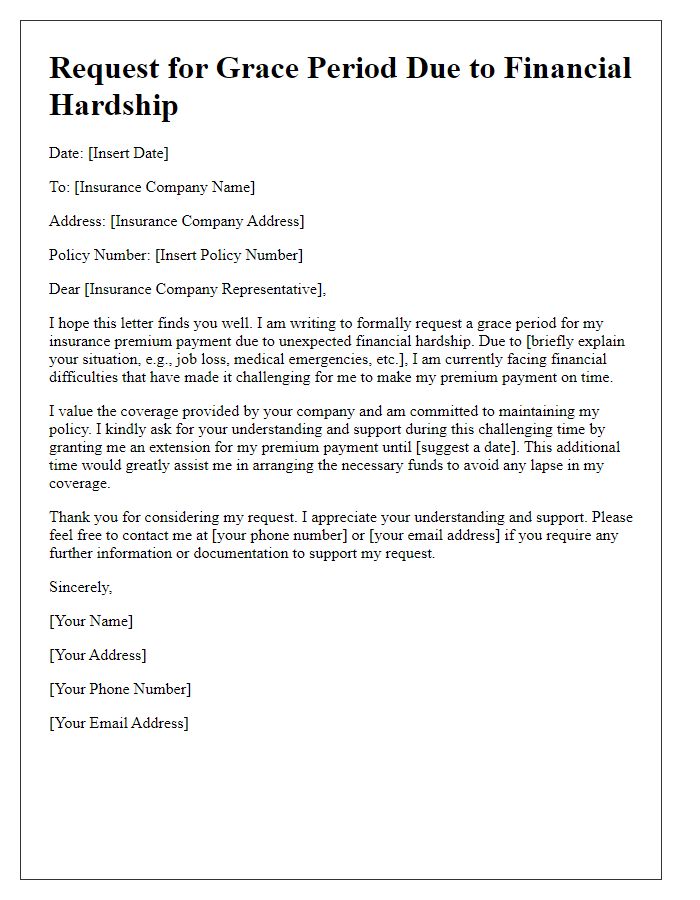

Letter Template For Insurance Premium Grace Period Samples

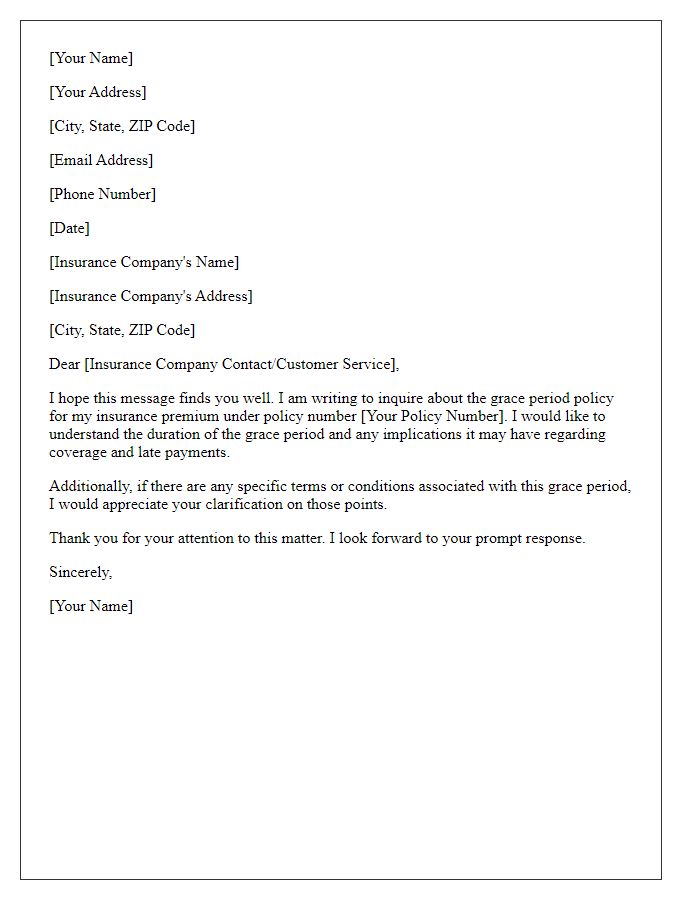

Letter template of inquiry regarding insurance premium grace period policy

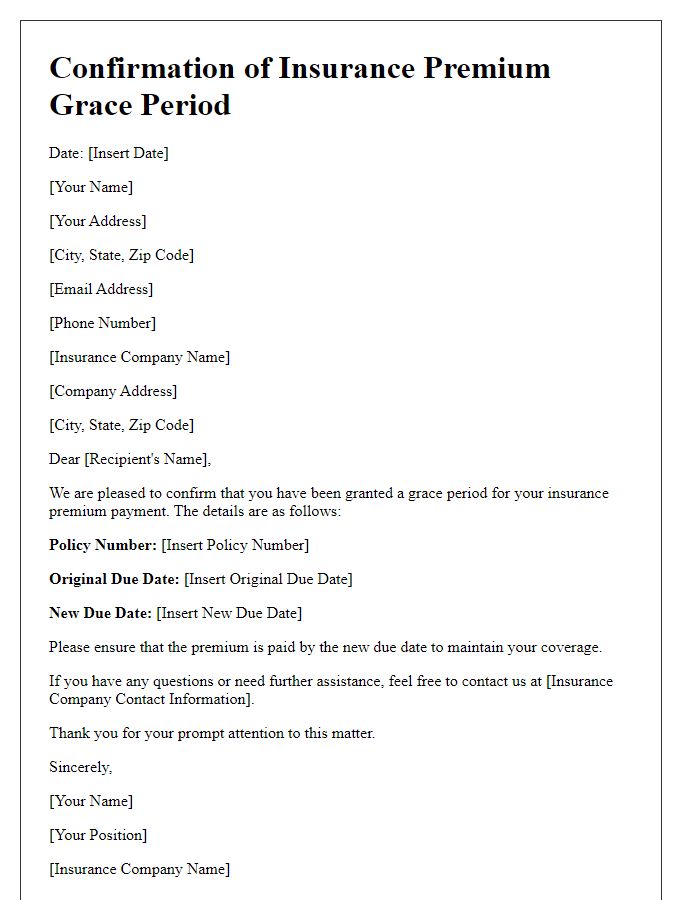

Letter template of confirmation for granted insurance premium grace period

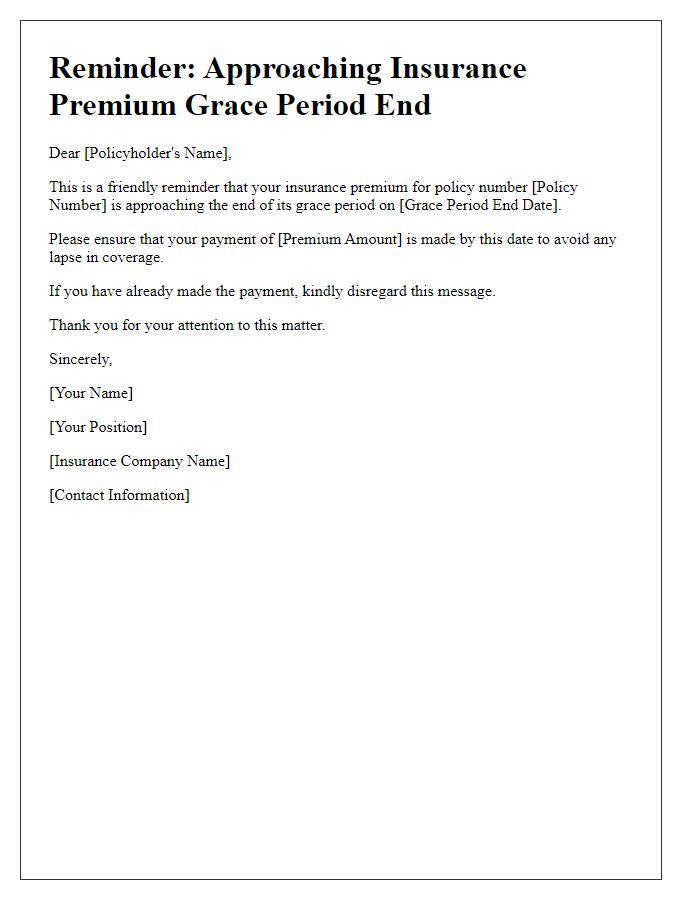

Letter template of reminder for approaching insurance premium grace period end

Letter template of follow-up for insurance premium grace period approval

Letter template of Stipulating insurance premium payment schedule during grace period

Comments