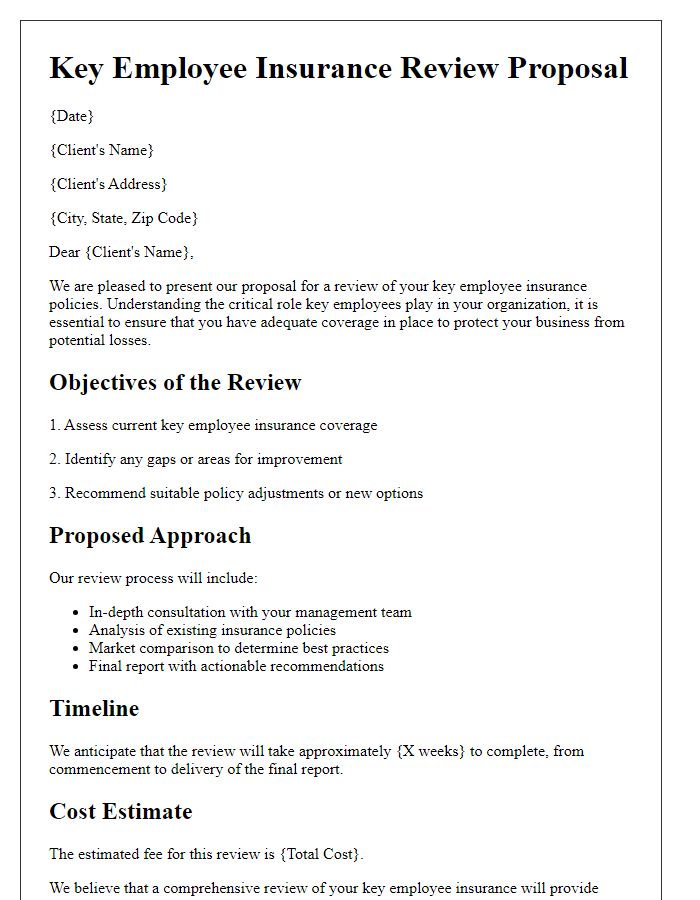

Are you considering the potential impact of losing a key member of your team? Key person insurance is an essential safeguard for businesses, providing financial support when it matters most. In this article, we'll explore the importance of evaluating your key person insurance needs and how it can protect your company's future. Join us as we dive deeper into the benefits and considerations of this crucial coverage!

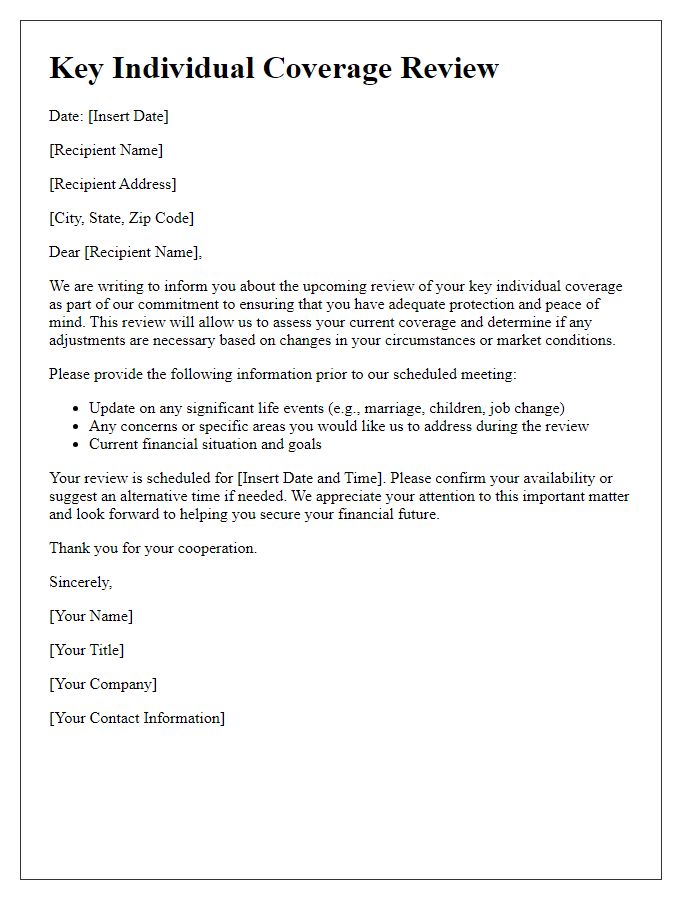

Insurance Coverage Needs

Key person insurance provides critical financial protection for businesses in case of the unexpected loss of highly valuable employees or executives. This type of insurance typically covers the loss of revenue or costs associated with hiring and training replacements for key individuals who contribute significantly to the company's success, such as CEOs or senior managers. Valuation of coverage needs often involves assessing the key person's impact on business revenues, projected earnings, and the costs associated with a sudden loss. In many cases, businesses may calculate a multiple of annual income, often ranging from five to ten times the key person's salary, to determine the appropriate coverage amount. Key factors to consider include industry standards, company size, and potential disruptions in operations. A comprehensive evaluation ensures that businesses can maintain stability and continue operations during challenging transitions.

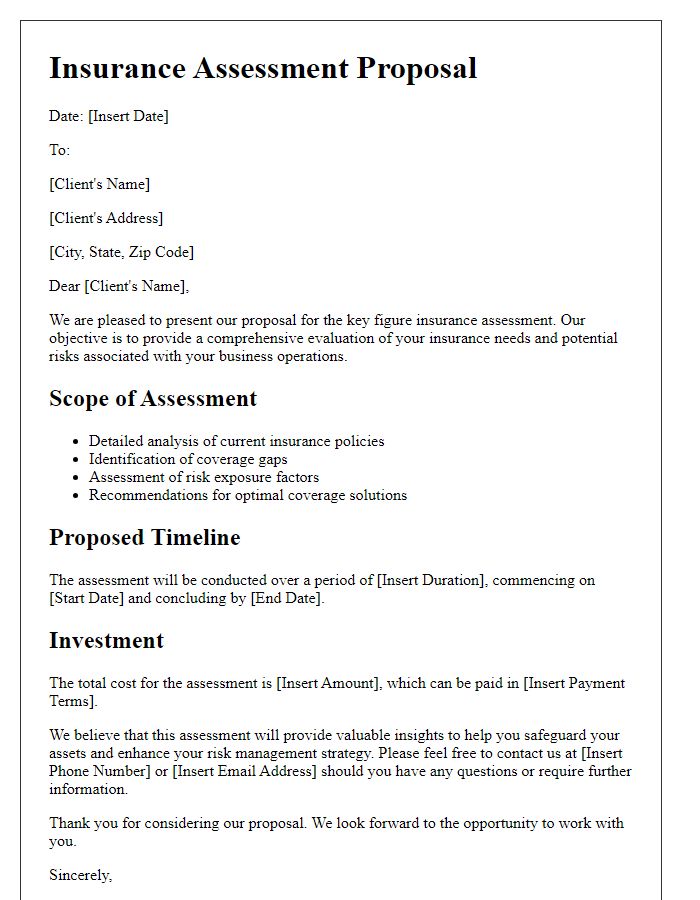

Financial Impact Assessment

Key person insurance evaluation involves assessing financial impact on a business following the loss of essential employees. This analysis considers key personnel such as executives or specialized staff whose absence could severely disrupt operations. Financial factors include lost revenue, hiring costs for replacements, and potential impacts on client relationships. Business size, revenue figures, and industry standards provide essential context. For example, a company with annual revenues of $2 million might face significant challenges if a senior leader, responsible for a major client account estimated at $500,000 annually, were to depart unexpectedly. The assessment also analyzes the overall risk exposure, insurance coverage amounts, and premiums required to mitigate these financial losses effectively.

Key Person Role and Responsibilities

Key person insurance evaluates individuals within an organization whose loss would significantly impact its operations and profitability. Furthermore, this insurance aims to protect businesses against the financial burden caused by the untimely absence of crucial personnel, such as executives, sales leaders, or specialized technicians. These key individuals often possess unique skills or vital industry connections, enhancing their importance to the company's strategic goals. The evaluation encompasses various responsibilities, including decision-making authority, leadership influence, and knowledge expertise. It also factors in the potential revenue generated by these key persons, notably their contribution to sales targets, project success rates, or innovative development. Quantitative assessments may include analyzing profit margins linked to their influence, forecasting potential revenue losses, and calculating hiring costs for replacements. Profitability assessments often examine industry benchmarks, revealing the broader implications on company performance during pivotal transitions. Ultimately, this thorough evaluation aids companies in securing essential coverage, ensuring financial stability in challenging times.

Succession Planning and Business Continuity

Key person insurance plays a critical role in succession planning and business continuity strategies for organizations, particularly small to medium enterprises. This type of insurance shields businesses from financial losses resulting from the unexpected absence of essential individuals, like CEOs, innovative founders, or high-performing sales directors. In the United States, the average annual premium for key person insurance typically ranges from $1,000 to $5,000, depending on factors such as the individual's health and role within the company. Businesses can use the financial support from this insurance to cover operational costs, recruit and train replacements, or manage debts. Implementing key person insurance ensures a smoother transition and protects investment, fostering stability and resilience in critical moments of change, ultimately ensuring that the organization's strategic objectives remain intact.

Policy Terms and Conditions

Key person insurance provides financial security and stability to businesses in case a crucial employee (often an executive or a founder) becomes unavailable due to unforeseen circumstances such as death or disability. The policy typically outlines critical terms, including coverage amount, which should reflect the economic value of the key person to the organization, and premium rates based on risk assessment factors like age, health, and occupation. Additionally, the policy specifies the payout process, ensuring beneficiaries receive the benefit promptly upon a qualifying event. It may also highlight exclusions, such as pre-existing medical conditions, which can affect eligibility and claims. Understanding these terms is essential for effective risk management and financial planning within a business structure.

Comments