Are you looking to navigate the often complicated world of insurance tax deductions? Understanding how to validate these deductions can significantly impact your tax savings and financial health. In this article, we'll break down the essential steps and provide you with a straightforward letter template to streamline the process. So, grab a cup of coffee and let's dive deeper into ensuring you maximize your deductions!

Accurate Policy Information

Accurate policy information is crucial for the validation of insurance tax deductions. Insurance policies, such as health insurance by providers like Blue Cross Blue Shield or State Farm, often contain specific details pertinent to the tax deduction process. These details include policy numbers, effective dates (typically ranging from January 1st to December 31st), premium amounts (which can vary significantly by state or coverage type), and coverage type (like individual versus family plans). Additionally, understanding deductible expenses (like those related to out-of-pocket medical costs) is vital. Accumulating the necessary documentation, including Form 1095-A or Form 1095-B from the IRS, ensures compliance with regulations and maximizes tax benefits. Accurate information prevents errors during tax filing, allowing for a smoother tax preparation process and potentially larger refunds.

Detailed Payment Records

Detailed payment records for insurance tax deduction validation often involve various documentations such as receipts, invoices, and statements. These records serve as proof of premium payments for health insurance policies, property insurance, or auto insurance that may qualify for tax deductions under the Internal Revenue Code, specifically Section 213(d). For example, a taxpayer could gather annual health insurance premiums totaling $3,600 or receipts showing monthly payments of $300. In addition, year-end statements from providers such as Blue Cross Blue Shield or Geico can substantiate claims for deductions, providing necessary information like policy numbers and coverage periods. Properly organized payment records ensure clear evidence for tax authorities, aiding in smooth validation during tax return processes.

Clear Tax Code References

The IRS outlined specific tax codes regarding insurance tax deductions, prominently featured in Section 162, which discusses ordinary and necessary business expenses. For self-employed individuals, a focus on Section 104(a)(3) details health insurance premiums' deductibility. Additionally, Section 213 provides guidelines on medical expense deductions, applicable to various insurance plans. Each citation provides clarity on how premiums, copayments, and unreimbursed expenses can qualify for tax deductions. Keeping detailed documentation also aligns with IRS requirements, ensuring all claims are well-supported and uphold the regulations set forth. Taxpayers should remain informed about annual changes to these codes that may impact their deductible limits or eligibility.

Appropriate Deduction Justifications

Insurance tax deductions can provide significant financial benefits for policyholders. Various types exist, such as health insurance premiums, homeowner's insurance, and life insurance policies. For example, self-employed individuals may deduct health insurance costs, which can reach thousands of dollars annually, significantly impacting taxable income. Homeowner's insurance, protecting properties valued at over $300,000 in many markets, may also qualify for deductions, particularly for home office setups. Additionally, life insurance policies may allow deductions in cases of key person policies for businesses, where coverage is essential for continuity. Proper documentation is crucial; maintain records of premiums paid, policy details, and relevant IRS guidelines to substantiate claims effectively.

Formal Request Statement

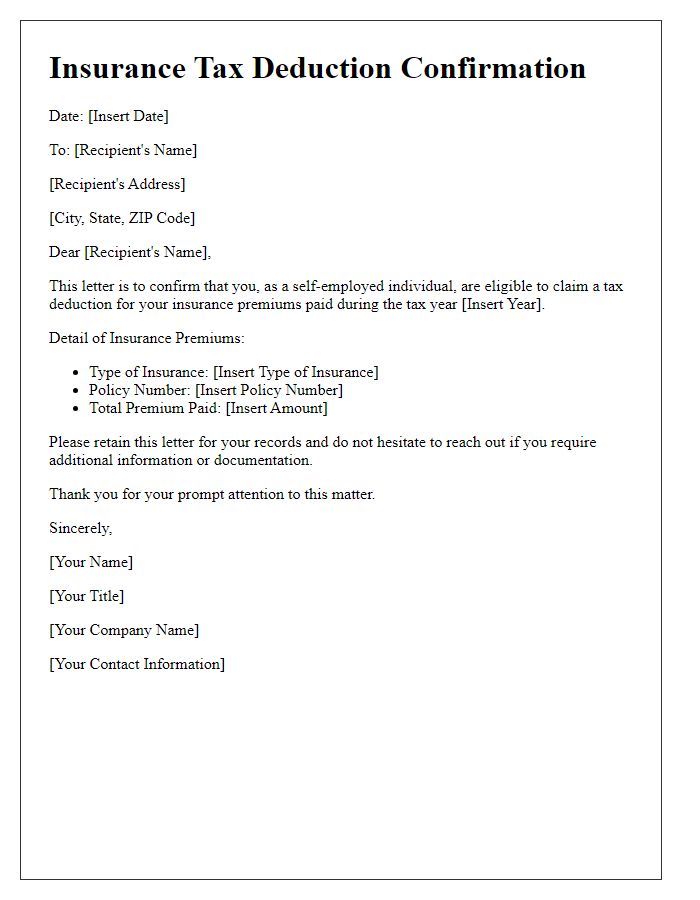

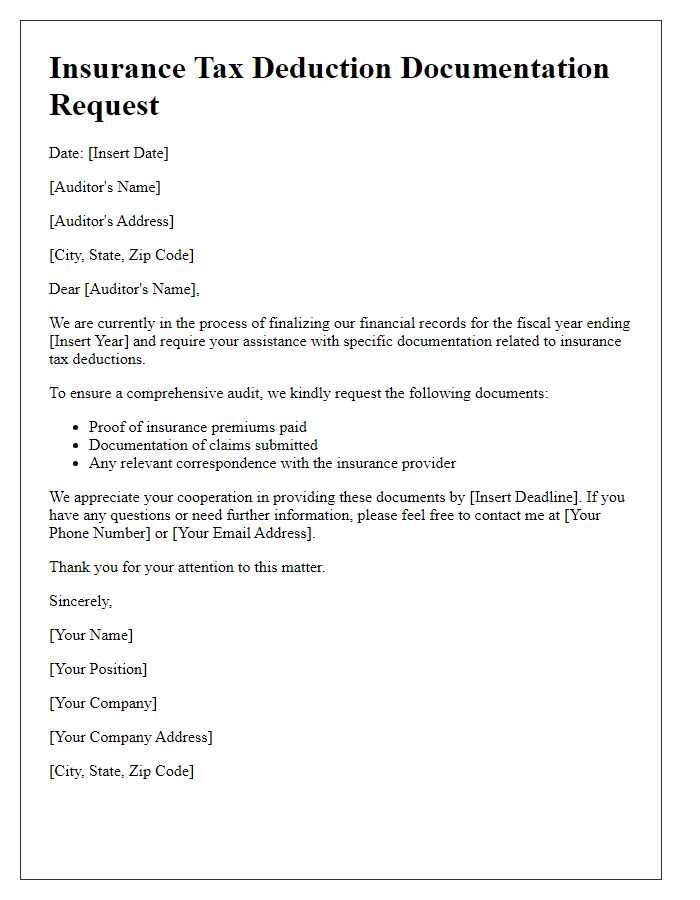

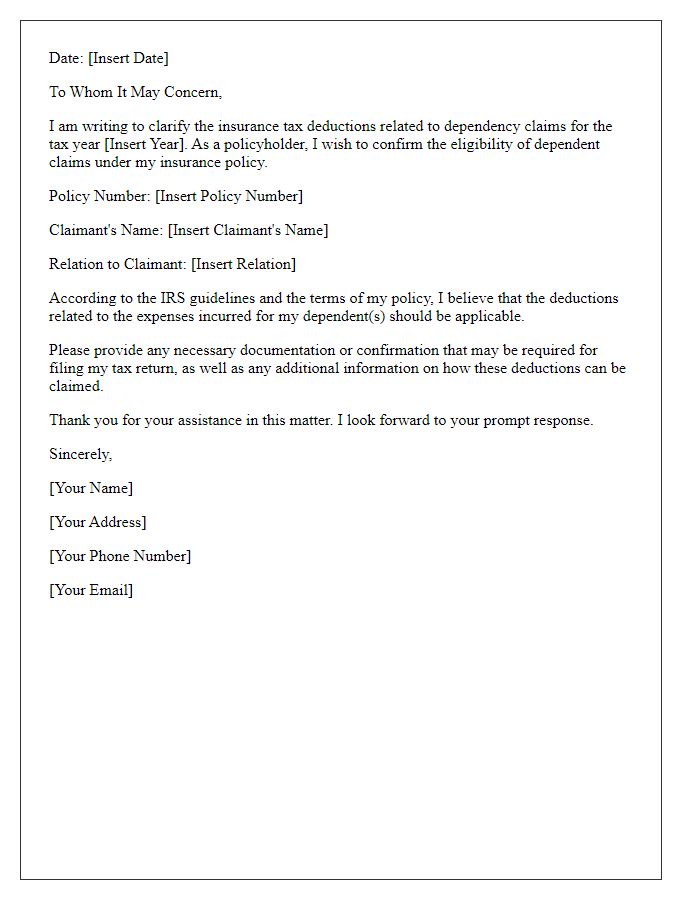

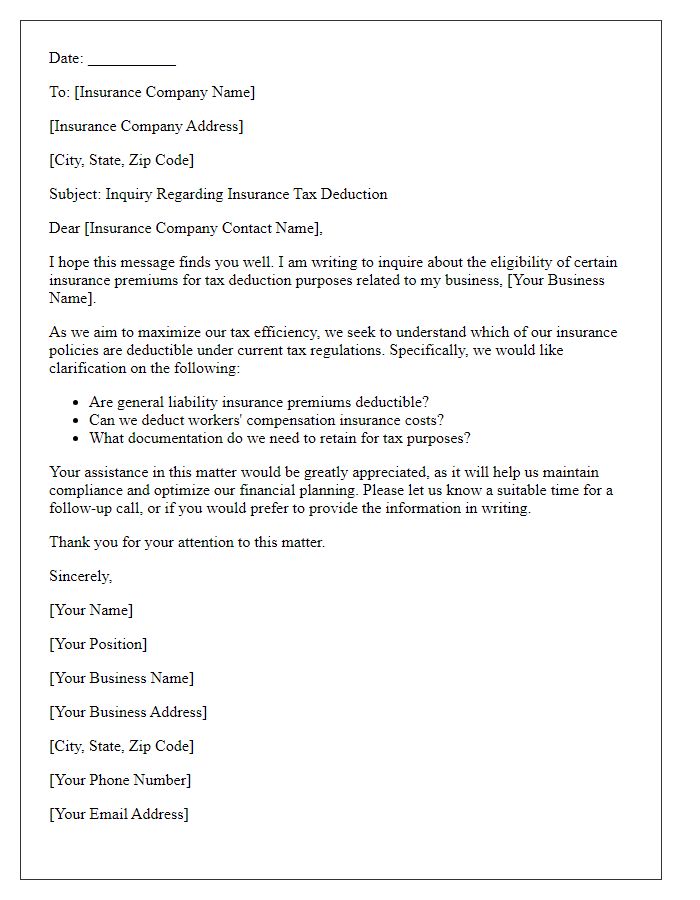

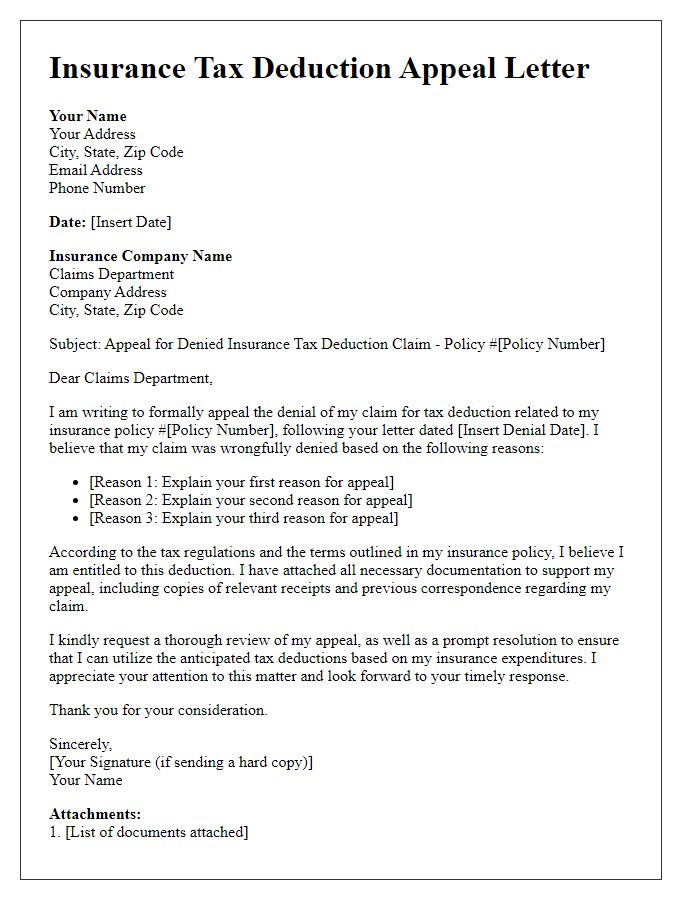

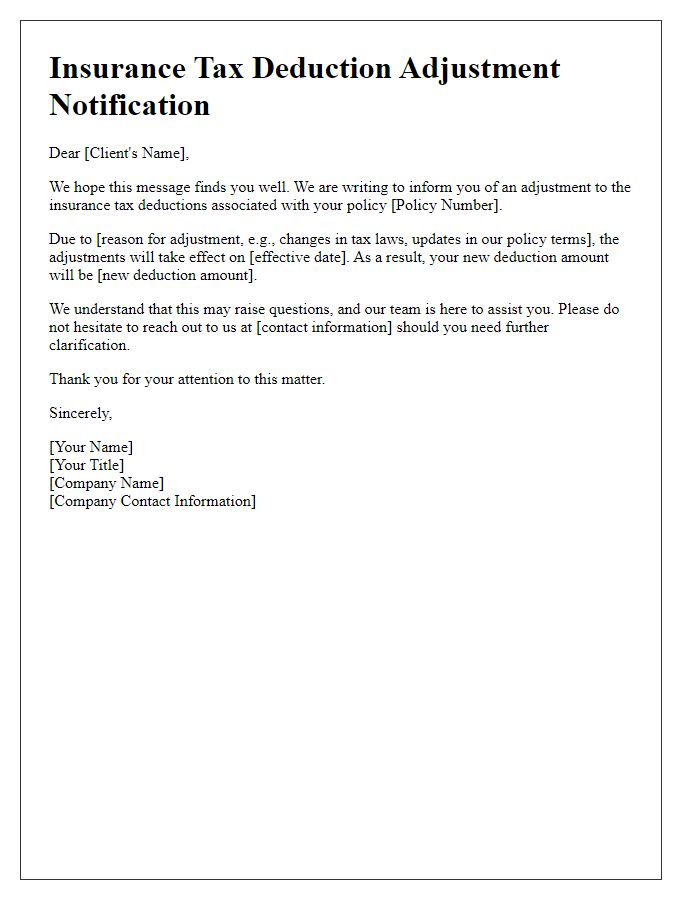

A formal request for insurance tax deduction validation requires a clear and concise articulation of the necessary details. Specifically, the request should identify the taxpayer, which could be an individual or an organization, and the specific tax year involved. Details about the insurance policy, including the policy number, the type of insurance (e.g., health, auto, home), and the total amount paid towards the premium during that calendar year must be included. It is essential to reference the applicable tax code or regulation that supports the eligibility of the deduction. Additionally, any relevant documentation, such as receipts or policy statements, should be mentioned as attached to the request. The overall tone should maintain professionalism, ensuring clarity while demonstrating the importance of accurate validation for tax purposes.

Letter Template For Insurance Tax Deduction Validation Samples

Letter template of insurance tax deduction confirmation for self-employed.

Letter template of insurance tax deduction documentation request for auditors.

Letter template of insurance tax deduction clarification for dependency claims.

Letter template of insurance tax deduction revision request after review.

Letter template of insurance tax deduction proof of payment for tax returns.

Letter template of insurance tax deduction explanation for tax preparers.

Comments