Are you looking to streamline your communication with clients regarding their insurance premium confirmations? Crafting a clear and professional letter template can make all the difference in maintaining transparent relationships. With the right words, you can ensure that your clients feel informed and valued every step of the way. Ready to create an effective insurance premium confirmation letter? Let's dive into the details!

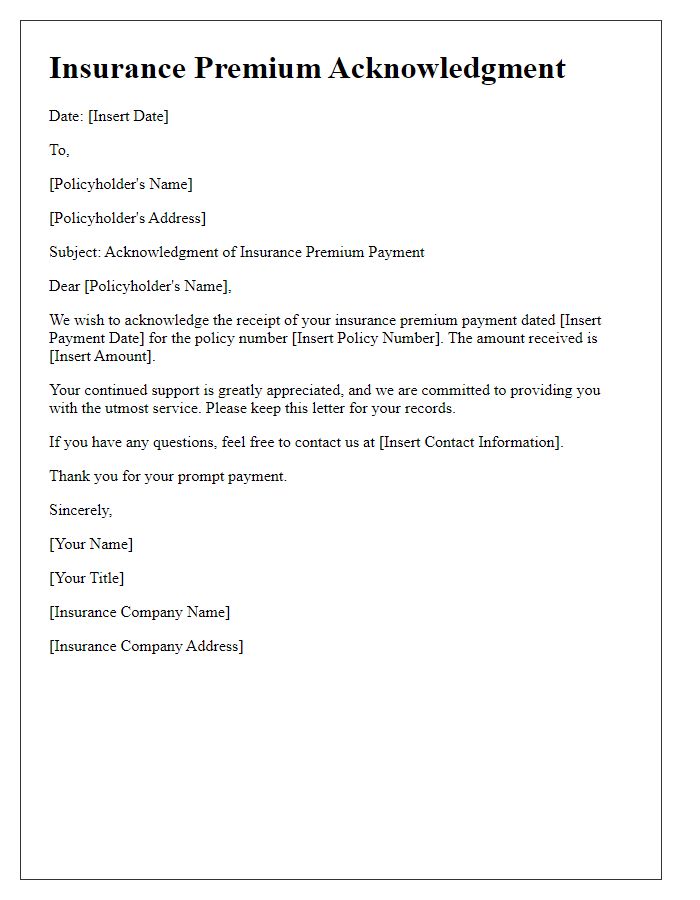

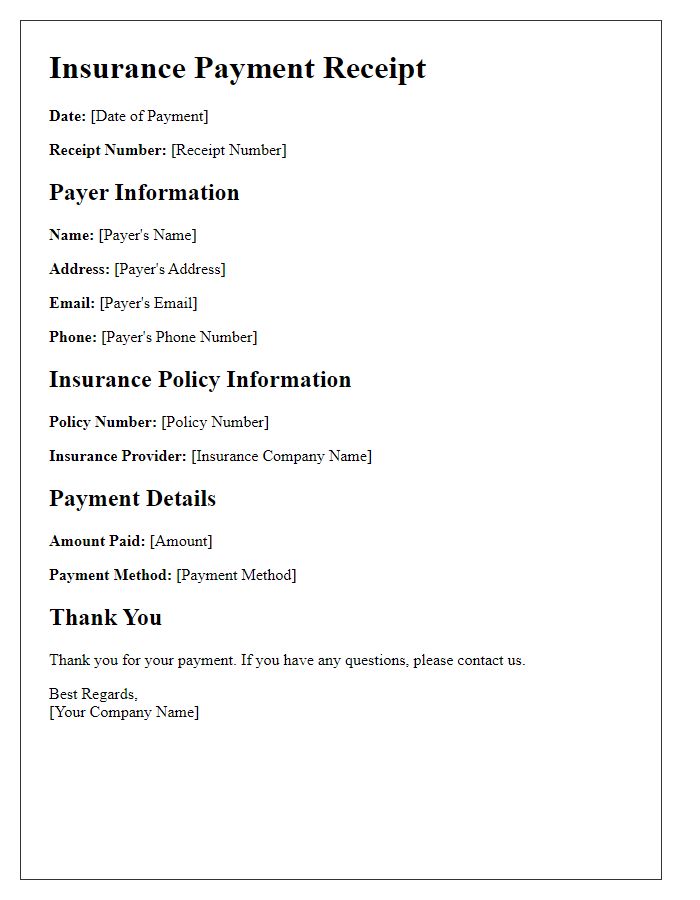

Policyholder Information

Insurance premium confirmation for policyholders requires clear identification of key details. Policyholders must provide essential information such as Name (e.g., John Doe), Policy Number (e.g., 123456789), and Coverage Type (e.g., comprehensive auto insurance). Premium Amounts (e.g., $1,200 annually) and Payment Due Dates (e.g., January 1, 2024) are crucial for maintaining policy validity. Contact Information (e.g., phone number, email) ensures efficient communication. Documenting Coverage Period (e.g., January 1, 2024 - December 31, 2024) confirms the timeframe of the insurance policy. Clarity on Terms and Conditions is vital, including the consequences of missed payments or adjustments to the premium based on claims history.

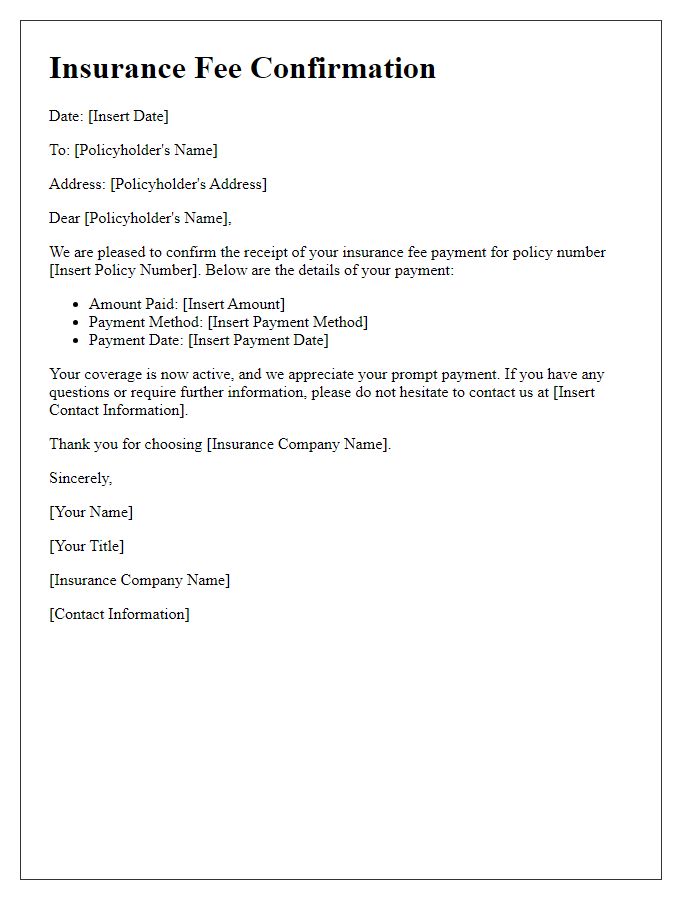

Policy Details

Insurance premium confirmation requires clear and detailed communication. The policy details should include the policy number, the insured party's name, the coverage amount, the premium amount due, and the due date for payment. It is essential to mention the insured entity type, whether it's auto, home, health, or life insurance, and provide specifics about the coverage period. Including additional information such as the renewal terms, discounts, or payment methods enhances clarity. Clients should understand any penalizations for late payments, ensuring they remain informed and compliant with their insurance contract.

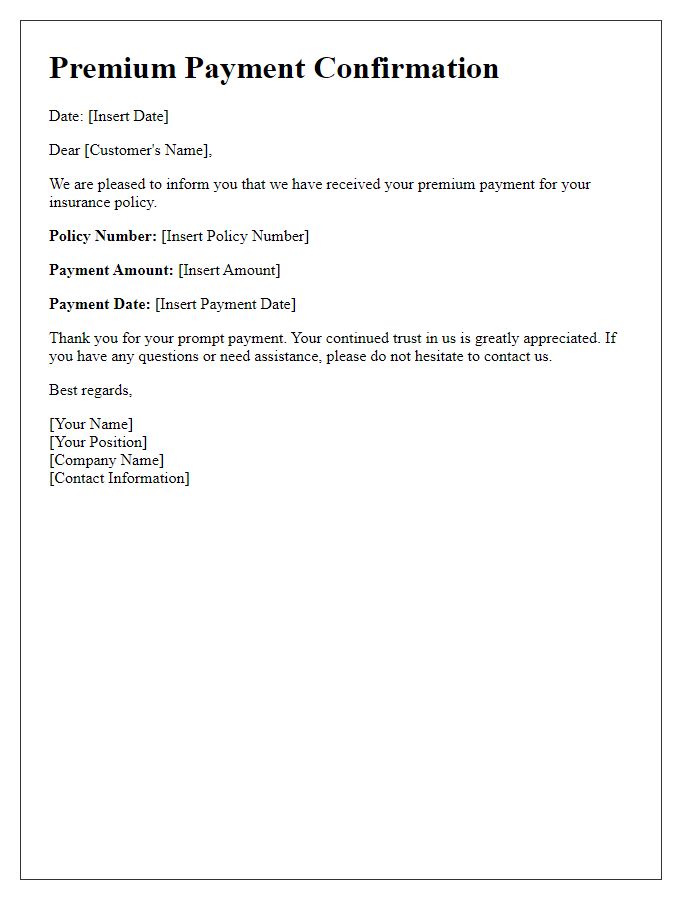

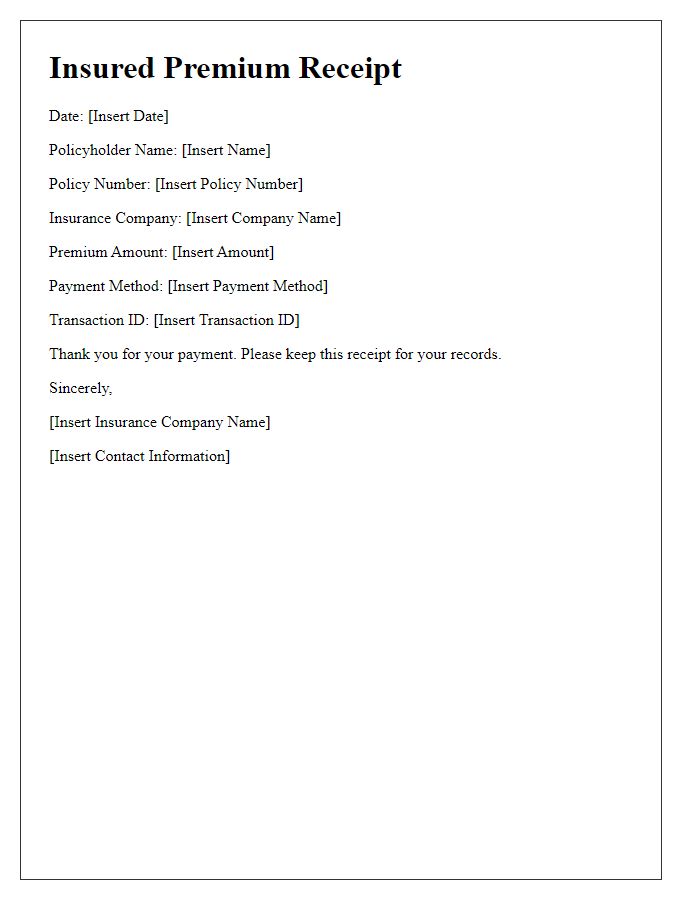

Premium Amount

Insurance premium confirmation provides policyholders with crucial details regarding their financial commitments. The premium amount, typically defined in a policy document, indicates the specific monetary payment required for coverage eligibility. For instance, an annual premium payment might be $1,200 for a comprehensive auto insurance policy covering vehicles such as sedans or SUVs. Timely payments, often due on the first of each month or at the policy's renewal date, ensure continuous protection against risks like accidents or theft. Failure to pay premiums may result in lapses in coverage, potentially exposing insured assets to financial loss.

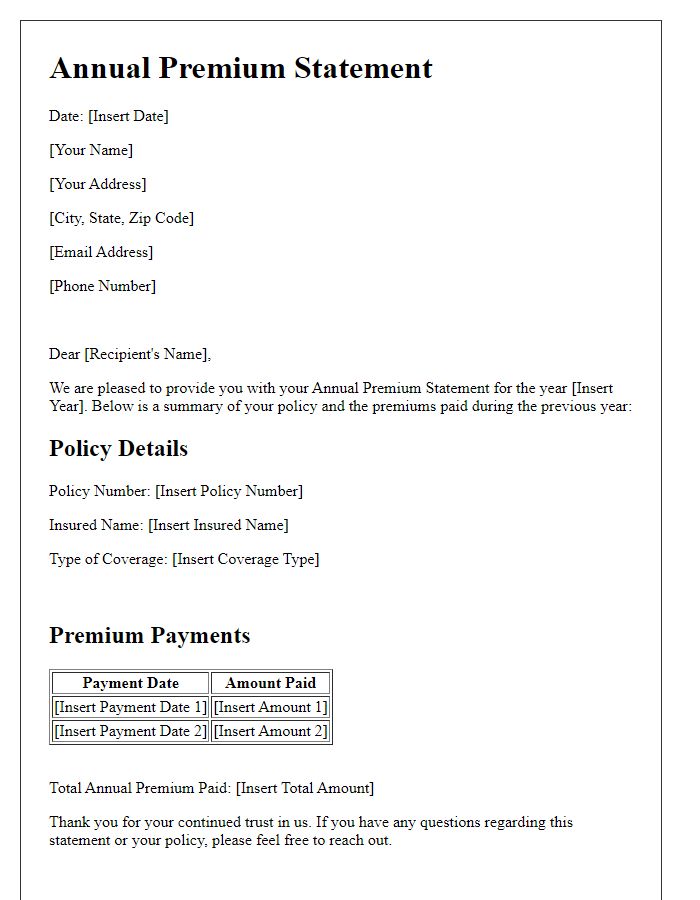

Payment Schedule

Insurance premium confirmations play a crucial role in establishing a clear payment schedule for policyholders. A typical insurance premium confirmation document outlines specific details such as the total premium amount, payment due dates, and frequency of payments (monthly, quarterly, or annually). For example, an annual premium of $1,200 might be broken down into 12 monthly payments of $100, with each payment due on the first of each month. The document usually includes the policyholder's name, policy number (for tracking purposes), and the effective date of the coverage. Additionally, it may provide information about acceptable payment methods, such as credit card, bank transfer, or automatic debit, ensuring ease of transaction for customers.

Contact Information

Insurance premium confirmation serves as an essential communication tool for policyholders and insurance companies. Premium amounts vary based on factors such as coverage types, deductible amounts, and the insured individual's risk profile, which can include age, health status, and driving record. Regular premium payments ensure continuous coverage for assets like vehicles or homes, protecting them from unforeseen events such as accidents or natural disasters. Policies may also delineate specific payment frequency--monthly, quarterly, or annually--impacting overall budgeting. Additionally, confirmation letters often include contact information for customer support, facilitating inquiries or changes to coverage plans, thereby enhancing the customer experience.

Comments