Are you looking to request a refund for your insurance premiums? Navigating the refund process can be a bit daunting, but don't worry; you're not alone. Many policyholders find themselves in need of clarity when it comes to securing their hard-earned money back. So, whether you're unsure about the necessary steps or just want some guidance, stick around to learn more about crafting the perfect refund request letter!

Personal Information

A refund request for insurance premiums should detail personal information such as full name, address (including street, city, state, and zip code), phone number (including area code), and email address. The policy number is essential for identifying the account. Including the date of the request and any relevant reference numbers or additional identification information further assists in processing the refund effectively. It is helpful to mention the policy type, such as health insurance, auto insurance, or homeowner's insurance, to clarify the context of the request. Keep communication professional yet concise, ensuring all necessary details for the insurance company to locate the account and process the refund are present.

Policy Details

Insurance premium refunds can occur for various reasons, including overpayment or policy cancellation. Policies, such as health insurance or auto insurance, often have specific terms regarding premium refunds. For example, an auto insurance policy with a cancellation date of January 15, 2023, may require a pro-rated refund based on the days remaining in the policy year. The refund amount may also depend on state regulations, which can vary significantly; for instance, California has specific laws governing premium refunds. Additionally, different insurance companies, such as State Farm or Allstate, might have varying processes for requesting refunds, including documentation requirements such as the policy number, proof of payment, and a written request detailing the reason for the refund. Properly addressing these details can facilitate a smoother refund process.

Reason for Refund Request

The insurance premium refund request stems from various factors influencing policy changes or cancellations. For instance, a policyholder may have relocated to a different state, such as California, resulting in changes to coverage requirements. Additionally, modifications to the insured property, like a home renovation in New York, might reduce the risk factor and subsequently decrease the premium amount. Furthermore, instances of overcharging due to administrative errors, which can occur during the annual billing cycle, may also justify a refund. Insurance companies, including major providers like Allstate or State Farm, often have established protocols for efficiently addressing these requests and processing refunds in compliance with state insurance regulations.

Supporting Documentation

When requesting an insurance premium refund, it is essential to include supporting documentation that verifies the policy details and justifies the refund request. Documents such as the original insurance policy (providing important terms, coverage levels, and effective dates), proof of payment (including bank statements or receipts showing premium payments), and any correspondence with the insurance provider regarding the cancellation or adjustment of the policy should be attached. Additionally, if applicable, include any claim denials or relevant notices that outline the reasons for requesting the refund. Such comprehensive documentation ensures a smooth review process and increases the likelihood of a timely resolution, maintaining compliance with the insurer's requirements.

Contact Information

To request a refund for an insurance premium, gather essential information such as the policyholder's name, policy number, and contact details, including phone number and email address. Ensure to specify the insurance provider's name and address for clarity. Reference any relevant dates such as policy initiation and payment dates. Include compelling reasons for the refund request, supported by documentation if necessary, like proof of overpayment or cancellation notices. Finally, express a desire for prompt processing of the request to facilitate a swift resolution.

Letter Template For Insurance Premium Refund Request Samples

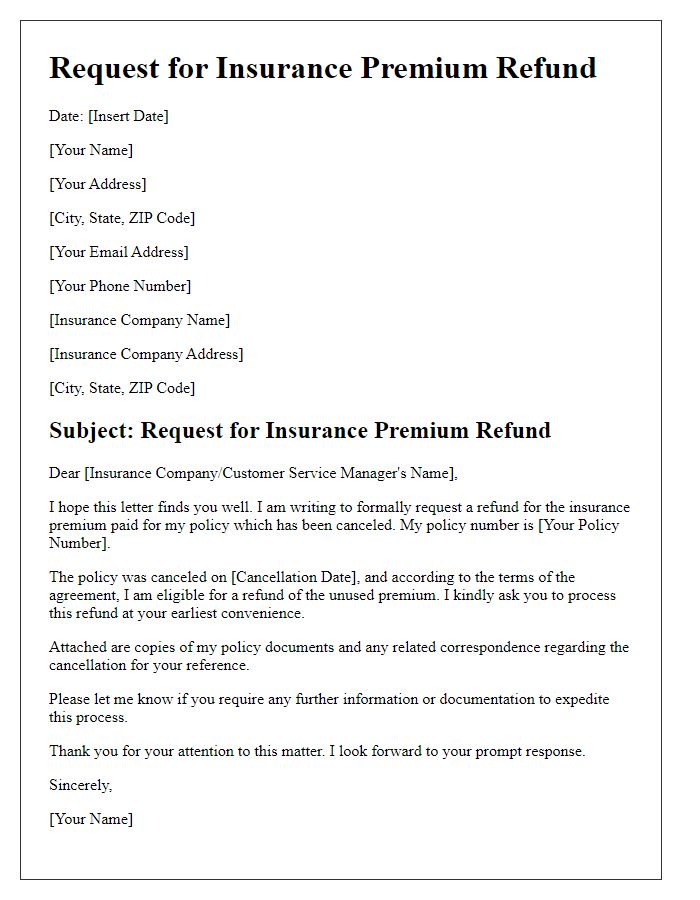

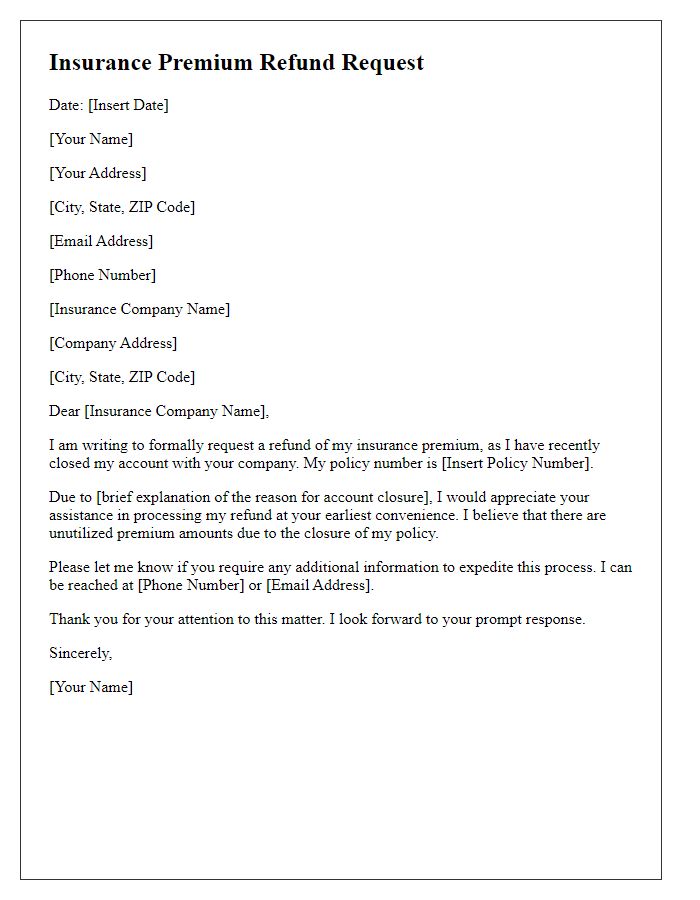

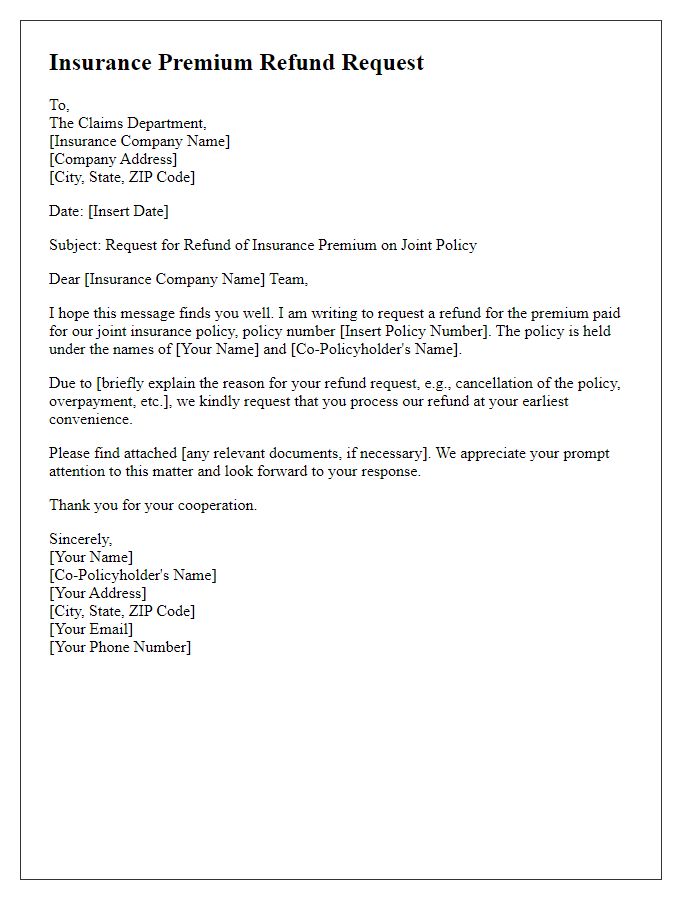

Letter template of insurance premium refund request due to policy cancellation.

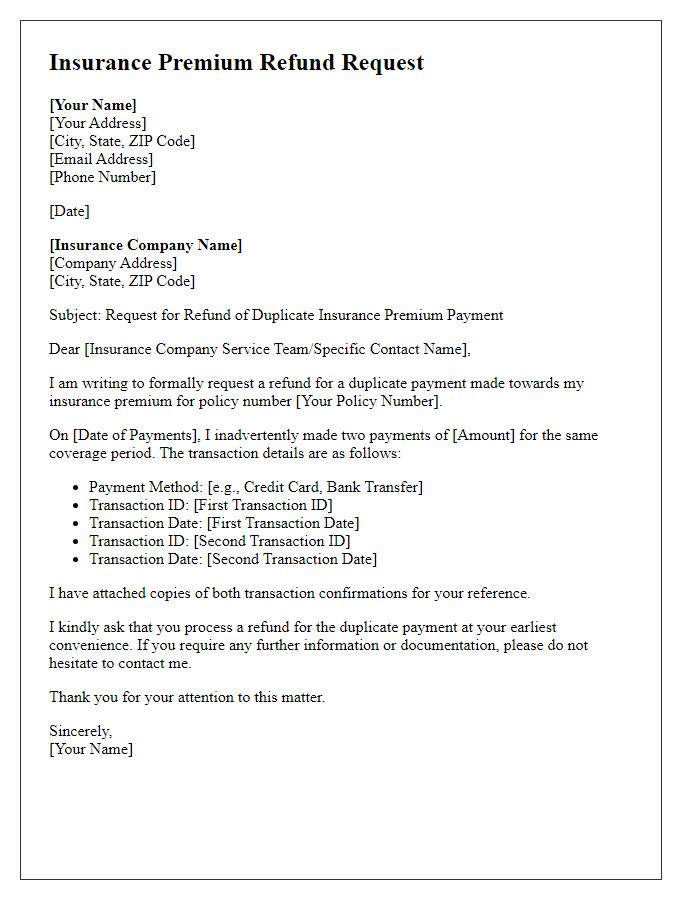

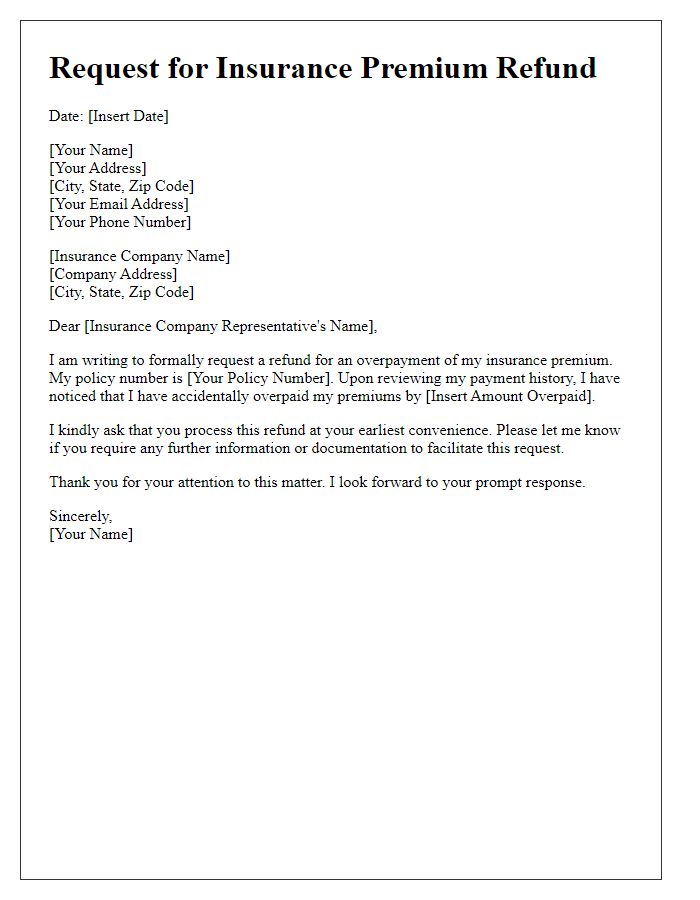

Letter template of insurance premium refund request for duplicate payment.

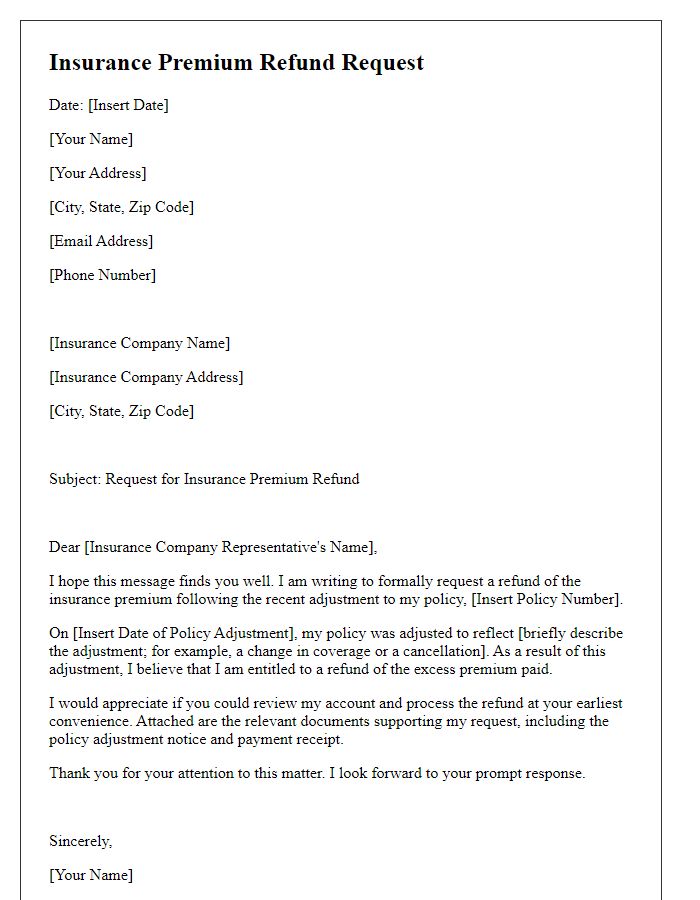

Letter template of insurance premium refund request after policy adjustment.

Letter template of insurance premium refund request for an inactive account.

Letter template of insurance premium refund request due to service dissatisfaction.

Letter template of insurance premium refund request for a billing error.

Letter template of insurance premium refund request following a claim denial.

Letter template of insurance premium refund request for account closure.

Comments