Are you considering securing peace of mind for your loved ones in the event of life's unexpected moments? Funeral insurance can be a crucial step towards ensuring that your family is not burdened with financial stress during a difficult time. Understanding the options available can be overwhelming, but it doesn't have to be. Let's dive in and explore how funeral insurance can provide comfort and security, and feel free to read more to find out the essential details you need!

Personal Information

Funeral insurance programs provide financial security for end-of-life expenses, ensuring families avoid unexpected costs during a difficult time. Types of policies, such as whole life, term life, and prepaid funeral plans, cater to varying needs and budgets. Common premiums range from $25 to $100 per month, depending on benefits. Policyholders can choose coverage amounts, typically between $5,000 and $25,000, intended to cover funeral services, transportation, and burial costs. Important factors include the insurer's reputation, payout speed, and flexibility in payment options. Understanding exclusions and waiting periods is crucial to ensure adequate coverage. Potential beneficiaries, often immediate family members, should be aware of the policy details to facilitate claims during stressful periods.

Policy Coverage Details

Funeral insurance policies provide financial support to cover end-of-life expenses, easing the burden on family members during a difficult time. Standard coverage typically includes costs for burial or cremation services, which can range from $7,000 to $15,000 in the United States, depending on the region and service choices. Additional benefits may include transportation of the deceased, flowers, and necessary permits, which vary by locality. Policyholders should review terms regarding waiting periods, which can last between 1 to 2 years before full benefits are accessible, and exclusion clauses that might apply to certain causes of death. Understanding these details ensures adequate preparation and selection of the right policy tailored to individual needs and preferences.

Premium Cost and Payment Options

Funeral insurance provides a financial safety net to cover funeral expenses, ensuring families are not burdened during an emotional time. Premium costs for such policies can vary significantly based on factors like age, health status, and coverage amount selected. Many providers offer flexible payment options, ranging from monthly installments to annual premiums, allowing policyholders to choose a plan that fits their budget. Additional benefits may include a guaranteed payout regardless of the time of death and options for additional coverage for related expenses, such as burial plots or cremation services. Understanding the nuances of each plan is essential for making an informed decision.

Beneficiary Designation

When considering funeral insurance, the designation of beneficiaries plays a crucial role in ensuring that the intended recipients receive the necessary financial support during a difficult time. Beneficiaries, often family members or close friends, are the individuals named to receive the benefits of the insurance policy upon the policyholder's passing. Accurate designation is essential, as it determines the flow of funds to cover funeral expenses, which can average around $7,000 to $12,000 in the United States, depending on location and services chosen. It is advisable to review the beneficiaries regularly, especially after major life events such as marriages, divorces, or the birth of children, to ensure that the designations reflect current relationships and wishes. Clarity in communication regarding beneficiary designations with both the insurance provider and potential recipients can prevent disputes and alleviate stress during an emotionally taxing period.

Exclusions and Limitations

Funeral insurance policies often include specific exclusions and limitations that can significantly impact coverage. Common exclusions may involve pre-existing medical conditions, which are typically defined as any health issues present before the policy's start date. Policies may also exclude coverage for certain causes of death, such as suicide within a specified period, often ranging from one to two years. Additionally, limitations can apply to the total payout amount, commonly capping benefits at a certain threshold, like $10,000. Investigating the waiting periods for coverage activation is crucial, as many policies impose a waiting period of one to two years before full benefits can be accessed. Understanding these exclusions and limitations ensures informed decisions regarding funeral insurance options.

Letter Template For Funeral Insurance Enquiry Samples

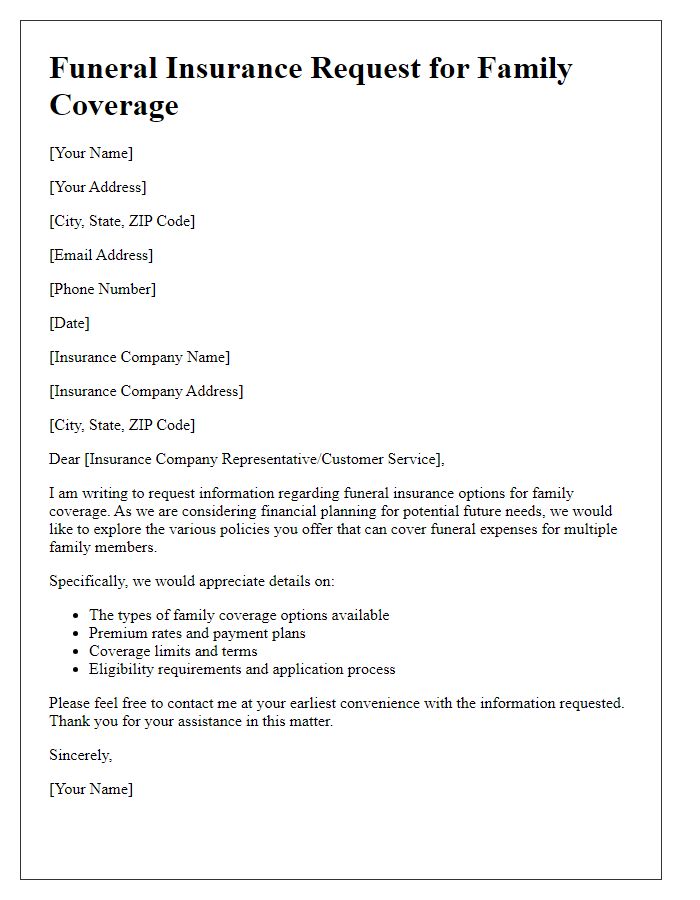

Letter template of funeral insurance request for family coverage options.

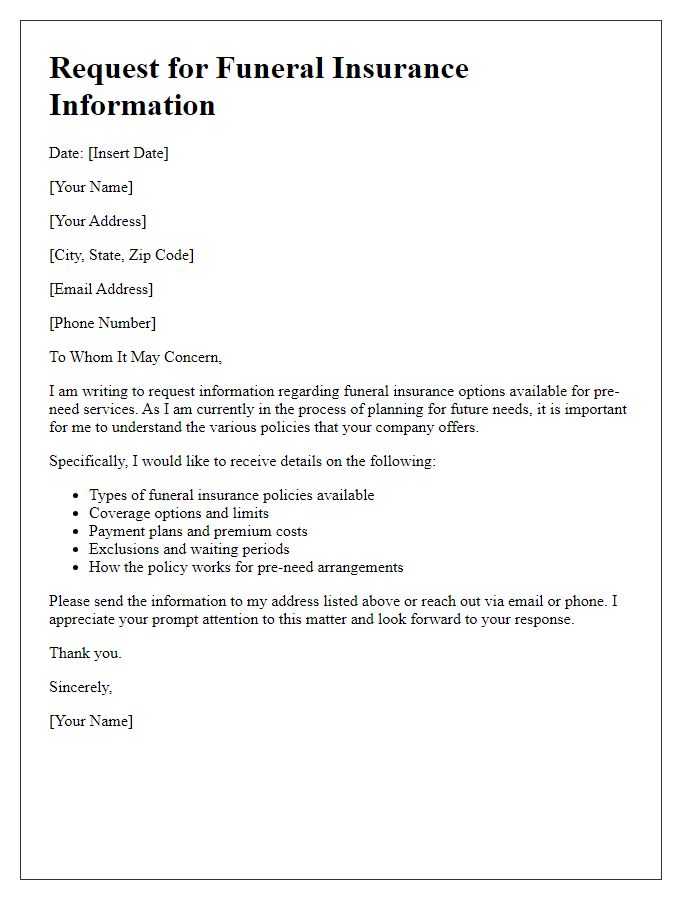

Letter template of funeral insurance information request for pre-need services.

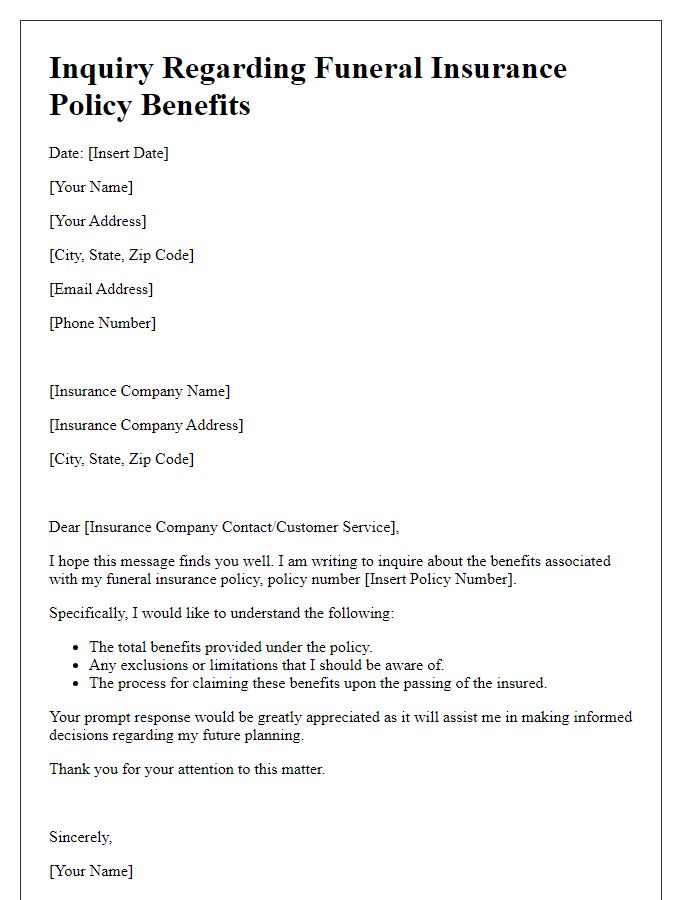

Letter template of funeral insurance question regarding policy benefits.

Comments