Hey there! We all know how important it is to stay protected with the right insurance, but have you ever stopped to think about the experience you had with your provider? Your feedback could be the key to improving services for everyone. We'd love to hear about your thoughts and insights regarding your insurance journey, so let's dive in together! Keep reading to discover how to share your feedback and make a real difference.

Personalization and Client Details

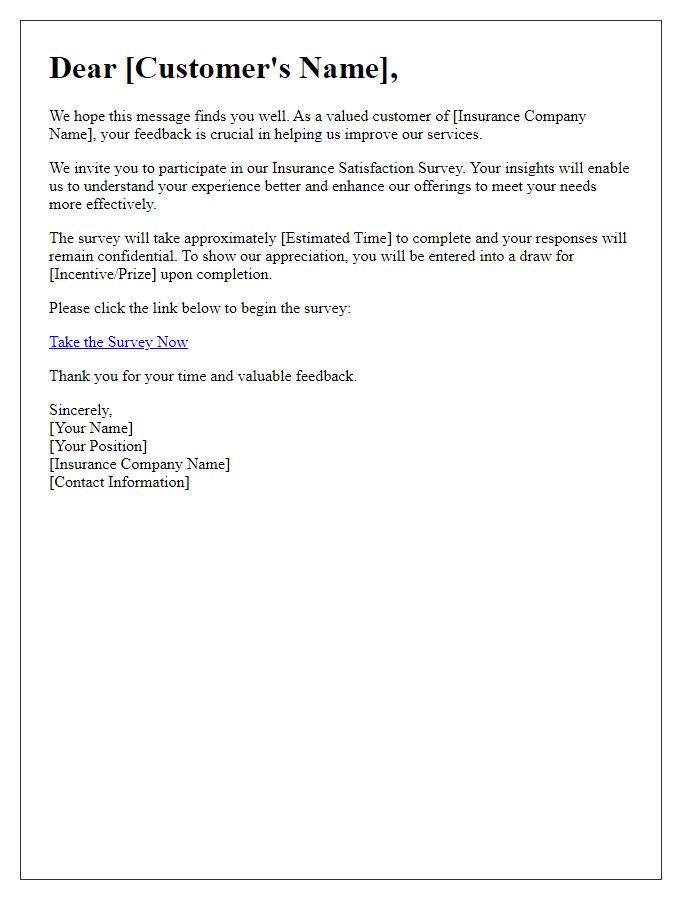

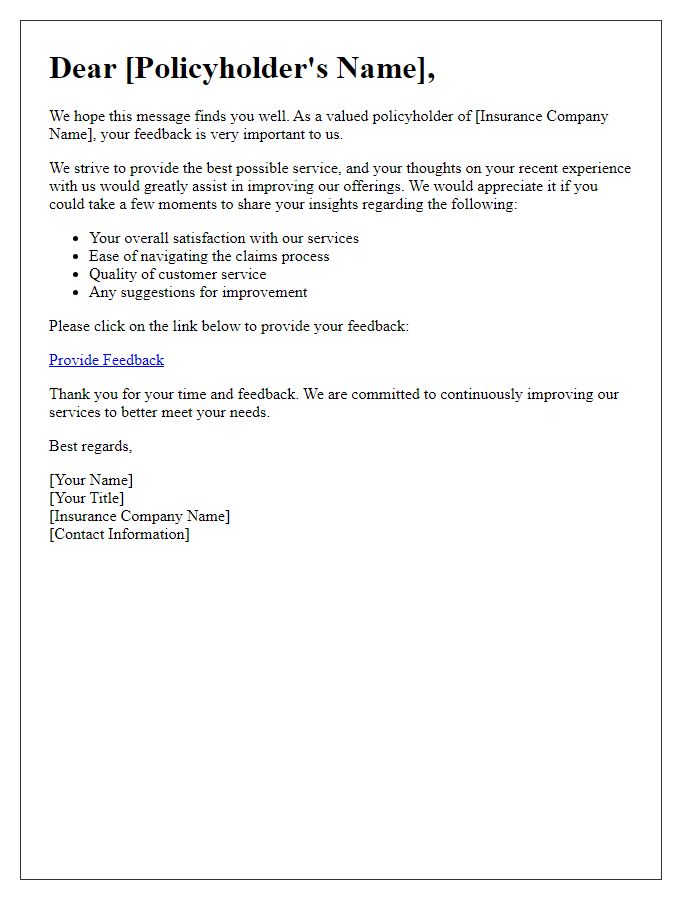

Insurance companies often seek feedback to enhance customer satisfaction and service quality. Personalization plays a crucial role in obtaining valuable insights. Client details, such as the policyholder's name, policy number, and type of coverage (e.g., auto, home, health), greatly assist in tailoring communication and addressing specific experiences. Additionally, gathering information about the client's recent interactions with the company's claims process or customer support can highlight areas needing improvement. Using personalized data (like the client's first name) in feedback requests fosters a sense of connection and encourages candid responses, ultimately guiding future enhancements in service delivery.

Clear Purpose and Request

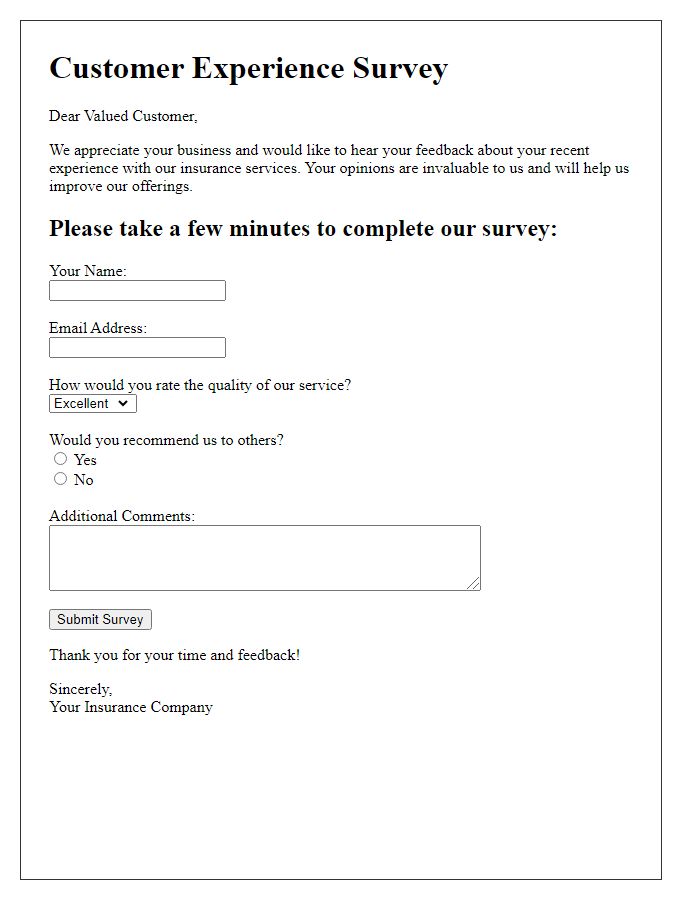

Insurance feedback requests are essential for improving service quality and customer satisfaction metrics. Policyholders receive targeted surveys via email or mobile apps, seeking insights about claims processes and support experiences. Common areas of focus include customer service interactions, claims processing efficiency (typically 30 days for standard claims), and overall satisfaction ratings on a scale from 1 to 10. Feedback collection methods can include direct questions about policyholder experiences or open-ended comments sections. Responses inform adjustments in training for customer service representatives and streamline claim handling procedures, aiming to enhance the overall insurance experience for clients.

Specific Feedback Questions

Insurance companies often seek feedback to improve customer service and policy offerings. Questions may include satisfaction ratings for claims processing, customer support responsiveness, clarity of policy information, and overall user experience on digital platforms. Specific prompts could involve rating the effectiveness of communication during the claims process, understanding of policy details, or ease of accessing online account management tools. Organizations often aim to gather insights that reflect customer expectations regarding timely resolutions and the quality of interactions with representatives.

Contact Information and Response Options

Insurance providers often seek client feedback to improve services and streamline processes. A well-structured feedback request should include clear contact information, such as a dedicated customer service email address (example: feedback@insuranceprovider.com) and a phone number (for example, 1-800-555-0199). Response options could range from online surveys accessible via a URL (for instance, www.insuranceprovider.com/survey) to direct telephone interviews, allowing clients to express their experiences regarding claim processing times, customer support responsiveness, and policy clarity. This multifaceted approach ensures clients have various avenues to share their valuable insights.

Thank You and Incentive Offer

Feedback requests for insurance services can promote customer satisfaction and engagement. A well-structured request should express gratitude, highlight the customer's experience, and include an incentive to encourage participation. Personalized messages can significantly enhance the likelihood of a response. Many companies offer discounts or gift cards as incentives for feedback, cultivating loyalty and appreciation. Additionally, placing importance on the feedback reinforces the company's commitment to continuous improvement and customer service excellence. It's essential to ensure the request is clear, concise, and respectful of the customer's time.

Comments