Hey there! If you've ever felt overwhelmed by the prospect of managing insurance premiums, you're not alone. Many people are discovering the benefits of premium financing as a savvy solution to ease the burden of upfront costs. This method can help you maintain adequate coverage while freeing up cash flow for other investments. Curious to learn more about how this option could work for you?

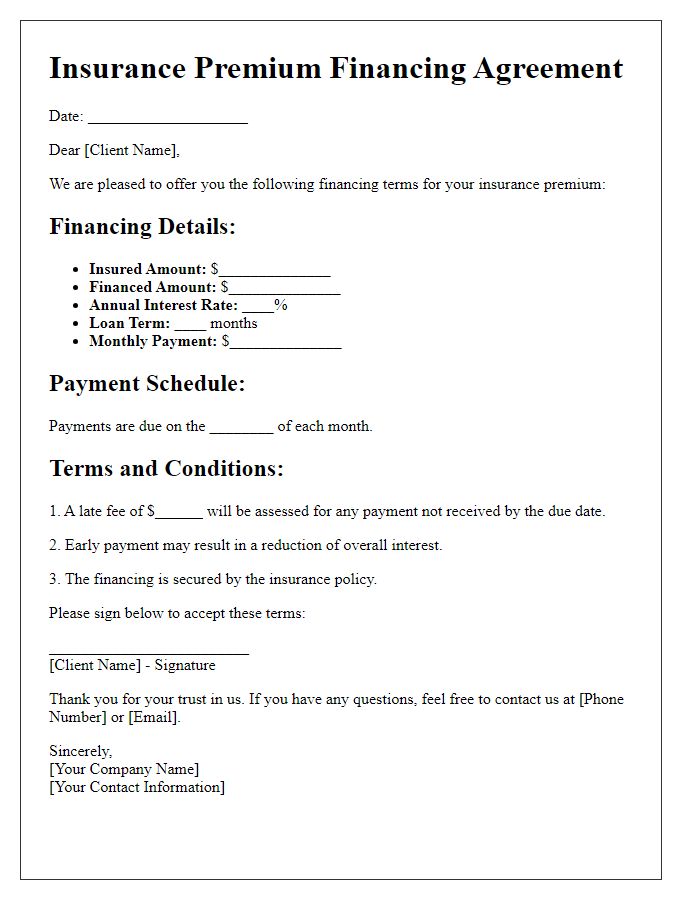

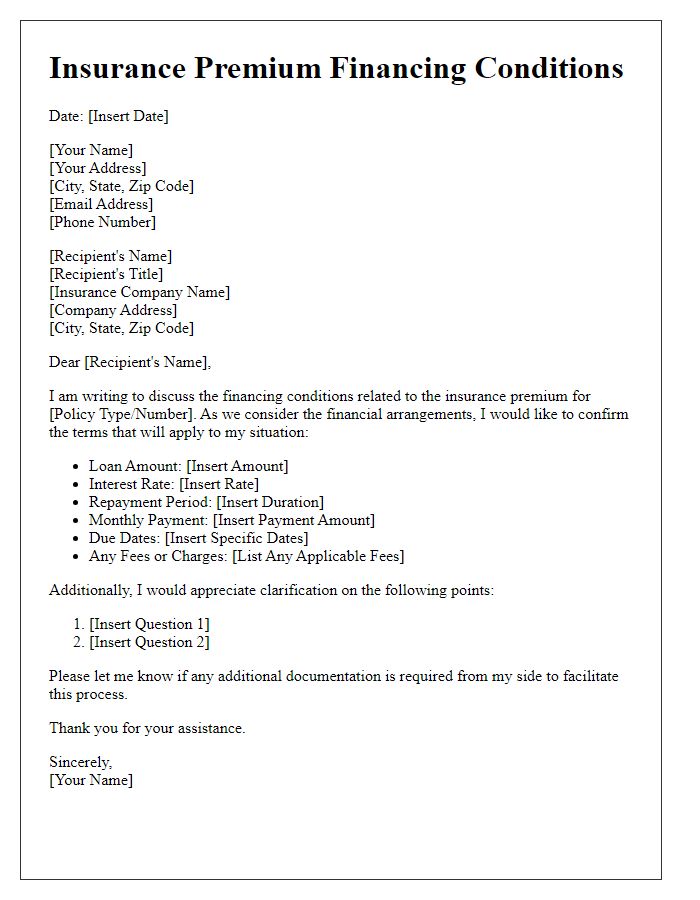

Clarity of Terms and Conditions

Insurance premium financing offers a way for policyholders to manage their premium payments, making it more feasible for individuals and businesses to maintain essential coverage. Clear terms and conditions are crucial for understanding the roles of parties involved, including the financier and the insured. Key components often include interest rates, repayment schedules, and potential fees associated with late payments. Additionally, details regarding the consequences of defaulting on the financing agreement are important to clarify, including potential cancellations of coverage and impact on credit scores. Transparency in these terms fosters trust and helps policyholders make informed decisions about their financial obligations related to insurance premiums.

Payment Schedule and Options

Insurance premium financing offers unique payment structures, allowing policyholders to manage large premium costs over time. Financing options often include monthly, quarterly, or annual payment schedules tailored to fit individual financial situations. A typical payment schedule may subdivide the total premium into manageable segments, often spanning 12 months for convenience. Interest rates on these financing plans typically range from 4% to 10%, depending on creditworthiness and loan amount. Early payment incentives or discounts may also be available, appealing to proactive account management. Providers such as finance companies (e.g., Premium Finance, LLC) often service these plans, ensuring ease of transaction and customer support throughout the financing term.

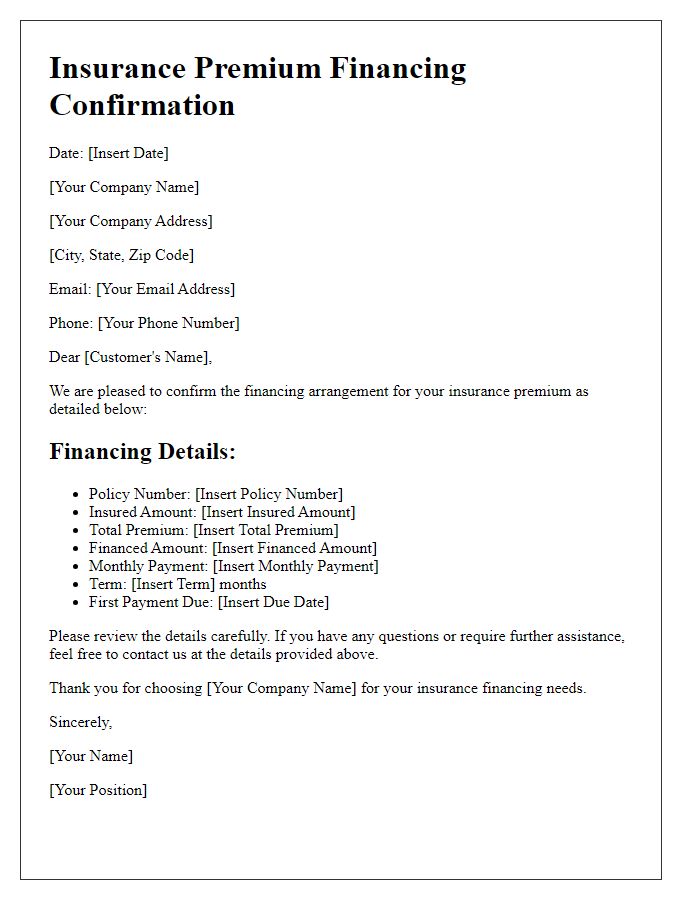

Interest Rates and Fees

Insurance premium financing allows policyholders to spread the cost of their insurance premiums into manageable monthly payments, while interest rates and fees associated with this financing can vary significantly. Interest rates typically range from 5% to 12%, depending on the lender and the creditworthiness of the borrower. Additional administrative fees may apply, often around $100 per transaction, impacting the total cost of financing. Late payment penalties may be imposed if payments are not made on time, often around 5% of the missed payment amount. Borrowers should carefully review the financing agreement to fully understand the implications of interest rates and fees, ensuring they make an informed financial decision regarding their insurance premiums.

Coverage Details and Limitations

Insurance premium financing offers a unique opportunity for policyholders seeking to manage their cash flow while obtaining necessary coverage. This financial arrangement allows individuals or businesses to pay their insurance premiums, such as property or liability insurance, in installments instead of a lump sum. However, key limitations exist. Financing typically incurs an interest rate, which can fluctuate based on market conditions, including changes in the base rate set by financial institutions. Additionally, failure to make timely payments could lead to policy cancellation, leaving individuals at risk. Specific coverage limitations may also apply, such as restrictions on claims related to natural disasters or liabilities exceeding certain thresholds. Understanding these essential details ensures informed decision-making when selecting financing options for insurance premiums.

Contact Information for Queries

Contacting customer support for queries regarding insurance premium financing can provide clarity on various options available. Reach out to dedicated representatives via phone at 1-800-555-0199, available Monday to Friday, 9 AM to 5 PM Eastern Standard Time. Email communication can be directed to inquiries@financeinsure.com for detailed responses, typically within 24 hours. Utilizing live chat on the official website, financeinsure.com, allows for immediate assistance during business hours. Comprehensive FAQs section on the website offers insights into common concerns regarding financing options, eligibility criteria, and repayment plans. Providing detailed information and timely assistance can significantly enhance customer experience and satisfaction.

Comments