Are you a business owner wondering how to protect your livelihood from unexpected disruptions? Understanding business interruption insurance is crucial for safeguarding your operations and ensuring financial stability during challenging times. This type of insurance provides essential coverage that can help you keep your business afloat when unforeseen events strike, like natural disasters or economic downturns. Dive into this article to learn more about the specifics of business interruption insurance and how it can benefit you and your business!

Policyholder Information

Business interruption insurance provides essential financial support during unexpected operational disruptions. Policyholders, such as small businesses or corporations, must maintain accurate documentation to ensure proper claims processing. Relevant entity details include the policy number, effective date, and the specific terms covering loss of income. The insured premises, like retail locations or manufacturing facilities, should be identified, alongside the nature of the business activities. Important information includes the duration of interruptions affecting operations, such as natural disasters like hurricanes or man-made events like fires. Additionally, the submission of financial records, including profit and loss statements, is crucial to substantiate income loss claims during the interruption period. Being diligent about these details can significantly enhance the efficiency of the claims process.

Policy Number and Details

Business interruption insurance provides financial protection against income loss due to unexpected events. This insurance policy, identified by the unique Policy Number (e.g., 123456789), typically covers various scenarios such as natural disasters, fire incidents, or even government-mandated closures. Essential details include coverage limits, which can range in the hundreds of thousands or even millions of dollars, depending on the business size and risk assessments. It also outlines waiting periods, often spanning 48 to 72 hours before coverage activates, and business income calculations that consider ongoing expenses and net profits. Specific endorsements might cover extra expenses necessary to maintain operations during the recovery period, emphasizing the crucial nature of understanding policy nuances to ensure financial stability.

Coverage Scope and Limits

Business interruption insurance provides essential financial protection for companies during unexpected events leading to operational downtime. Coverage typically includes lost income, ongoing expenses such as rent and utilities, and any additional expenses incurred to resume business operations. Policies may vary, but many offer coverage for a specific period, often ranging from 12 to 24 months, depending on the insurer and the nature of the risk. For instance, in the case of a natural disaster, like Hurricane Ida in 2021, businesses with this insurance can claim compensation for income lost during the recovery phase. Key limits may feature specific caps on coverage amounts, often calculated based on a company's previous earnings and ongoing operational costs. Understanding these limits is crucial for business owners to ensure adequate protection against extended interruptions due to circumstances such as fire, flooding, or even pandemics.

Incident Description and Causes

A recent business interruption incident at a prominent retail establishment, located in downtown Chicago, stemmed from an unexpected water leak event caused by heavy rainfall (recorded at 3 inches in a single day). The flooding resulted in significant damage to inventory and infrastructure, leading to a temporary closure of the store for repair and restoration work. The disruption encompassed a total downtime of approximately 10 days, during which sales revenue significantly decreased due to the inability to operate. The incident also involved logistical challenges, such as the inability to restock shelves, affecting customer relations and brand reputation. Furthermore, this incident illustrated the impact of severe weather on business continuity in urban environments.

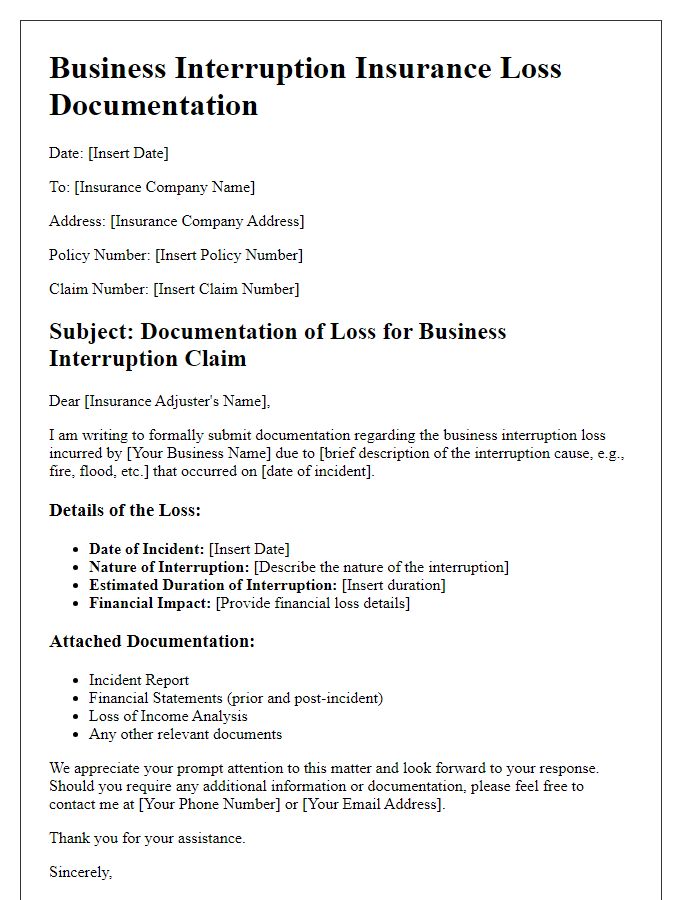

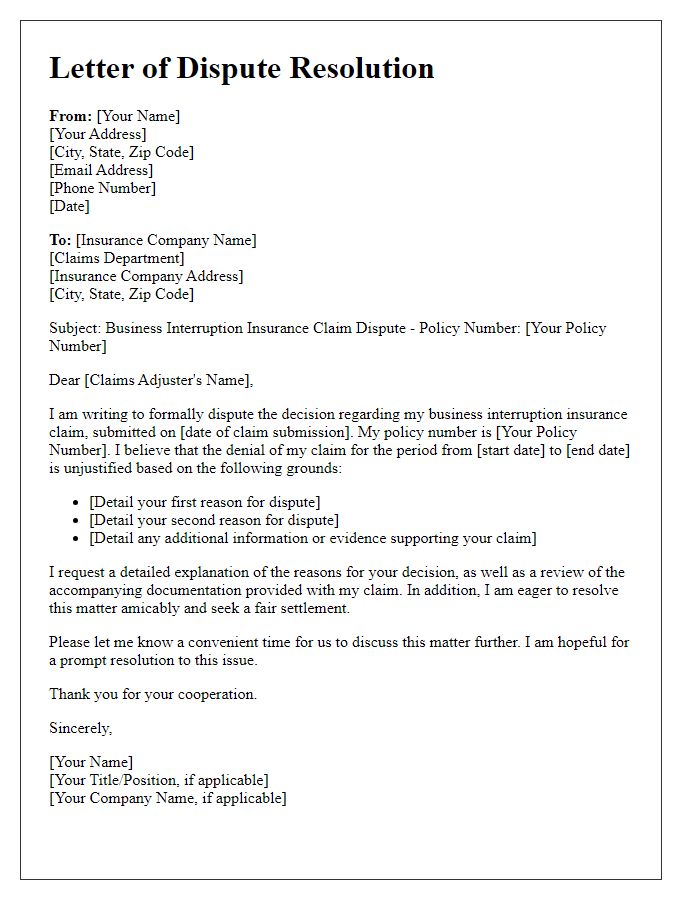

Claim Submission Instructions and Deadlines

Business interruption insurance claims require precise submission of documentation to ensure timely processing. Policyholders must gather essential materials, including the completed claim form, detailed financial records (including profit and loss statements from the previous year), and documentation of the event causing interruption (such as police reports, fire department reports, or other relevant incident logs). Claims typically must be submitted within a specified deadline, often ranging from 30 to 180 days post-event, depending on individual policy terms. In the event of a natural disaster, such as Hurricane Ian that struck Florida in 2022, timely submission is crucial to facilitate prompt claims processing and mitigate financial losses during recovery. The insurance company will often provide a claims adjuster who will assess the situation and guide the policyholder through the evaluation process.

Letter Template For Business Interruption Insurance Details Samples

Letter template of business interruption insurance coverage clarification

Comments