Looking for a way to enhance your insurance coverage? Our special insurance proposal is designed to meet your unique needs and provide you with peace of mind. With tailored options and personalized service, we ensure you're protected against the unexpected while enjoying the benefits of comprehensive coverage. Curious to learn more about how this proposal can safeguard your future?

Personalization and Client Information

Personalized insurance coverage proposals often incorporate specific client information to address unique needs and circumstances. For instance, a tailored personal insurance policy might include comprehensive details about the client's assets, such as their home (valued at $500,000 in a specific neighborhood like Willow Creek), vehicles (including a 2020 Tesla Model 3), and any additional valuable collections (like a coin collection worth $10,000). The proposal may also highlight statistics about local disaster risks, such as an annual 30% chance of flooding in the area, underscoring the necessity for specialized coverage. Additionally, the document would reflect the client's individual profile, including lifestyle factors (such as frequent travel to international destinations), which could influence premium rates and policy terms.

Coverage Options and Descriptions

Special insurance coverage options can be tailored to fit unique needs, such as enhanced protection for high-value items or bespoke liability policies for businesses. Comprehensive home insurance may include coverage for natural disasters (earthquakes, floods) affecting areas like California or Texas, providing financial support for repair costs. Auto insurance can offer specialized options, including coverage for classic vehicles (over 20 years old) or collector's cars valued above $100,000, protecting against loss or damage. Event insurance, crucial for large gatherings (weddings, corporate events) in venues like convention centers or outdoor parks, ensures financial security against cancellations or liability claims. Business insurance may expand to include cybersecurity coverage, essential for companies operating in digital spaces, safeguarding against data breaches with costs exceeding $3 million on average. Each of these coverage types provides tailored support, ensuring peace of mind and financial security against unexpected events.

Key Benefits and Features

Comprehensive special insurance coverage offers critical benefits and features designed to meet unique individual or business needs. Enhanced protection against unforeseen events, such as natural disasters (earthquakes, floods) and cyber threats (data breaches, ransomware), ensures peace of mind. Customizable policy options allow for tailored coverage limits, catering to specific risks associated with valuable assets (real estate, high-value collectibles). Additional benefits include 24/7 claims assistance, rapid response support services during emergencies, and risk management resources. Policy discounts may also apply for implementing recommended safety measures, incentivizing proactive risk reduction. Regular policy reviews provide opportunities to adjust coverage as life circumstances or market conditions change, ensuring ongoing relevance and protection.

Pricing and Payment Terms

Special insurance coverage proposals can vary widely but generally consist of several pricing strategies, including flat rates, tiered pricing, and customized plans tailored to individual client needs. Payment terms often involve upfront payments, monthly installments, or annual premiums, depending on the policy type and coverage level selected. Additional factors such as deductibles, co-pays, and coverage limits play a pivotal role in determining overall costs. For example, a policy covering high-risk events like natural disasters may necessitate higher premiums due to increased potential costs. Detailed breakdowns of pricing can help clients understand how various factors influence their total payments. Flexibility in payment methods is crucial, with options ranging from credit cards to bank transfers, facilitating ease of transaction for clients in various regions.

Call to Action and Contact Information

A compelling special insurance coverage proposal details specific benefits tailored for the client's needs. Highlighting unique features, such as comprehensive liability protection or exclusive policy discounts, addresses potential risks directly relevant to the client. Including statistics, like a 20% decrease in claim costs with expanded coverage options, reinforces value. Clear and inviting contact information encourages immediate response--displaying a dedicated agent's name, direct phone line, and personalized email ensures a seamless connection. Implementing a clear call to action, such as scheduling a consultation or requesting a comprehensive quote, fosters engagement and promotes swift decision-making.

Letter Template For Special Insurance Coverage Proposal Samples

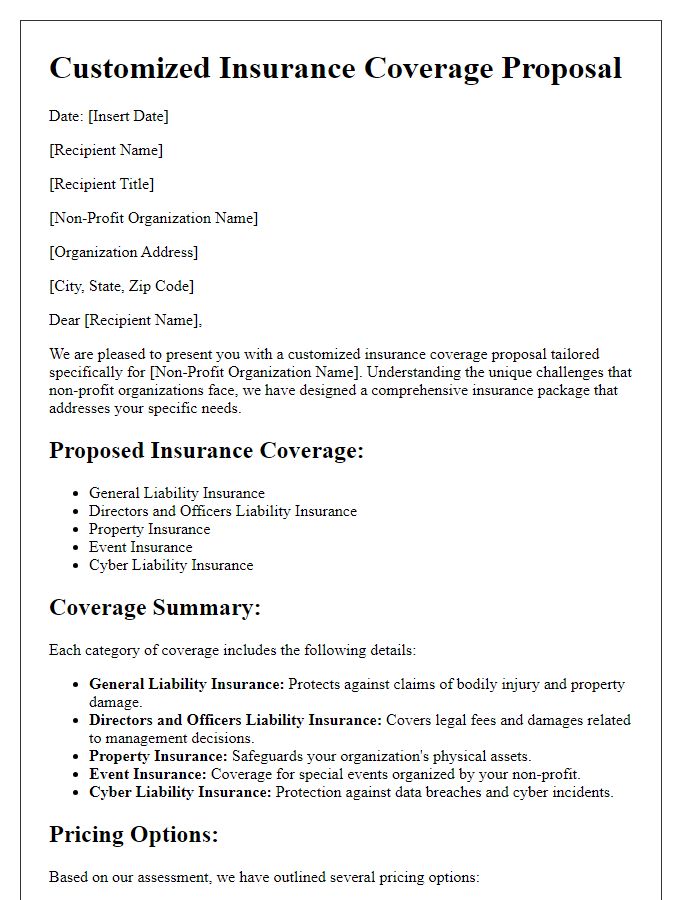

Letter template of customized insurance coverage proposal for non-profits.

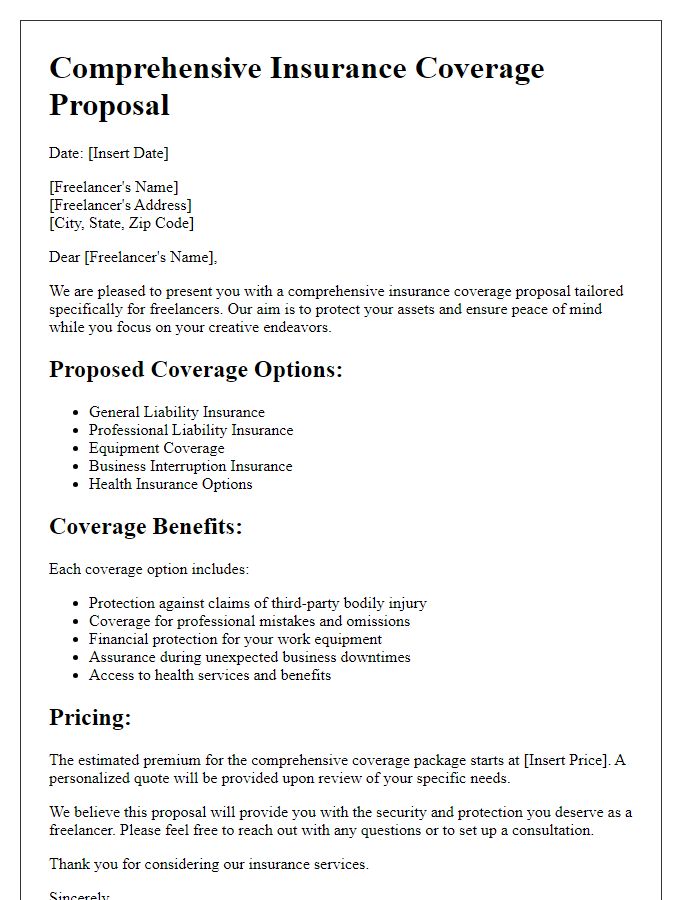

Letter template of comprehensive insurance coverage proposal for freelancers.

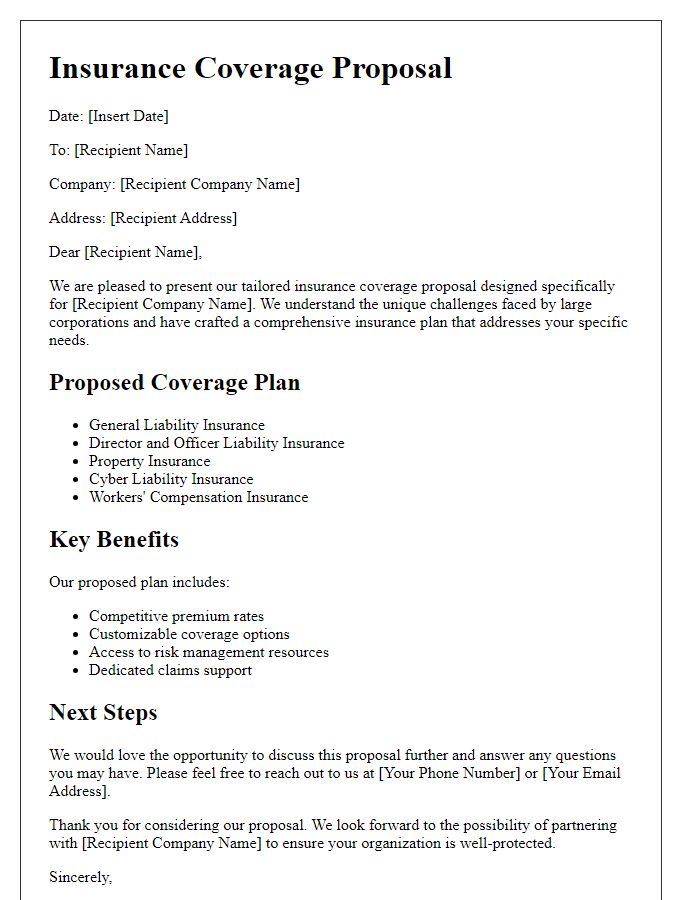

Letter template of tailored insurance coverage proposal for large corporations.

Letter template of specialized insurance coverage proposal for real estate investors.

Letter template of flexible insurance coverage proposal for gig economy workers.

Letter template of extensive insurance coverage proposal for healthcare professionals.

Letter template of innovative insurance coverage proposal for tech startups.

Comments