Have you ever found yourself puzzled by an error in your insurance contract? It's more common than you might think, and addressing these discrepancies can feel daunting. However, understanding the rectification process can save you time, money, and a lot of stress. So, let's dive into the essential steps you need to take to correct those pesky mistakes in your insurance paperworkâkeep reading to find out how!

Policyholder Information

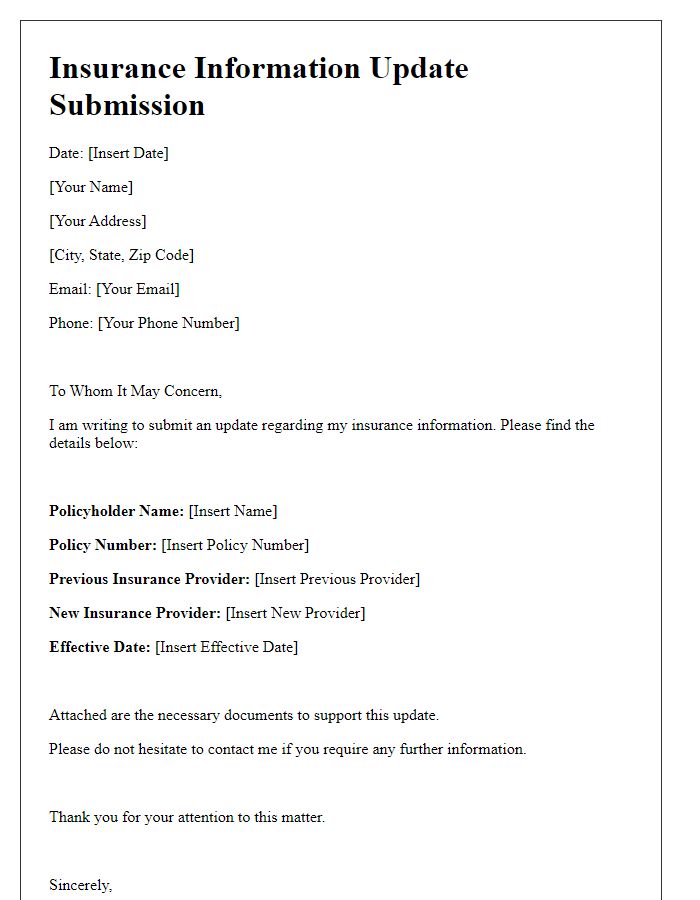

Policyholder information includes critical elements such as the policyholder's full name, their residential address, and contact details like phone number and email address. This data, essential for identifying the individual associated with an insurance policy, ensures accurate communication between the insurance provider and the policyholder. Specific details such as the policy number, which serves as a unique identifier for the insurance contract, and the date of the policy's inception, are vital for tracking the coverage period. Additionally, noting the type of insurance, such as health, auto, or home insurance, provides context for the rectification needed in the contract. Accurate documentation of this information supports the rectification process, ensuring any errors can be promptly corrected for effective coverage and compliance.

Error Description

Insurance contract errors can lead to significant misunderstandings and financial implications. Common issues include incorrect policyholder names, errors in coverage amounts, or inaccuracies in the scope of coverage for specific events. For example, a policy designed to cover natural disasters such as floods may incorrectly list a different type of peril, significantly altering the protection offered. Contract details such as the effective dates (often crucial for claims) may also be misprinted, potentially voiding the policy at critical times. Furthermore, discrepancies in premium amounts can result in unexpected charges or lapses in coverage, causing distress during claims processing. It is essential for policyholders to identify and rectify these errors promptly to ensure adequate protection and compliance with the terms defined in the insurance contract, protecting both their financial interests and legal rights.

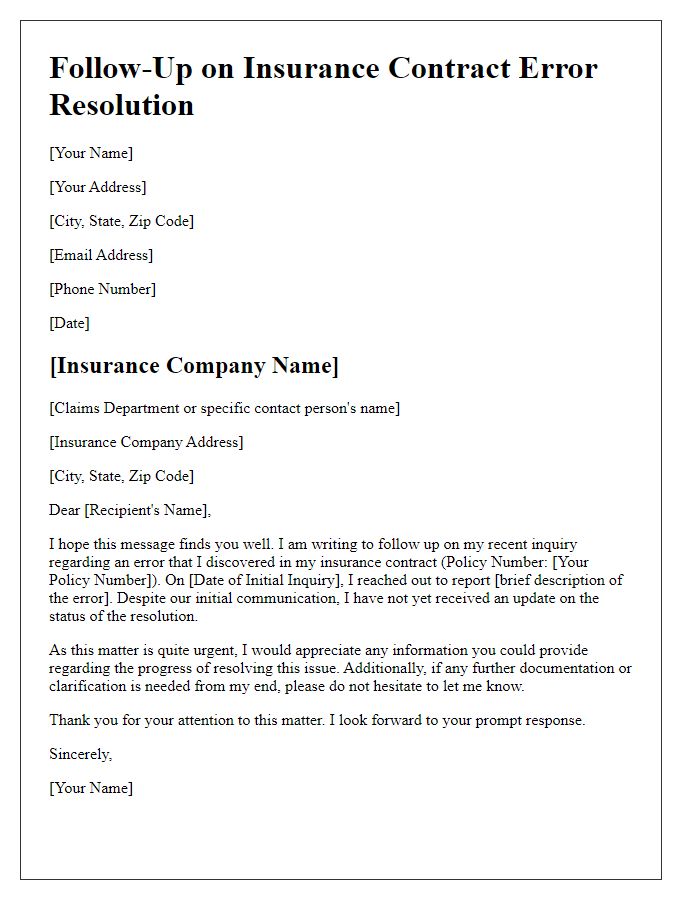

Corrective Action Required

Errors in insurance contracts can lead to significant misunderstandings and potential financial implications for both parties involved. For instance, an incorrect policy number or beneficiary name can result in issues during claims processing. In the case of a home insurance policy in New York, a typographical error in the property address may delay coverage verification, exposing the homeowner to risk. Additionally, miscalculated premiums can lead to insufficient coverage, jeopardizing the insured asset's protection. Prompt corrective action is essential to rectify inaccuracies and ensure that all parties have a clear understanding of the terms, facilitates smooth claims processes, and maintains trust in the insurance service provider.

Relevant Documentation

In the process of rectifying errors in an insurance contract, essential relevant documentation plays a crucial role in ensuring accuracy and compliance. Key documents include the original insurance policy, typically containing terms and conditions, coverage details, and premium amounts associated with the policyholder's account number. Additionally, correspondence related to the error, such as emails, letters, or recorded conversations with customer service representatives, provides context and evidence necessary for clarification. Identity verification documents, like a government-issued ID or Social Security number, may be required to authenticate the policyholder's identity. Furthermore, any amendments or endorsements made to the original contract should be included to highlight changes and corrections necessary for the rectification process, ensuring all information aligns with the policyholder's expectations and legal standards.

Contact Information for Follow-up

In the process of rectifying errors in insurance contracts, providing accurate contact information is essential for seamless communication. Insurance providers, such as Allstate Insurance Company headquartered in Northfield Township, Illinois, typically require a direct point of contact like an underwriting specialist or claims adjuster. It's crucial to include the full name, direct phone number (such as a 312 area code for Chicago), and email address of the responsible officer for follow-up queries. For larger firms, dedicating a specific department like Customer Relations or Policy Services can streamline the rectification process. Ensuring these details are prominently placed on the relevant documentation can greatly enhance the efficiency of addressing inaccuracies.

Letter Template For Insurance Contract Error Rectification Samples

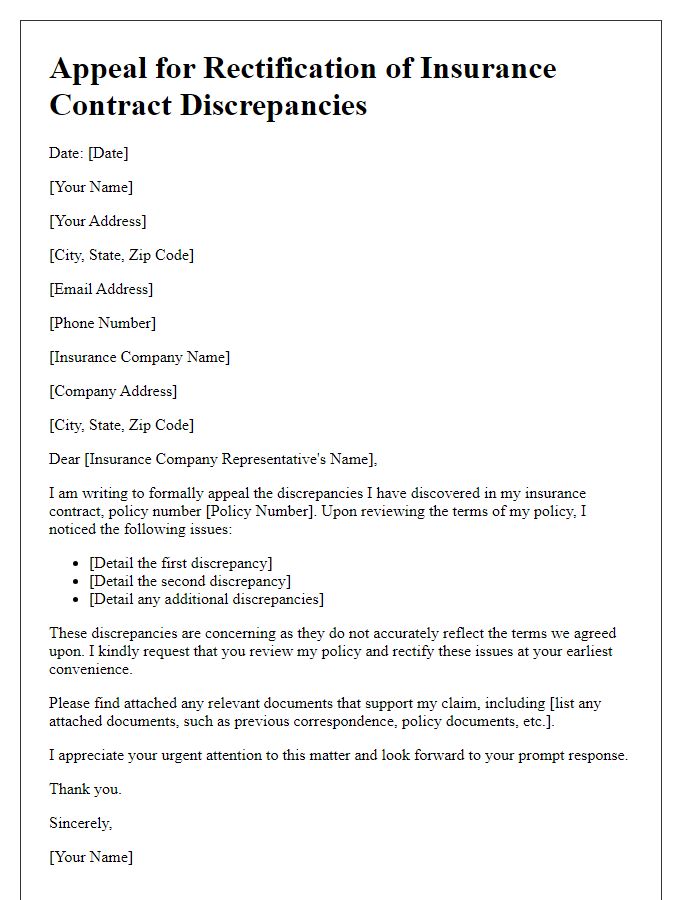

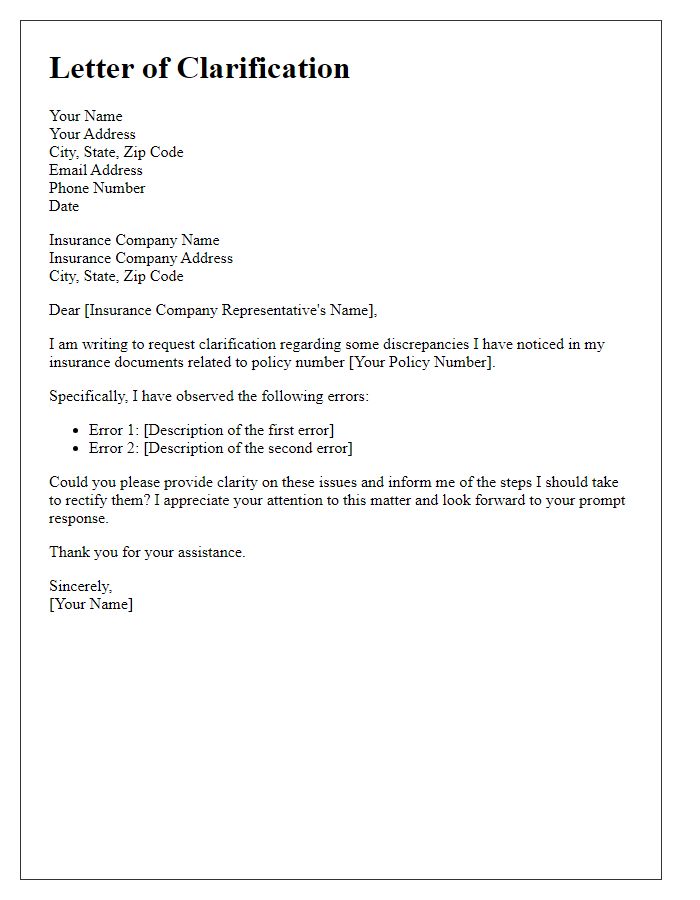

Letter template of appeal for rectifying insurance contract discrepancies.

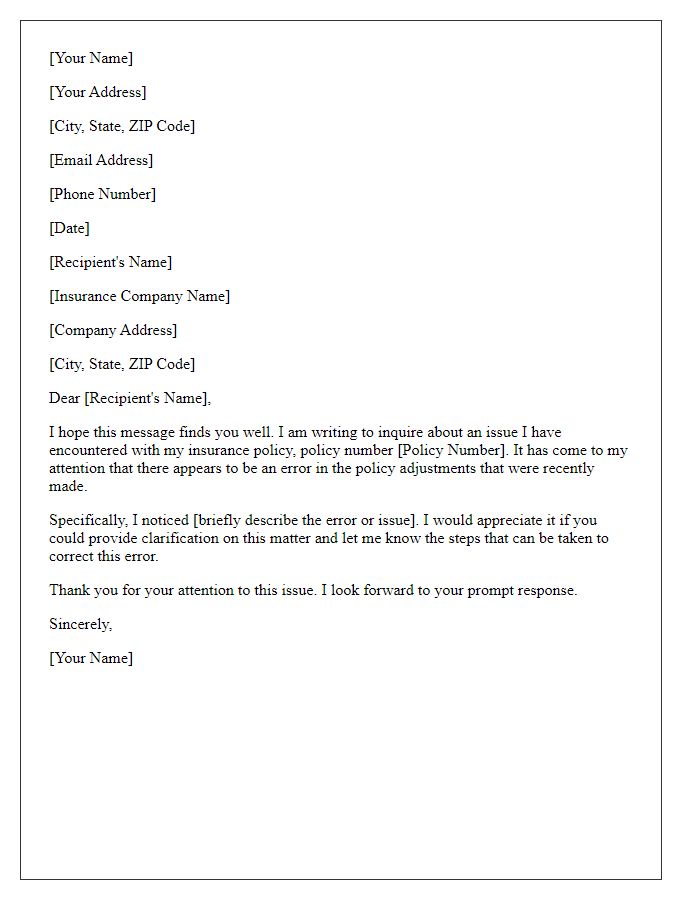

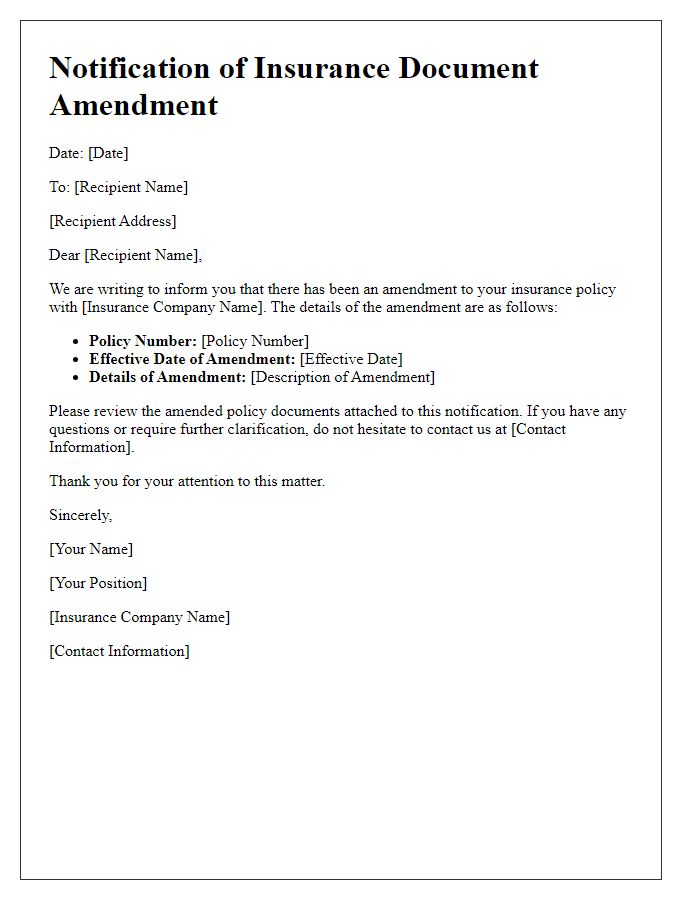

Letter template of inquiry regarding insurance policy error adjustments.

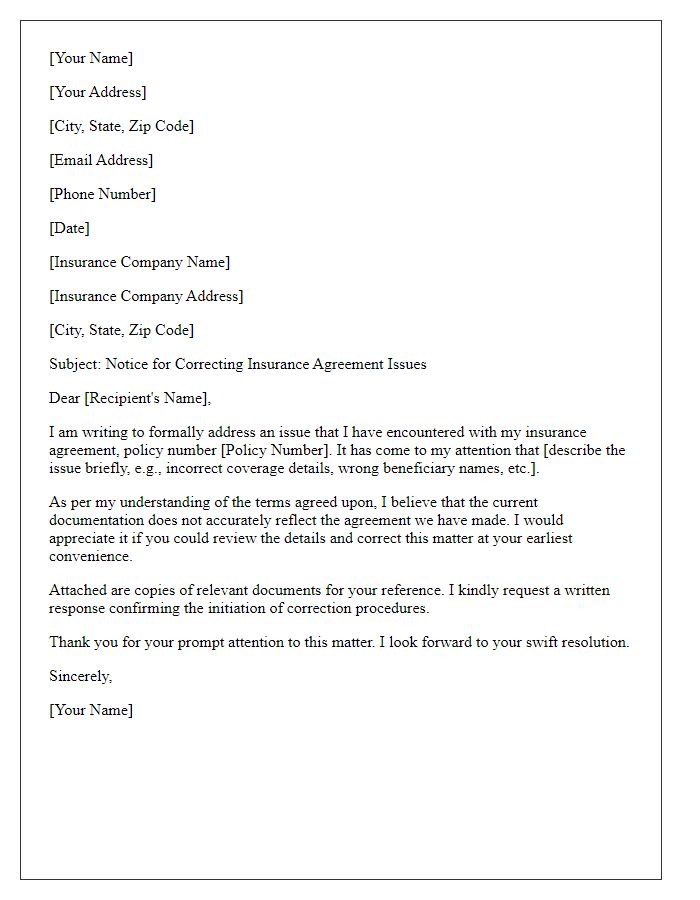

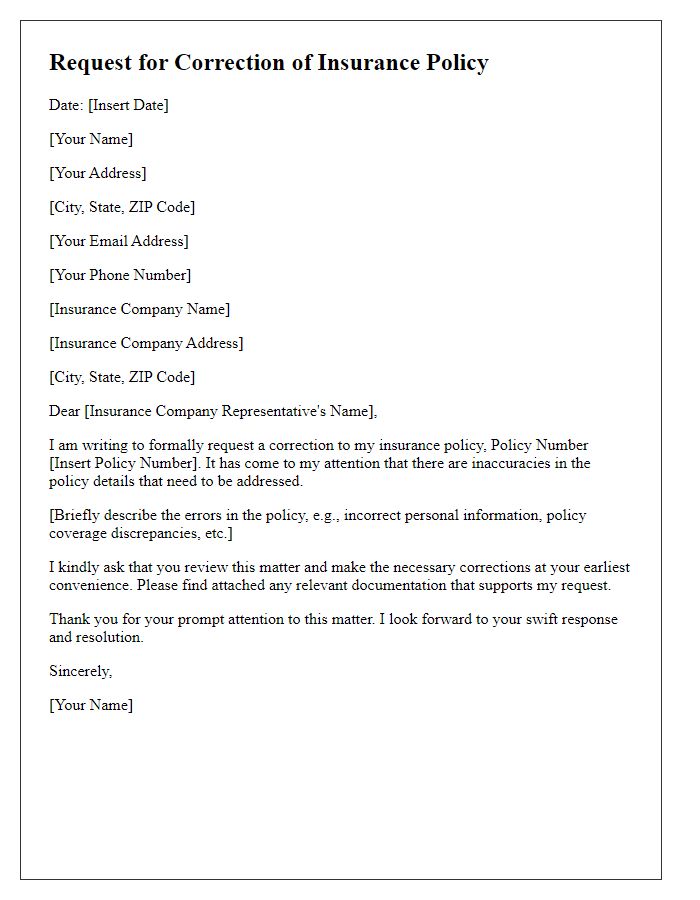

Letter template of formal notice for correcting insurance agreement issues.

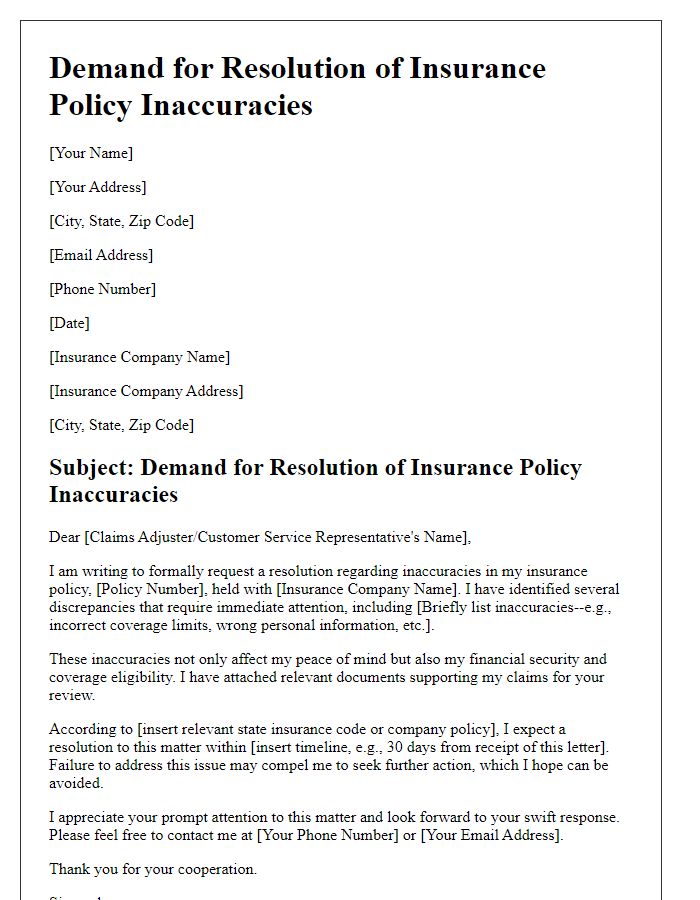

Letter template of demand for resolution of insurance policy inaccuracies.

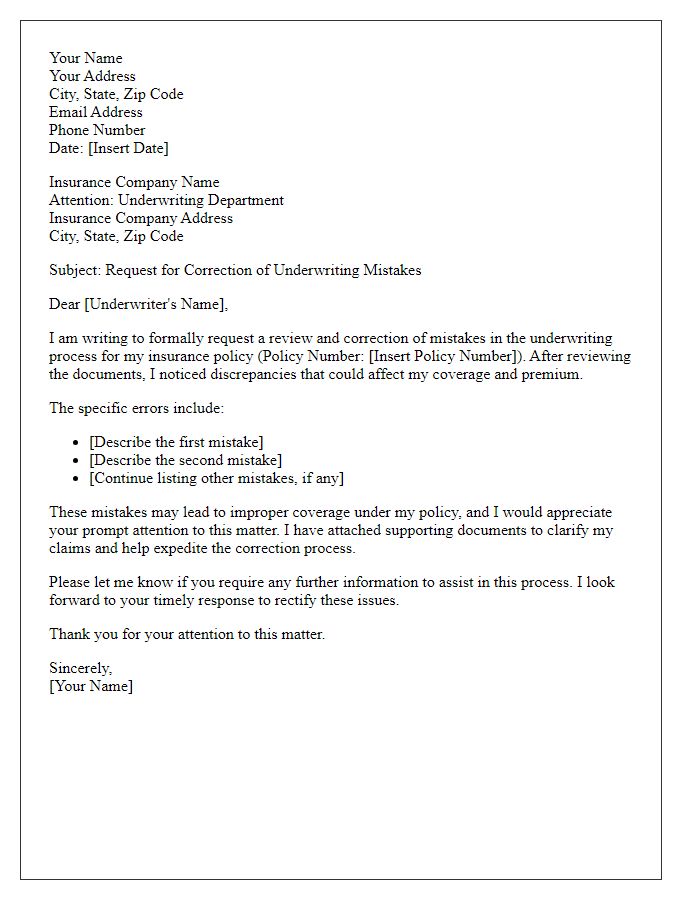

Letter template of correction request for insurance underwriting mistakes.

Comments