Are you considering the importance of protecting your family's financial future in the face of unexpected health challenges? In recent times, the conversation around critical illness coverage expansion has become more relevant than ever. Understanding the nuances of these policies can help you make informed decisions that benefit you and your loved ones. Dive into our article to explore the ins and outs of critical illness coverage and see how expanding your options can offer peace of mind.

Policyholder Information

Critical illness coverage expansion enhances financial protection for policyholders facing life-altering health events. This coverage specifically targets severe medical conditions such as heart attacks, strokes, and cancer diagnoses, providing lump-sum payouts that alleviate the burden of treatment costs. The policy, typically available through major insurance providers like MetLife or Prudential, often covers a range of additional illnesses, expanding beyond the traditional list of covered conditions. Enhancements may include coverage for conditions like Alzheimer's disease or organ transplant needs, aligning with evolving healthcare needs and increasing life expectancy. Policyholders should assess their options, considering factors such as age, family medical history, and lifestyle choices, to tailor a plan that ensures comprehensive protection during critical times.

Current Coverage Details

Critical illness coverage provides essential financial protection against serious health conditions, including cancer, heart attacks, and strokes, typically covering up to 25 different illnesses as specified by the insurance policy. Current coverage limits may cap at predetermined amounts, often ranging from $10,000 to over $500,000, depending on the policyholder's choice during enrollment. Premium costs fluctuate based on age, health status, and the level of coverage selected. The waiting period before benefits are accessible usually spans from 30 days to six months post-issue, emphasizing the need for timely application. Key entities involved include insurance companies like Aetna and Prudential, which have diverse policy options tailored for different demographic needs, including family coverage and standalone plans. Each plan often includes critical illness riders that expand coverage options beyond the primary policies, providing additional financial security when faced with life-altering health events.

Illness and Condition Specification

Critical illness coverage expansion is essential for enhancing financial protection against life-altering health events. Specific illnesses, such as heart attacks (myocardial infarction) affecting nearly 805,000 individuals each year in the United States, and strokes (cerebral vascular accidents) claiming approximately 795,000 lives annually, exemplify the importance of comprehensive coverage. Additionally, conditions like cancer, including breast cancer (with an estimated 290,000 new cases diagnosed in 2023) and prostate cancer (about 288,000 cases), warrant inclusion to ensure policyholders are adequately covered during distressing health challenges. Expanding coverage to include conditions such as end-stage renal disease (ESRD), impacting over 700,000 Americans, can address the financial burdens of dialysis and transplants. Enhancements in critical illness policies should reflect these realities to provide robust financial security and peace of mind during critical health crises.

Expansion Benefit Request

Critical illness coverage expansion offers enhanced protection against severe health conditions, such as cancer, heart attacks, or strokes, providing financial support during medical emergencies. Policyholders can consider specific ailments, including Stage 4 cancer or major organ failure, which significantly impact life expectancy and quality of life. Insurance providers may introduce additional benefits, like coverage for new medical technologies or treatments, to keep pace with advancements in healthcare. For example, gene therapy advancements and innovative cancer treatments are reshaping patient outcomes, prompting insurers to adapt their policy offerings. Expanding critical illness coverage ensures that individuals receive comprehensive support when facing life-threatening health challenges, promoting financial security and peace of mind during critical periods.

Supporting Medical Documentation

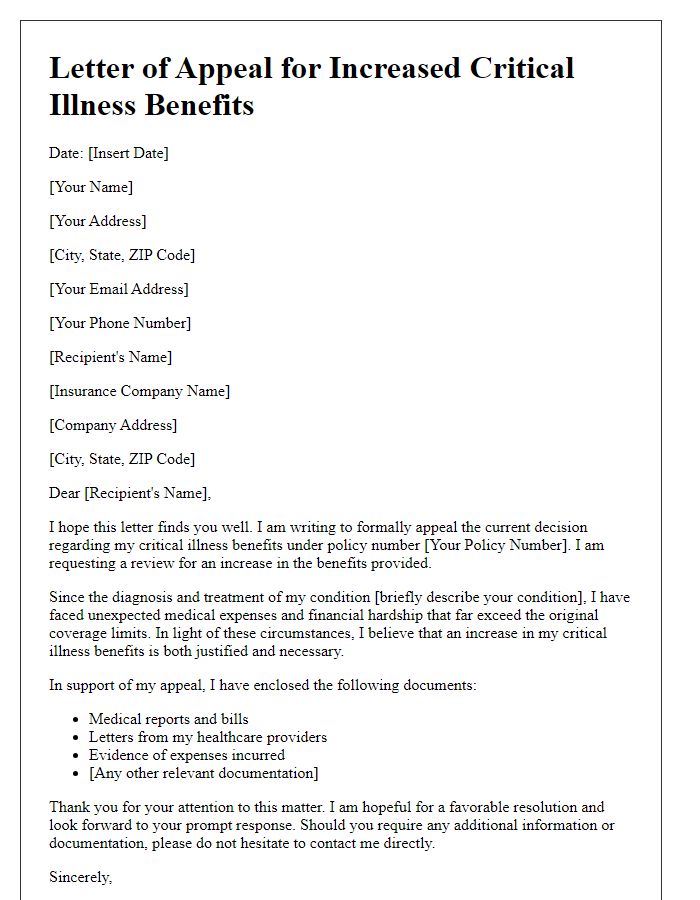

Critical illness coverage expansion requires comprehensive supporting medical documentation to ensure adequate evaluation and approval. Medical records, including detailed diagnosis reports, lab test results, and imaging studies, must be submitted to substantiate the claim. Documentation from healthcare professionals, such as specialists and treating physicians, clearly outlining the patient's condition and treatment plan is also essential. Specific critical illnesses, such as cancer, heart attack, or stroke, should be well-documented with information on stages, recommended therapies, and prognosis. Additionally, the inclusion of treatment costs, follow-up care details, and any alternative therapies utilized can provide further context to the claim. Maintenance of organized and complete documentation can significantly enhance the chances of approval for expanded coverage.

Letter Template For Critical Illness Coverage Expansion Samples

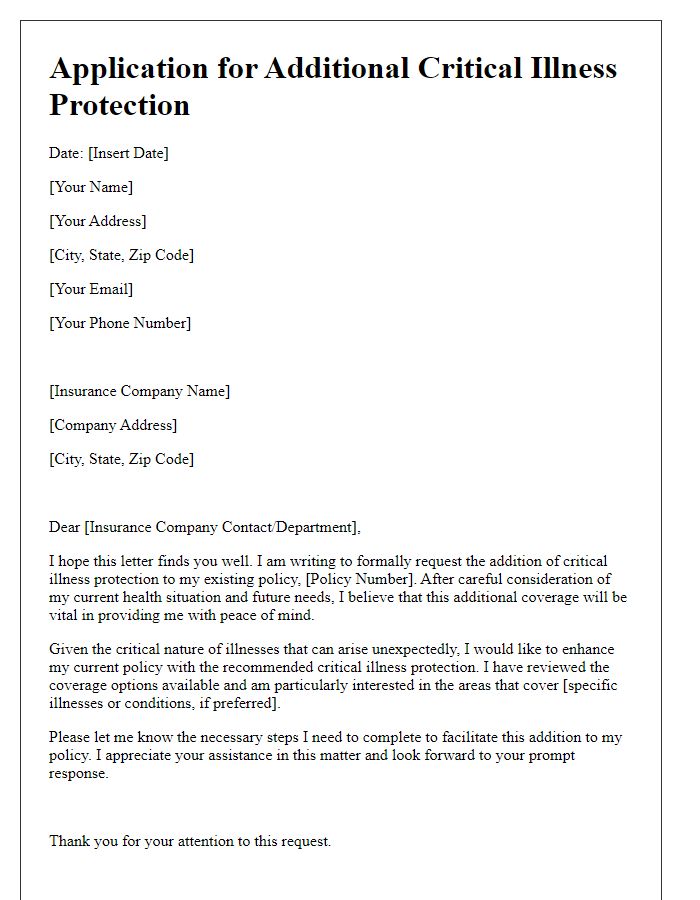

Letter template of application for additional critical illness protection

Comments