Have you ever found yourself anxiously waiting for an insurance claim to be processed, only to be met with unforeseen delays? It can be incredibly frustrating, especially when you're counting on timely support during a challenging time. In this article, we'll explore the common reasons behind these processing delays and give you practical tips to navigate the often complex insurance landscape. So, if you're looking for ways to expedite your claim and get back on track, keep reading for some valuable insights!

Policyholder Information

Insurance claim processing delays can be frustrating for policyholders, who often rely on timely assistance during unforeseen events. Claim processing at insurance companies, such as State Farm or Allstate, typically adheres to certain timelines but may encounter setbacks due to factors like high claim volumes or missing documentation. Policyholders, especially those affected by natural disasters like Hurricane Harvey or wildfires in California, may face additional stress if their claims remain unresolved. For individuals holding policies related to home insurance or auto insurance, understanding the duration of these delays, which can occasionally extend beyond 30 days, is essential for managing expectations and ensuring proper communication with the insurance provider.

Claim Details

The processing delay of insurance claims can significantly impact policyholders who are awaiting compensation for their losses. Recent statistics indicate that insurance claims for property damage, particularly those related to natural disasters like hurricanes in coastal areas such as Florida or Texas, can take weeks to process, with an average wait time exceeding 30 days. Adjusters must assess damage thoroughly, often hindered by high volumes of claims during peak seasons. Moreover, complexities such as incomplete documentation or discrepancies in reported damages can lead to additional delays. Efficient communication with the insurance company, particularly through digital platforms or dedicated claims representatives, is essential in navigating this intricate process and expediting resolution for affected clients.

Reason for Delay Inquiry

Insurance claim processing delays can cause significant frustration for policyholders awaiting resolution. Complexities in documentation assessment may arise, such as incomplete forms, missing signatures, or insufficient evidence to support the claim. Insurance adjusters often experience overwhelming workloads during peak seasons, leading to longer review times. Additionally, industry regulations (such as state-specific guidelines) may mandate thorough investigations, further prolonging the process. Communication gaps between policyholders and claims representatives can exacerbate the delay, creating uncertainty regarding claim status. Understanding the specific reasons for delays can help policyholders navigate the process more effectively.

Expected Resolution Timeline

Insurance claim processing delays can significantly impact financial stability during unforeseen events, like accidents or property damage. Typical timeframes (ranging from 30 to 90 days) for claims resolution vary based on complexity and required investigations. Each insurance company may adhere to state regulations, which can influence processing times; for example, claims in California must be addressed within 40 days as mandated by law. Effective communication with claims adjusters, who assess damages and validate claims, is crucial to understanding the timeline and complexity of specific claims. Additionally, the completion of necessary documentation, such as police reports or repair estimates, can further influence the expected resolution timeline.

Contact Information for Follow-up

Insurance claim processing delays can significantly impact individuals seeking timely resolution and compensation. Claims related to car accidents, health issues, or property damage can face delays due to various factors, including high volumes of claims, complex paperwork, or missing documentation. In 2022 alone, claims processing times averaged around 30 days but varied significantly between insurance companies. Contacting the claims adjuster or claims department directly can provide clearer insights into the status. Keeping a personal log of communication dates, times, and key details can aid in follow-ups. Providing contact information, such as email addresses and phone numbers of relevant personnel, ensures efficient communication for quicker resolution.

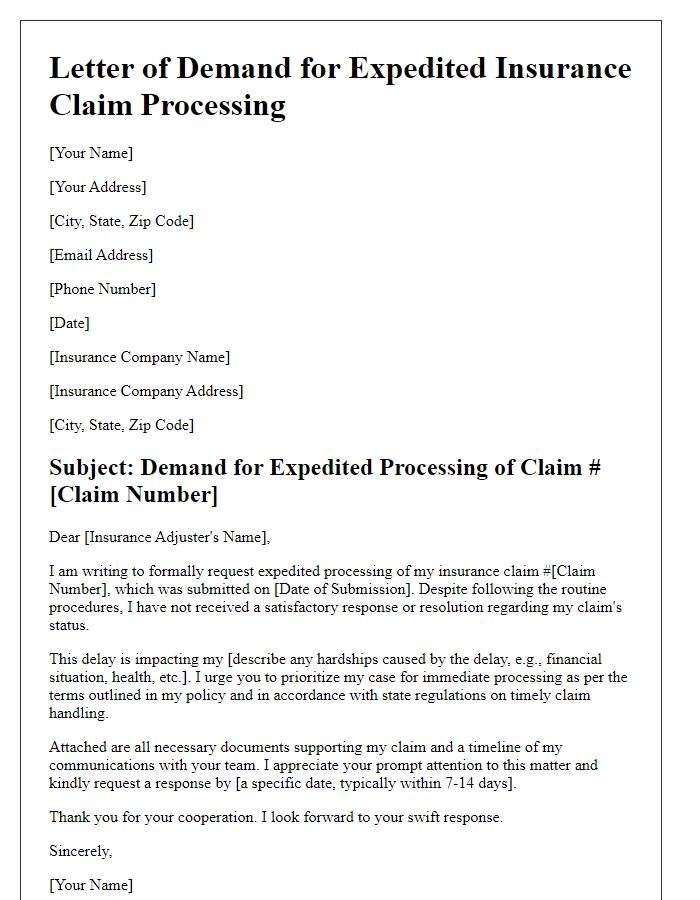

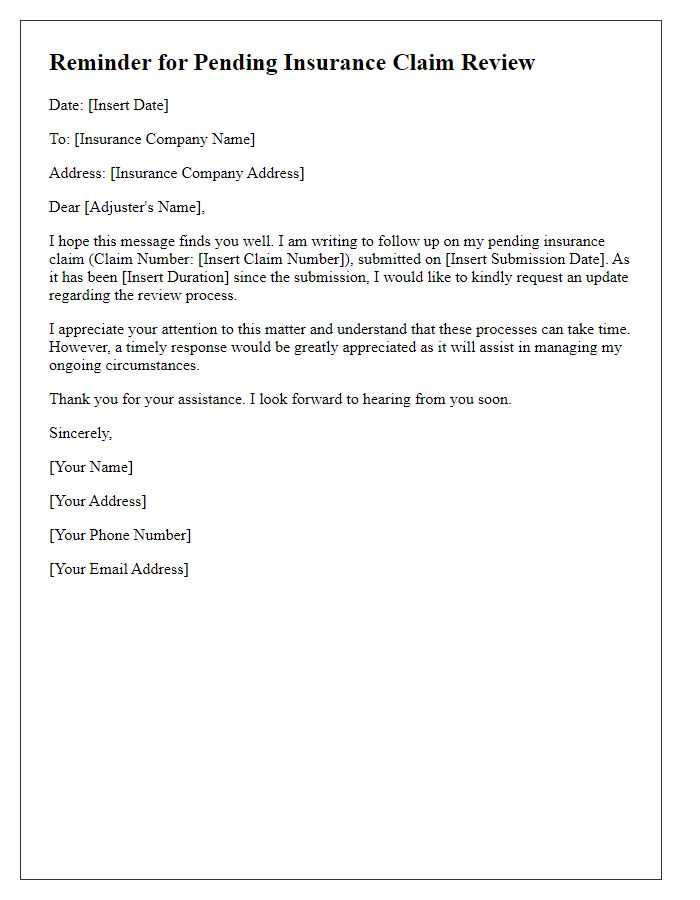

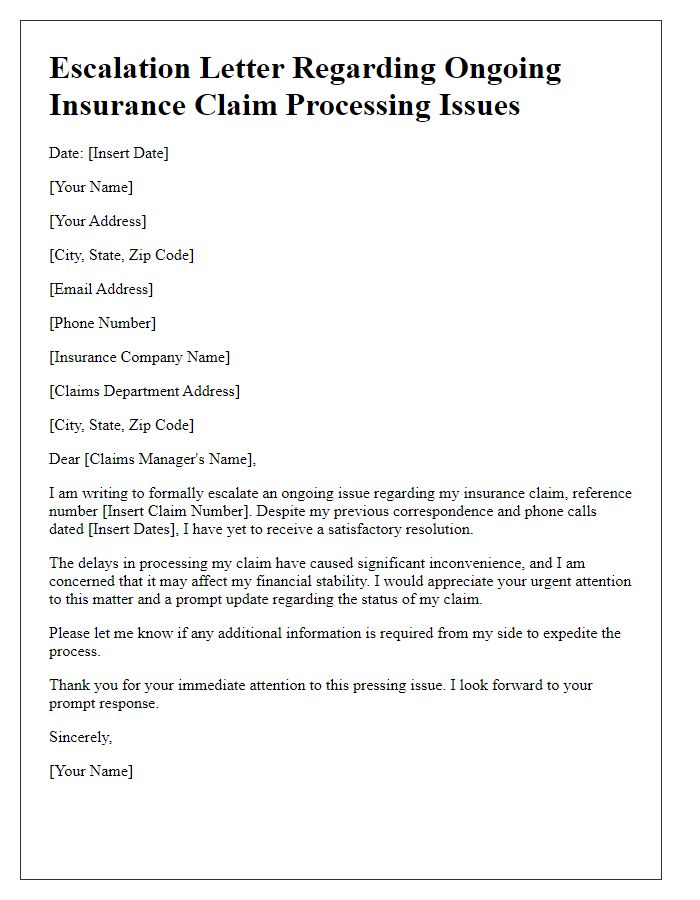

Letter Template For Insurance Claim Processing Delay Samples

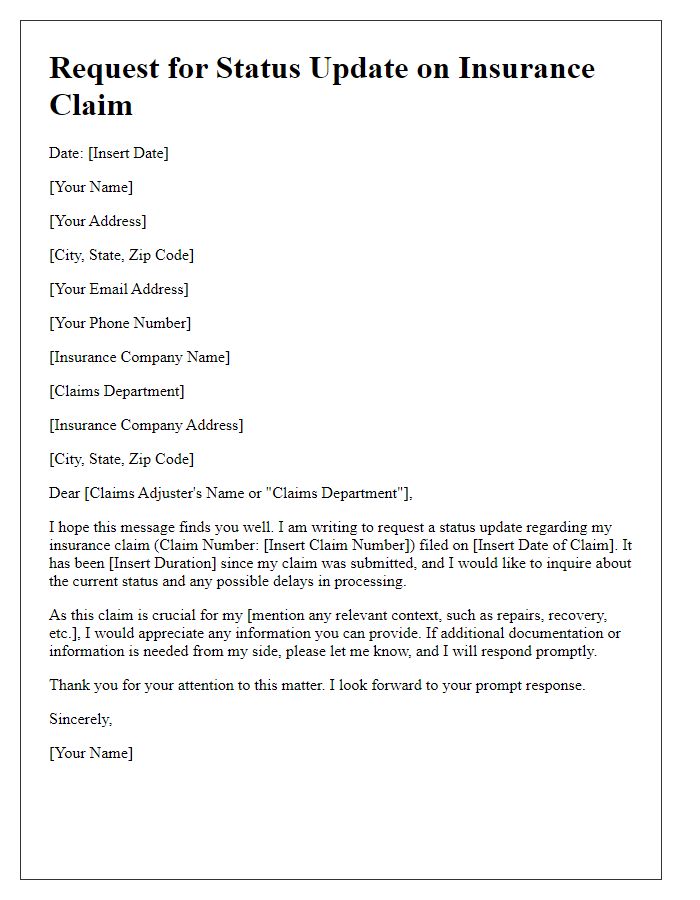

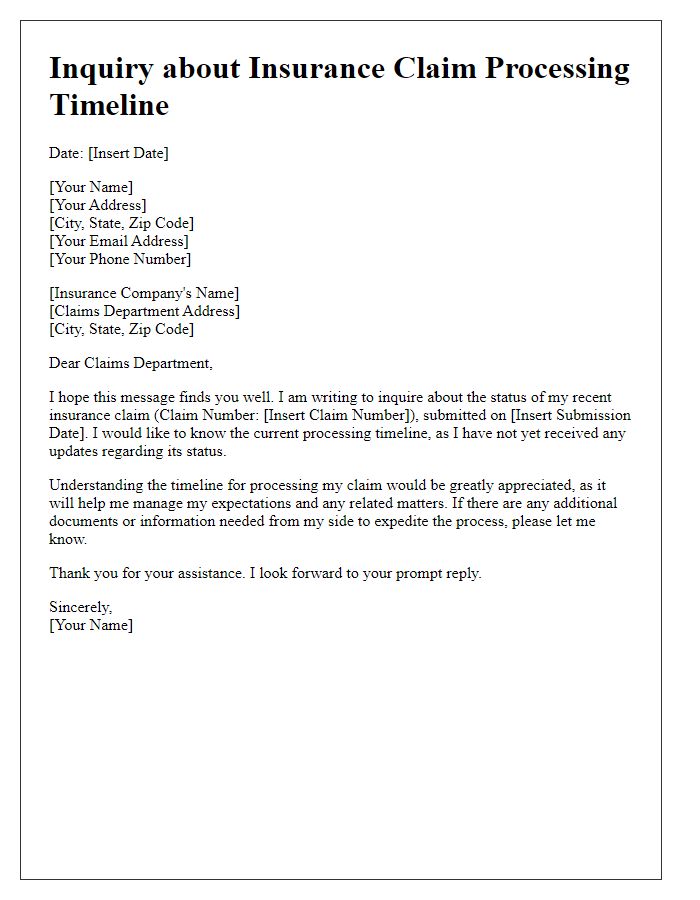

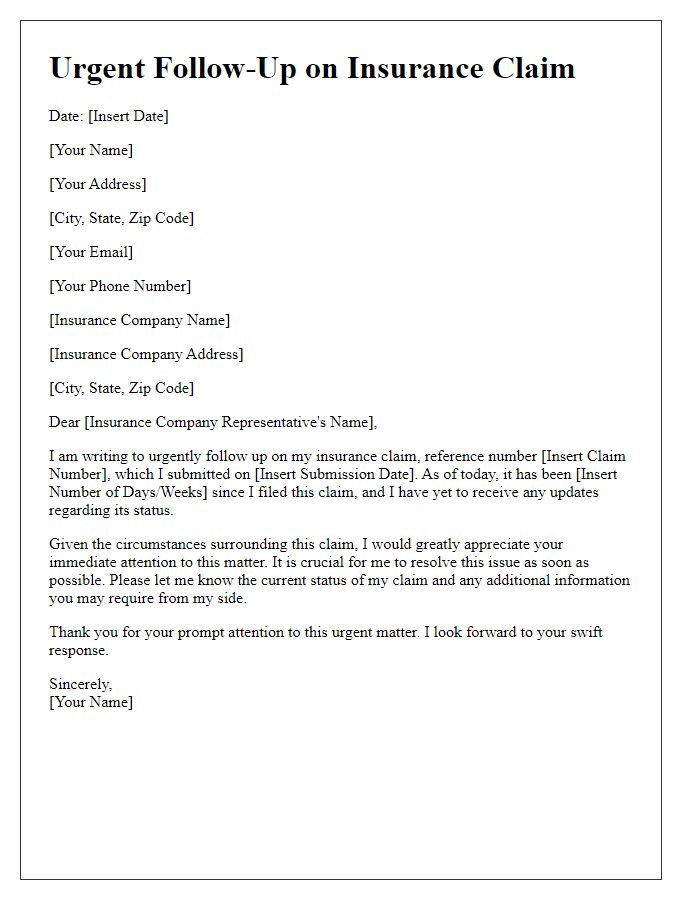

Letter template of request for status update on insurance claim processing delay

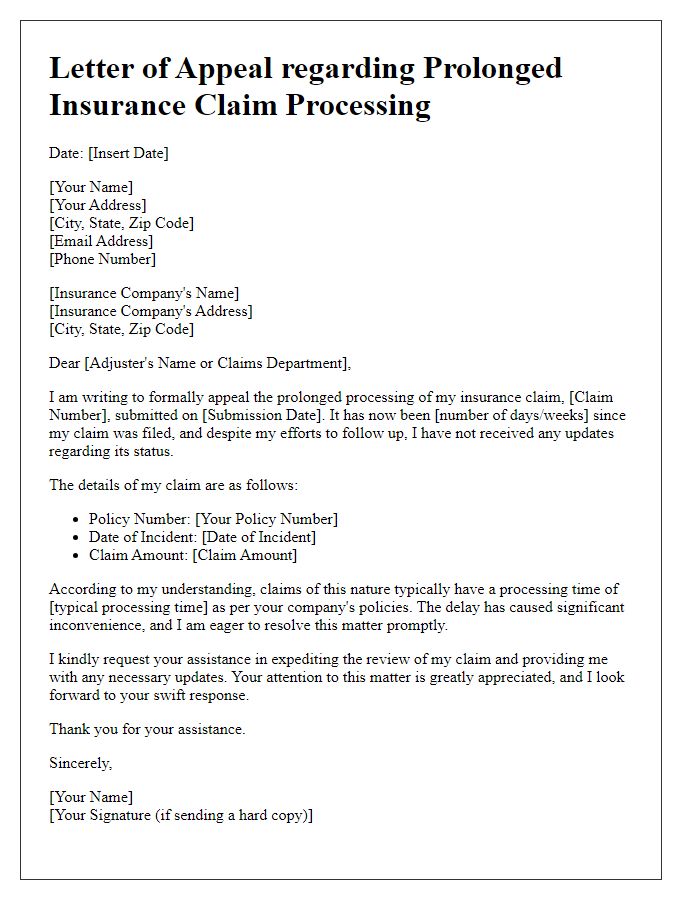

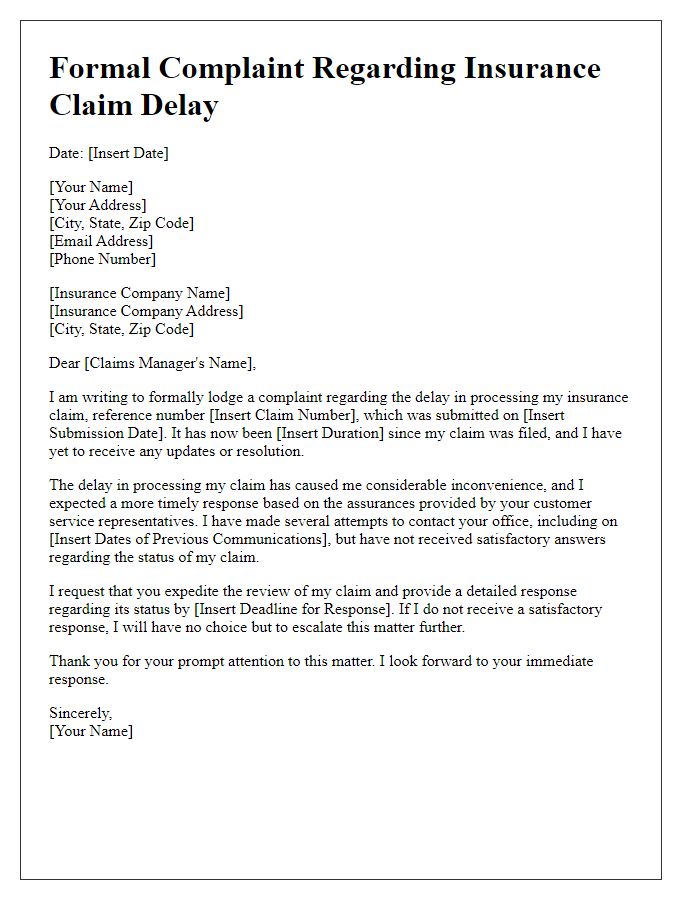

Letter template of appeal regarding prolonged insurance claim processing

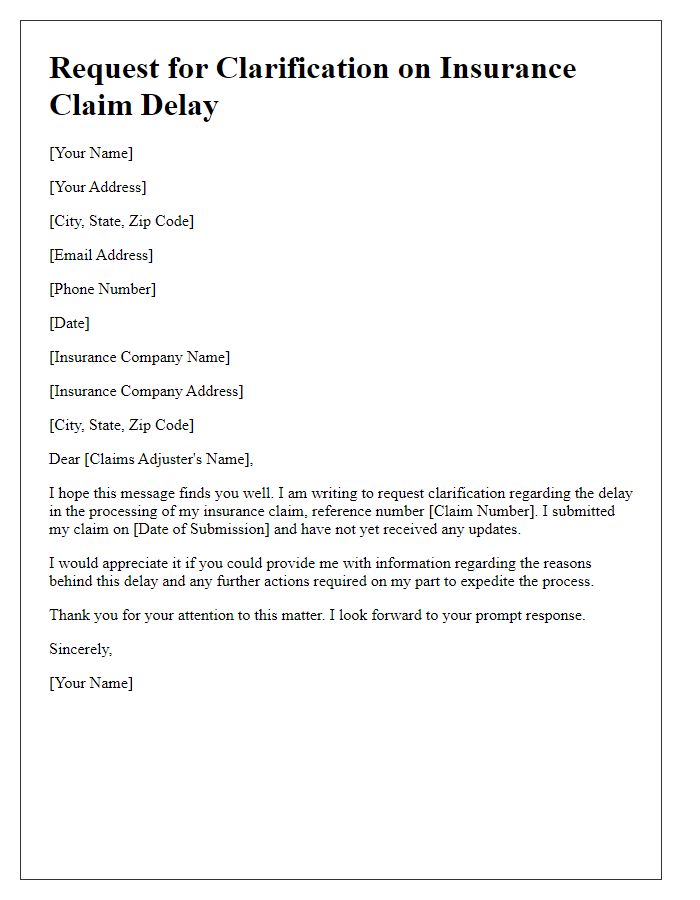

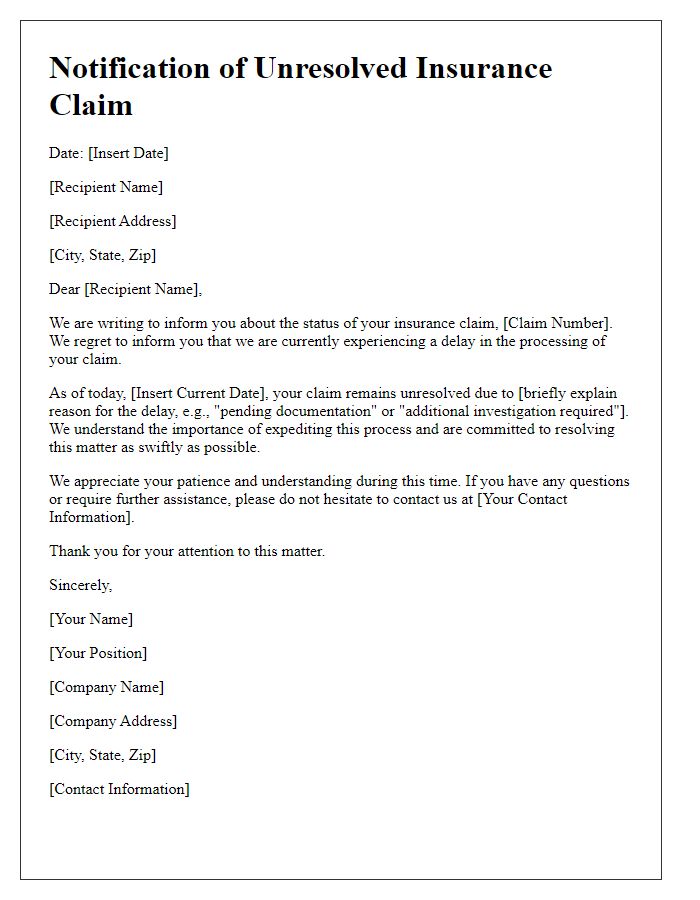

Letter template of request for clarification on insurance claim delay reasons

Comments