Hey there! If you've recently received a notice about a change in your vehicle insurance premium, you might be feeling a mix of confusion and curiosity. It's important to understand not only the reasons behind this change but also how it can affect your overall coverage. In this article, we'll break down the key factors influencing your premium adjustment and offer tips on how to navigate the process smoothly. So, stick around to learn more about making sure you're getting the best value for your insurance!

Policy Holder Information

Vehicle insurance premiums can fluctuate significantly based on various factors, including changes in individual risk assessments by insurance companies. Policyholders, such as those with policies from major insurers like State Farm or Allstate, may see adjustments due to factors like driving history, vehicle type, and claims history. A clean driving record can help maintain lower premiums, whereas factors like accidents or traffic violations may lead to increases. Additionally, updates in state regulations, such as those enacted in California or Florida, can impact overall rates. Understanding the specifics of one's policy, including coverage limits, deductibles, and applicable discounts, is crucial for policyholders to make informed decisions about their insurance options. Regularly reviewing policy terms can provide clarity on potential premium changes and ensure optimal coverage levels.

Current and Revised Premium Details

Vehicle insurance premiums can fluctuate based on various factors, including changes in risk assessment and underwriting guidelines. The current premium, assessed at $1,200 annually, may increase to $1,500 due to new market data indicating higher accident rates in urban areas. Additionally, factors such as the vehicle's make and model (for example, a 2022 Ford F-150 versus a 2021 Honda Accord), driving history of the insured, and the overall claims experience can influence these adjustments. Insurers also evaluate geographic risks, where locations like Los Angeles reporting increased theft rates can lead to premium revisions. Understanding the rationale behind these changes is crucial for policyholders to make informed decisions regarding their insurance coverage.

Reason for Premium Change

Vehicle insurance premiums can fluctuate due to various factors, including changes in risk assessment, claims history, and market trends. Insurers often revise premium rates based on geographical risk (such as urban versus rural areas), which can significantly influence costs. For instance, a shift from lower-risk locations to urban centers with higher accident rates usually results in increased premiums. Additionally, a driver's claims history impacts premiums, where multiple claims within a policy year can indicate a higher risk, leading to a surcharge. Market dynamics, such as heightened repair costs due to supply chain disruptions or natural disasters, also contribute to premium increases. Insurers may revise their pricing strategies annually, reflecting these ongoing shifts to ensure coverage remains sustainable and competitive in the industry.

Effective Date of Change

Vehicle insurance premiums can fluctuate based on several variables including market conditions, claims history, and underwriting criteria. An effective date of change is typically the specific day when a new premium rate takes effect. This date may be scheduled quarterly--common for auto insurers like State Farm or Geico--or upon policy renewal. For example, if a policyholder's premium is adjusted due to an increase in the assessed risk of their vehicle (like a higher theft rate in their area such as Los Angeles), the effective date could begin at the next billing cycle, ensuring accurate billing and compliance with state regulations. Understanding the effective date is crucial for budgeting and avoiding lapses in coverage.

Contact Information for Inquiries

Changes in vehicle insurance premiums can affect policyholders significantly. Insurers typically evaluate factors such as claims history, coverage limits, and market trends when determining premium adjustments. For example, a recent comprehensive study showed that California experienced an average increase in car insurance rates of 3% within the last year, driven by higher repair costs and increased traffic incidents. In case of specific inquiries regarding these changes, policyholders should contact the customer service department of their insurance provider, usually accessible via a dedicated phone line listed in policy documents or on the company website, ensuring timely and accurate information related to their individual circumstances.

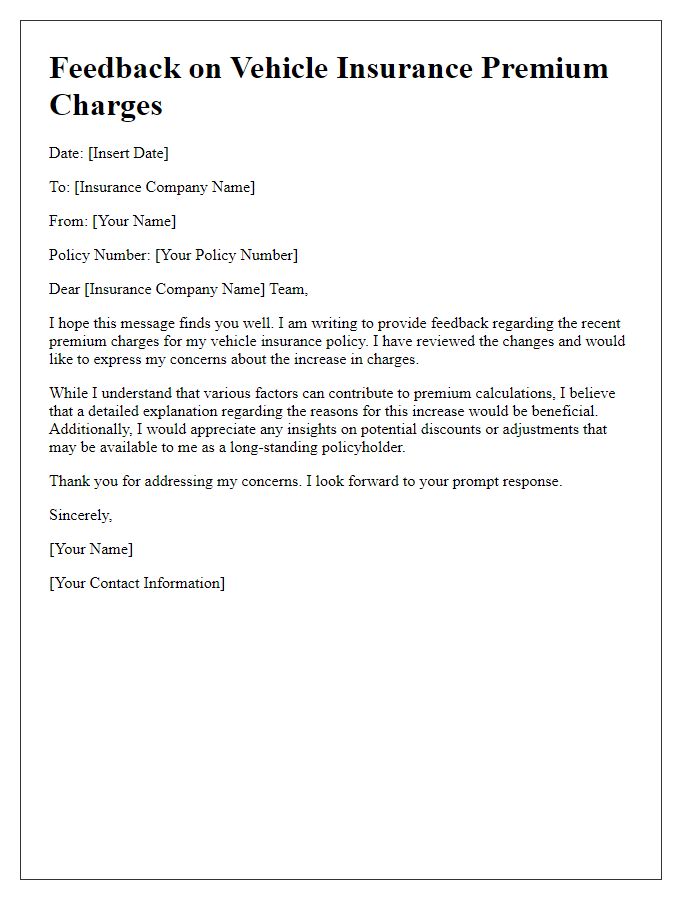

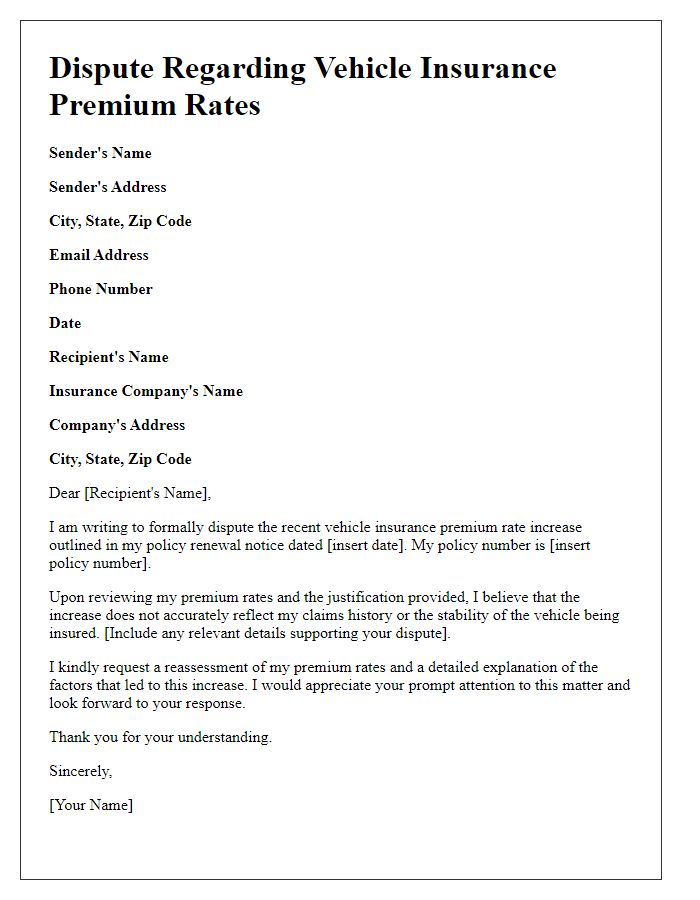

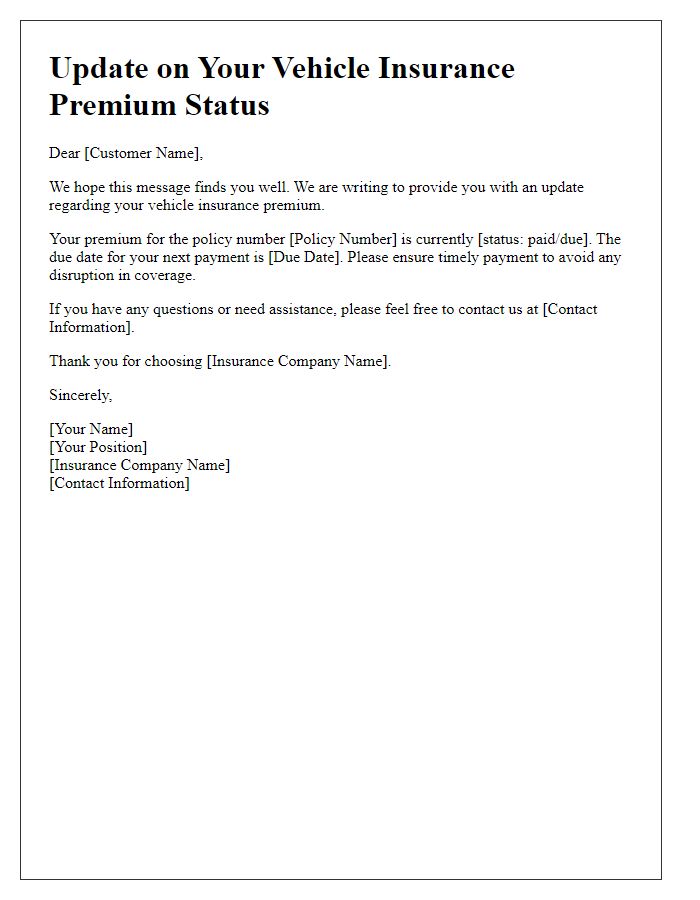

Letter Template For Vehicle Insurance Premium Change Samples

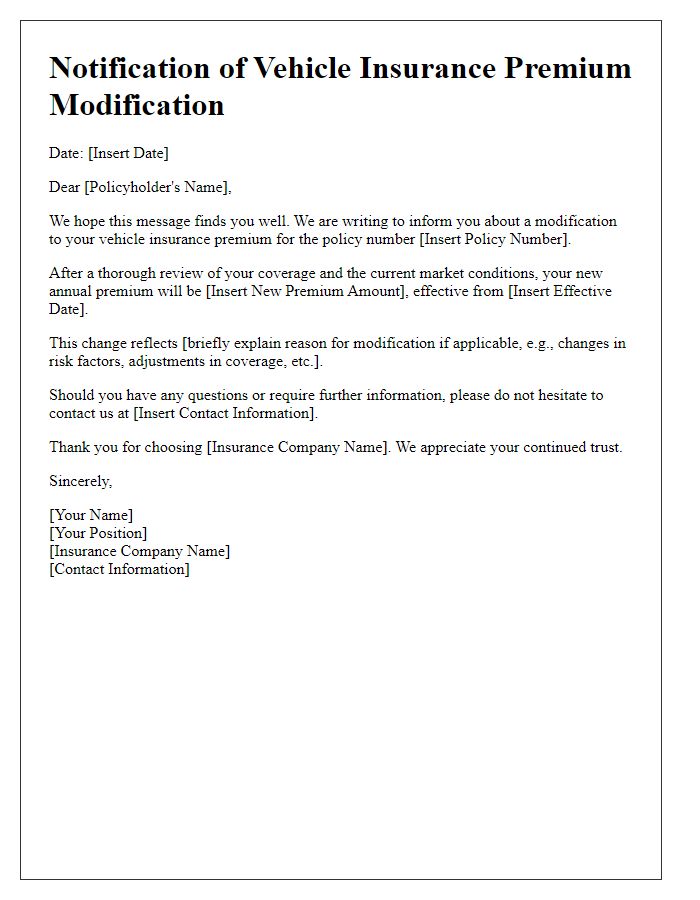

Letter template of notification for vehicle insurance premium modification

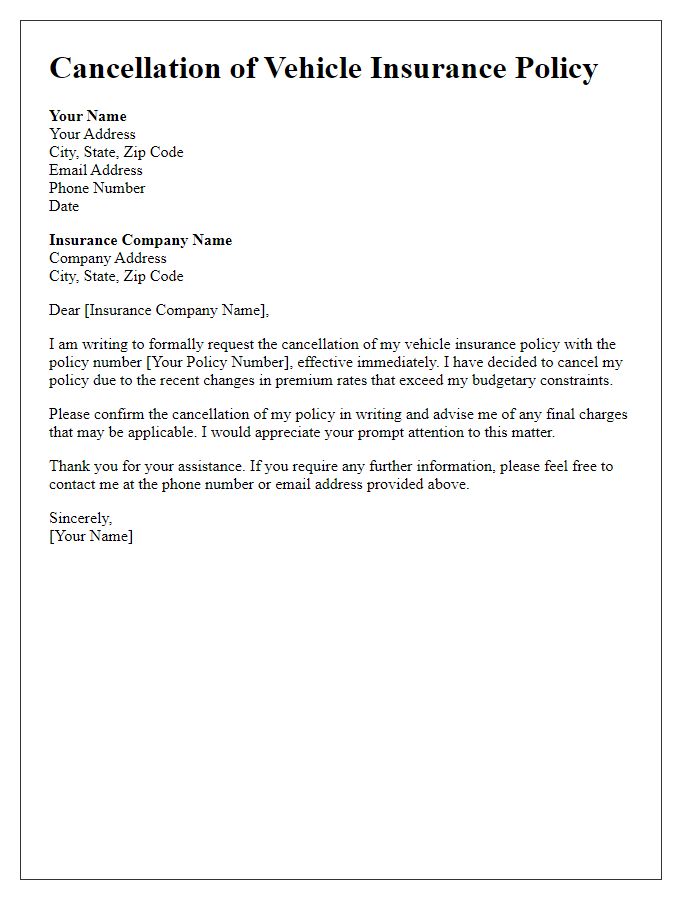

Letter template of cancellation of vehicle insurance policy due to premium change

Comments