When considering a franchise opportunity, it's crucial to evaluate the potential risks that come along with it. A thorough risk assessment report will help you identify any red flags and understand the challenges you might face as a franchisee. By examining financial stability, market conditions, and franchisee support, you can make informed choices that align with your goals. Ready to dive deeper into the world of franchise risk assessment? Let's explore this essential topic further!

Executive Summary

Franchise risk assessment reports provide essential insights for prospective franchisees. The evaluation examines critical elements including financial stability, brand reputation, operational procedures, and legal compliance. Market dynamics, particularly regional competitiveness (analyzing over 50 franchises in North America), influence decision-making. Economic indicators demonstrate risks related to fluctuations in consumer spending, particularly during recessionary periods. Additionally, franchise relationships warrant scrutiny, where disputes can arise from miscommunication or contractual ambiguities. A thorough assessment considers the potential impact of competitive threats from emerging brands and market saturation. Ultimately, identifying these risks allows stakeholders to make informed decisions and strategize effectively for long-term success.

Market Analysis

Market analysis involves evaluating industry trends, consumer behavior, and competitive landscape to identify potential risks and opportunities for franchise operations. The global franchise market is expected to grow significantly, with the International Franchise Association predicting a 6.1% increase in revenue in 2023, reaching approximately $500 billion in total economic output. Key consumer demographics vary depending on geographic regions; for instance, Millennials (ages 26-41 in 2023) show strong preferences for brands that emphasize sustainability and transparency. Moreover, competitor analysis reveals a significant presence of established franchises in fast-food sectors, necessitating differentiation. Emerging markets, particularly in Southeast Asia, present opportunities due to rising disposable incomes, while regulatory challenges in specific countries might pose risks. Understanding local market dynamics, including supply chain constraints and cultural nuances, is critical for mitigating risks and ensuring successful franchise expansion.

Financial Evaluation

Financial evaluations play a critical role in franchise risk assessments by analyzing key metrics such as initial investment amounts, ongoing royalty fees, and projected revenue streams. First-year profit margins typically range from 5% to 15% depending on the franchise model. Sensitivity analysis examines various scenarios, like economic downturns, that could impact financial stability. Cash flow projections for the first three years provide insights into the franchise's liquidity and overall financial health. Industry benchmarks, such as average sales per unit in the fast-food sector, often aid in comparative analysis. Additionally, historical performance data from existing franchisees across multiple locations helps assess long-term viability, reducing inherent investment risks in the franchise business model.

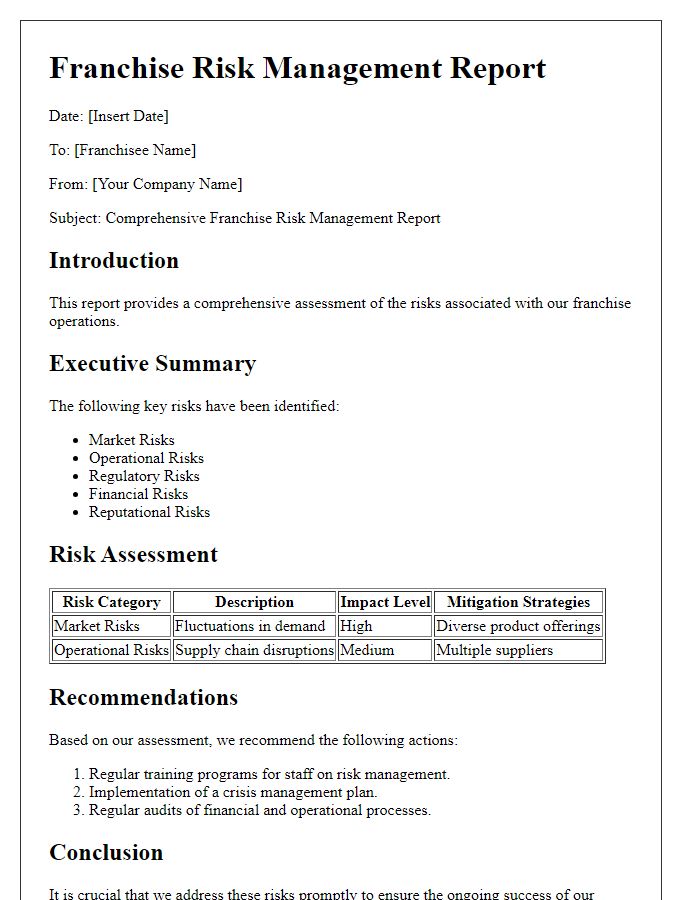

Operational Risk Factors

Operational risk factors in franchise environments can significantly influence overall business performance and stability. Factors such as inadequate training programs can lead to inconsistencies in service delivery across franchise locations, with potential revenue losses of up to 25% per underperforming unit. Compliance with operational standards is critical; non-adherence can result in penalties, damaged reputation, and even franchise termination, especially in heavily regulated industries like food service. Supply chain disruptions, particularly in high-demand markets like California, can cause delays in product availability, impacting customer satisfaction and sales. Additionally, technology failures, such as Point of Sale (POS) system outages, can halt transactions entirely, leading to losses of thousands of dollars in peak hours. Effective risk management strategies are essential to mitigate these operational challenges and ensure sustainable franchise success.

Regulatory and Compliance Considerations

Franchise risk assessment reports require meticulous attention to regulatory and compliance considerations that impact franchise operations. Legal frameworks in various regions, such as the Federal Trade Commission (FTC) guidelines in the United States, establish guidelines for franchise offerings and sales. Compliance with state-specific franchise laws, like California's Franchise Investment Law, is essential to avoid penalties. Franchisees must adhere to health and safety regulations including OSHA standards, safeguarding employees and customers in operational locations. The significance of intellectual property protection, including trademarks registered with the United States Patent and Trademark Office (USPTO), cannot be overlooked, ensuring brand integrity. Additionally, understanding international regulatory requirements may be pertinent for franchises operating across borders, adhering to laws such as the European Union's General Data Protection Regulation (GDPR) to protect customer data. Comprehensive awareness of these parameters will mitigate risks associated with non-compliance, ultimately safeguarding the franchise's reputation and operational stability.

Comments