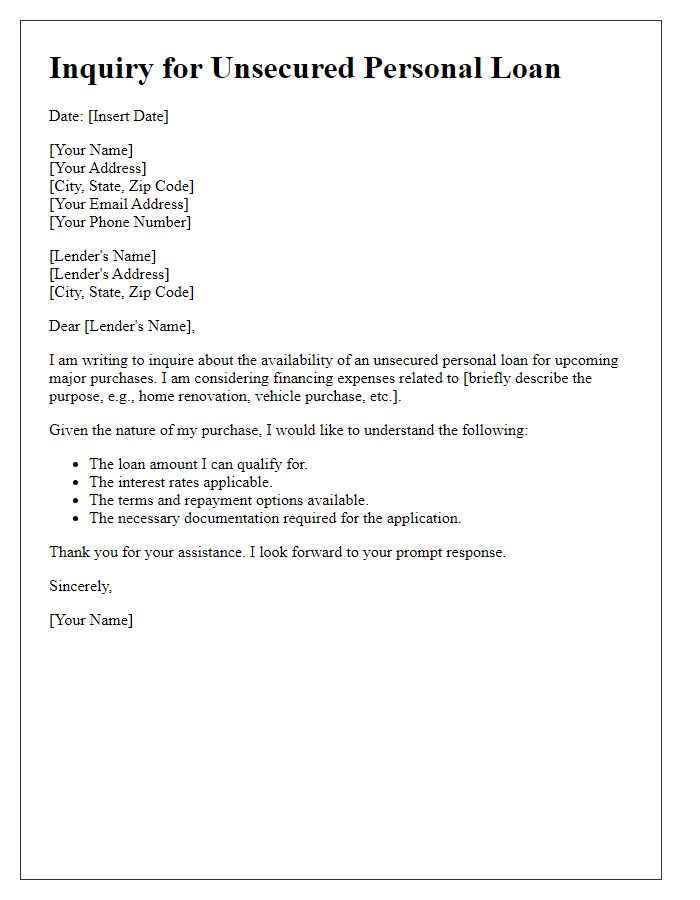

Are you considering applying for an unsecured personal loan but feeling unsure about where to start? You're not aloneâmany people find the process overwhelming with all the options available. In this article, we'll break down the essential steps for crafting an effective inquiry letter that can help you secure the funds you need. So, if you're ready to take the leap into the world of personal financing, read on for simple tips and templates!

Purpose of the Loan

When seeking an unsecured personal loan, identifying the purpose can significantly influence the approval process. Common purposes for these loans include consolidating high-interest debts, covering unexpected medical expenses, financing home improvements, and funding educational pursuits. Loan amounts typically range from $1,000 to $50,000, depending on the lender and borrower's creditworthiness. It is essential to provide clear, detailed explanations for the intended use of funds, as lenders assess risk based on how the loan will be utilized. Personal loans usually have a fixed interest rate, which can vary from 5% to 36%, affecting monthly payments and total repayment amounts. Understanding these factors assists borrowers in conveying their needs effectively.

Loan Amount Requested

Unsecured personal loans provide borrowers with funds without the requirement of collateral or asset backing, often ranging from $1,000 to $50,000 depending on the lender's terms and the borrower's creditworthiness. The application process typically involves submitting financial details, including income and expenses, to evaluate the loan amount requested. Lenders assess credit scores, usually ranging from 300 to 850, to determine eligibility and interest rates. Key factors in the decision-making process also include debt-to-income ratios, which ideally should be below 36%, and employment stability, emphasizing the importance of consistent income sources. Approval times can vary from a few hours to a few days, depending on the lender's policies, providing borrowers with flexibility in addressing urgent financial needs.

Personal Financial Information

Personal financial information, crucial in assessing eligibility for an unsecured personal loan, includes various key elements. Annual income, typically documented through recent pay stubs or tax returns, reflects financial stability and capacity to repay, often benchmarked by lenders against established minimum income thresholds. Credit score, a pivotal numerical representation of creditworthiness derived from credit reporting agencies such as Equifax, Experian, and TransUnion, significantly influences loan approval and interest rates, with scores above 700 generally categorized as good. Debt-to-income ratio, calculated by dividing monthly debt payments by gross monthly income, provides insight into financial obligations, with ratios ideally remaining below 36% for favorable loan terms. Employment history, spanning at least two years in the same role or industry, demonstrates job stability and promotes lender confidence. Additionally, personal savings or other assets may be evaluated to ascertain overall financial health and contingency plans in case of unforeseen circumstances.

Repayment Ability

An unsecured personal loan inquiry often requires detailed consideration of repayment ability, which is critical for lenders assessing risk. Factors influencing this assessment include the borrower's monthly income, total monthly expenses, existing debt obligations (such as credit card balances or mortgage payments), and employment stability (duration at current job). Credit score, which indicates financial health and borrowing history, also plays a significant role. Lenders typically analyze the debt-to-income ratio (DTI), a percentage that compares total monthly debt payments to gross monthly income, ideally below 36%. Additional assets, such as savings accounts or investment portfolios, can demonstrate financial resilience, providing assurance to lenders regarding the borrower's capability to meet loan obligations responsibly.

Contact Information

Unsecured personal loans offer borrowers financial flexibility without the need for collateral. Potential lenders in the United States, such as banks and online financial institutions, evaluate creditworthiness based on factors like credit score (ranging from 300 to 850), income level, and existing debt-to-income ratio (ideally below 36%). Borrowers typically seek amounts between $1,000 to $50,000 with terms varying from 1 to 7 years. Interest rates (varying significantly based on credit scores, starting around 5% to upwards of 36%) play a crucial role in determining repayment amounts. Understanding fees, such as origination fees (which can be 1% to 8% of the loan amount), is essential for assessing overall loan costs.

Letter Template For Unsecured Personal Loan Inquiry Samples

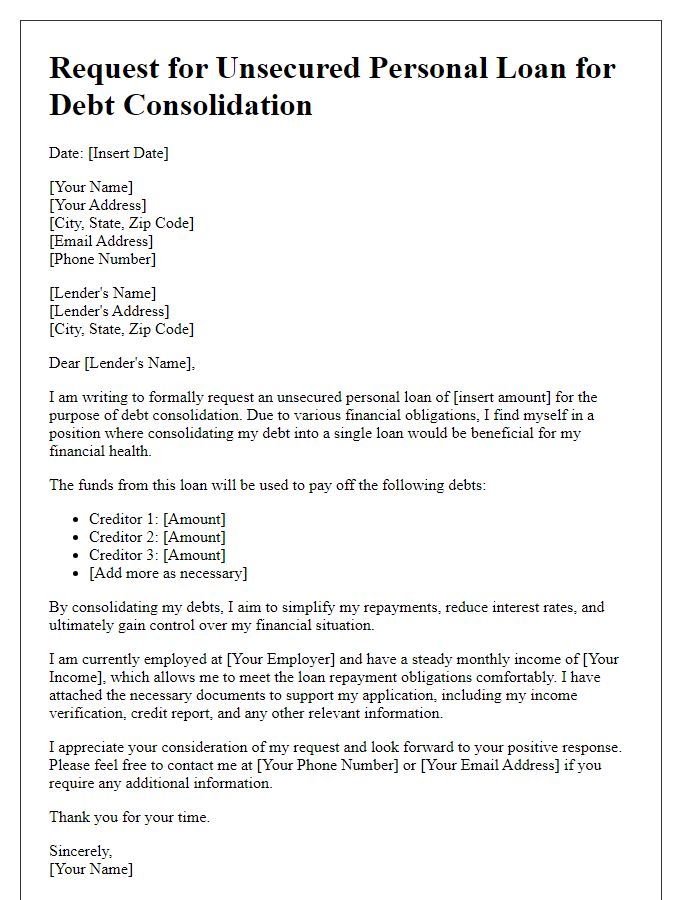

Letter template of unsecured personal loan request for debt consolidation.

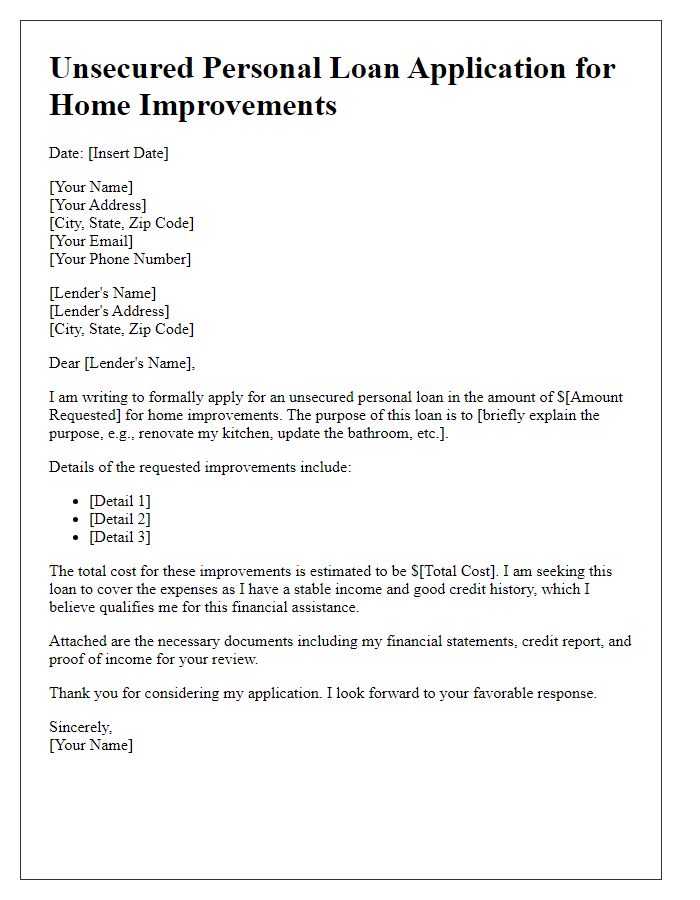

Letter template of unsecured personal loan application for home improvements.

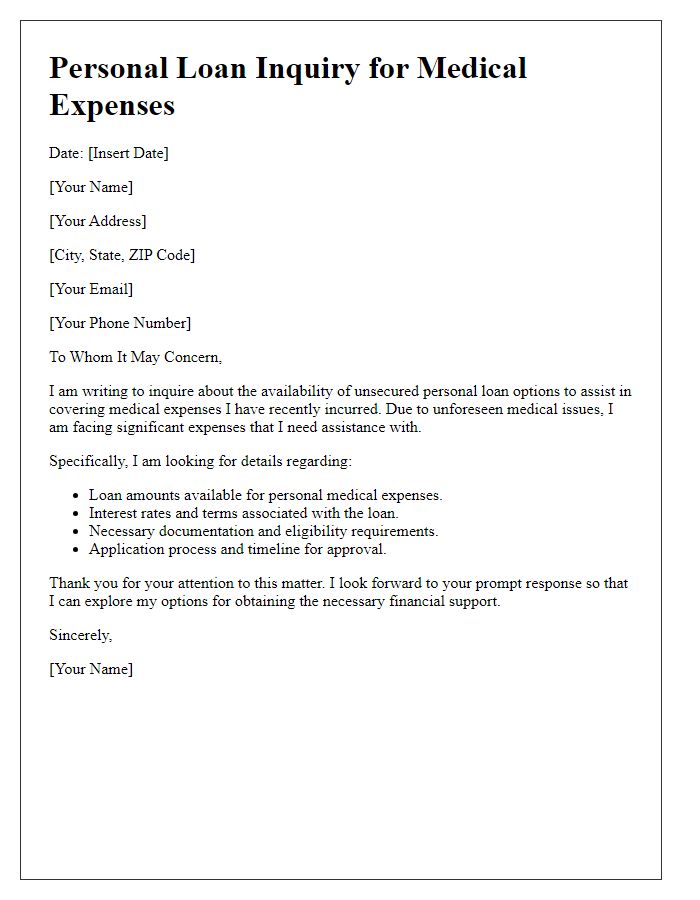

Letter template of unsecured personal loan inquiry for medical expenses.

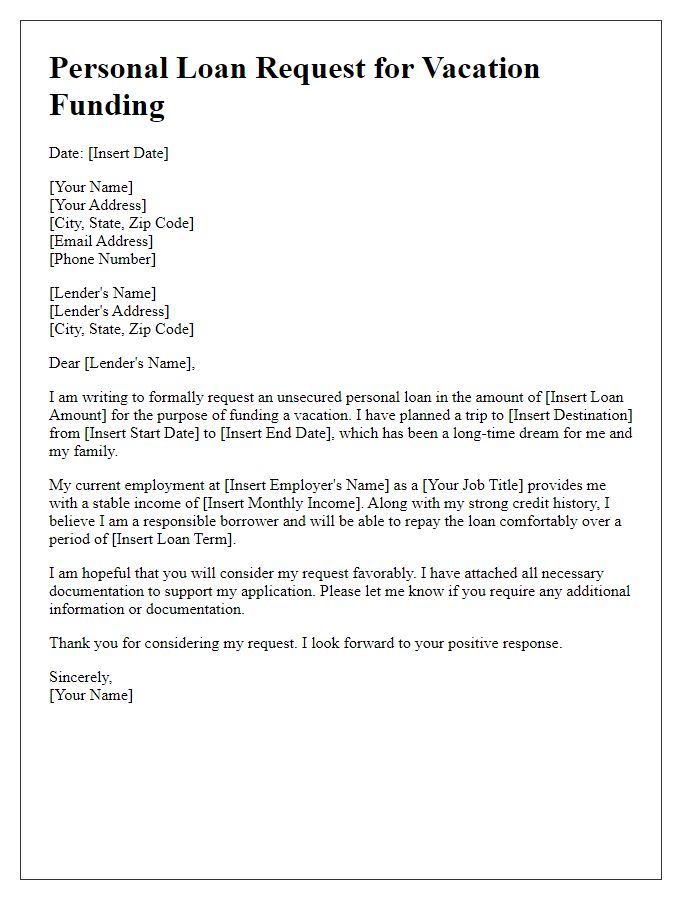

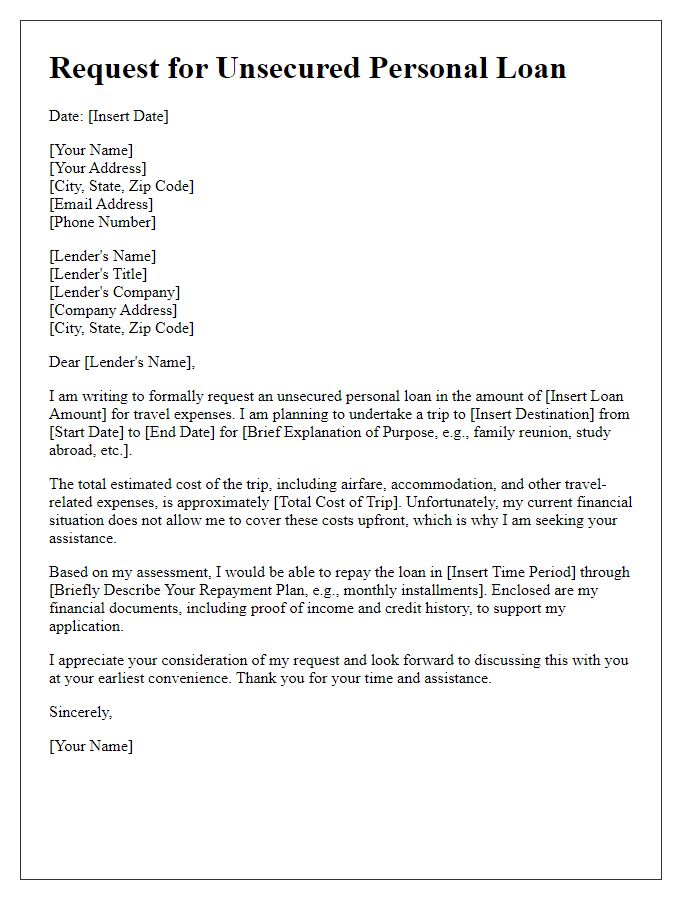

Letter template of unsecured personal loan request for vacation funding.

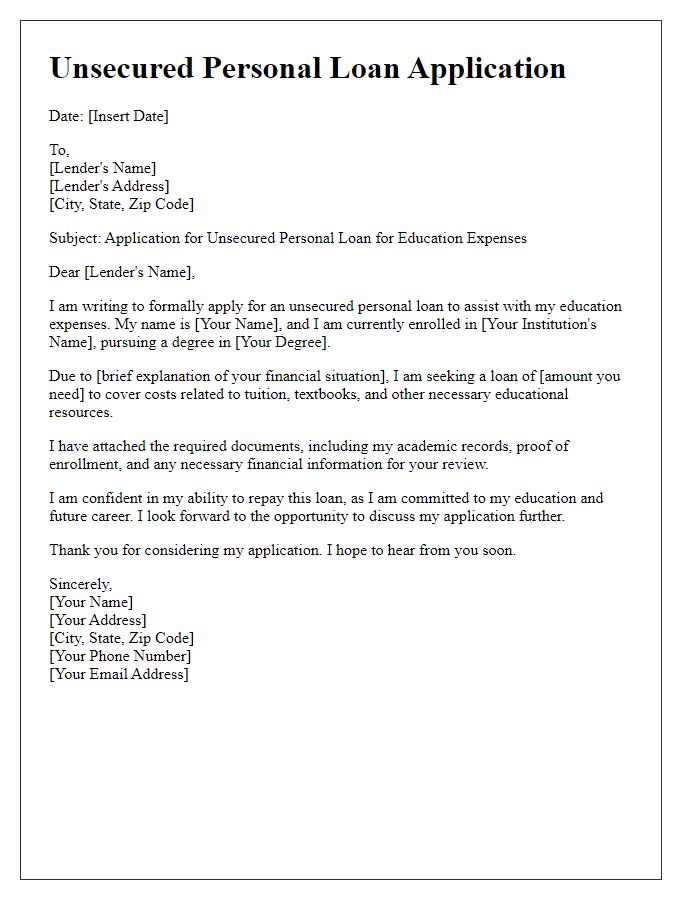

Letter template of unsecured personal loan application for education expenses.

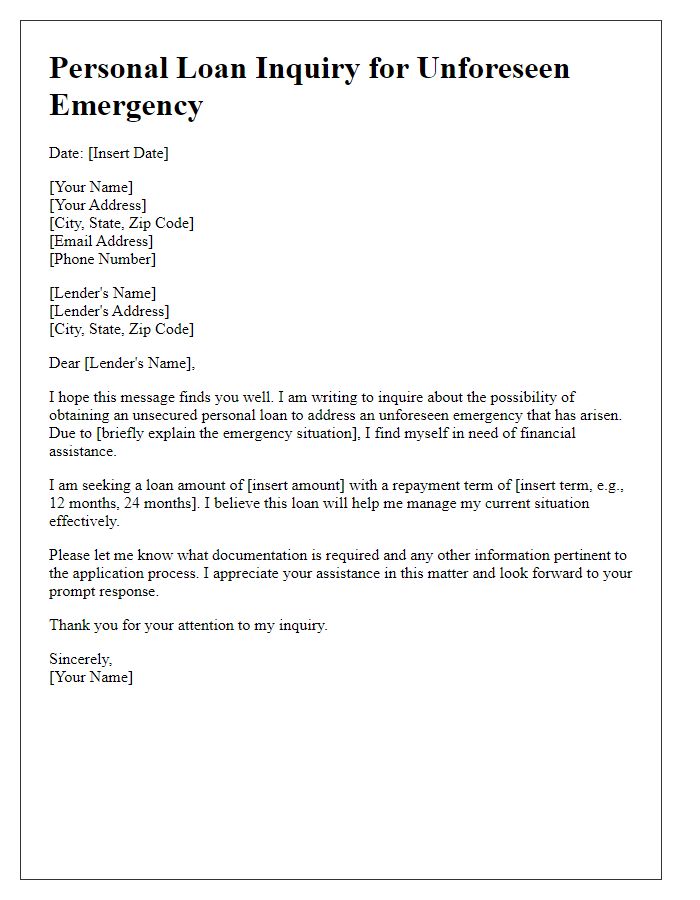

Letter template of unsecured personal loan inquiry for unforeseen emergencies.

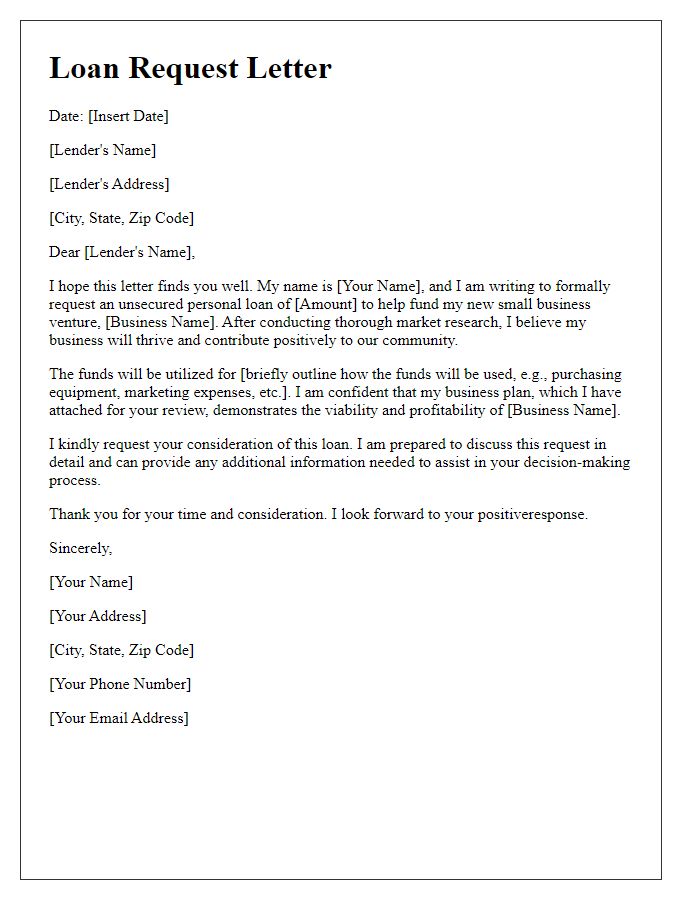

Letter template of unsecured personal loan request for starting a small business.

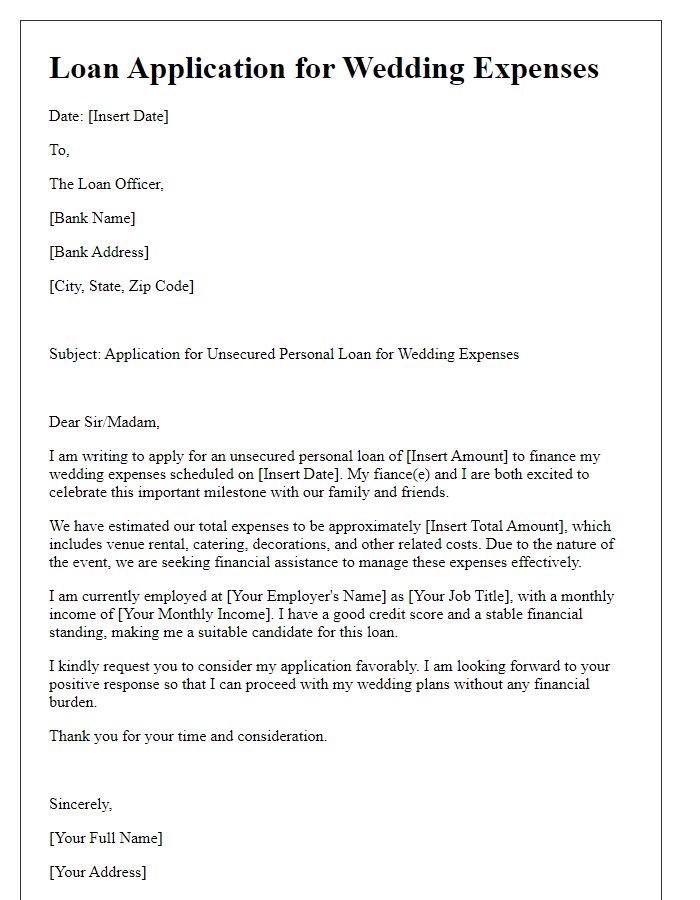

Letter template of unsecured personal loan application for wedding expenses.

Comments