Have you ever found a mysterious charge on your bank statement that just didn't add up? Dealing with unauthorized loan charges can be both frustrating and confusing, especially when you weren't expecting any new debt. In this article, we'll guide you through the essential steps to dispute those unwelcome charges and reclaim your peace of mind. Ready to learn how to take control of your finances? Let's dive in!

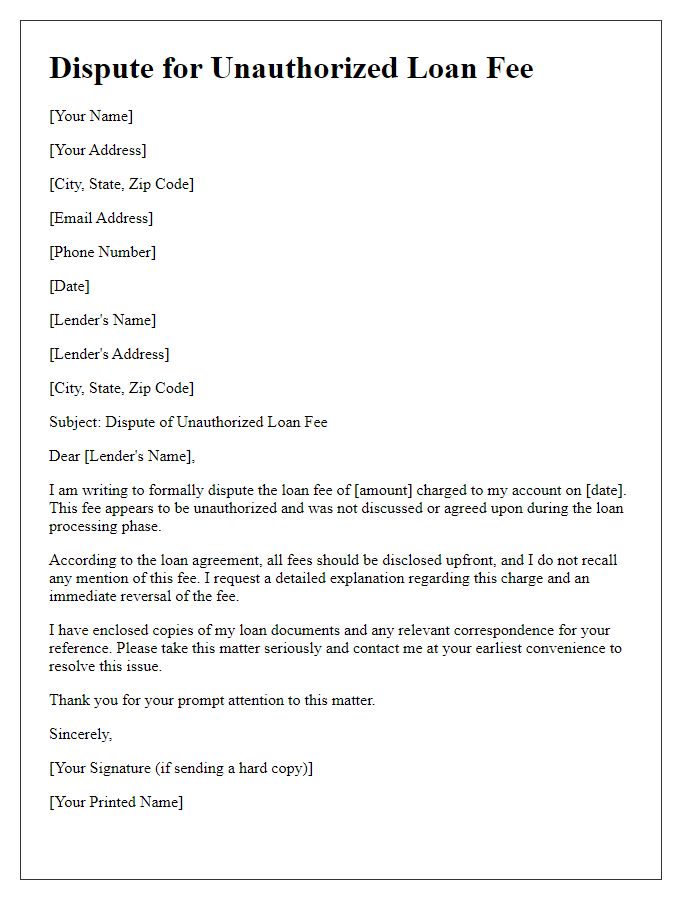

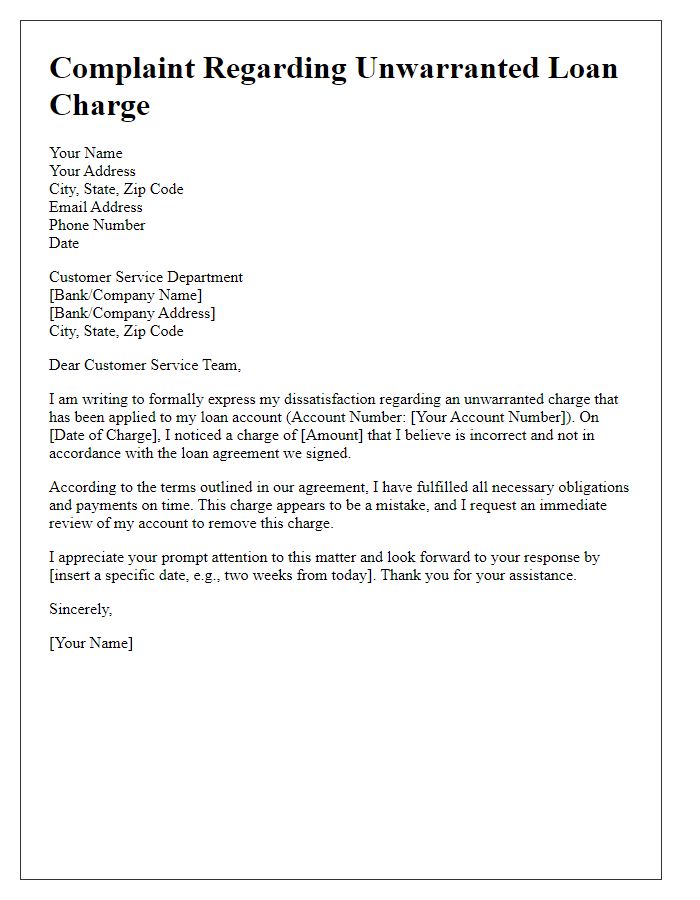

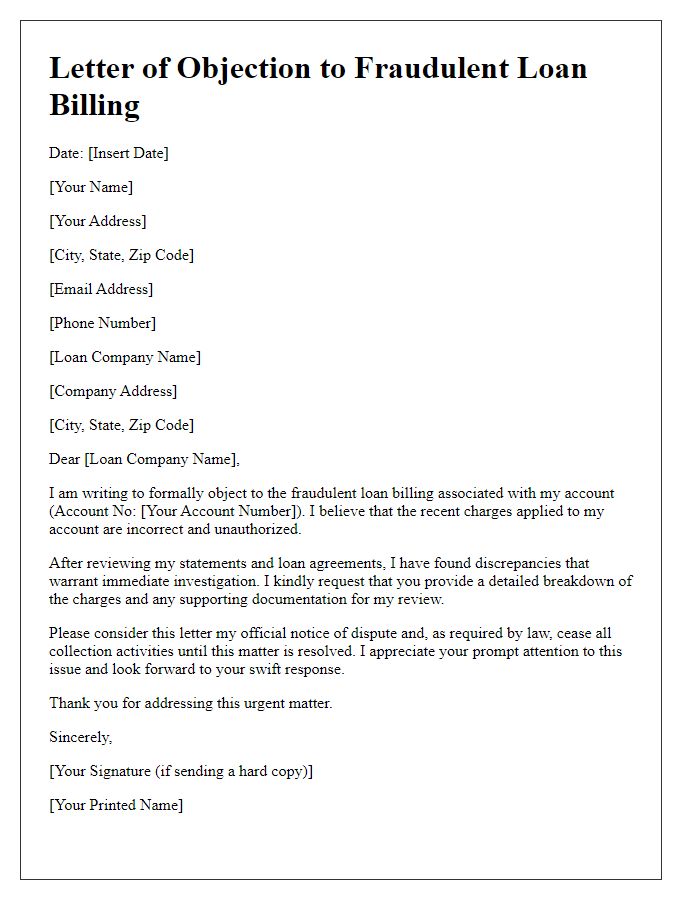

Account Information

Unauthorized loan charges can significantly impact personal finances, causing distress and uncertainty for those affected. Account information, including detailed statements, should be thoroughly reviewed to identify discrepancies related to the disputed charges. Key entities such as the lending institution, account numbers, transaction dates, and amounts must be accurately documented to support the dispute. Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) encourage consumers to report unauthorized activity promptly. A formal dispute process may involve submitting evidence through online platforms or via certified mail to ensure acknowledgment of the claim by the lender. Understanding one's rights under the Fair Credit Reporting Act (FCRA) can be instrumental in navigating these challenging situations.

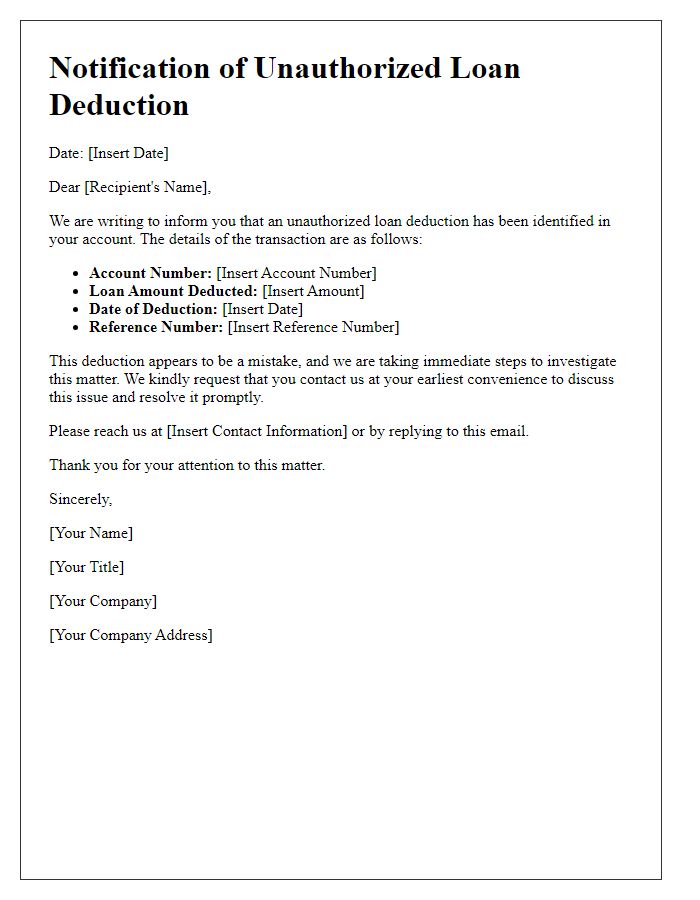

Unauthorized Charge Details

Unauthorized loan charges can lead to significant financial distress for consumers. A common scenario occurs when individuals discover unexpected withdrawals from their bank accounts related to loans, often linked to predatory lending practices. Detailed examination may reveal unauthorized charges, such as fees for loan processing or interest rates exceeding legal limits, which can amount to hundreds or even thousands of dollars. Regulatory bodies, like the Consumer Financial Protection Bureau (CFPB) in the United States, provide resources to dispute such charges effectively. Consumers in these situations should document transaction dates, amounts, and any communication with lenders or financial institutions, ensuring they have a comprehensive record to support their claim. Reporting these discrepancies to credit bureaus can prevent potential damage to credit scores, providing a safeguard for financial integrity.

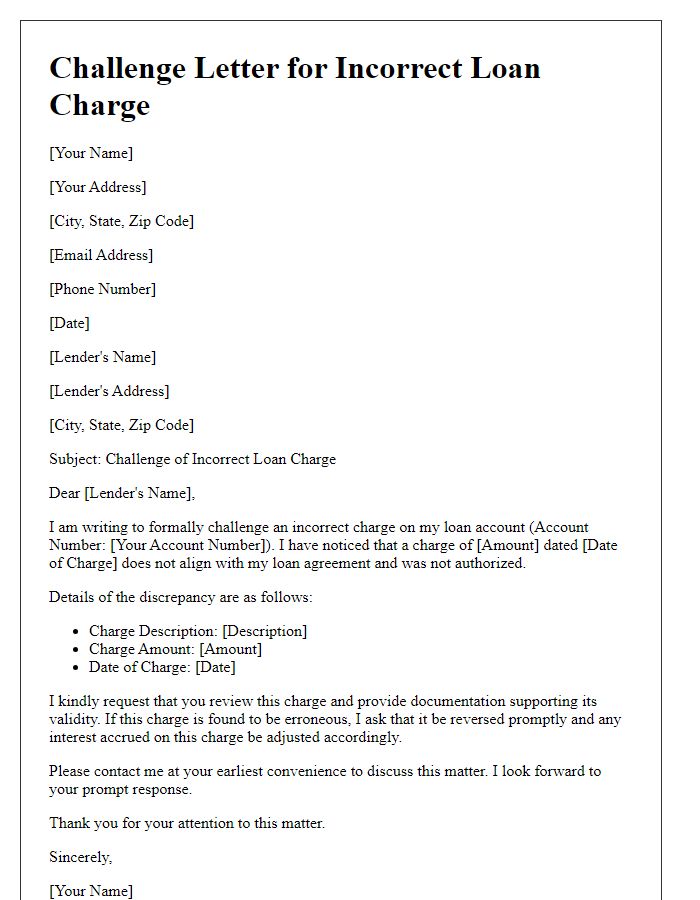

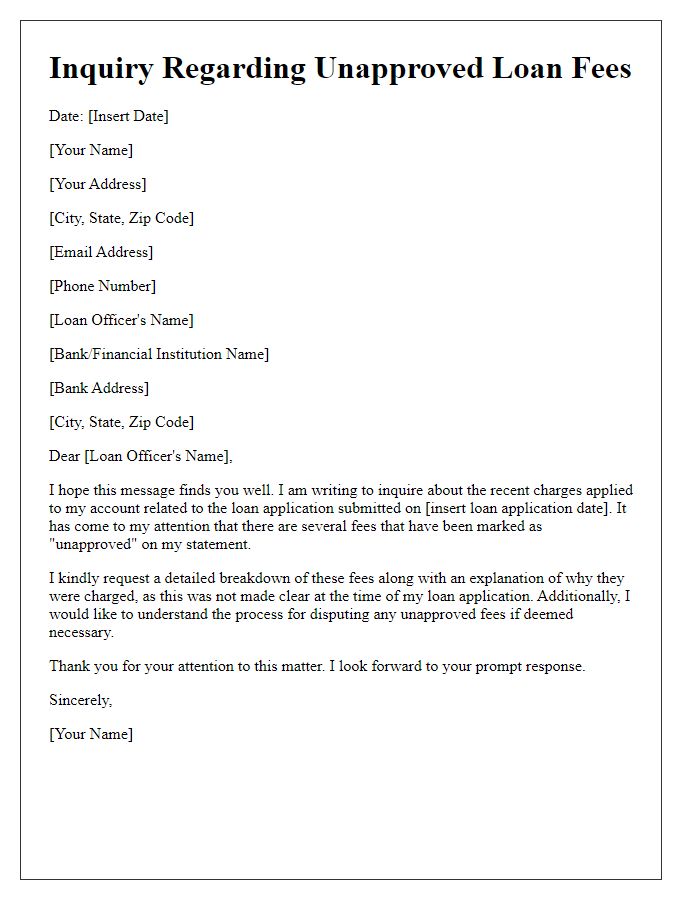

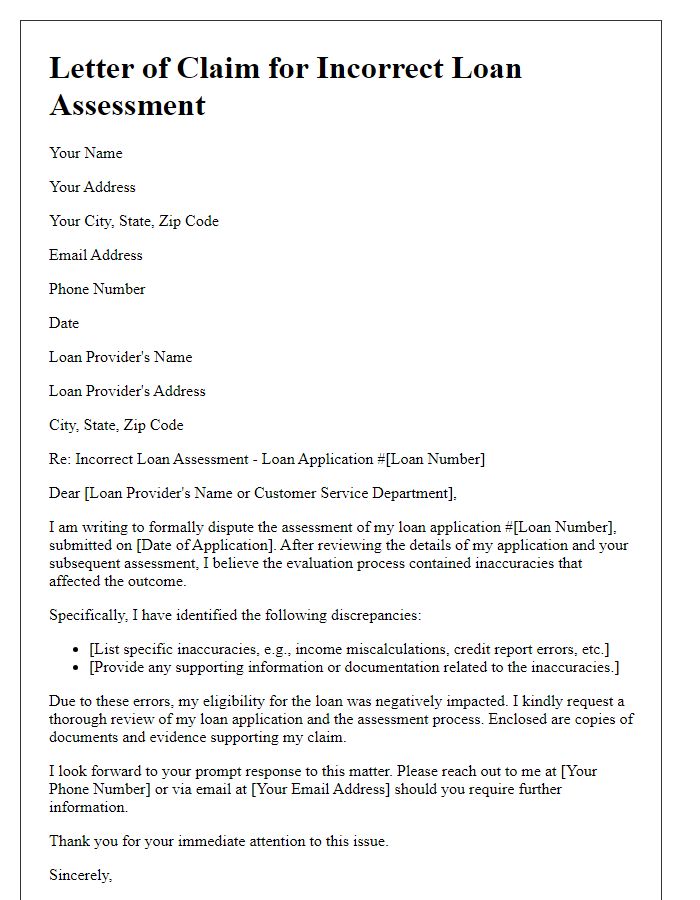

Formal Dispute Statement

Unauthorized loan charges can create significant financial strain on consumers, often leading to distress. Numerous individuals report unexpected deductions from bank accounts due to undisclosed fees or fraudulent loans from entities such as predatory lenders. For instance, a consumer may notice a charge of $500 stemming from a personal loan taken out without their consent or knowledge. The Federal Trade Commission (FTC) provides guidelines for disputing such charges, advising consumers to gather documentation like bank statements and communication records with the lender. Effective resolution often involves contacting the lending institution directly, providing a formal dispute statement, and ensuring the consumer's rights are upheld under the Fair Credit Reporting Act (FCRA). Swift action is essential, as many financial institutions have specific time frames for disputing erroneous charges.

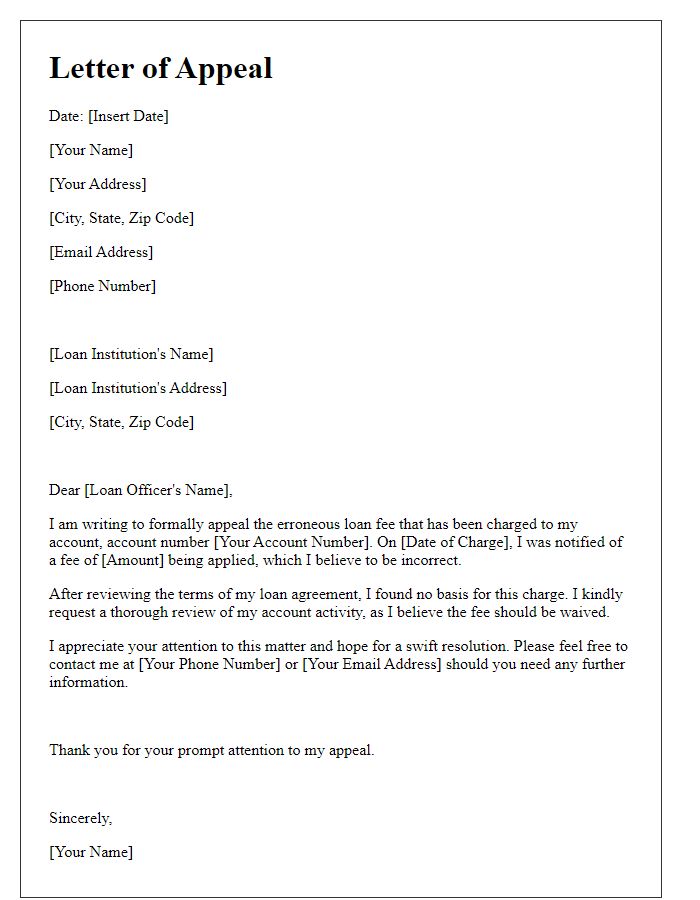

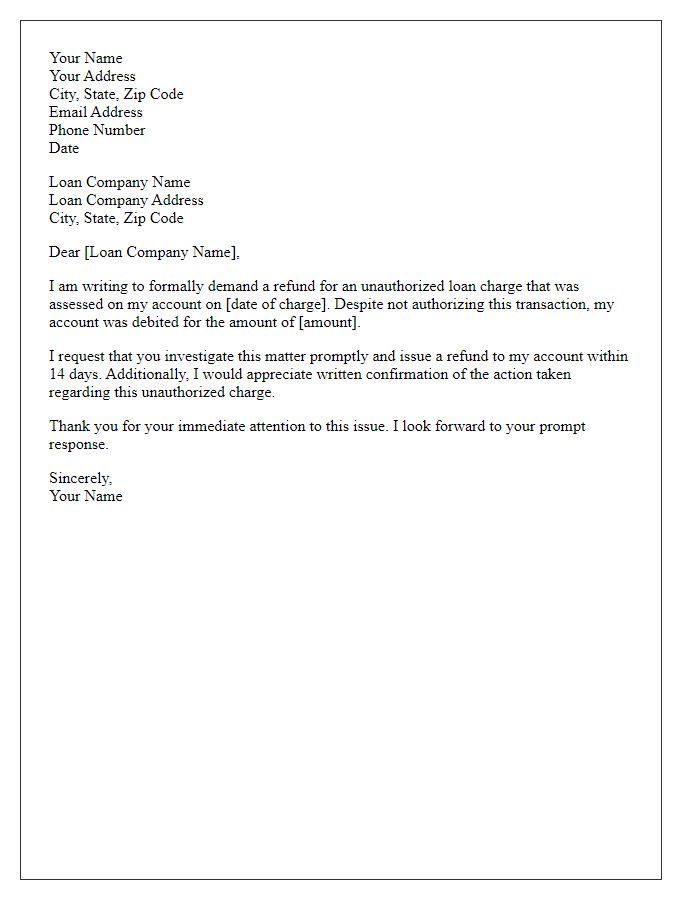

Request for Investigation

Unauthorized loan charges may lead to significant financial distress for individuals. In recent cases, consumers have reported unexpected deductions from bank accounts attributed to loans they did not initiate. For example, high-interest payday loans can appear on bank statements without prior consent, often linked to unclear agreements or misleading offers. Disputes arise when financial institutions, such as credit unions or online lenders, fail to acknowledge these discrepancies. Affected individuals frequently request investigations from their financial institutions, seeking to recoup their funds and prevent future unauthorized activities. Prompt responses from lenders can help restore consumer trust and accountability in financial transactions.

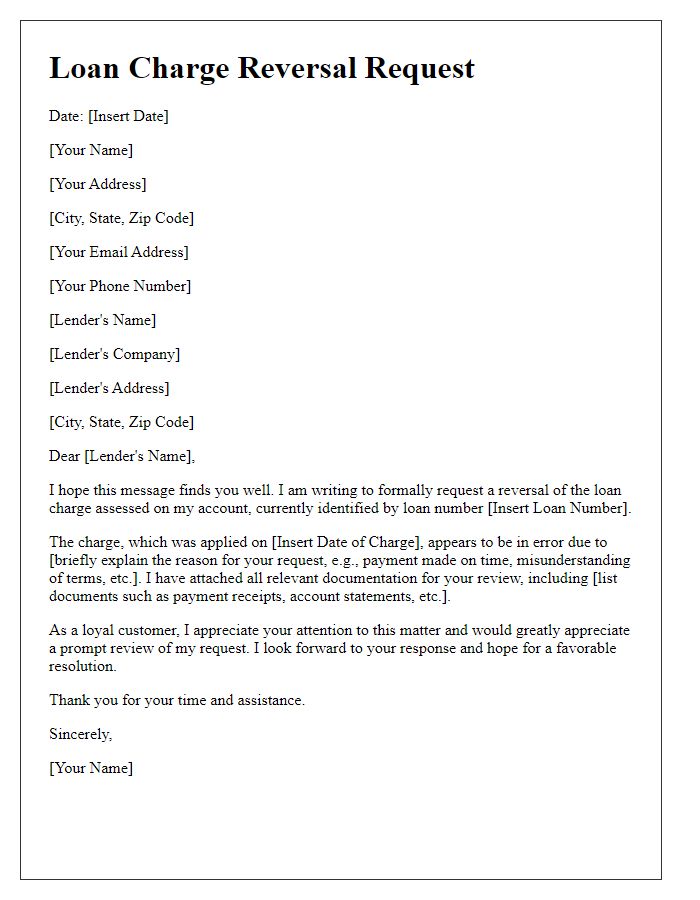

Contact Information

Unauthorized loan charges can result in significant financial distress for individuals. Swift response is essential in resolving these disputes. Steps involve documenting all pertinent details such as loan provider names, transaction amounts, dates of unauthorized charges, and relevant loan agreement terms. Include personal contact information, such as name, address, email, and phone number, to facilitate communication. Collect evidence, such as account statements or correspondence from the lender, to support claims. Properly formatted documentation increases the likelihood of a favorable resolution, mitigating potential damage to credit scores and personal finances.

Comments