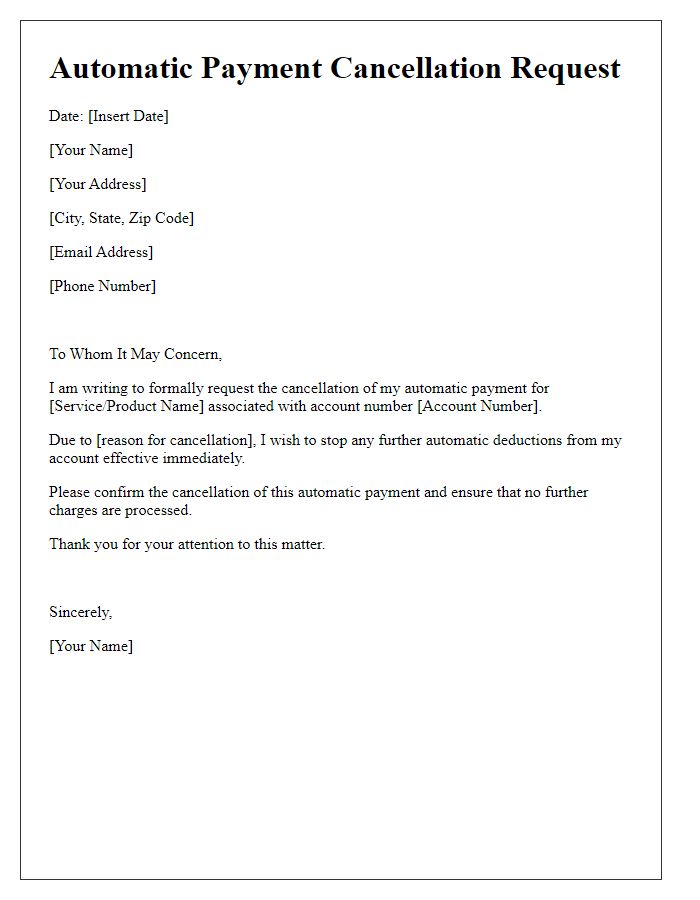

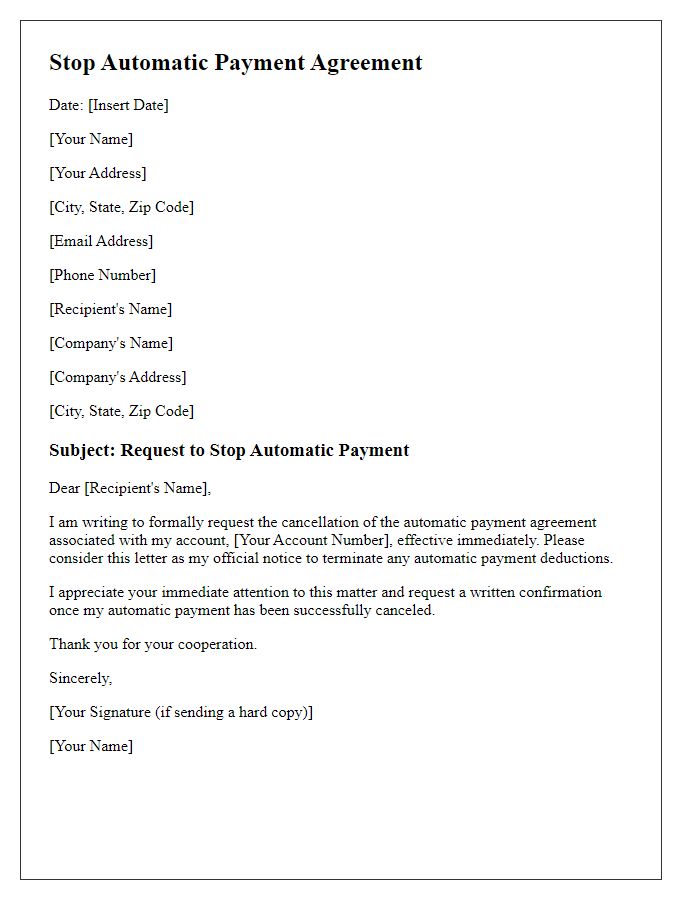

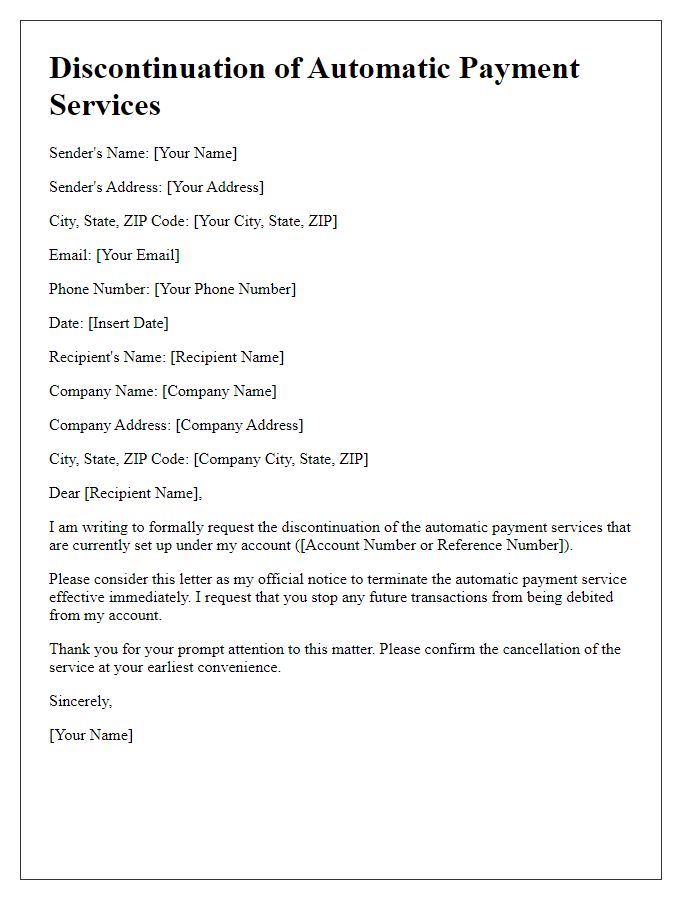

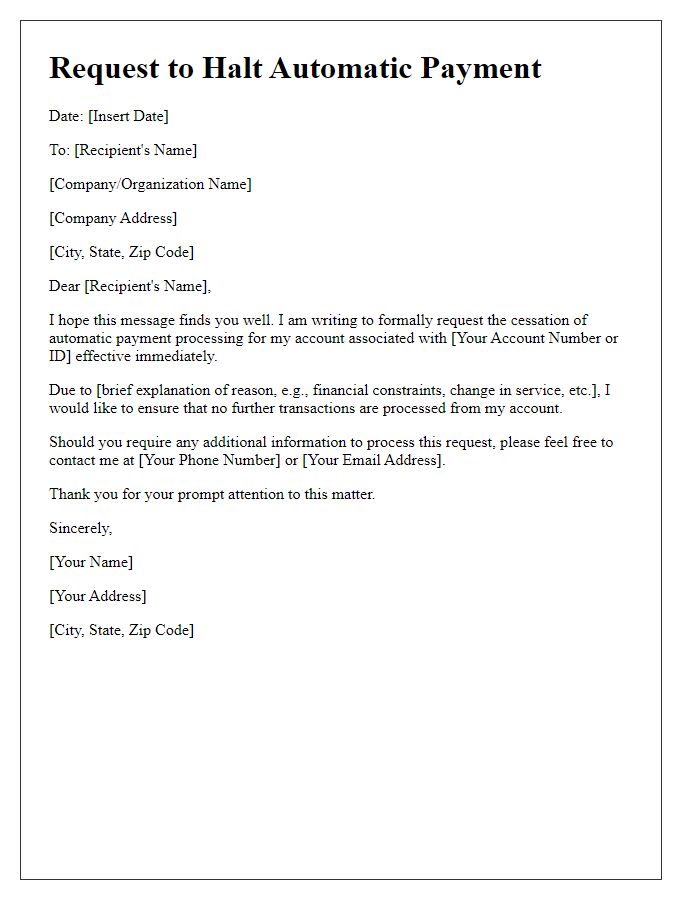

Hey there! Have you ever found yourself needing to cancel an automatic payment but weren't sure how to go about it? Don't worry; you're not alone! In this article, we'll walk you through a simple letter template that you can use to cancel those pesky automatic payments hassle-free. So, let's dive in and get that cancellation sorted!

Account details

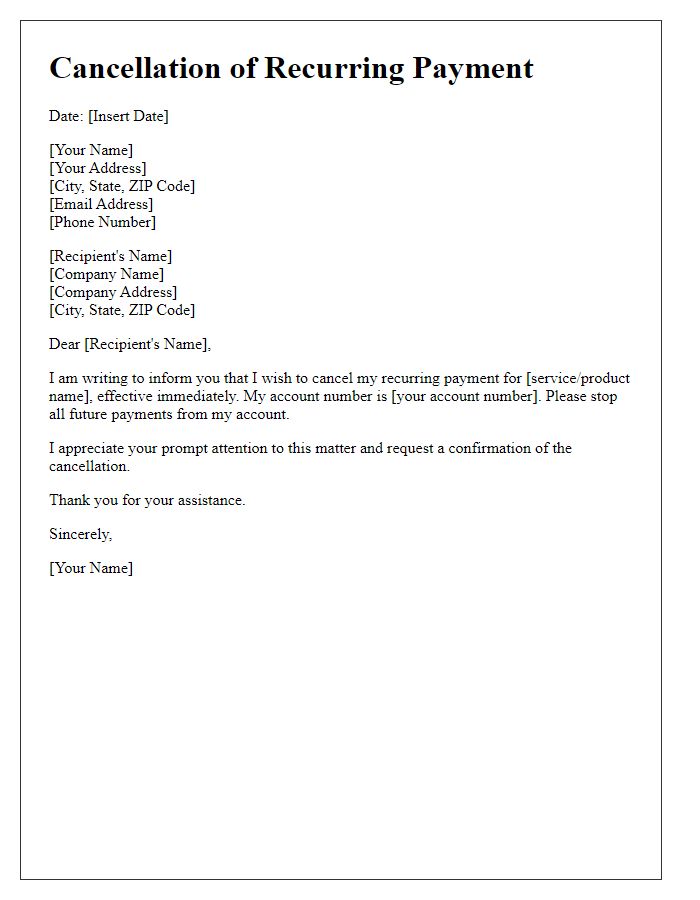

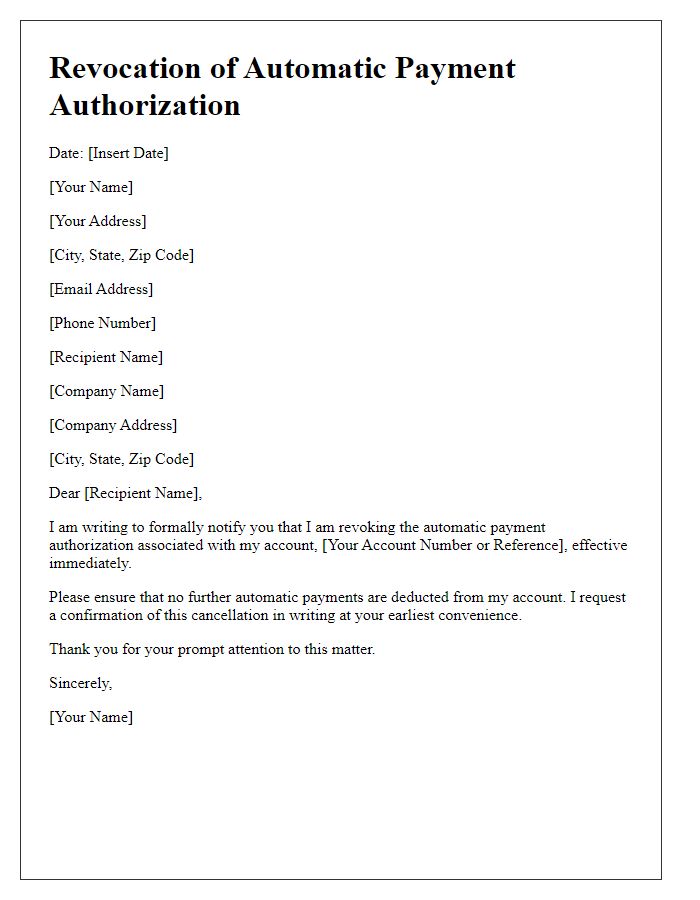

To cancel automatic payment services associated with a bank account, it is essential to provide clear account details for proper identification. For example, include specific account numbers (like 123456789) and the type of account (such as checking or savings) associated with the payment services. Additionally, reference the payment provider (for instance, a utility company) and the effective date for cancellation, ensuring clarity to avoid misunderstandings. Providing contact details, like a phone number (e.g., 123-456-7890) or email address, facilitates any follow-up communication needed to process the cancellation smoothly and efficiently.

Cancellation date

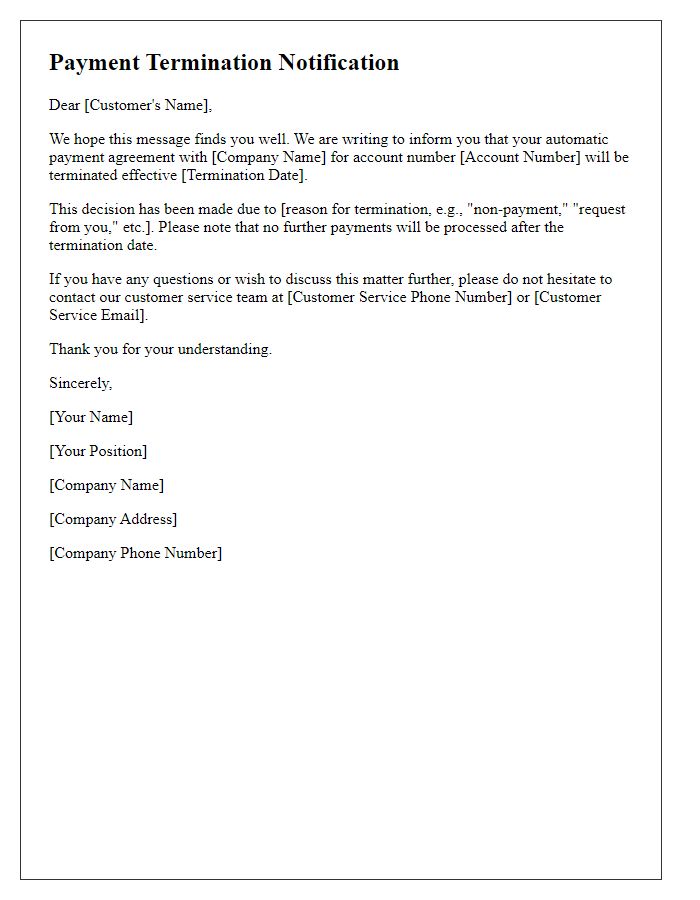

A cancellation of automatic payment requires clear communication detailing the specific date and relevant account information. The cancellation date serves as the final day the automatic transaction will take place, ensuring that no further deductions occur beyond this point. Individuals should reference relevant account numbers or identifiers (like billing ID) associated with the payment to avoid confusion. Notifying service providers through written correspondence or an online portal can facilitate a smooth discontinuation process. Maintain records of the request for future reference, ensuring the end of the automatic payments aligns with financial management practices.

Payment method

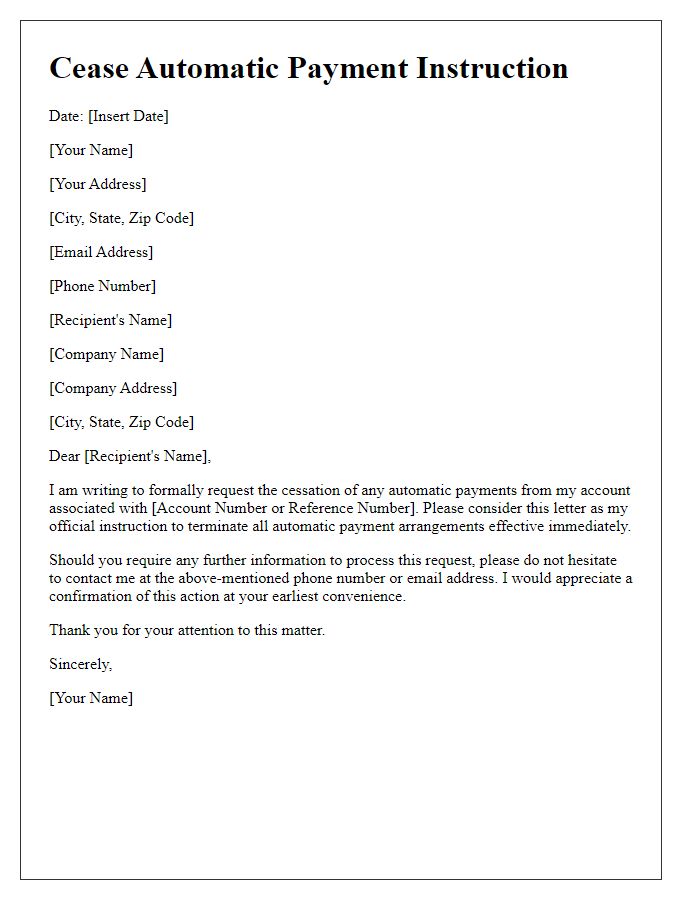

Automatic payment methods, such as credit cards or bank transfers, can sometimes lead to unwanted charges, prompting the need for cancellation. Consumers should always provide clear information regarding their payment provider, whether it be Visa, MasterCard, or a specific banking institution. Cancellation processes vary across platforms, with some requiring online account management while others might necessitate direct communication with customer service representatives. It's crucial to keep track of cancellation confirmation numbers and any applicable terms, such as potential notice periods outlined in the service agreements, to avoid future billing disputes.

Reason for cancellation

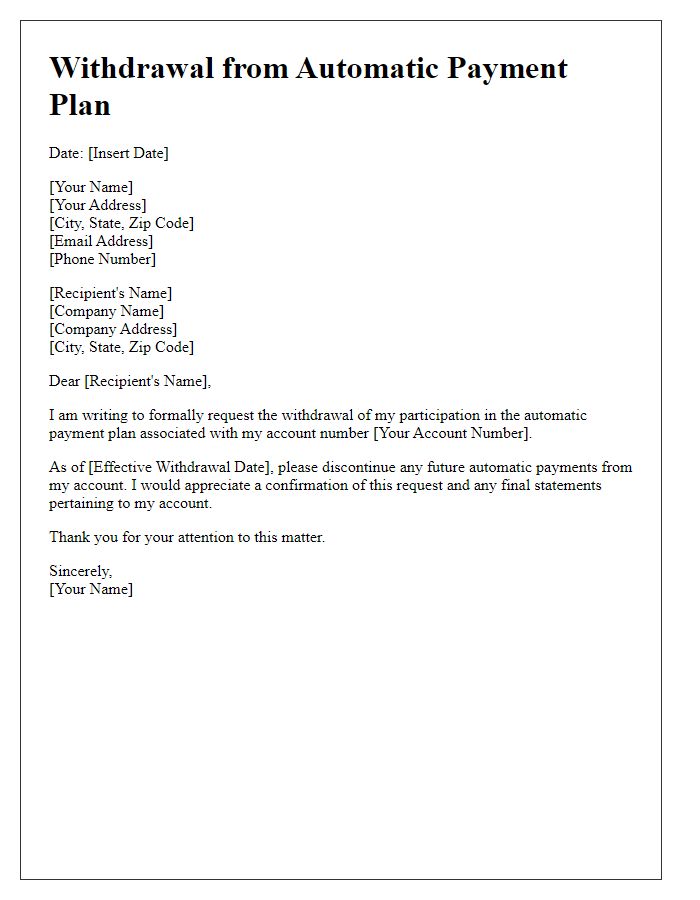

Automatic payment cancellation requests often stem from various reasons such as financial constraints, service dissatisfaction, or changes in personal circumstances. For instance, individuals may experience budgetary challenges leading to a reevaluation of recurring expenses, like subscription services or loan repayments. Service dissatisfaction can arise from unmet expectations in quality or customer support, prompting customers to terminate these payment arrangements. Additionally, life events such as job loss or significant lifestyle changes might necessitate immediate changes in financial commitments. Key components of this cancellation process typically include a formal communication to the service provider, clear identification of the specific account or service affected, and a stipulated request for confirmation of the cancellation. It is vital to also reference any relevant account information such as account numbers or transaction IDs to ensure accurate processing.

Confirmation request

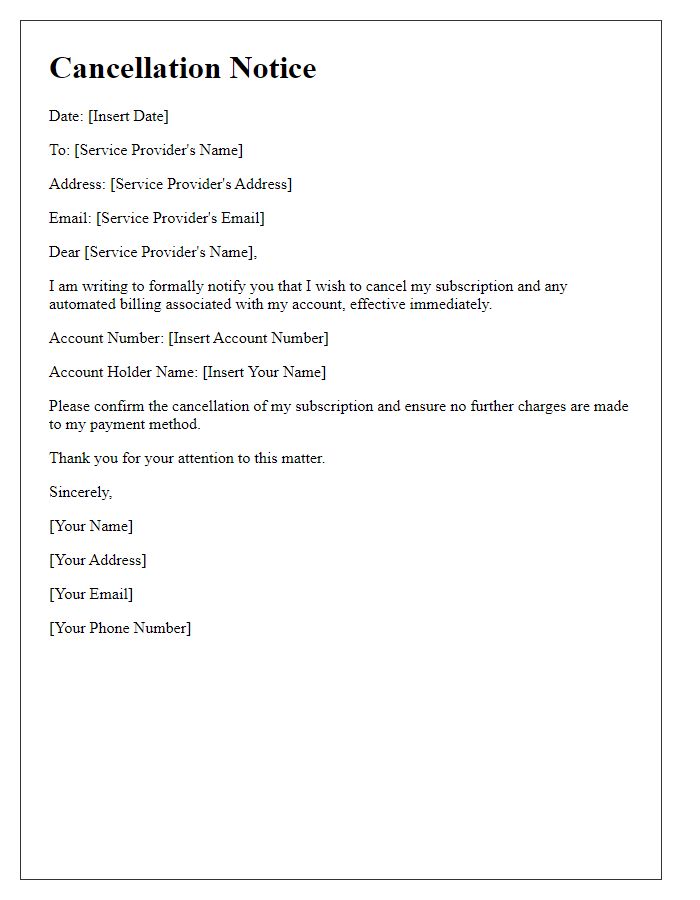

Automatic payment cancellations require precise communication for clarity and accuracy. An effective cancellation confirmation should include key details such as the billing amount, the date of scheduled transactions, and the service provider's name. Providing account information, such as the last four digits or billing ID, helps identify the account in question. Additionally, mentioning any reference numbers related to previous communications can facilitate a smooth cancellation process. Emphasizing a request for written confirmation can ensure that both parties maintain a clear record of the cancellation. The timeframe for receiving the cancellation confirmation, typically within 3-5 business days, underscores the importance of prompt action.

Comments