Hey there! If you're a trust fund beneficiary, staying informed about your fund is crucial, and we're here to help with just that. Knowing the latest updates can empower you to make the best decisions for your financial future. Ready to dive deeper into the details? Let's explore what's new in your trust fund today!

Personalization and Beneficiary Details

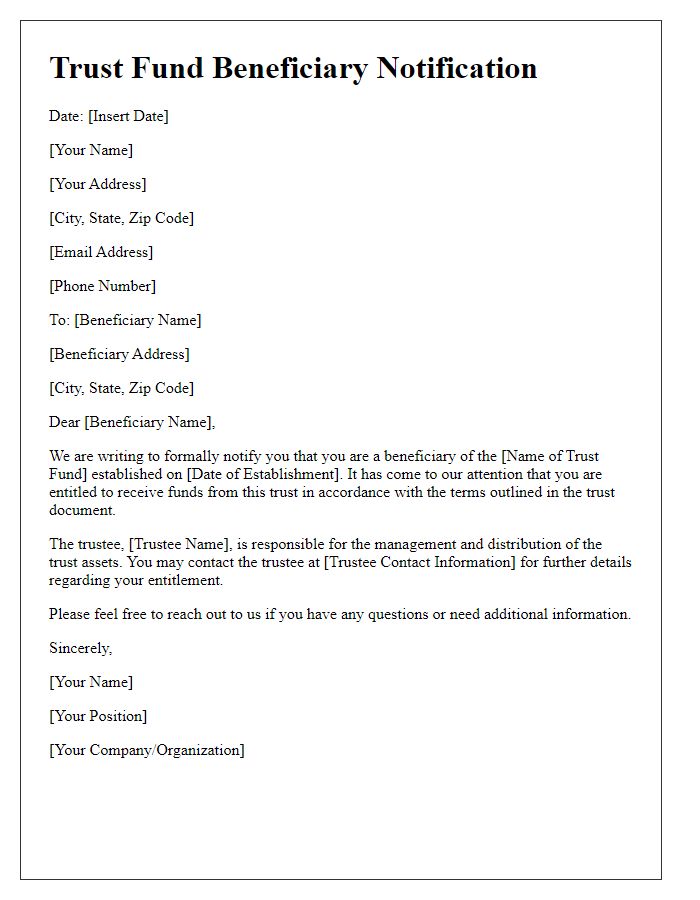

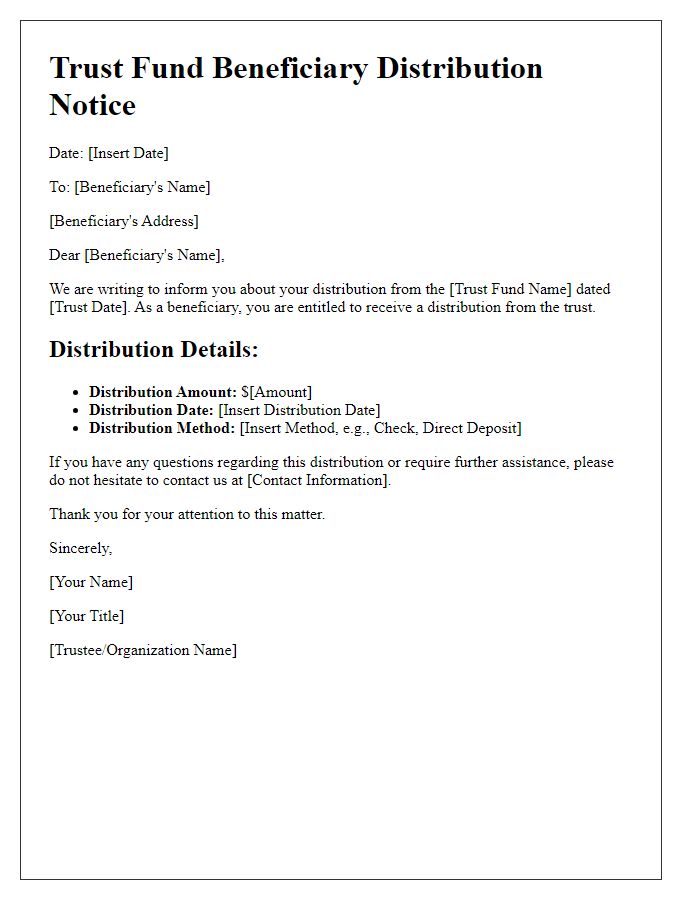

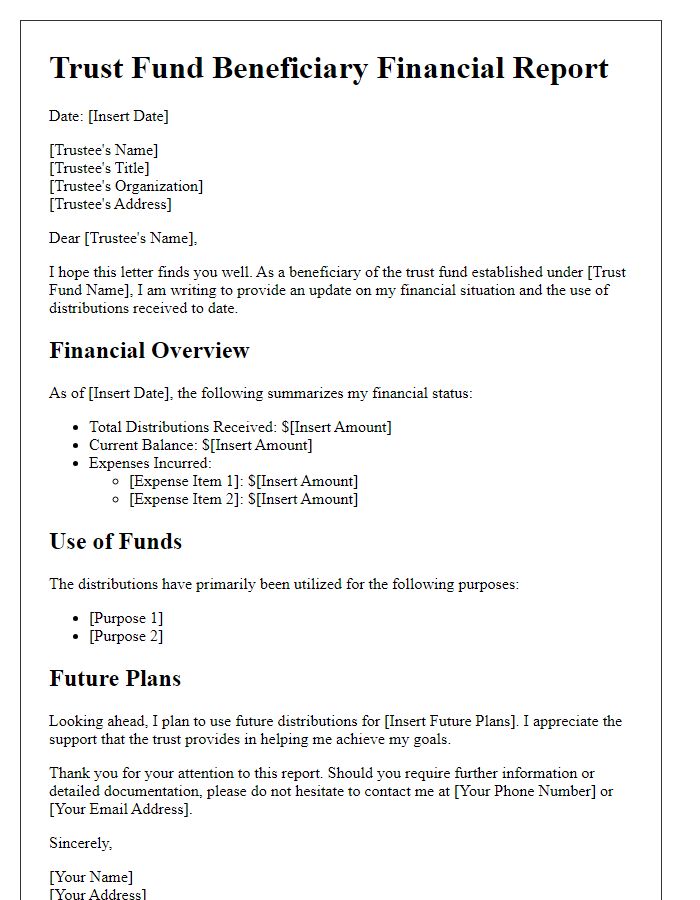

Trust fund beneficiaries often require specific updates regarding their financial agreements and account status. Each beneficiary, identified by name and unique identification number, is entitled to regular communication regarding the trust's performance and distributions. The trust document outlines essential details, including the date of establishment, the trustee's name, and the specific conditions under which distributions occur. Beneficiary details must reflect demographics such as age, relationship to the grantor, and any special conditions affecting their eligibility. Regular updates may include financial statements, investment performance, and upcoming distribution dates, ensuring clarity and transparency regarding fund management. Personalizing communications fosters engagement, helping beneficiaries feel informed and connected to their inherited wealth.

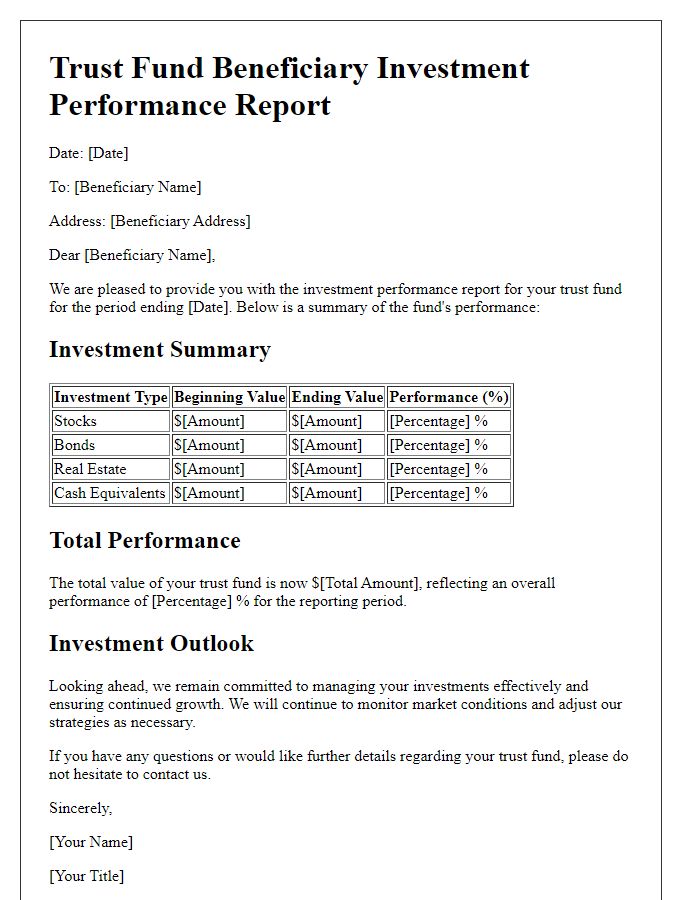

Trust Fund Performance Overview

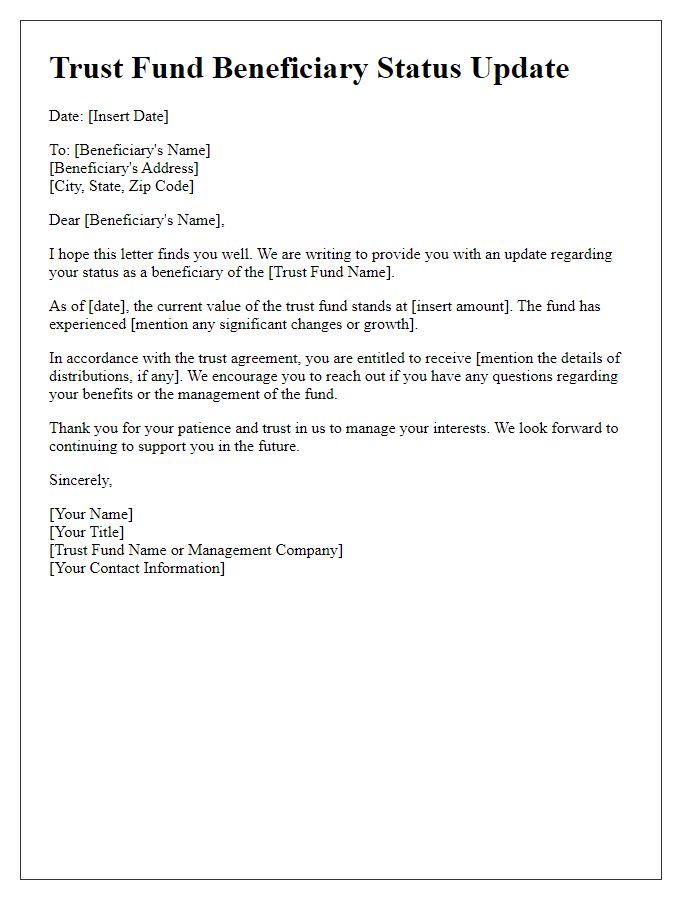

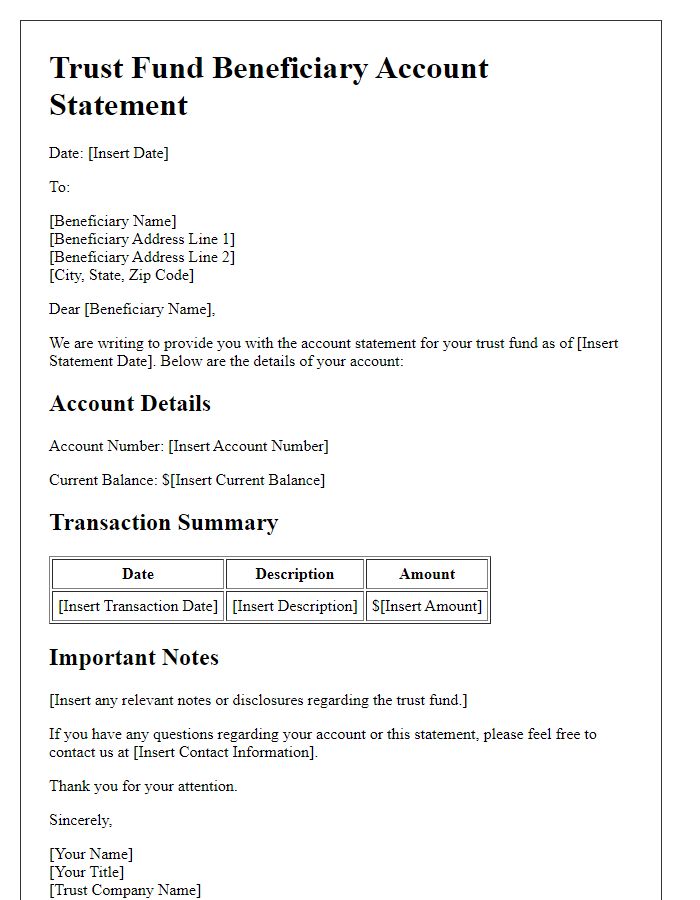

The Trust Fund Performance Overview provides beneficiaries with critical insights into the financial status and growth of their respective trust funds, specifically those established under legal agreements for asset management. The performance metrics typically include the total assets under management, which may total millions of dollars, along with year-on-year growth percentages, often ranging from 5% to 10% depending on market conditions. The report highlights key investments, including equities in prominent companies like Apple Inc. or Microsoft Corporation, as well as fixed-income securities such as U.S. Treasury bonds. Beneficiaries can also view the asset allocation strategy employed by the fund managers, which might involve diversification across various sectors like technology, healthcare, and real estate to mitigate risks. Additionally, updates on distributions made during the reporting period, often scheduled annually, reflect the trust's commitment to providing financial support to beneficiaries while adhering to the fiduciary duties outlined in the trust agreement. Regular performance reviews ensure that beneficiaries remain informed about their financial interests in instances of market volatility or changes in economic conditions.

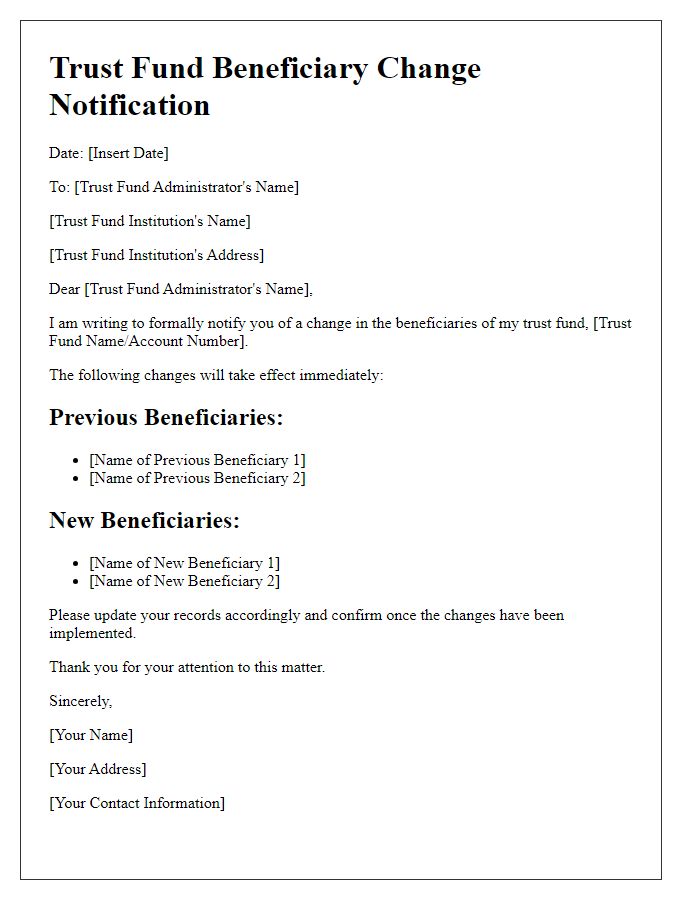

Changes to Terms or Conditions

A trust fund established in 1998 in Delaware may undergo significant alterations that impact beneficiaries. Recent legislative changes effective January 2024 have introduced additional conditions regarding distributions, including age restrictions and financial need assessments. Beneficiaries, such as those named in the original trust document, must be informed about adjustments affecting their expected payouts. Trustees are required to notify each beneficiary by mail or electronic communication, outlining the specifics of these modifications. It is essential for beneficiaries to review their financial plans considering these new stipulations thoroughly.

Financial Advisor Contact Information

A trust fund beneficiary update should include essential details about the financial advisor overseeing the account. The contact information should detail full name, position, and firm associated with managing the trust, such as Smith & Associates Wealth Management. Include direct phone line (e.g., (555) 123-4567) and professional email address (e.g., john.smith@smithassociates.com) to ensure straightforward communication. Clarification regarding office hours (e.g., Monday to Friday, 9 AM to 5 PM EST) can enhance accessibility for beneficiaries seeking assistance. This information helps maintain transparent communication and ensures beneficiaries have access to the necessary resources for their financial planning.

Privacy and Confidentiality Assurance

Trust fund beneficiaries often receive updates regarding the status of their accounts, policies, and distributions from the managing institution, usually a financial institution or legal entity. These updates instill confidence in the transparency and security of the trust fund, assuring beneficiaries that their personal information remains protected. Privacy measures such as encryption and secure communication channels play a critical role in safeguarding sensitive beneficiary data during updates. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) ensures that beneficiaries' rights regarding their personal information are respected. Regular audits and monitoring contribute to a high standard of confidentiality, allowing beneficiaries to feel secure in the management of their trust funds.

Comments