Are you considering separating a joint account and unsure where to start? This process can often feel overwhelming, but with the right guidance, it can be straightforward. In this article, we'll walk you through a simple letter template you can use to initiate the separation, ensuring you cover all necessary details while maintaining a respectful tone. So, let's dive in and make this transition easier for youâread on to explore the essential steps!

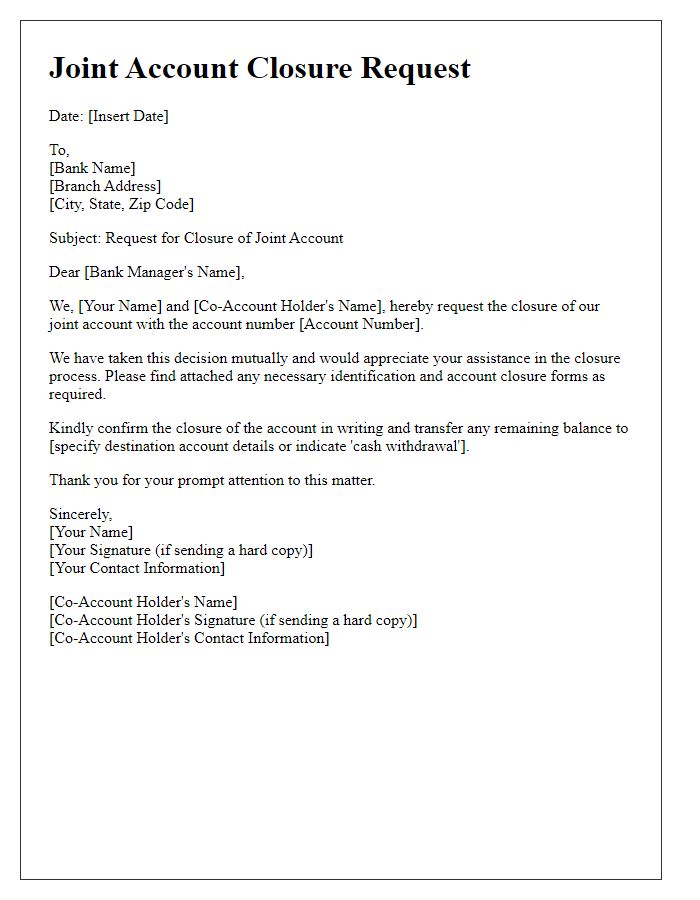

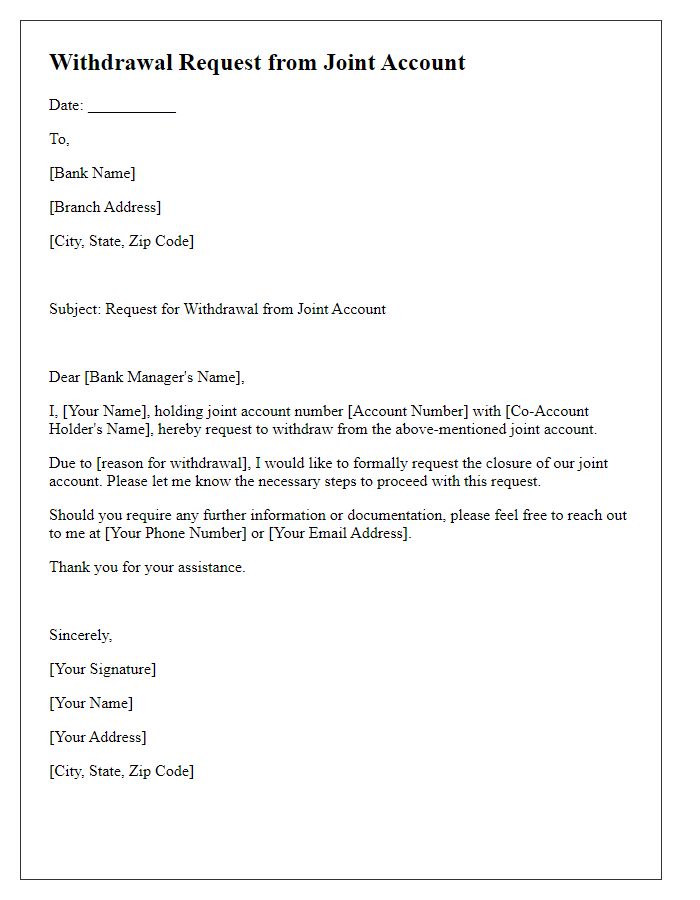

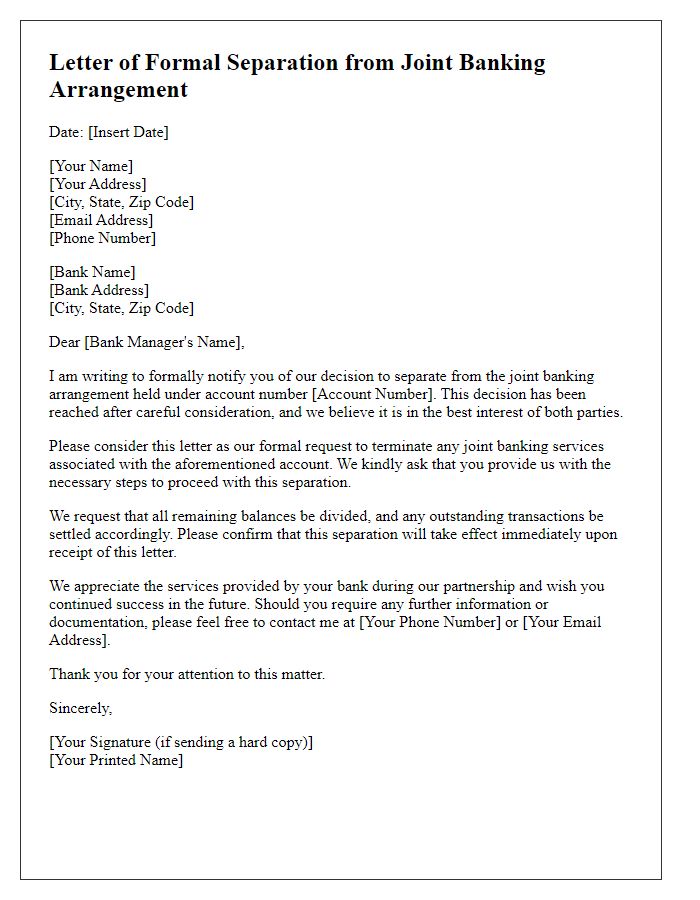

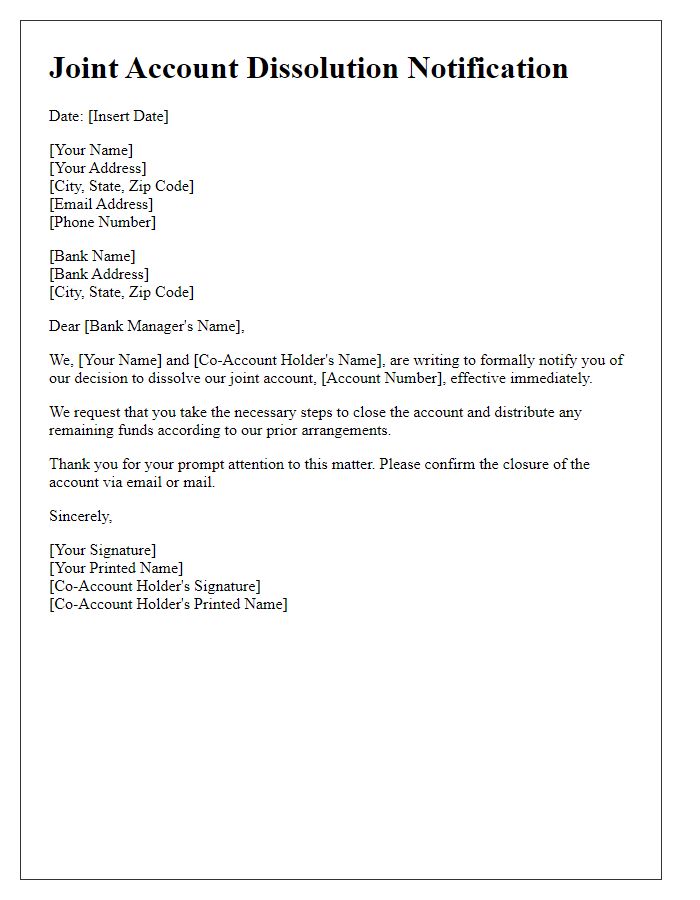

Account holder details

When separating a joint account, it is essential to communicate effectively with the banking institution involved to ensure a smooth process. Each account holder, typically two individuals sharing the financial responsibility, should prepare the necessary information, including full names, account numbers, and any identification details required. The separation process often involves submitting a formal request while adhering to the specific bank's policies. Account holders may be required to complete a separation form, provide identification such as a driver's license or passport, and detail the reasons for separation. It is advisable to confirm remaining balances (potentially requiring a final statement), outstanding transactions, and the distribution of shared assets prior to closure to prevent complications.

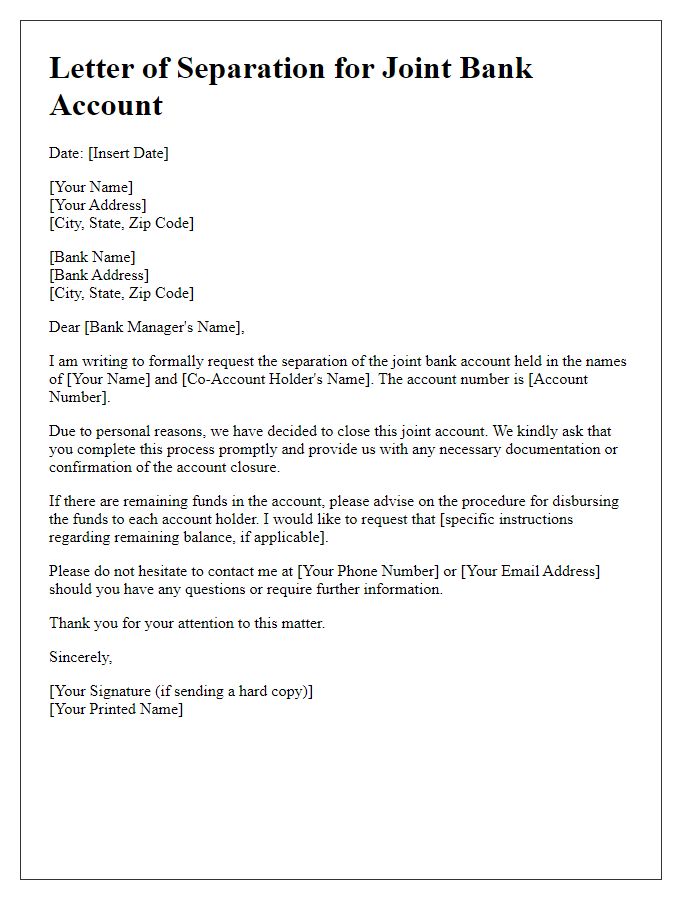

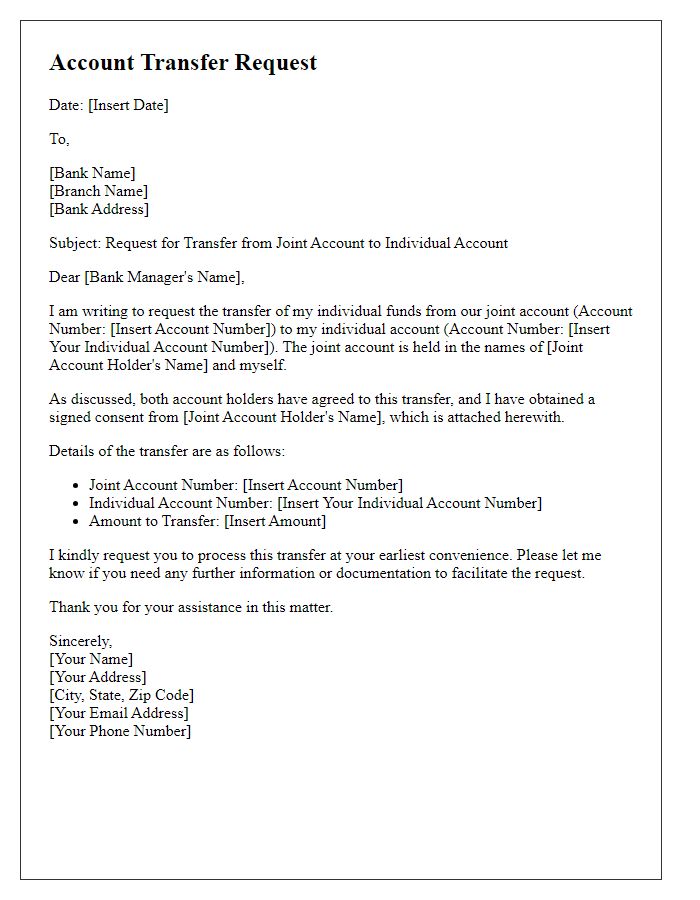

Account number information

Joint account separation requires attention to detail and clarity to ensure both account holders understand the process. Each bank typically needs specific information, including the joint account number (e.g., 123456789), the names of both parties involved (e.g., John Doe and Jane Smith), and the desired outcome regarding the funds (e.g., equal division or transfer to a single account). Additionally, identification documents (such as driver's licenses or passports) may be necessary for verification purposes, along with any outstanding transactions or direct debits tied to the account. It's crucial to clarify how remaining balances will be handled, whether moved to a new individual account or split between the parties.

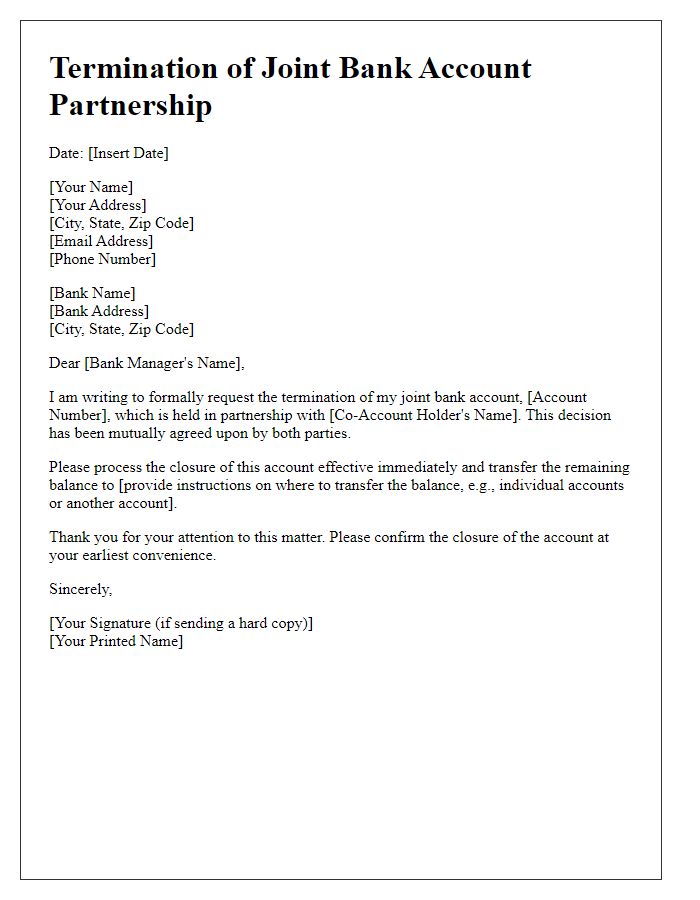

Reason for separation

Joint account separation often occurs due to various factors. Common reasons include relationship dissolution, such as divorce or separation, leading to the need for financial independence. Unexpected outcomes like a significant disagreement over spending habits can also prompt individuals to initiate a separation. Additionally, life changes such as moving to a different city for a job or personal reasons can create a necessity to manage finances separately. Furthermore, major events like the loss of trust or a change in partnership dynamics may influence the decision to close a joint account, ensuring that both parties can maintain distinct financial pathways.

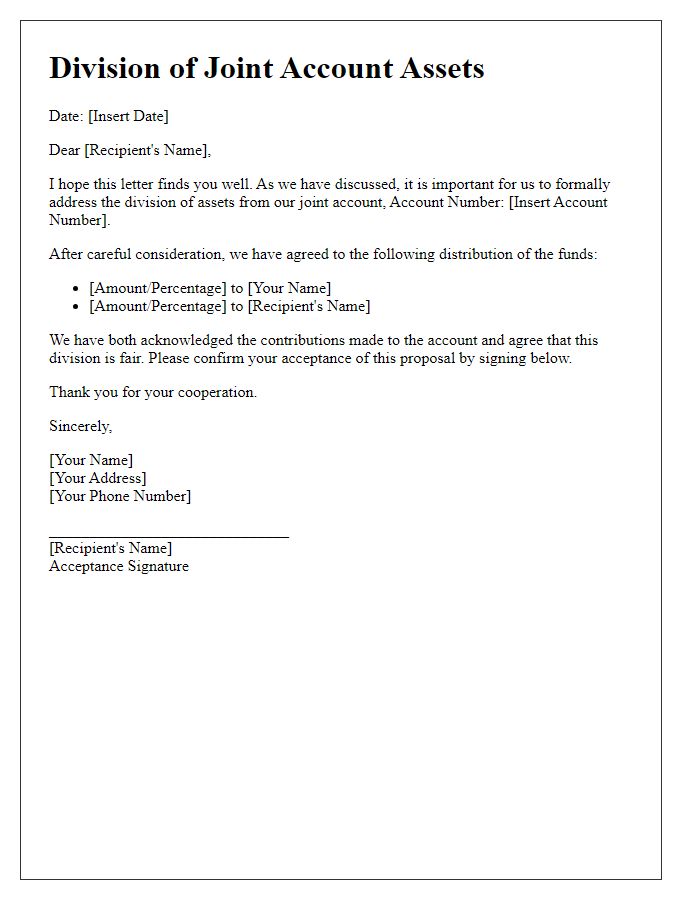

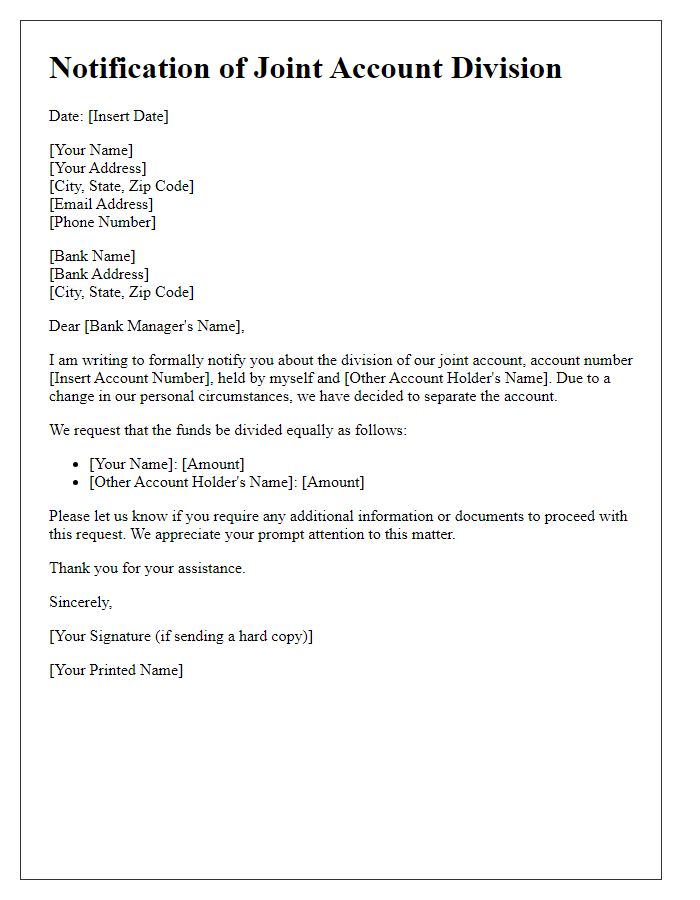

Instructions for distribution

Joint account separation involves clear instructions for the equitable distribution of funds and assets. Each account holder must review the available balance, which may include savings of $15,000 and checking accounts of $5,000. Compile a list of shared expenses, such as mortgage payments($2,500/month) and utility bills averaging $300/month, to ensure both parties meet financial obligations. Detail any shared investments, like stocks or joint ventures which total around $25,000, emphasizing their division. Agree on the process for closing the account(s), including the necessary forms from the bank located at Main Street Branch. Legal documentation may be required to formalize the separation, ensuring compliance with state guidelines and preventing future disputes.

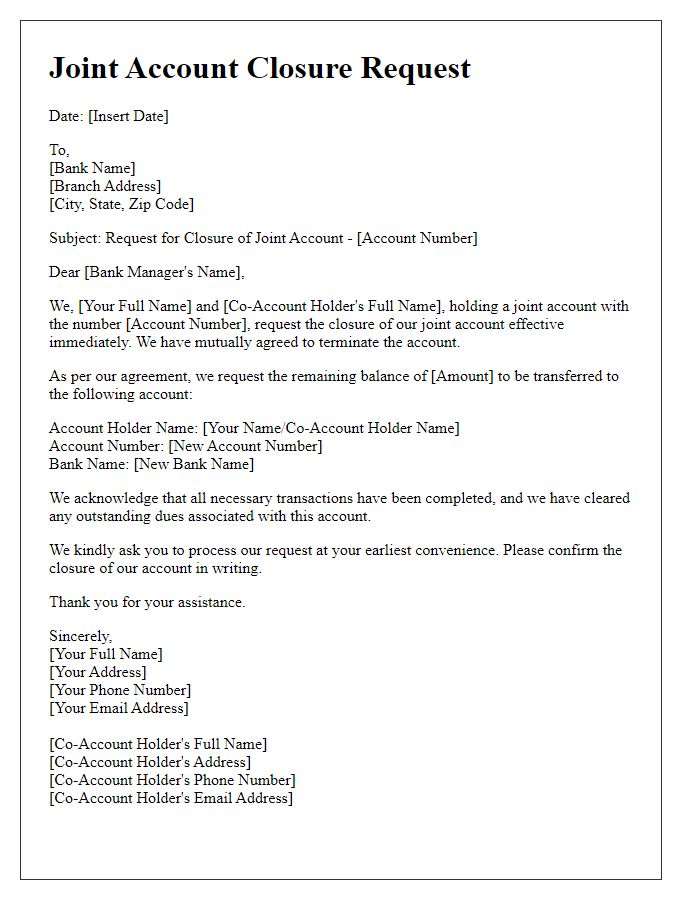

Contact information for further communication

Separation of a joint account involves several key steps to ensure both parties manage their finances independently moving forward. Necessary details include names, account numbers, and the financial institution's contact information. It's essential to document the specific reasons for the separation, along with any agreements regarding shared assets like outstanding debts or pending transactions. To facilitate future communication, provide relevant contact information for both parties, including phone numbers and email addresses, ensuring that both individuals can address any lingering matters or questions pertaining to the account and its closure efficiently.

Comments