Are you looking to update your account beneficiary details but don't know where to start? It can feel overwhelming, but we've got you covered with a simple letter template that makes the process smooth and straightforward. By following our easy guide, you'll ensure that your assets are distributed according to your wishes. Ready to find out how to craft the perfect beneficiary update letter? Let's dive in!

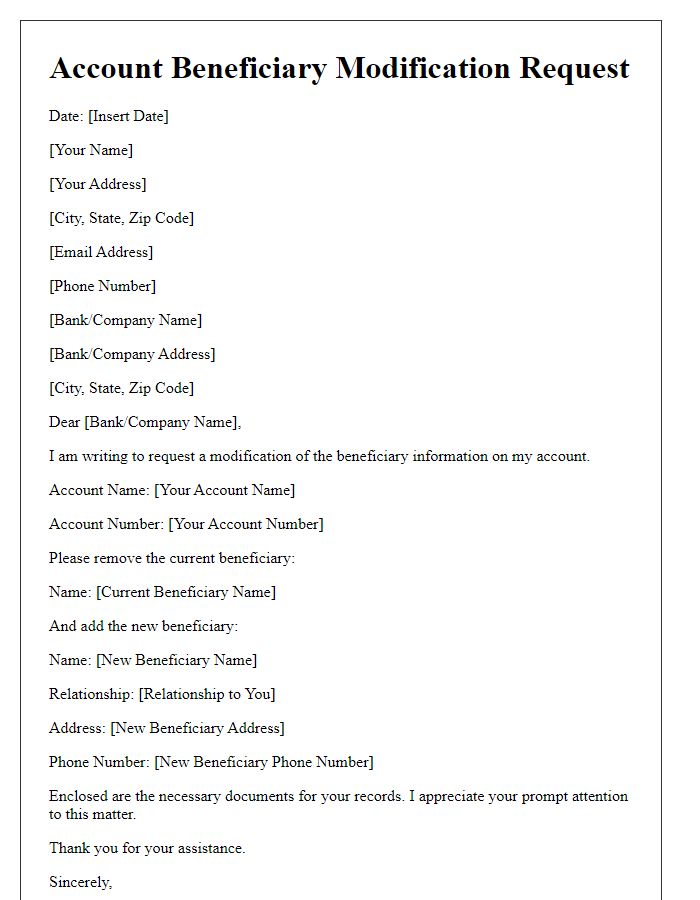

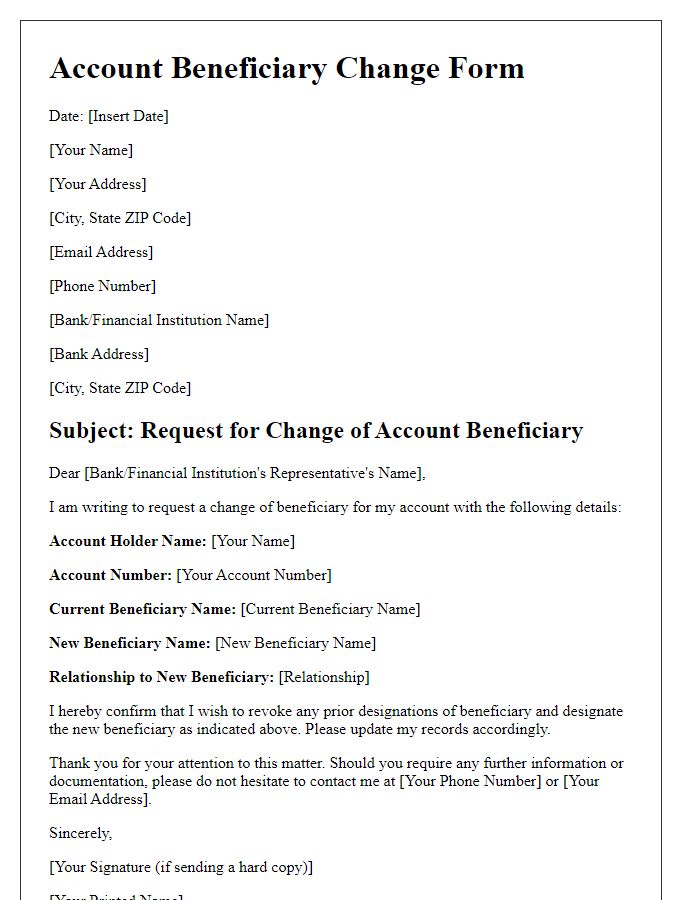

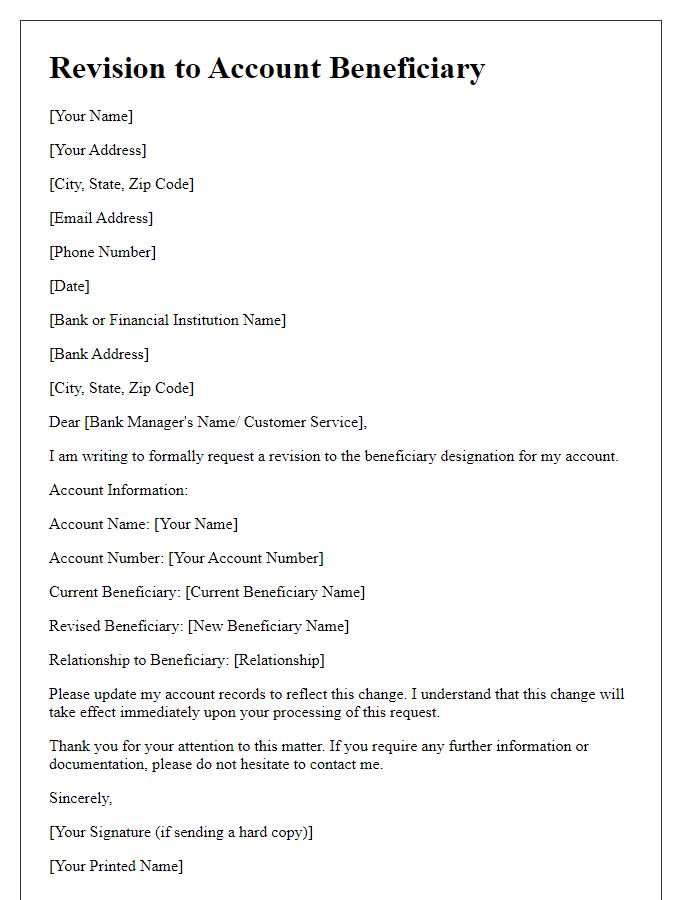

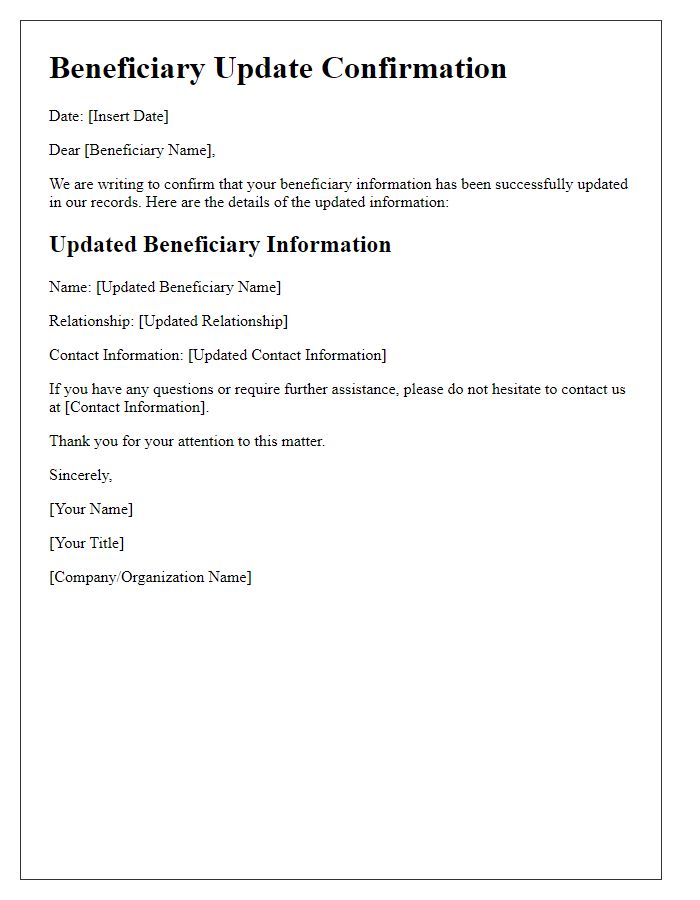

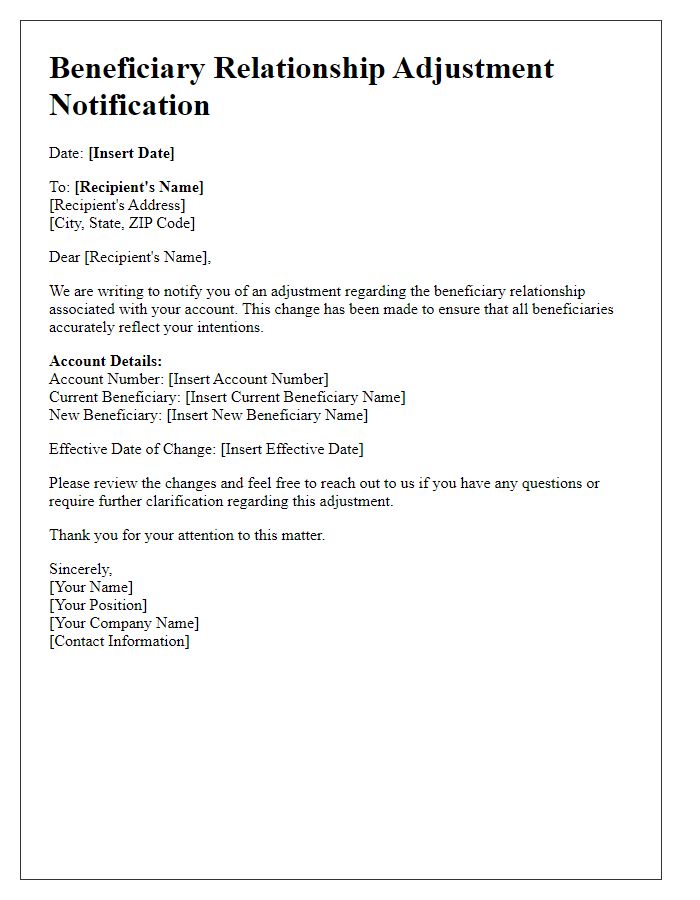

Specific account details and identification.

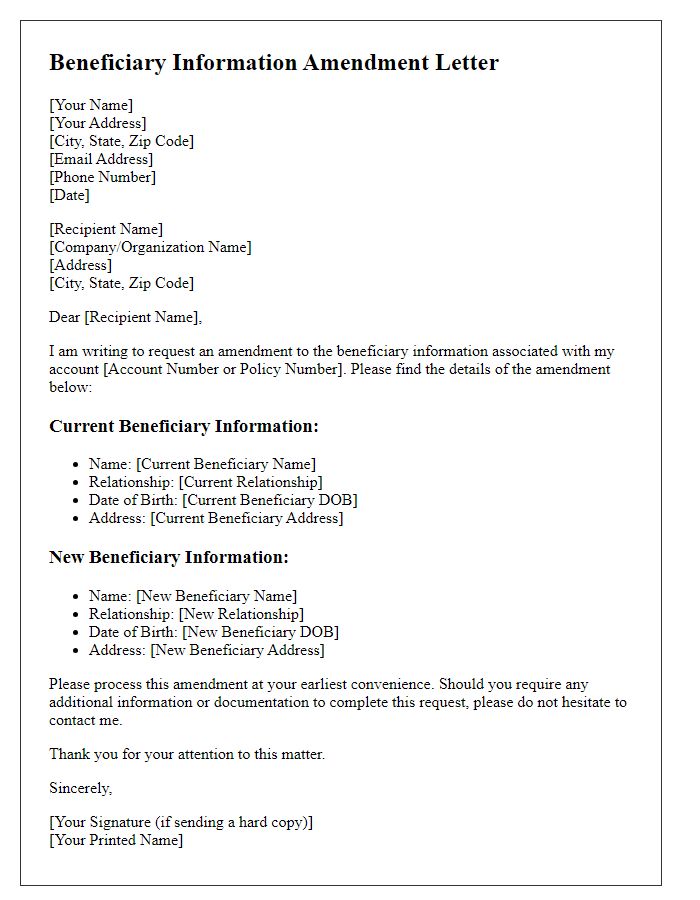

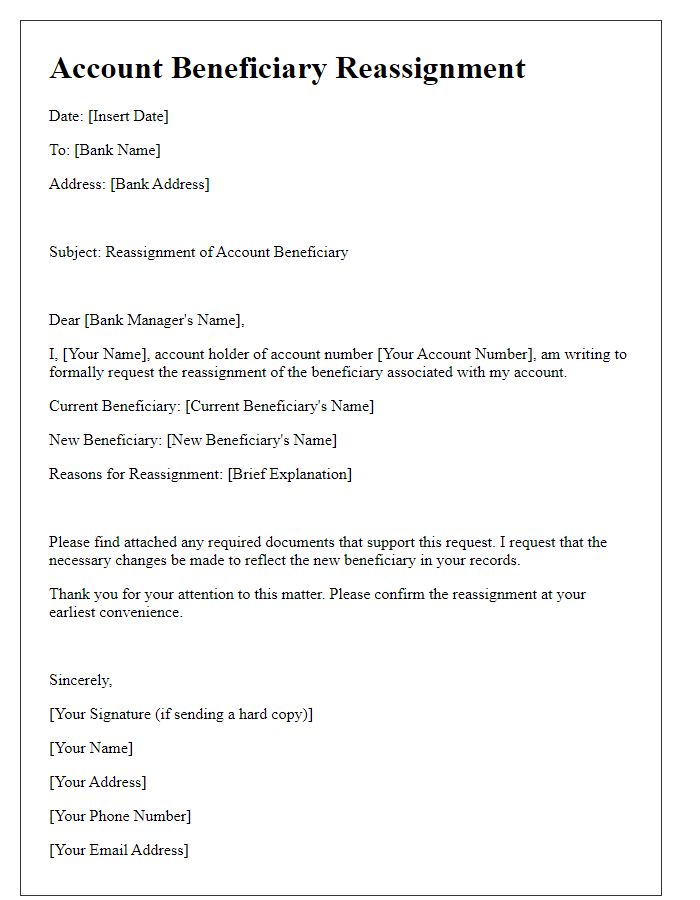

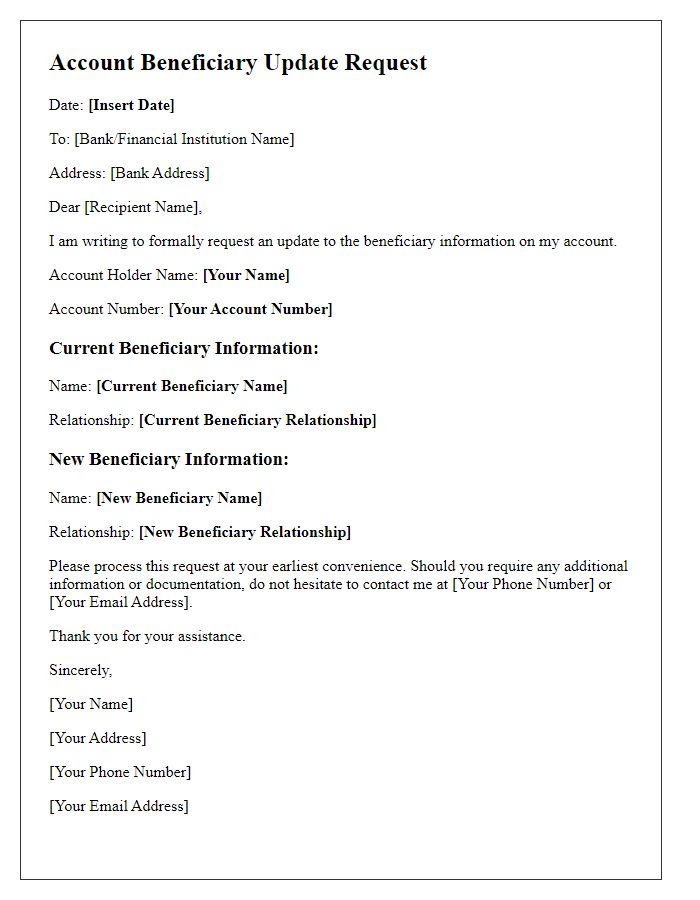

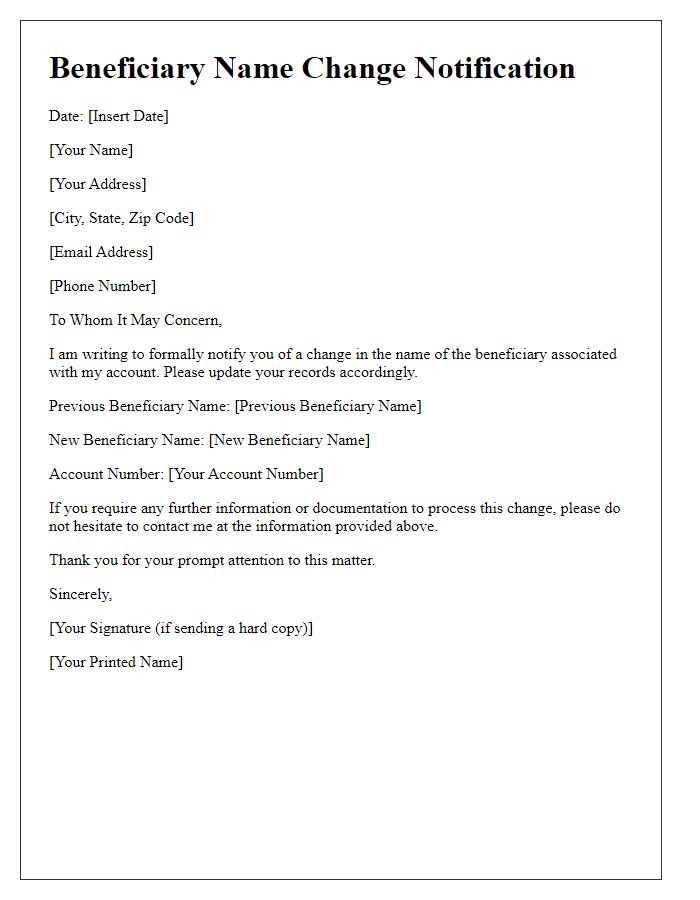

Updating the account beneficiary information is a crucial process for account holders, typically involving financial institutions such as banks or retirement funds. Account beneficiaries, defined as individuals designated to receive the assets of an account upon the account holder's death, require clear identification details. Important specifics include the account number, which uniquely identifies the financial account, and full legal names, ensuring no ambiguity in beneficiary rights. Required identification may encompass Social Security numbers for verification, dates of birth to confirm identity, and perhaps addresses to maintain records accurately. Furthermore, additional documentation, such as government-issued photo IDs, may be requested to authenticate the beneficiary's identity effectively. Accurate and timely updates help prevent complications related to inheritance and ensure that the rightful beneficiaries receive their intended assets without delay.

Full details of the current beneficiary.

Updating account beneficiaries involves providing specific information about the current beneficiary's details, which ensures proper record keeping and clarifies the intended recipient of assets. The current beneficiary, Jane Doe, holds the account number 123456789 at ABC Bank, established on March 15, 2015. Jane resides at 456 Elm Street, Springfield, IL 62701, and holds a date of birth of July 12, 1985, establishing her identity and eligibility. Contact details include her phone number, (555) 123-4567, and email address, janedoe@email.com. Additionally, a Social Security Number (SSN) is associated with her account, ensuring that the bank can verify her identity accurately. Any changes to this information should be documented to maintain transparency and compliance with financial regulations.

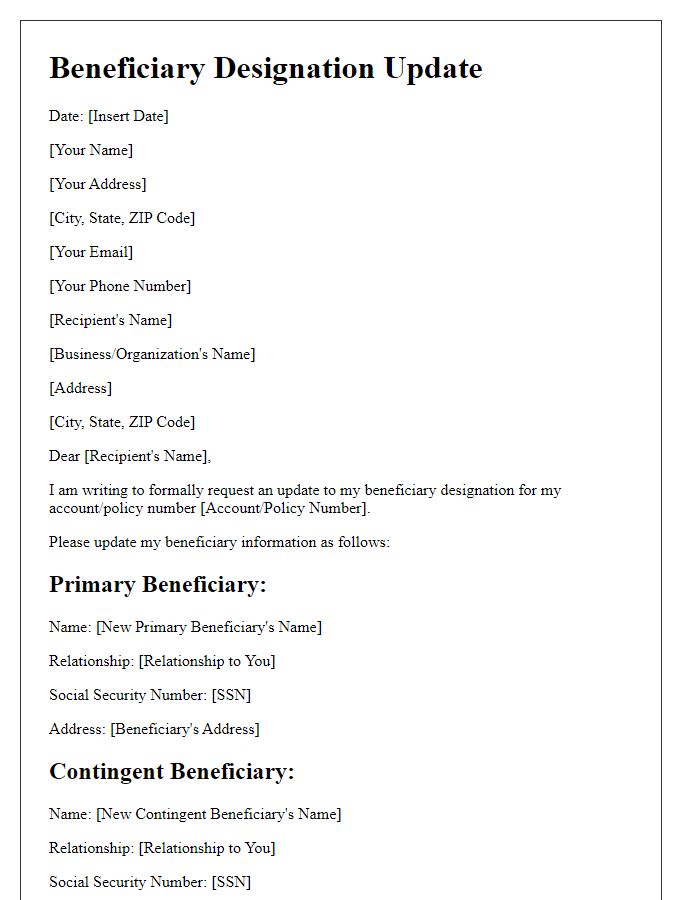

Complete information of the new beneficiary.

Updating account beneficiary information requires careful attention to detail to ensure all necessary data is included for a smooth transition. Key components often include the full name of the new beneficiary (for example, John Smith), date of birth (January 15, 1985), Social Security number (123-45-6789), relationship to the account holder (such as son, daughter, spouse), and address (123 Main St, Springfield, IL, 62701). Additionally, contact information (phone number: 555-123-4567, email: john.smith@example.com) is critical for future communications. Lastly, account identifiers like account numbers (XYZ123456789) and type of account (savings, checking, or investment) should be provided to clarify the beneficiary's assignment.

Legal documentation and authorization.

Account beneficiary updates require precise legal documentation and clear authorization to ensure compliance with banking regulations. Such updates often necessitate forms such as a Beneficiary Designation Form (specific to financial institutions), Identity Verification documents (government-issued IDs like passports or driver's licenses), and possibly a notarized signature to validate the request. The account holder (individual with financial assets) must submit these documents to the financial institution (bank or investment firm) for processing and approval. Timely submission is crucial, as many institutions stipulate a specific processing period (usually 3 to 5 business days) before new beneficiary designations are effective. Furthermore, clear communication with the institution regarding any policy changes (e.g., those related to beneficiaries) is essential for accountability and transparency in financial management.

Contact information for follow-up.

Updating the contact information for account beneficiaries ensures seamless communication regarding important financial matters. Accurate details, such as phone numbers, email addresses, and physical addresses, are critical for reaching out regarding investment opportunities, legal notifications, or estate planning details. Financial institutions emphasize the need for updated information (e.g., quarterly reviews) to comply with regulations and maintain efficient account management. Missing or outdated contact information can lead to significant delays, affecting the timely distribution of assets or important financial updates. Regularly reviewing and updating these details safeguards the interests of beneficiaries and strengthens financial planning strategies.

Comments