Are you looking to navigate the sometimes complicated waters of international fund transfers? Writing a request letter can be the first step in ensuring your funds reach their destination smoothly and efficiently. It's important to state your needs clearly and provide all necessary details to streamline the process. To learn more about crafting an effective letter for your international transfer request, keep reading!

Sender's complete personal and bank account information

International fund transfers require meticulous attention to detail to ensure accuracy and security. Typically, senders must provide their full name, residential address, and contact number. Bank account details are crucial, including bank name, account number, and SWIFT/BIC code, which identifies the specific bank in international transactions. Additionally, the sender should include their International Bank Account Number (IBAN), if applicable, for enhanced accuracy in overseas transfers. It is essential to check with the receiving bank for any additional requirements or specific forms they may need to process the fund transfer efficiently.

Recipient's full details including bank account and SWIFT/BIC code

International fund transfers require precise details for successful transactions. Essential recipient information includes the full name of the recipient, both street address and city, state or province, and country. Specific banking details are crucial, including the recipient's bank account number, which may vary in length depending on the country, and the SWIFT/BIC code that identifies the recipient's bank globally, consisting of 8 to 11 characters. It is vital to ensure that these details align with the requirements of the sending bank to facilitate a smooth transfer process, potentially avoiding delays or issues in fund delivery.

Specific transfer amount and currency type

An international fund transfer request requires specific details to ensure accuracy and efficiency. The transfer amount, such as $1,500 USD, needs to be clearly stated along with the currency type, for example, Euros (EUR1,400). Additionally, the recipient's bank account number and the bank's SWIFT or IBAN code must be included to facilitate cross-border transactions. Important information like the purpose of the transfer, whether for personal reasons, business payments, or invoices, should also be mentioned. Including the recipient's full name and address can help prevent delays caused by discrepancies.

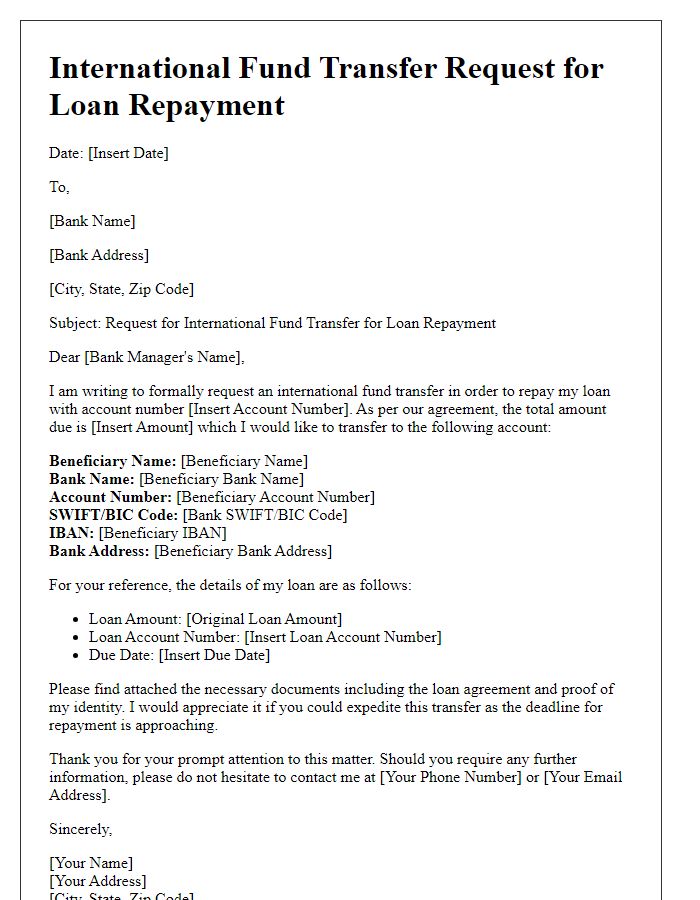

Purpose and urgency of the fund transfer

Urgent international fund transfers often arise due to critical circumstances such as medical emergencies, unforeseen business expenses, or significant investment opportunities. In urgent situations, funds may need to be transferred quickly to treatment facilities like hospitals or clinics, particularly in countries known for specialized medical care such as India or Germany. Business entities might require funds swiftly to capitalize on acquiring assets or securing contracts, especially in fast-paced markets like the technology sector in Silicon Valley or the thriving manufacturing hubs in China. Each transfer necessitates a clear understanding of currency exchange rates and potential transaction fees, which can vary considerably across different financial institutions and regions. Ensuring compliance with regulations in both the sending and receiving countries is crucial for a successful transaction, minimizing delays and ensuring that purposes such as humanitarian aid, personal support, or investment endeavors are met promptly and efficiently.

Compliance with international banking regulations and security protocols

International fund transfers often require adherence to banking regulations and security protocols to prevent fraud and ensure transaction integrity. Compliance measures, such as Know Your Customer (KYC) requirements, mandate verification of the sender's identity through documentation like passports and utility bills, ensuring legitimacy in transactions. Additionally, banks must implement Anti-Money Laundering (AML) practices, which involve monitoring transactions for suspicious activities or large sums exceeding specific thresholds, typically set at $10,000 in many jurisdictions. Security protocols, including encryption methods for data transmission and secure communication channels, safeguard sensitive information during the transfer process. The SWIFT network, a major means for executing international transfers, utilizes robust security measures to ensure that only authorized entities can initiate and receive funds, minimizing risks associated with international transactions.

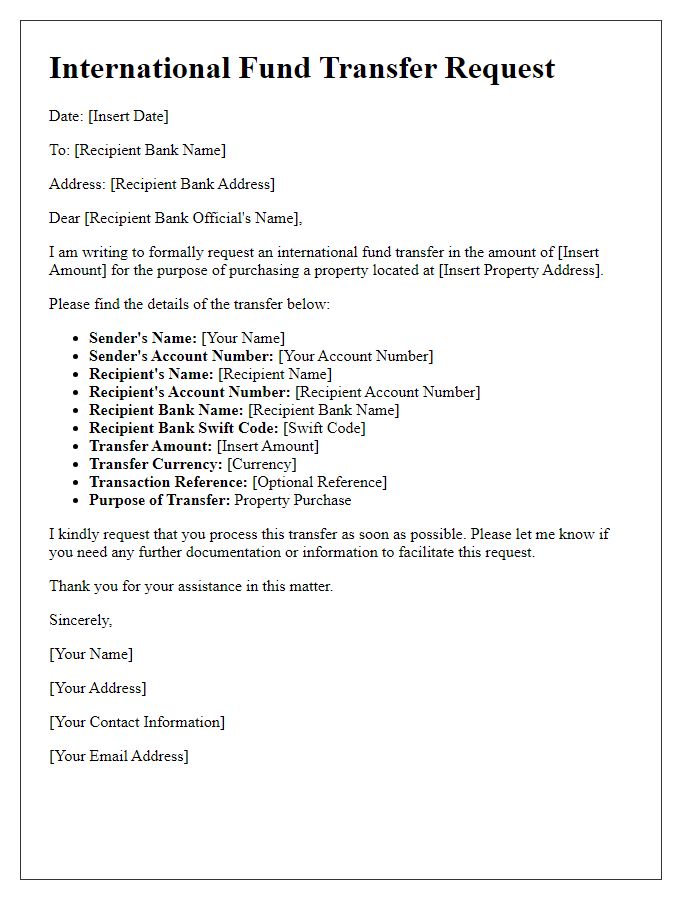

Letter Template For International Fund Transfer Request Samples

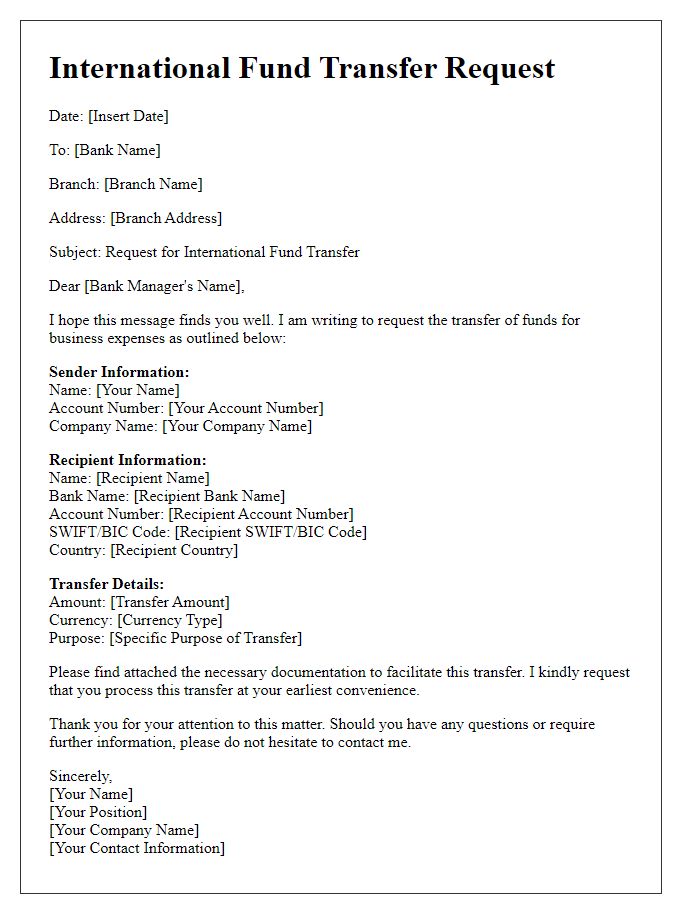

Letter template of international fund transfer request for business expenses

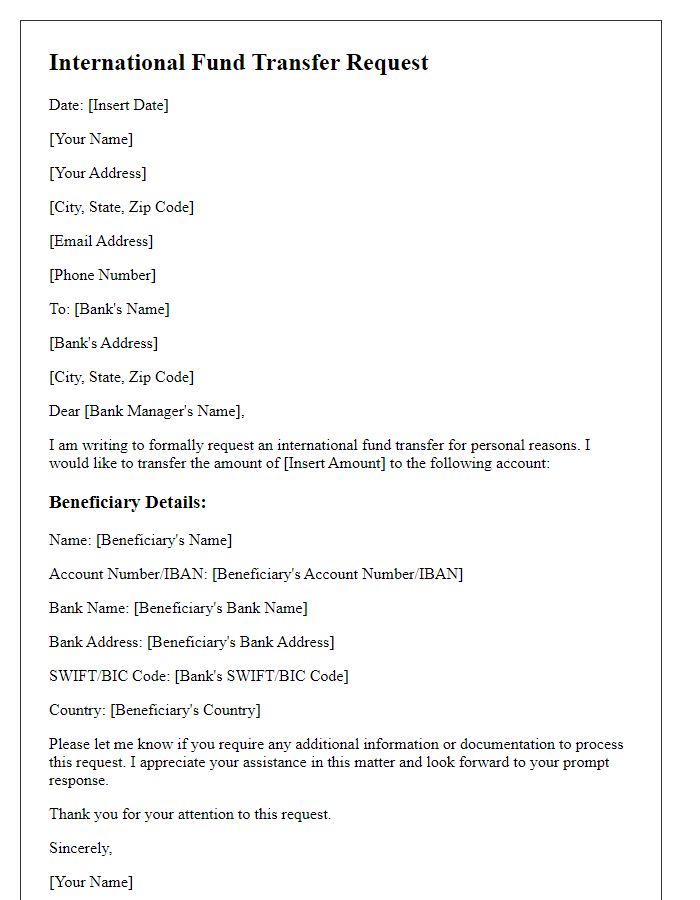

Letter template of international fund transfer request for personal reasons

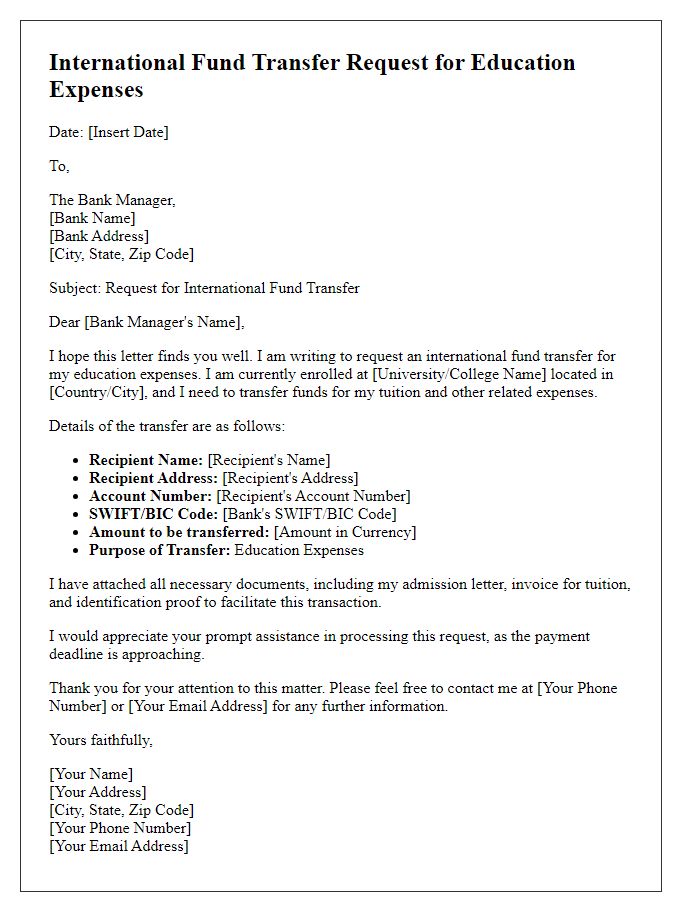

Letter template of international fund transfer request for education expenses

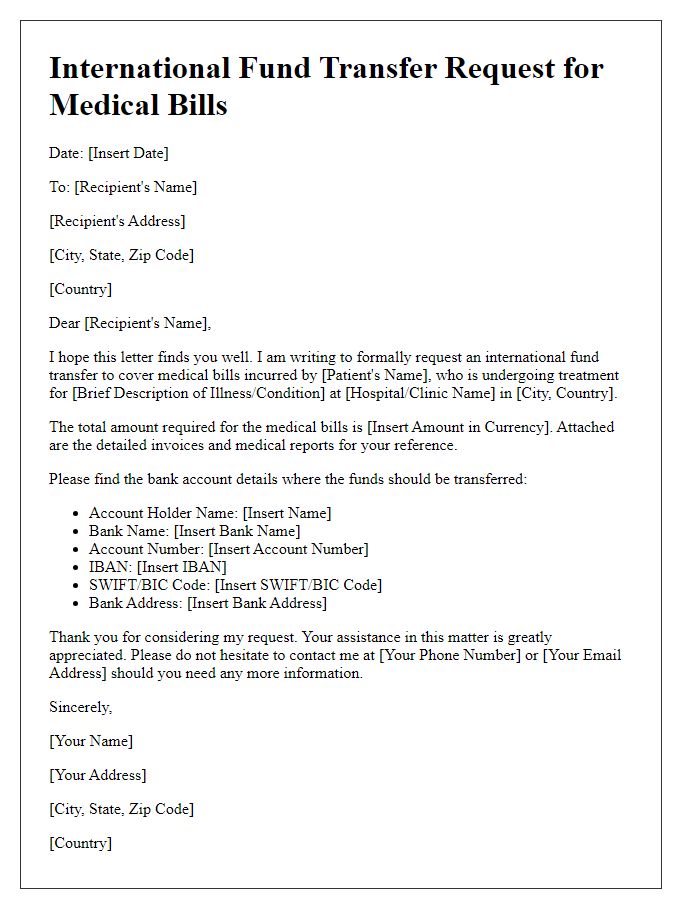

Letter template of international fund transfer request for medical bills

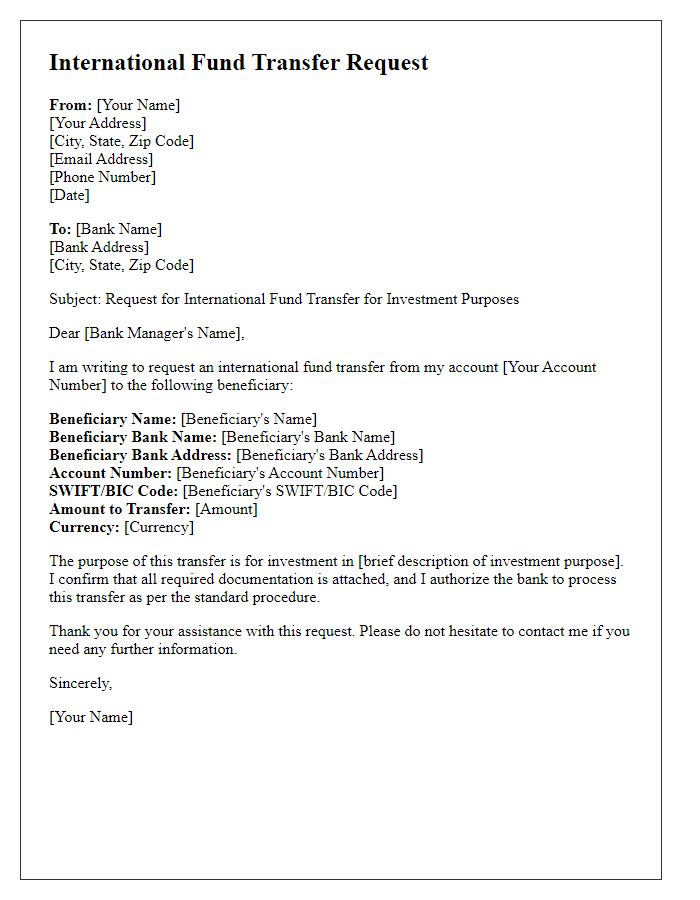

Letter template of international fund transfer request for investment purposes

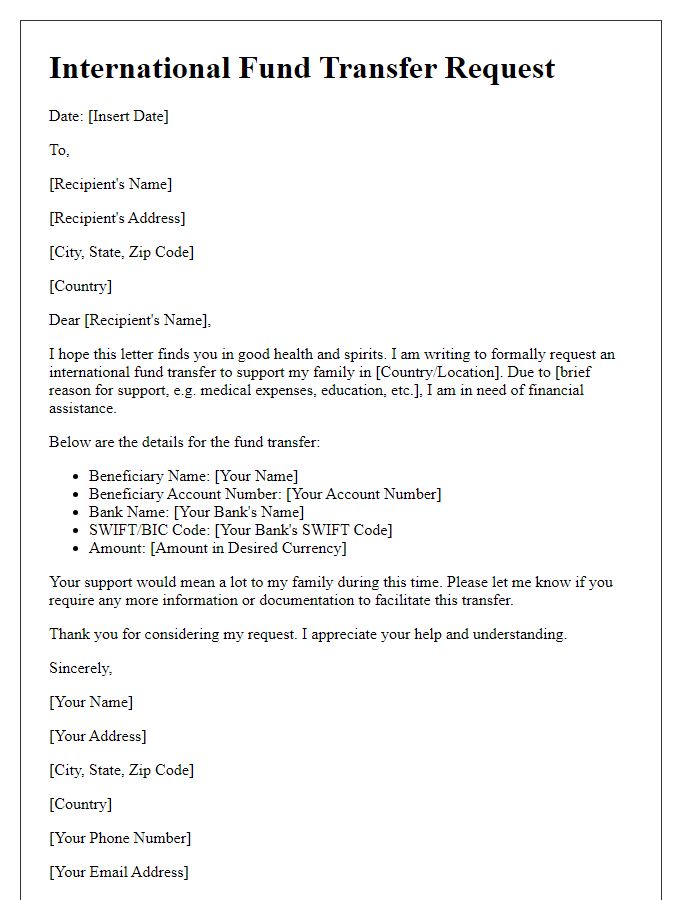

Letter template of international fund transfer request for family support

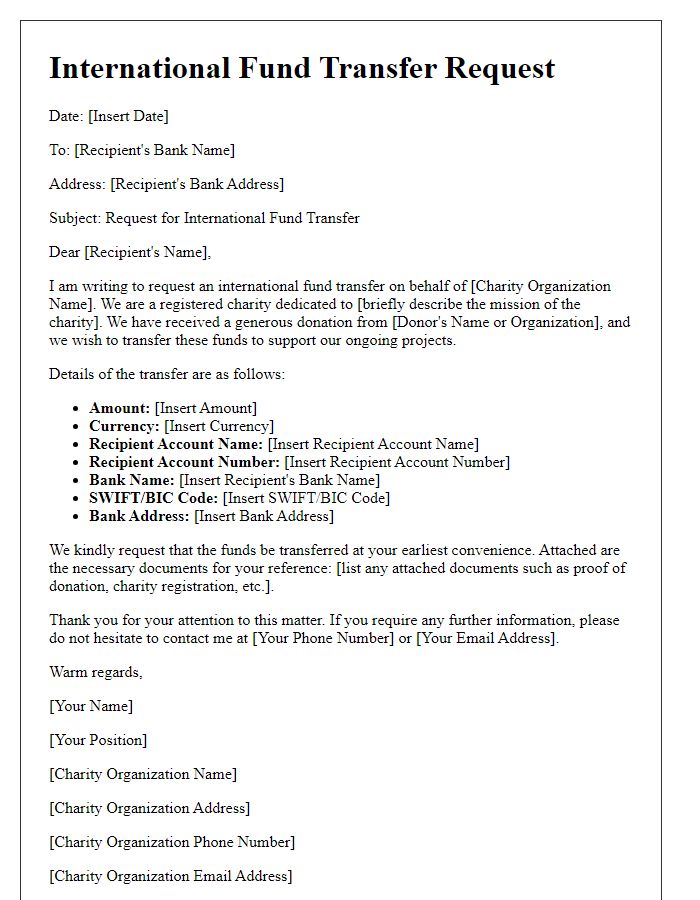

Letter template of international fund transfer request for charity donations

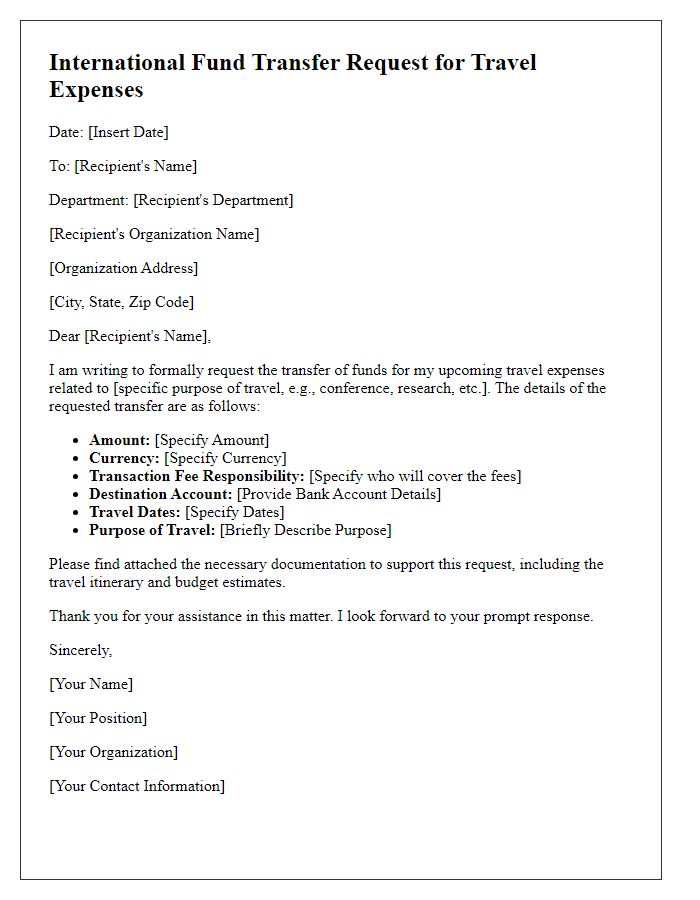

Letter template of international fund transfer request for travel expenses

Letter template of international fund transfer request for property purchase

Comments