Are you feeling overwhelmed by your loan repayment schedule? You're not aloneâmany find managing their loans to be a daunting task. A clear and structured repayment plan can make all the difference, helping you stay organized and on track. Join me as we explore effective strategies and templates to simplify your loan repayment journey!

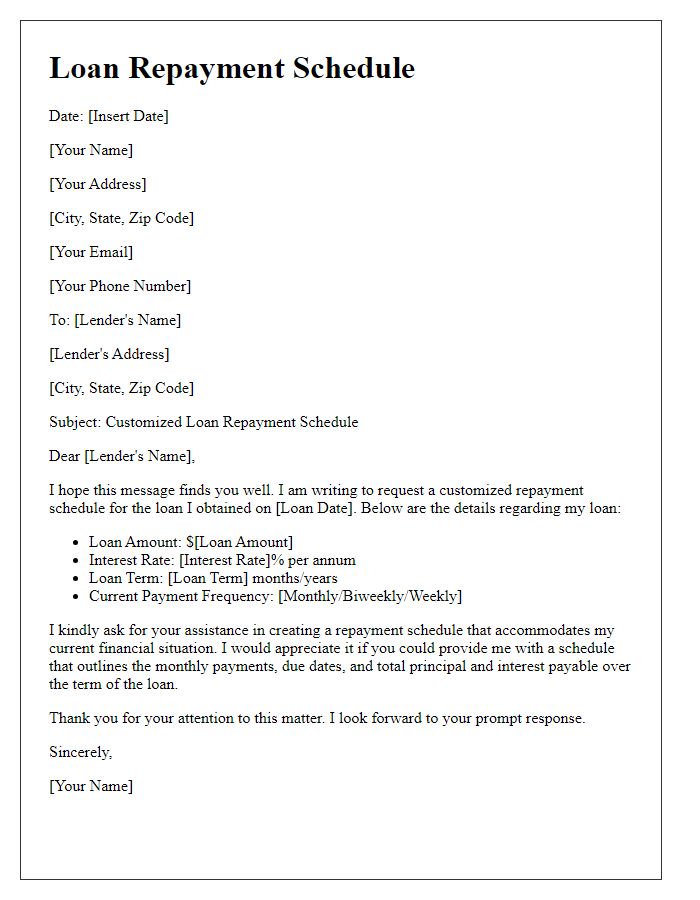

Loan Amount and Interest Rate

A loan repayment schedule outlines the terms and conditions of repaying borrowed funds, detailing aspects such as the loan amount, interest rate, and payment period. For instance, a $10,000 loan with a 5% annual interest rate over a 36-month term can illustrate how monthly payments are structured. Each payment contributes to both principal and interest, where the total cost of the loan includes the borrowed amount plus interest accrued over time. Understanding these specifics allows borrowers to plan their finances effectively and ensures timely repayments to maintain a good credit score.

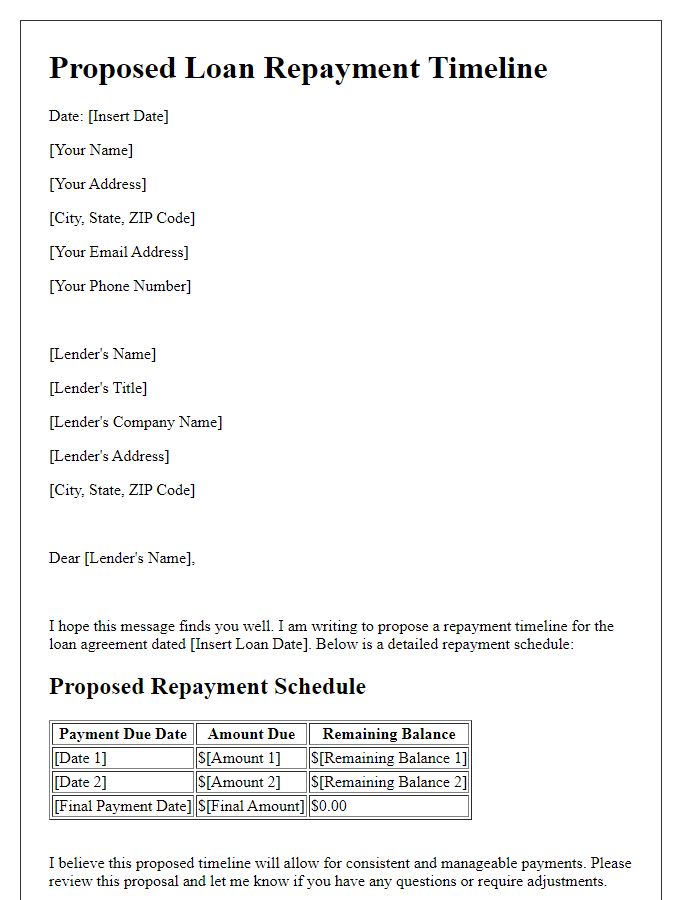

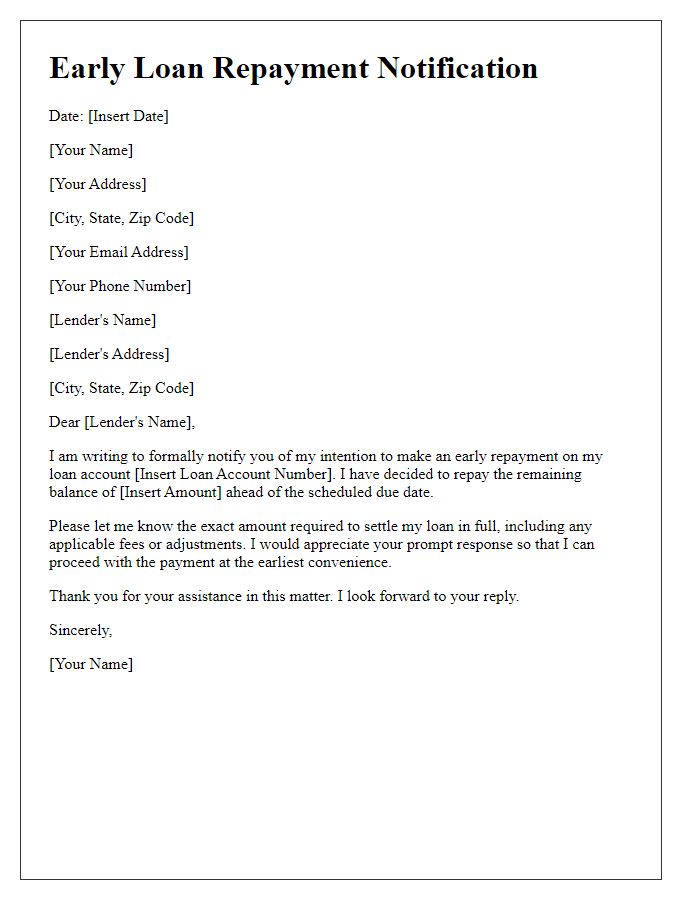

Payment Due Dates

A loan repayment schedule outlines critical payment due dates for borrowers, ensuring prompt and accurate financial management. Each month, a specific day is designated for the repayment of principal and interest, typically falling within a 30-day cycle. For example, if the loan was disbursed on March 1, 2023, subsequent payment due dates would occur monthly on the 1st of each month, culminating in a final payment due on March 1, 2028, if it's a five-year term loan. Additionally, any delay in payments can incur late fees, often a percentage of the missed payment, emphasizing the importance of adhering to the repayment schedule. Providing clarity on these dates protects both lenders and borrowers, facilitating financial stability and planning.

Installment Amounts

The loan repayment schedule specifies the installment amounts due for each payment period, detailing consistent payment intervals, such as monthly or quarterly. For example, a loan amount of $10,000 with an interest rate of 5% may require monthly installments of approximately $188.71 over a 5-year period, amounting to a total payment of about $11,322.60. Each installment typically includes a portion allocated towards interest payments and a portion towards the principal balance, ensuring gradual reduction of the overall debt. Key dates for payments should be outlined, such as the first payment due date, ensuring borrowers remain informed and compliant with their financial obligations.

Grace Period and Late Payment Penalties

Loan repayment schedules often include critical details like grace periods and late payment penalties. A grace period, typically ranging from 10 to 30 days, allows borrowers to make payments without incurring additional fees. During this time, no interest is charged on the outstanding balance, which can ease financial burden for individuals experiencing temporary setbacks. However, if payments are not made within the grace period, late payment penalties can be applied, often as a percentage of the overdue amount or a fixed fee. For instance, a penalty might be 5% of the missed payment, or $25, whichever is greater, to encourage timely repayments. Understanding these terms is essential for maintaining a healthy financial status.

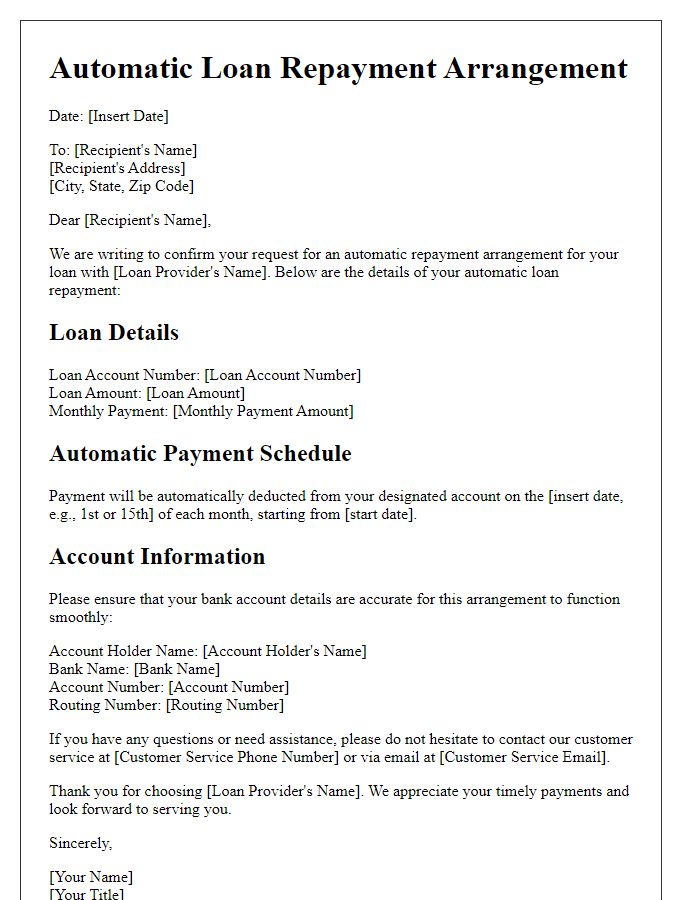

Contact Information and Customer Service Details

A loan repayment schedule serves as a crucial financial document outlining the payment structure for borrowers, often including details such as payment amounts, due dates, and interest rates. For example, borrowers should provide accurate contact information, including phone numbers and email addresses, for communication regarding the loan. Customer service details highlight resources available for assistance, such as dedicated hotlines or online chat services that facilitate queries about repayments or adjustments to payment plans. Understanding these components ensures borrowers remain informed and capable of managing their financial obligations effectively.

Comments