Are you feeling overwhelmed by multiple debts and looking for a way to simplify your financial situation? A debt consolidation loan could be the solution you need to streamline your payments and reduce interest rates. In this article, we'll explore how this option works, the benefits it offers, and what you need to consider before applying. Join us as we dive deeper into the world of debt consolidation and discover if it's the right choice for you!

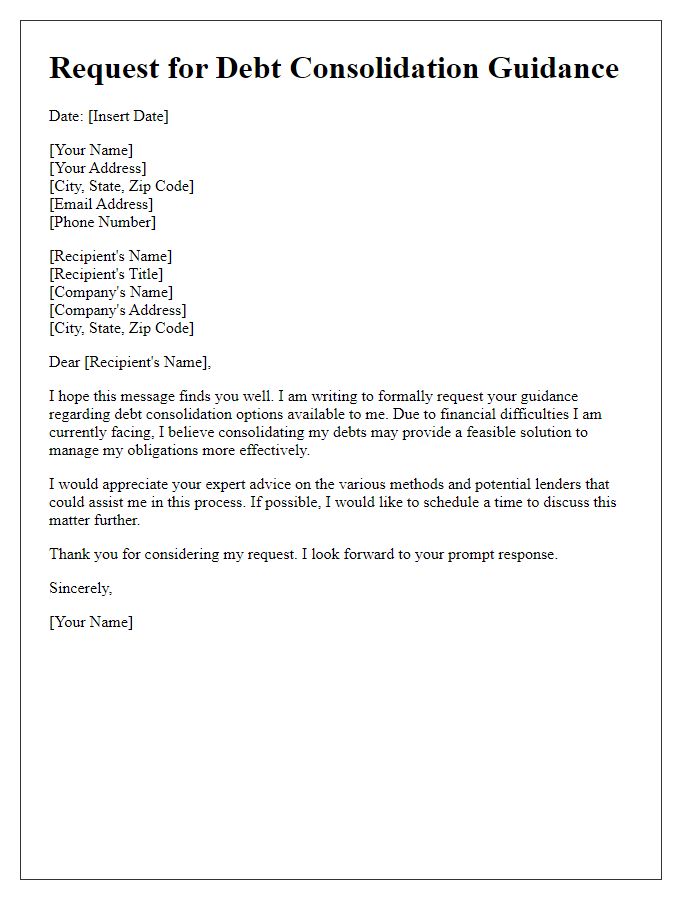

Clear Subject Line

In recent years, many individuals have sought debt consolidation loans to manage financial liabilities more effectively. These loans typically combine multiple debts into a single loan, often with lower interest rates. A notable example can be found in 2020 when the average interest rate for personal loans was approximately 9.41%. Many financial institutions, including credit unions and banks, offer these loans, which can have repayment terms ranging from three to five years. Additionally, debt consolidation can improve credit scores if payments are made consistently. However, potential borrowers should be aware of origination fees or prepayment penalties that may apply, which can affect the overall cost of the loan. Researching various lenders in your local area or online platforms can help individuals make informed decisions about their options.

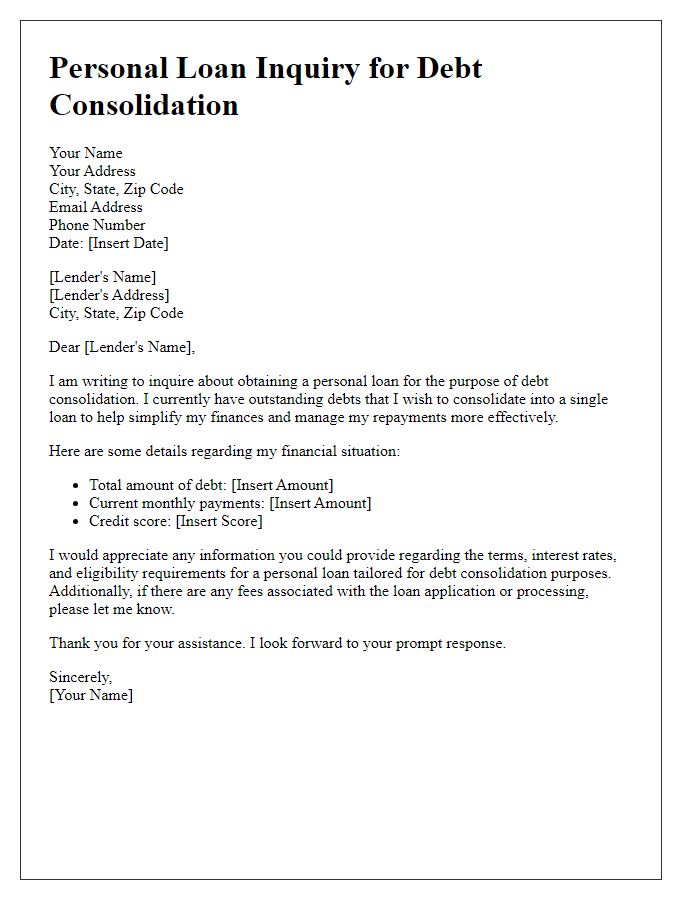

Personal Information

Debt consolidation loans can significantly alleviate financial stress for individuals managing multiple debts. These loans typically combine various high-interest debts such as credit card balances, medical bills, or personal loans into a single, manageable loan with a lower interest rate. Borrowers must provide personal information, including name, address, social security number, and income details, to lenders like banks or credit unions for assessment. FICO credit scores (ranging from 300 to 850) play a crucial role in determining loan eligibility and interest rates. Understanding the terms, such as loan duration (interest rates may vary between 3 to 7 years), repayment schedules, and any associated fees, is essential for making informed financial decisions. Researching reputable lenders and considering alternatives, like non-profit credit counseling services, can further guide individuals towards effective debt management solutions.

Loan Amount and Purpose

Debt consolidation loans can simplify financial management by combining multiple debts into a single payment. Typical loan amounts range from $1,000 to $50,000, depending on the borrower's creditworthiness and lender policies. These loans are often used to pay off credit card debts, personal loans, or medical bills, providing an opportunity for lower interest rates and reduced monthly payments. Effective debt consolidation can also improve credit scores over time by lowering credit utilization ratios and promoting timely payments on the new consolidated loan.

Financial Summary

Debt consolidation loans can significantly influence financial stability and personal budgeting strategies. Individuals often consider these loans to manage multiple high-interest debts, such as credit card balances averaging 18% APR, medical bills, or personal loans. By consolidating debts into a single monthly payment, typically with a lower interest rate, borrowers can simplify their finances. Financial institutions offer various options, with loan amounts ranging from $1,000 to $50,000, and terms extending from 2 to 7 years. Analyzing the total cost of the loan, including potential fees and interest reductions, is crucial. Accurate financial summaries help assess overall debt, monthly income fluctuations, and existing credit scores, which typically affect loan approval and interest rates.

Terms and Conditions Preferences

Debt consolidation loans serve as a financial tool for individuals aiming to combine various outstanding debts into a single loan with potentially lower interest rates. These loans typically encompass a range of terms and conditions, including the loan amount, interest rates (which can vary based on credit scores), repayment periods (often extending from three to five years), and any associated fees such as origination fees or prepayment penalties. Prospective borrowers should evaluate the lender's requirements, which may include proof of income, credit history, and existing debts, ensuring they understand all stipulations before proceeding. Additionally, considering the implications of a co-signer and secured versus unsecured loans is critical for fully grasping the financial commitments involved in the consolidation process.

Comments