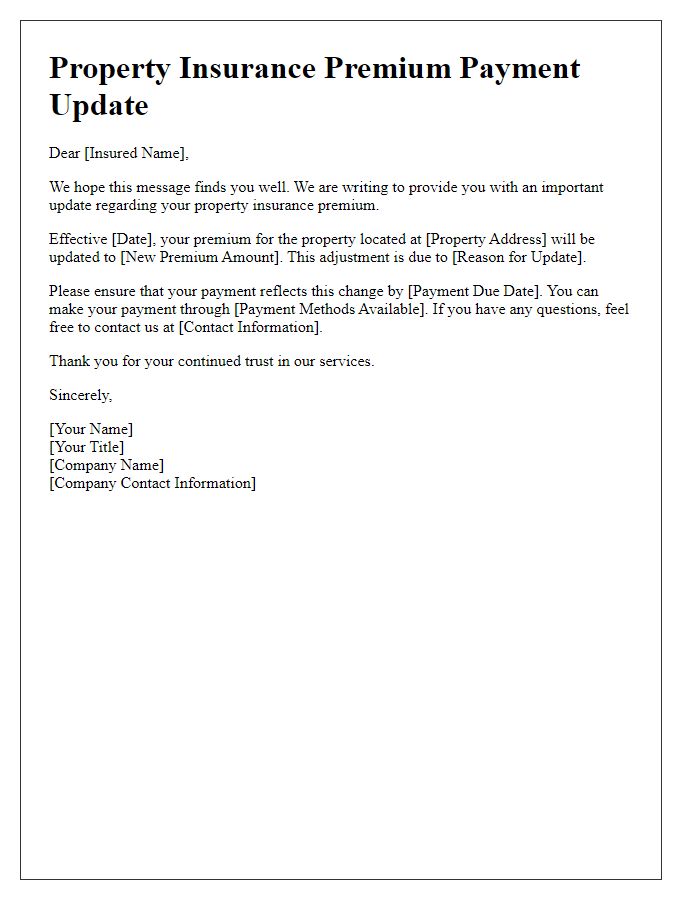

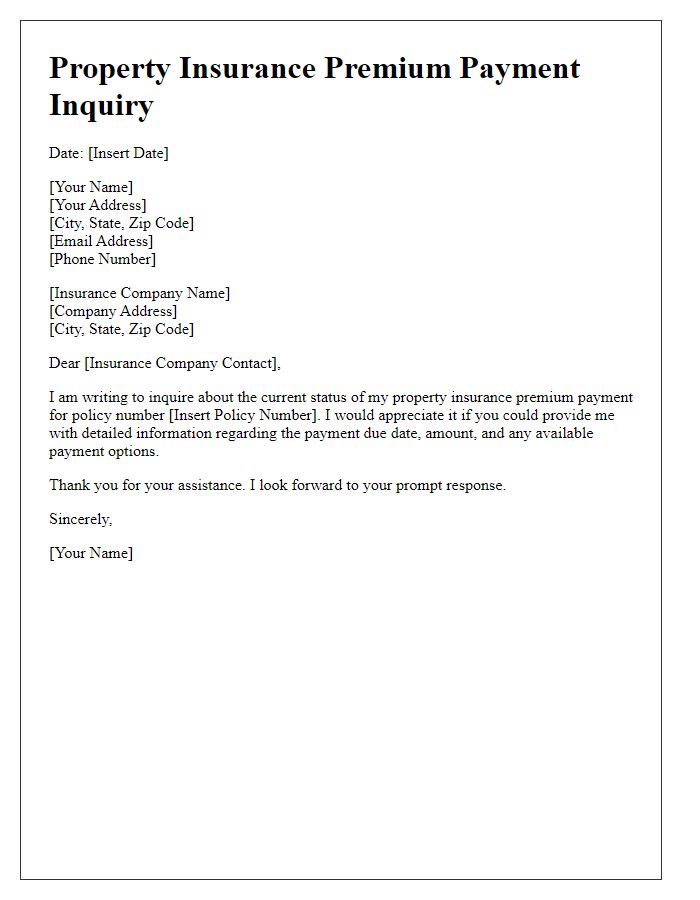

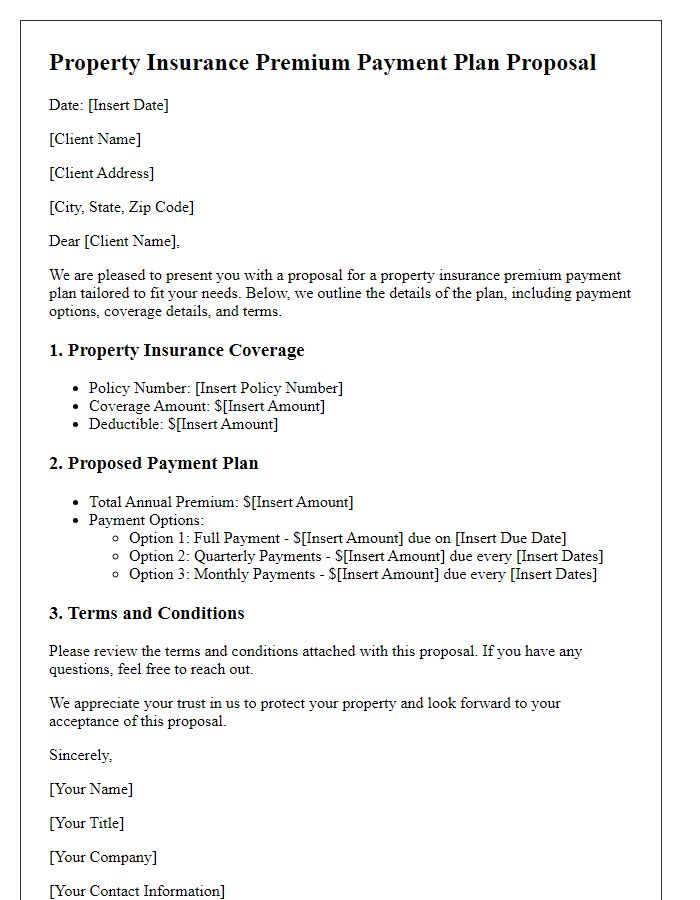

Are you looking to streamline the process of paying your property insurance premium? Understanding the crucial elements of a well-structured letter can make all the difference, ensuring your payment is processed smoothly and on time. In this article, we'll explore essential tips and a helpful template to simplify your communication with your insurance provider. So, let's dive in and make your next payment letter a breeze!

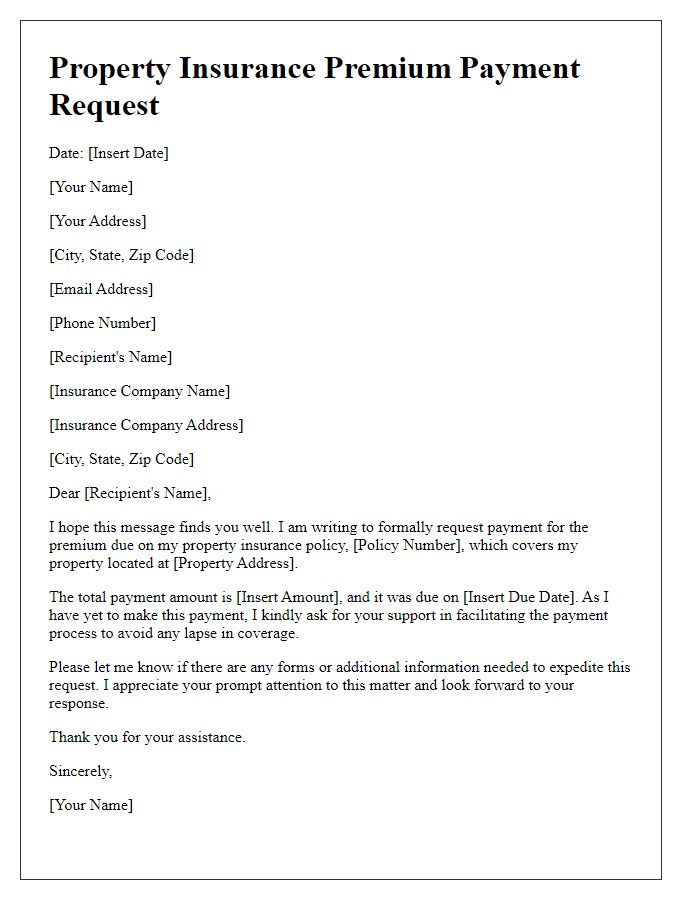

Sender's Contact Information

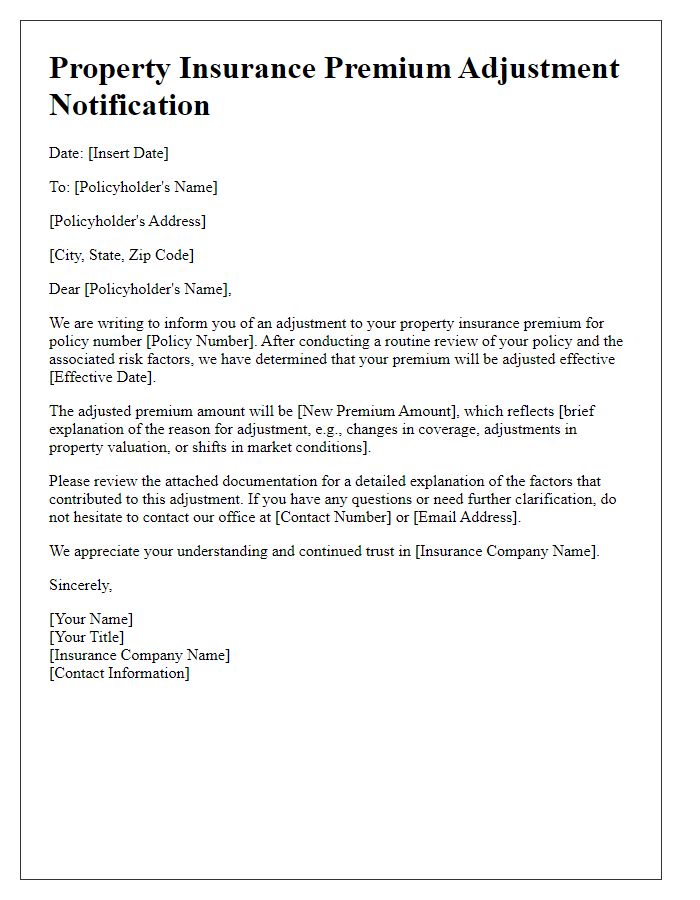

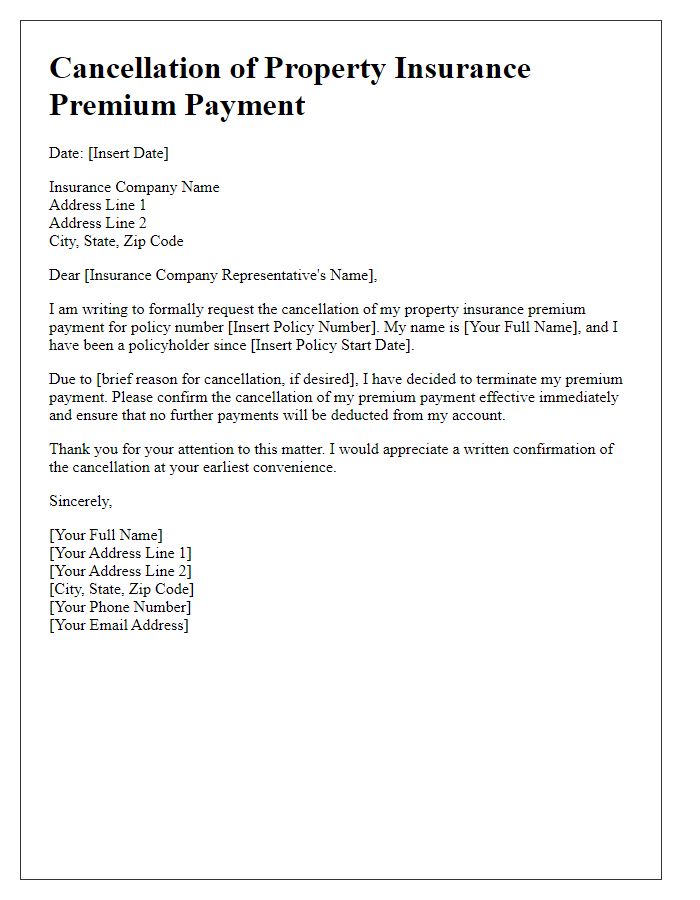

Property insurance premiums are crucial for safeguarding real estate investments against unforeseen damages. Typically, homeowners receive annual statements outlining their obligations for properties located in high-risk zones, such as areas prone to natural disasters like hurricanes or wildfires. Premiums can vary significantly depending on factors like property value, location, and coverage limits, with rates often exceeding $1,000 annually for suburban homes. Additionally, policyholders must ensure timely payments to avoid lapses in coverage, which could leave properties unprotected during critical times. Failure to pay premiums can lead to penalties or increased rates upon renewal, emphasizing the importance of managing these financial obligations diligently.

Recipient's Contact Information

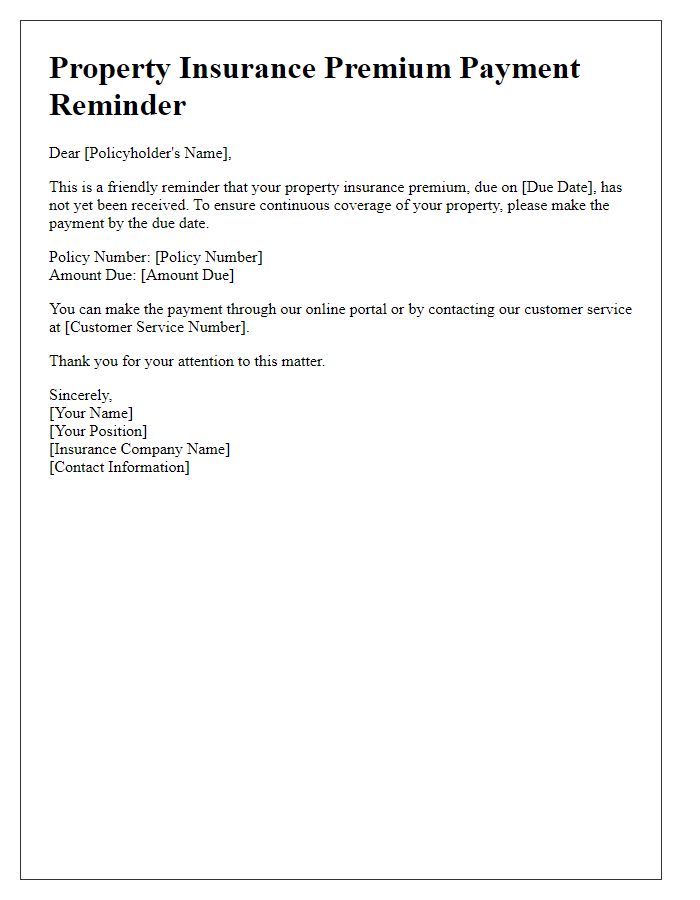

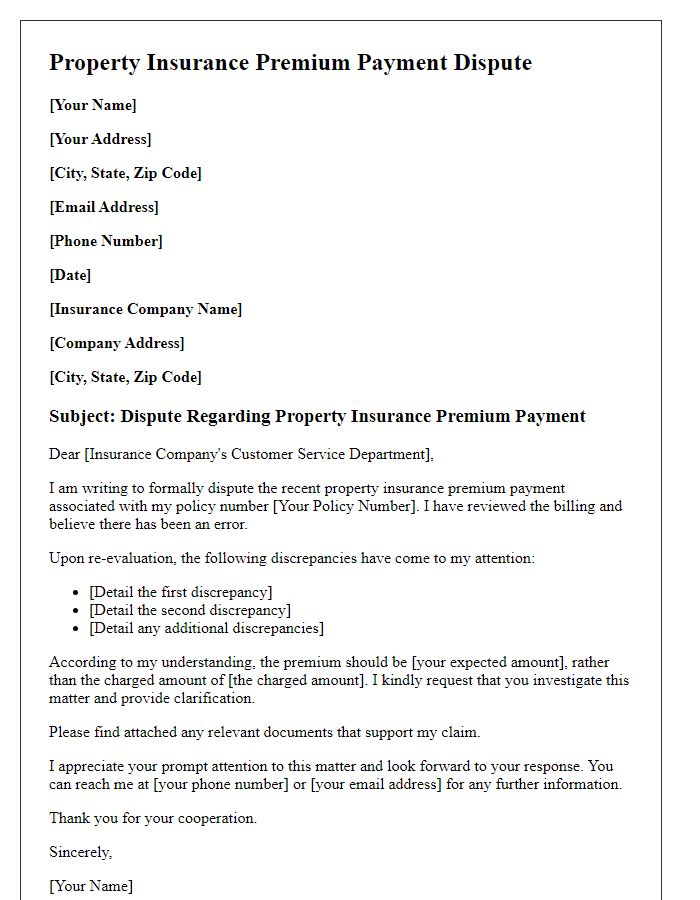

Property insurance premiums are vital for homeowners to safeguard their assets against potential risks. For example, a typical homeowner's insurance policy in the United States can range from $600 to $1,200 annually, depending on various factors like location, property value, and coverage limits. Timely payment of premiums prevents lapses in coverage, ensuring financial protection against perils such as fire, theft, or natural disasters. Major insurance providers like State Farm or Allstate often offer multiple payment methods, including online transactions or automatic bank drafts, enhancing convenience for policyholders. Missing payment deadlines can lead to cancellation of policies or increased future premiums, underscoring the importance of maintaining communication with insurance agents regarding due dates and payment options.

Policy Number and Details

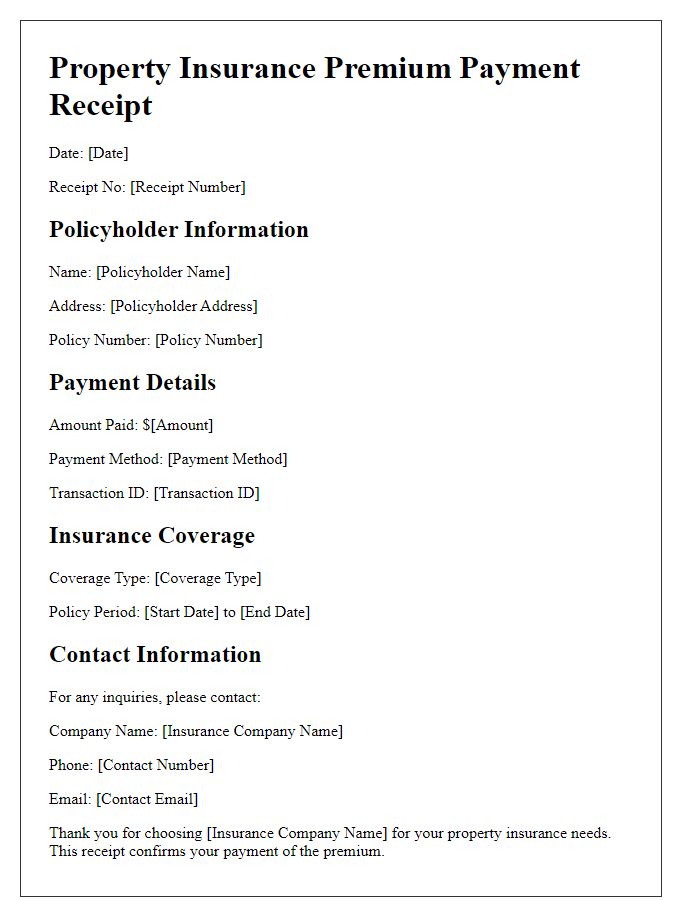

Property insurance premiums, such as those associated with homeowners or commercial property policies, often require timely payments to ensure continued coverage. For instance, a policy number (like H123456789) identifies the specific insurance contract protecting a property against various risks, including fire, theft, or natural disasters. Payment typically occurs on a specified schedule, ranging from monthly to annually, with varying amounts depending on factors like property value, location, and coverage limits. Failure to pay premiums can result in a lapse of coverage, putting the property at risk and leading to potential financial loss. Always check the due date and payment methods accepted by the insurance provider for a seamless transaction.

Payment Amount and Due Date

Property insurance premiums represent a crucial financial commitment for safeguarding valuable assets, such as homes and commercial buildings, against potential risks. Payment amounts vary significantly based on factors like location, property value, coverage levels, and claim history, with average annual premiums typically ranging from $500 to $3,000 in the United States. Due dates for these premium payments usually fall on an annual, semi-annual, or monthly schedule, often aligned with the policy's effective date, which is commonly set for the start of a calendar year or fiscal year. Timely payments help maintain coverage and prevent lapses, ensuring financial protection against events such as fire, theft, or natural disasters, like hurricanes and floods. Failure to meet these obligations may lead to the cancellation of the policy, leaving property owners vulnerable to unforeseen circumstances.

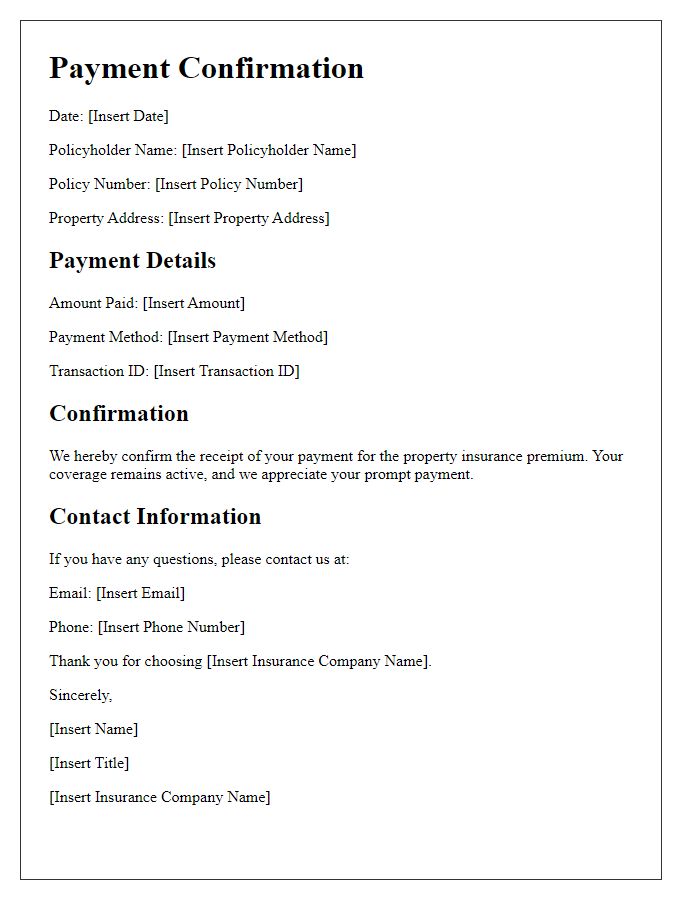

Payment Method and Instructions

Property insurance premiums are crucial for safeguarding homes and businesses against unforeseen events. Standard payment methods include bank transfers, credit card payments, and automatic debits, each offering unique convenience and security features. For instance, a bank transfer typically requires account details and might take 1-3 business days to process, while credit card payments are usually instant. Automatic debits can ensure timely payments, reducing the risk of lapses in coverage. For the payment instructions, policyholders should verify their insurance policy number (usually a 10-15 digit code) and ensure they follow the specific requirements outlined by the insurance provider to avoid complications. Understanding due dates is essential, as late payments can result in penalties or even cancellation of coverage.

Comments