Are you considering closing your credit card account but unsure how to go about it? It's a common scenario many people find themselves in, whether due to high fees or simply wanting to simplify their finances. In this article, we'll guide you through a straightforward letter template that will make your closure request hassle-free and ensure your account is closed responsibly. Keep reading to discover how to craft the perfect closure request letter!

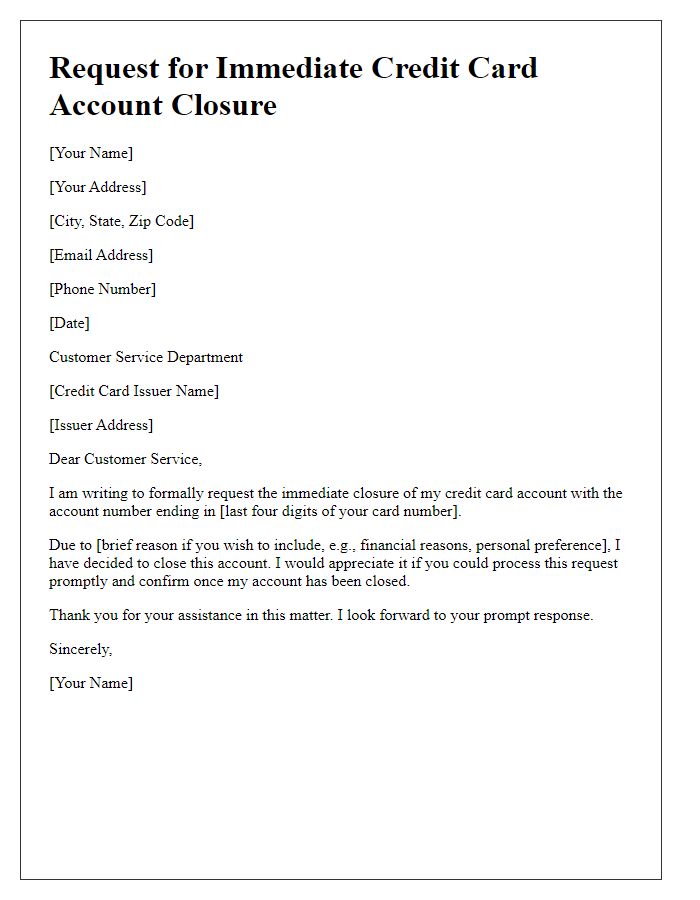

Clear subject line

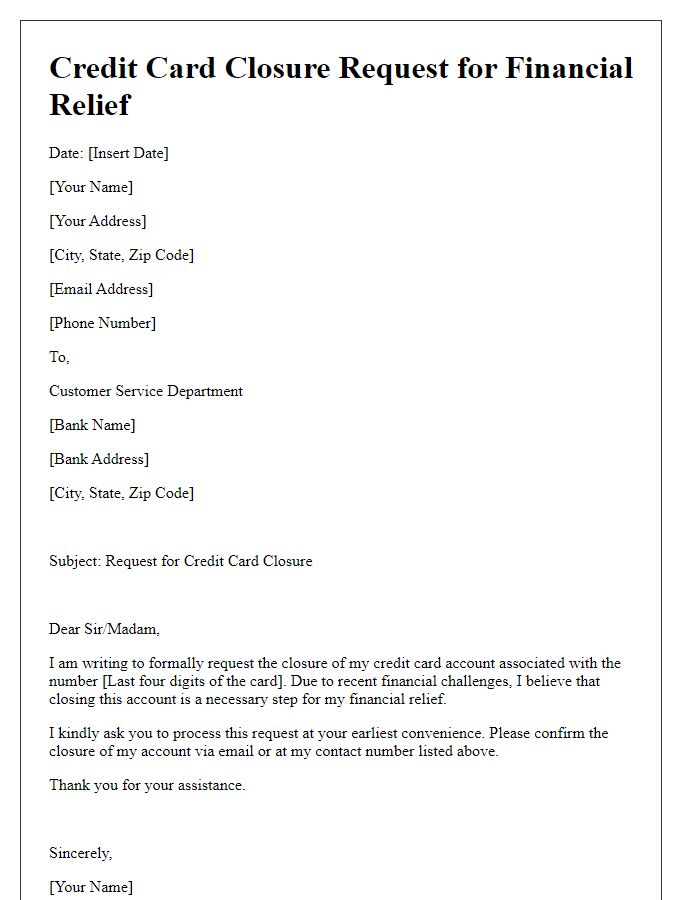

Request for Credit Card Closure Dear [Credit Card Issuer's Name], I am writing to formally request the closure of my credit card account with the number ending in [last four digits of credit card]. I appreciate the services provided thus far, but I have decided to discontinue use of this account effective immediately. Please confirm the closure of my account in writing and notify me of any final statements or charges that may require my attention. Thank you for your assistance in this matter. Sincerely, [Your Full Name] [Your Address] [Your Email Address] [Your Phone Number] [Date]

Personal account information

Closing a credit card account can significantly impact your credit score, particularly with FICO scoring, where factors like account age and credit utilization are critical. The personal account information, including the account number, should be provided clearly to avoid any confusion or delays in the closure process. Including your name, address, and contact number ensures proper identification and customer service resolution. Often, issuers, such as American Express or Chase, may have specific protocols and may ask for reasons behind account closure, which can potentially influence retention offers. Understanding the implications of closing that account, such as potential loss of reward points or benefits, is essential for informed decision-making.

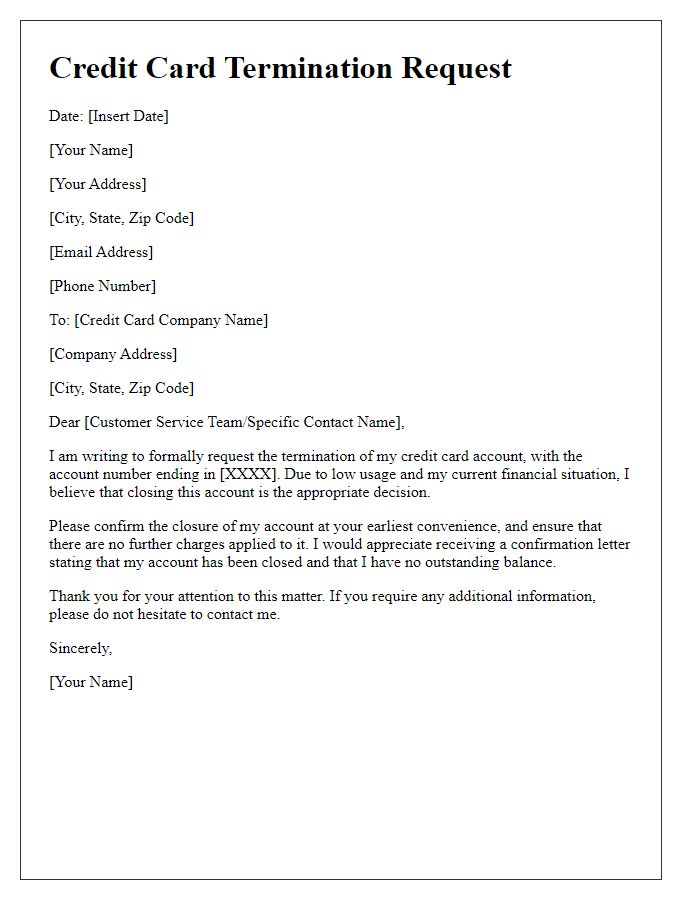

Reason for closure

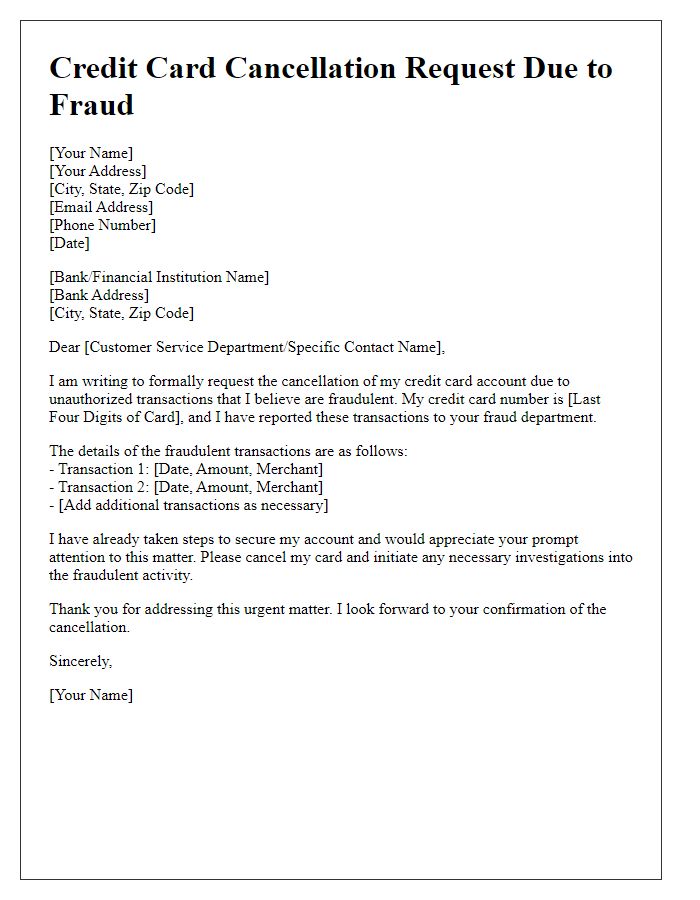

Requesting closure of a credit card account may stem from various reasons. Common motivations include high annual fees, poor customer service experiences with the issuing bank, or a shift towards utilizing alternative payment methods such as mobile wallets or debit cards. Financial management strategies may also prompt account closure to avoid accumulating debt or to streamline personal finances. Additionally, dissatisfaction with rewards programs or offers that no longer align with personal spending habits can lead customers to conclude that maintaining the credit card is no longer beneficial.

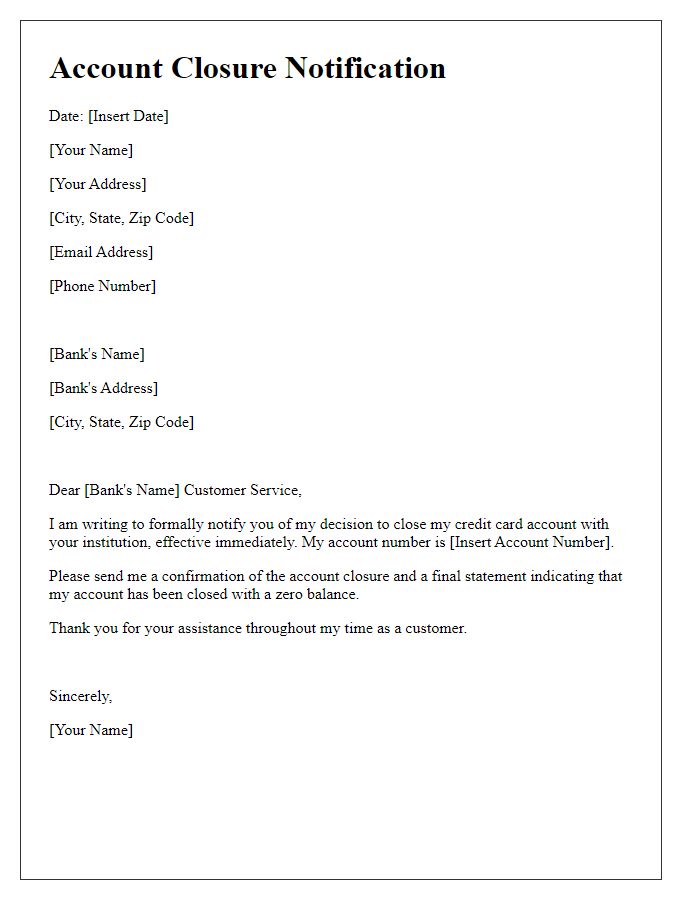

Request for written confirmation

When requesting the closure of a credit card account, it is crucial to emphasize the need for written confirmation of the closure from the issuing bank, such as JPMorgan Chase or Bank of America. This confirmation acts as an official record, ensuring that no further transactions can occur on the account. Additionally, detailing any specific account information, including the account number and the card type, will facilitate a smooth process. It is also important to mention the effects of account closure on the credit score; for instance, the potential impact on the credit utilization ratio. By obtaining written confirmation, customers safeguard themselves against possible disputes in the future, creating a clear trail of correspondence regarding the closure event.

Positive tone and appreciation

Requesting closure of a credit card account requires understanding the implications and expressing gratitude for the previous service. A well-crafted letter can convey the necessary intent while maintaining a positive tone, showcasing appreciation for the provider's assistance and support during the account's operational period. Recognizing the advantages received, such as rewards or customer service, can foster goodwill. The request should include essential details like account number, request for closure confirmation, and any remaining balance settlement specifics, ensuring a smooth transition. Emphasizing satisfaction with past interactions can leave a positive impression, strengthening future relationships.

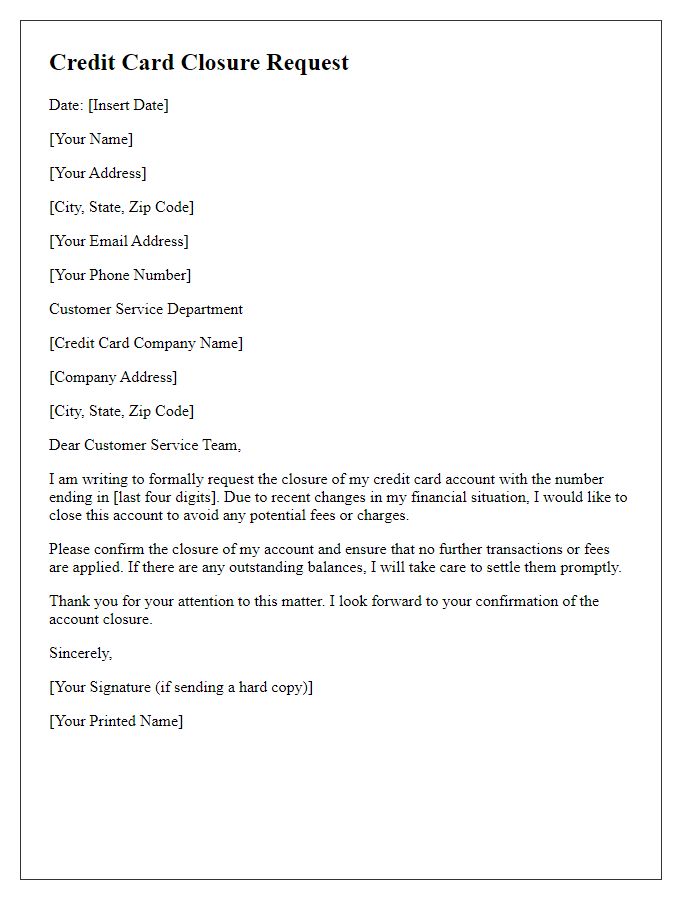

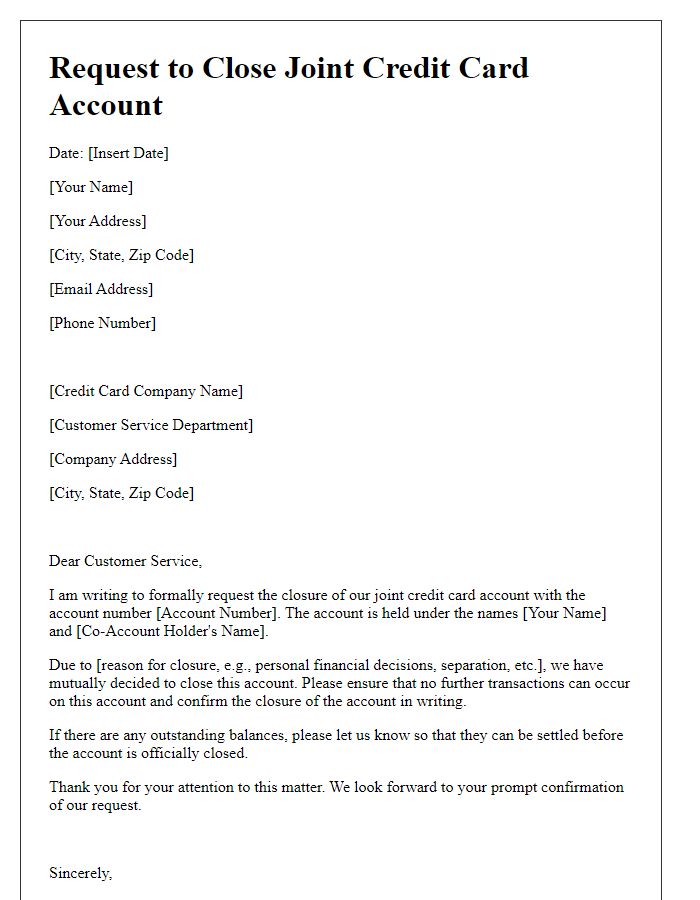

Letter Template For Credit Card Closure Request Samples

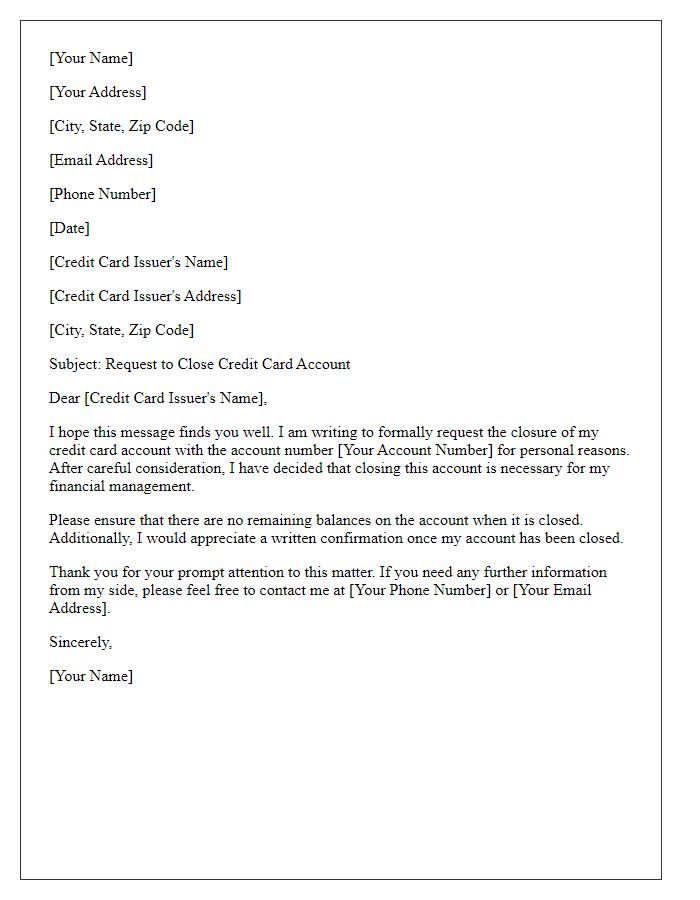

Letter template of Request to Close Credit Card Account for Personal Reasons

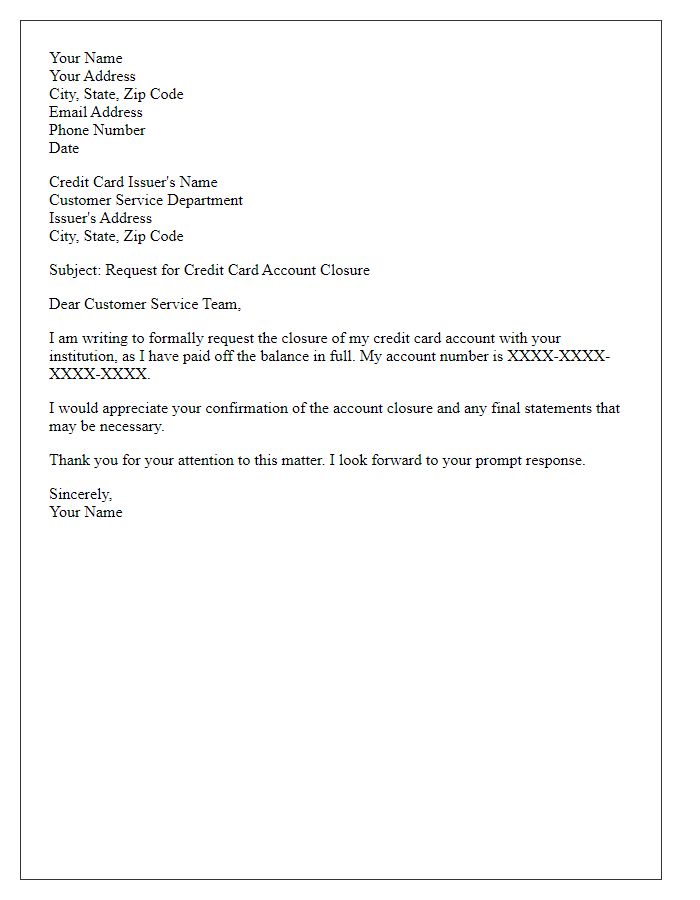

Letter template of Request for Credit Card Account Closure After Balance Paid

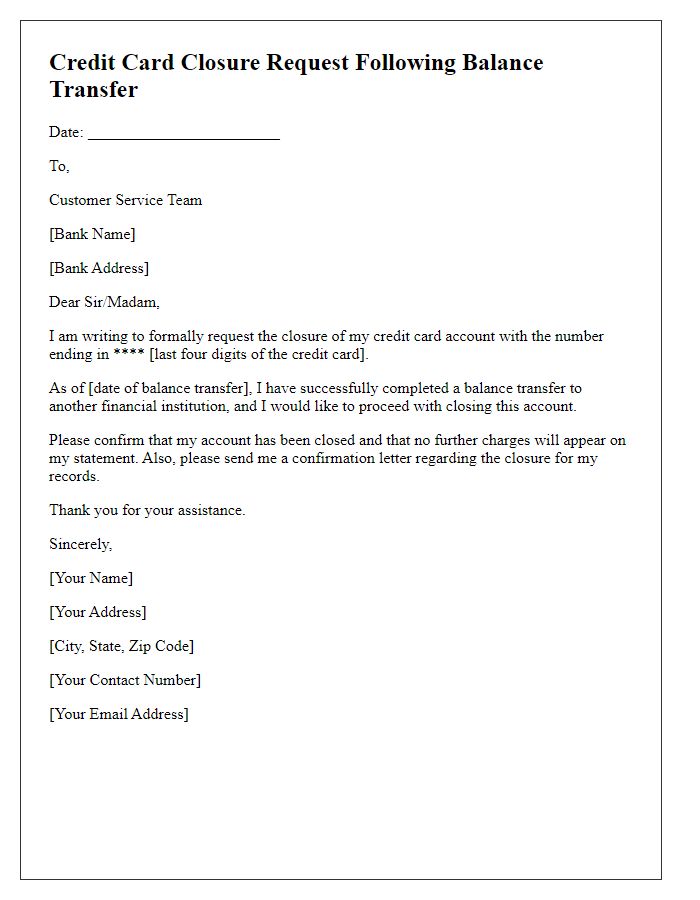

Letter template of Credit Card Closure Request Following Balance Transfer

Comments