Are you considering exchanging foreign currency but unsure where to start? The process might seem daunting, but with the right letter template, you can navigate it with ease. This guide will provide you with a clear and effective format to make your currency exchange request seamless. Keep reading to discover the essential elements to include in your letter!

Purpose of Exchange

Foreign currency exchange transactions serve various purposes, including travel, business operations, and investments. Travelers often exchange local currency for foreign denominations to cover expenses such as meals, accommodations, and transportation while abroad. Business operations may require exchanging currency for international trade, facilitating payments for goods and services between companies across different countries. Additionally, investors may seek currency exchanges to diversify portfolios, capitalize on currency fluctuations, or invest in foreign assets. Understanding the specific purpose of the exchange helps ensure optimal rates and efficient transaction handling, allowing individuals and businesses to achieve financial objectives while navigating the complexities of foreign currencies.

Amount and Currency Needed

A foreign currency exchange request typically involves specifying the desired amount of currency, such as Euros (EUR), US Dollars ($), or Japanese Yen (Y=), along with additional details for clarity and accuracy. For instance, requesting 500 Euros for travel to Europe may require the exchange rate and service fees to be considered, impacting the final amount received. Designating a specific date for the exchange can also be critical due to fluctuating rates. Locations like international banks or currency exchange offices play a vital role in facilitating these transactions, ensuring that customers receive the appropriate value based on current market conditions.

Beneficiary Details

Beneficiary details are critical in foreign currency exchange transactions, ensuring accurate fund transfers to intended recipients. Information such as the beneficiary's full name, designated bank name, and account number facilitate seamless processing. Additional identifiers like the International Bank Account Number (IBAN) and the bank's SWIFT/BIC code enhance precision in international transfers. Including the beneficiary's address, city, state, and postal code provides further verification, minimizing errors in financial exchanges. Currency type details, along with the specific amount to be transferred, also play a significant role in fulfilling the request accurately, thereby ensuring efficient transactions and adherence to international banking regulations.

Preferred Exchange Rate

Foreign currency exchange requests often concern preferred exchange rates for transactions involving currencies such as the US Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY). The availability of specific rates can fluctuate based on market conditions, liquidity, and geopolitical events. Exchange rates are typically quoted with a bid-ask spread, reflecting the buying and selling prices offered by financial institutions, such as banks and currency exchange services. When making a request, clearly stating the desired amount (e.g., 1,000 USD), type of currency exchanged, and urgency of transaction (e.g., within 24 hours) can facilitate a more favorable arrangement.

Contact Information

Foreign currency exchange requests typically involve financial institutions or service providers that facilitate transactions involving different currencies. When submitting such a request, it's important to include specific contact information for seamless communication. This may consist of a full name (e.g., John Smith), email address (e.g., john.smith@example.com), telephone number (e.g., +1-555-0123), and mailing address (e.g., 123 Main St, Anytown, USA). In addition, providing details such as account number (if applicable) and preferred contact method can enhance clarity and efficiency in processing the request. Including this comprehensive contact information ensures that both parties can easily coordinate for transaction confirmations and any necessary follow-up communication.

Letter Template For Foreign Currency Exchange Request Samples

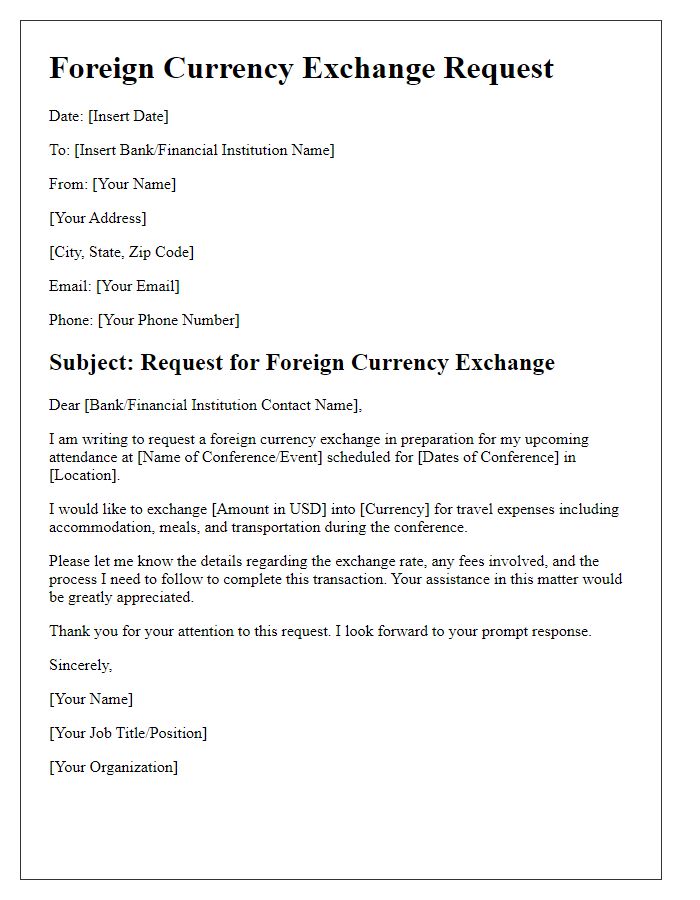

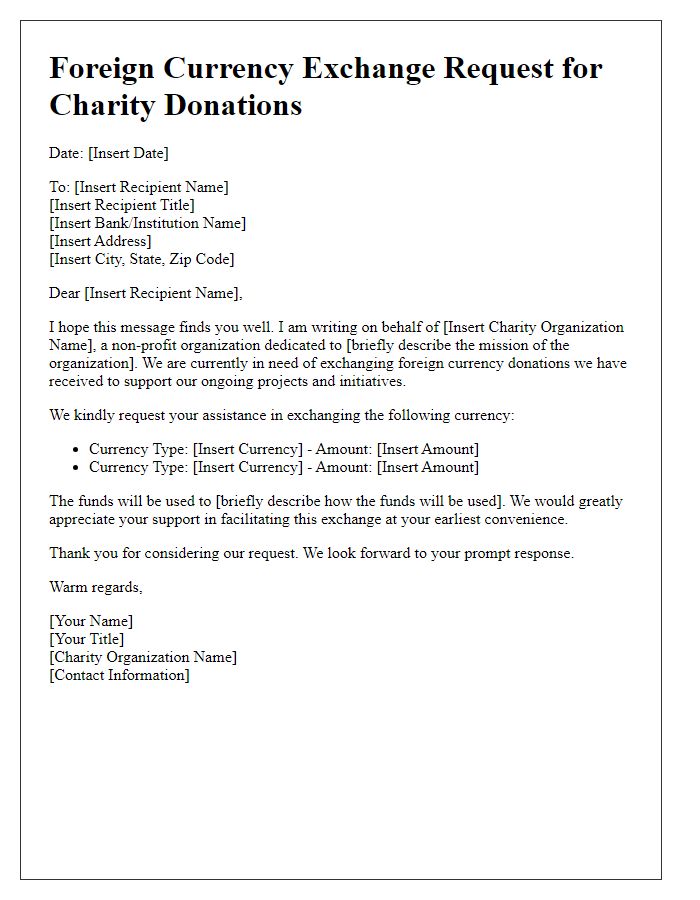

Letter template of foreign currency exchange request for business travel.

Letter template of foreign currency exchange request for personal vacation.

Letter template of foreign currency exchange request for international investment.

Letter template of foreign currency exchange request for online shopping.

Letter template of foreign currency exchange request for foreign tuition fees.

Letter template of foreign currency exchange request for sending remittances.

Letter template of foreign currency exchange request for real estate purchase abroad.

Letter template of foreign currency exchange request for foreign medical expenses.

Letter template of foreign currency exchange request for overseas conference attendance.

Comments