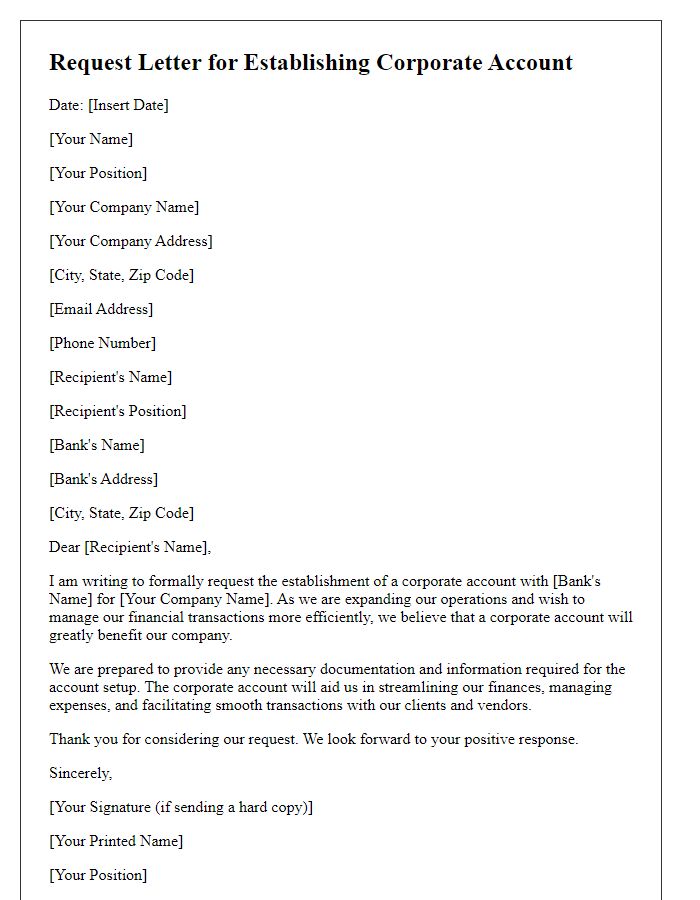

Are you looking to streamline your corporate account opening process? We've got you covered with a comprehensive letter template that makes it easy to convey your business's intentions clearly and professionally. With the right structure and key information, you can ensure a smooth initiation of your banking relationship. Ready to unlock the full potential of your corporate accounts? Dive in to explore our detailed guide!

Company Information

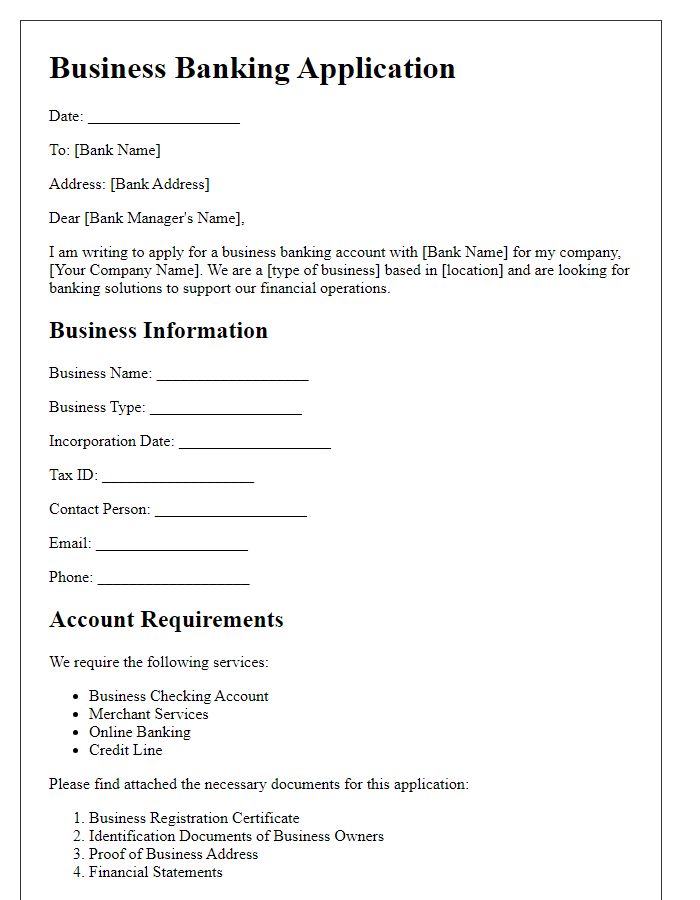

A corporate account opening requires comprehensive company information to facilitate the process. Essential details include the legal business name, registered address, and incorporation date, often mandated by local business regulations. Key representatives, such as the CEO or CFO, should be designated along with their contact information, including phone numbers and email addresses. Furthermore, a Tax Identification Number (TIN) is needed for tax documentation. Ownership structure details, whether sole proprietorship, partnership, or corporation, must be disclosed. Financial statements, such as balance sheets and income statements, may be required for accurate assessment. Additional documents might include articles of incorporation, bylaws, and business licenses, ensuring compliance with banking regulations.

Purpose of Account

A corporate bank account serves as a crucial financial tool for businesses, enabling efficient management of company funds and operations. This type of account facilitates various transactions, such as payroll processing for employees, payment of supplier invoices, and receipt of customer payments. Through a corporate account, businesses can enhance their financial transactions, ensuring transparency and easier tracking of expenditures. Additionally, corporate accounts often provide features such as overdraft protection, high transaction limits, and dedicated customer service, which are essential for companies operating on larger scales. Establishing a corporate account is a fundamental step for any registered entity seeking to foster growth and maintain organized financial records in compliance with regulatory requirements.

Authorized Signatories

Opening a corporate bank account requires a formal request that outlines authorized signatories for transaction approval. Authorized signatories, typically directed by a company's board of directors, include key individuals designated to manage financial operations. Banks often require identification documents such as government-issued IDs, business registration certificates, and proof of address for these signatories. Notably, companies must specify the extent of authority given to each signatory, which may range from full transaction capabilities to limited access. Institutions such as regional banks or major financial corporations often provide specific forms to document this information, ensuring compliance with regulations established by financial oversight bodies. Properly detailing authorized signatories helps facilitate smooth banking operations and ensures that only designated personnel handle financial matters.

Compliance and Regulatory Requirements

Corporate account opening requires strict adherence to compliance and regulatory requirements mandated by financial authorities. Essential documentation includes the business registration certificate, often issued by the Secretary of State, detailing the legal entity status of the corporation. A Tax Identification Number (TIN) must be provided, which the Internal Revenue Service (IRS) uses for tax reporting purposes. Identification documents for authorized signatories, such as government-issued photo IDs, are necessary to establish personal identity and prevent fraud. Additionally, a resolution from the board of directors, affirming the decision to open the account, may be required. Financial institutions also perform Know Your Customer (KYC) checks to ensure compliance with anti-money laundering regulations, assessing the nature of the business and expected transaction activities.

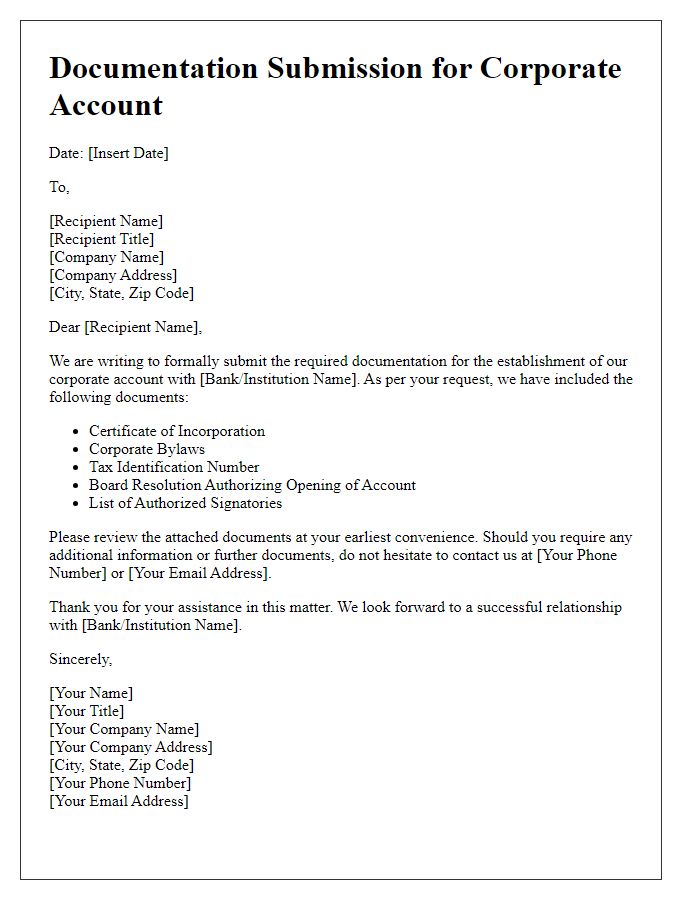

Documentation Checklist

The documentation checklist for corporate account opening includes essential papers required by financial institutions for verification and compliance. Companies must provide their certificate of incorporation, which is a legal document issued by the state government confirming the business's formation and structure. Additionally, a comprehensive list of authorized signatories is necessary, detailing individuals permitted to conduct transactions on behalf of the company. The business's tax identification number (TIN) is also critical, serving as a unique identifier for tax purposes. Companies must include proof of address, such as utility bills or lease agreements, which validates the company's physical location. Finally, the board resolution authorizing the opening of the account and specifying who can sign on behalf of the company is required for governance and accountability. These documents help ensure that the financial institution complies with regulations set by authorities such as the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC).

Comments